So, we’ve talked about the different types of real estate investors, what they’re typically looking for, and how you might work with them as a real estate agent running a real estate investor group. Now, I’ll get right to it: why start and run a real estate investor group.

I think there are 4 compelling reasons for starting and running a real estate investor group.

- Toll Bridge

- Saleable, Appreciating Asset

- Attract Great Clients

- Simplified, Value Adding Stay In Touch Tool

Toll Bridge

“In an inflationary world, a toll bridge (like company) would be a great thing to own because you’ve laid out the capital costs. You built it in old dollars and you don’t have to keep replacing it.” – Warren Buffett

Once you take the time to setup your real estate investor group, it continues to produce for you over time. When we talk about ways to monetize your real estate investor group, you will also see that you can get paid for access to your group or profit directly from the group by offering your services as a real estate agent to some of the members.

Saleable, Appreciating Asset

Last year in our local market, one of the investor clubs sold. While I do not have inside information as to the sale price, my best guess is that it sold for just under $100,000.

Investing in growing your own investor group is investing in a saleable, appreciating asset. The longer you own and grow your group, the more it is worth.

A real estate agent coming into my market could buy my real estate investor group from me and start generating commissions from it right away. It is like buying an established, up-and-running, highly profitable, lead-generating machine.

Attract Great Clients

I consider the first two reasons for starting and running an investor group as bonus reasons. The next two reasons for starting and running an investor group are the best reasons of all.

First, you can use your real estate investor group to attract great clients.

I am in the top 1% of buyer brokers in my market and the overwhelming majority of my transactions can be traced directly back to the real estate investor group. Most are people coming directly from the meetings. Some are referrals from people who attend meetings. Either way you look at, our business would be a puny fraction of what it is without the investor group.

And these are dream clients: clients that buy repeatedly, appreciate what you do, and respect your time and your business.

Since you could take the time to reconstruct our sales volume from MLS sales for me if you really wanted, I will save you the time and tell you that we did $369,703 in commissions in 2016 and $420,776 in 2017. I am writing this in early March 2018 and we’re ahead of 2016 and 2017 numbers as of right now.

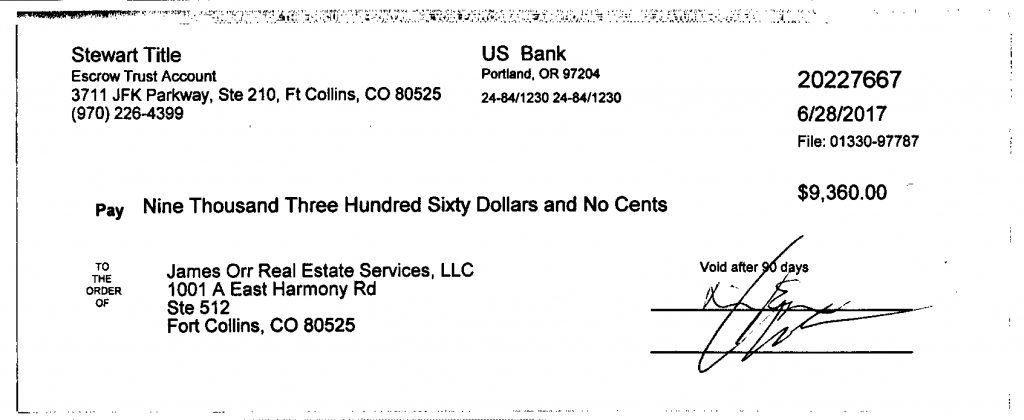

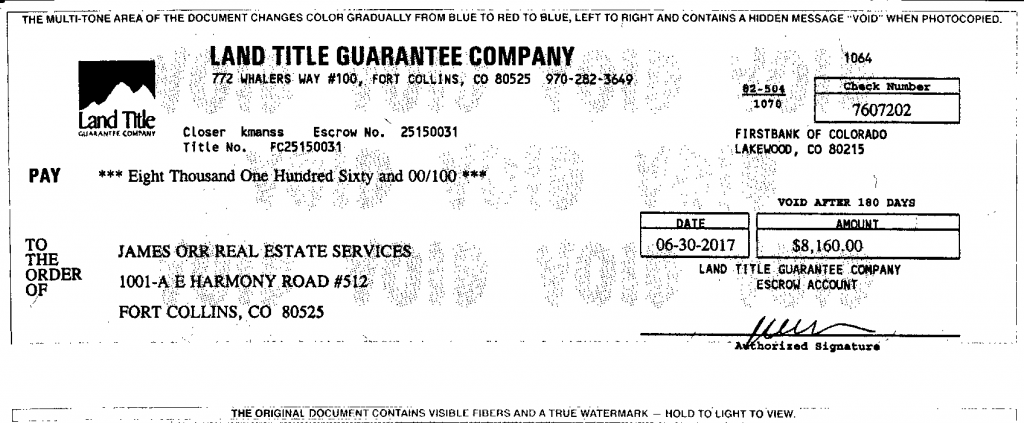

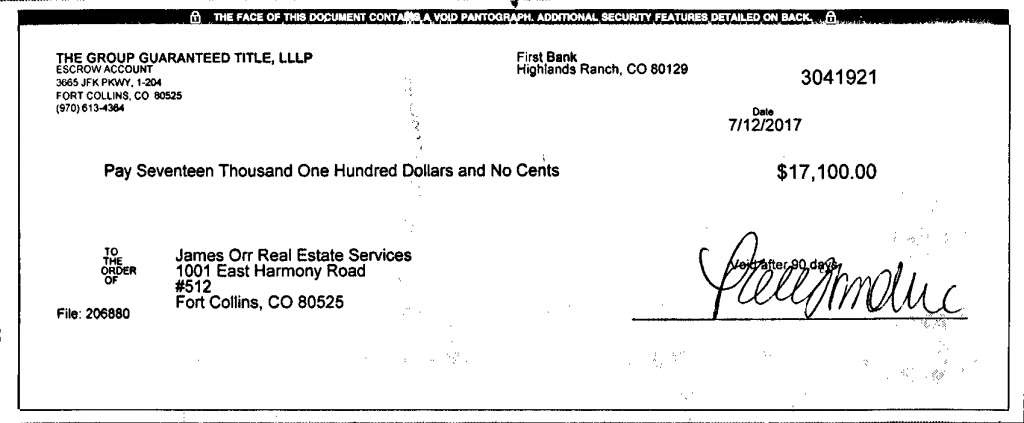

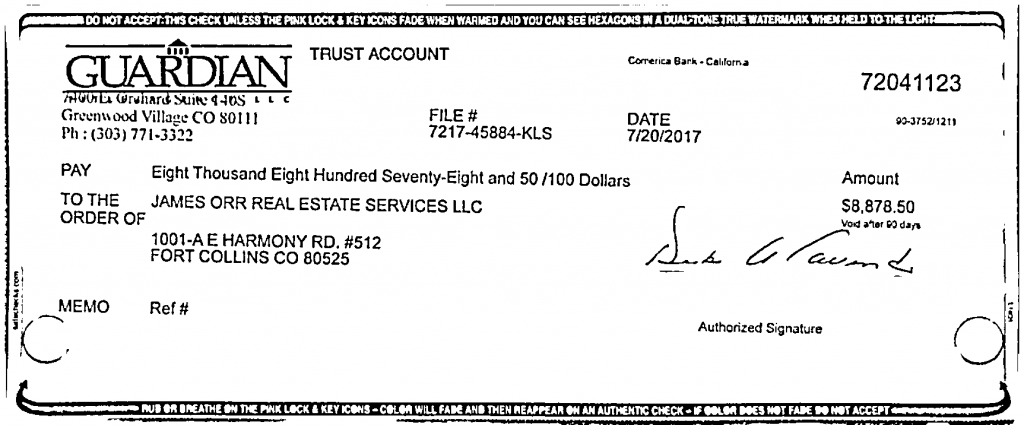

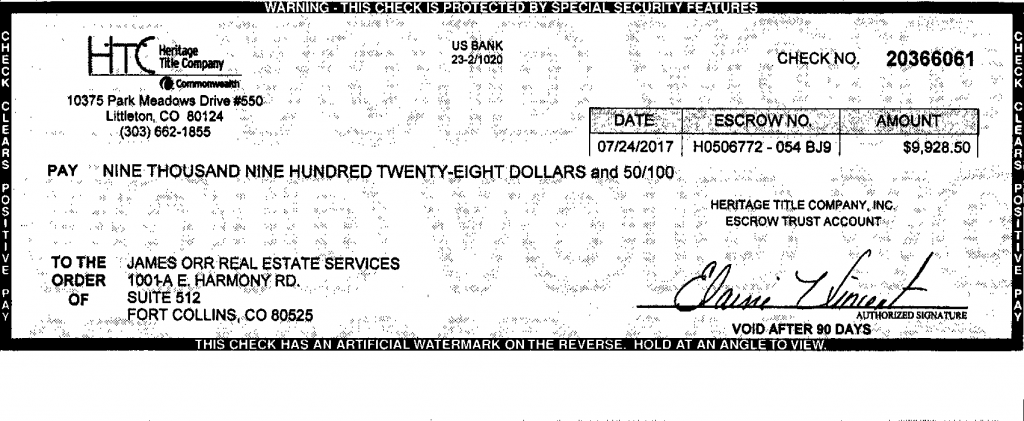

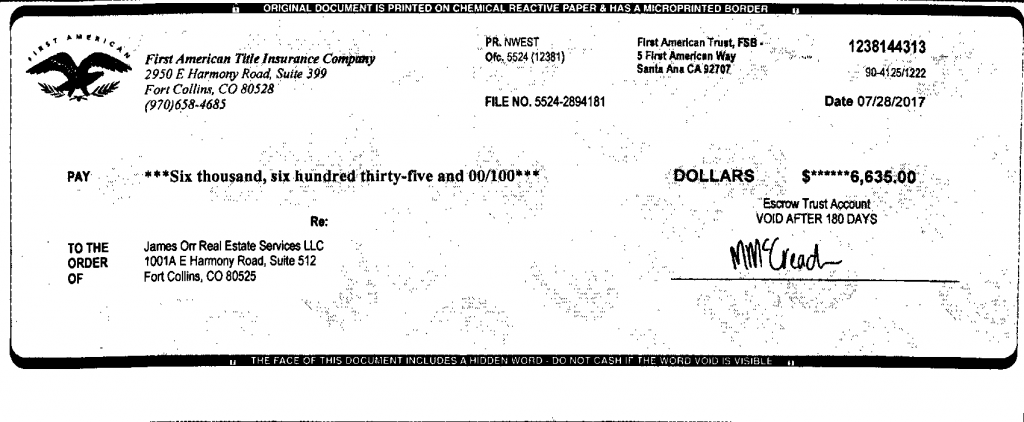

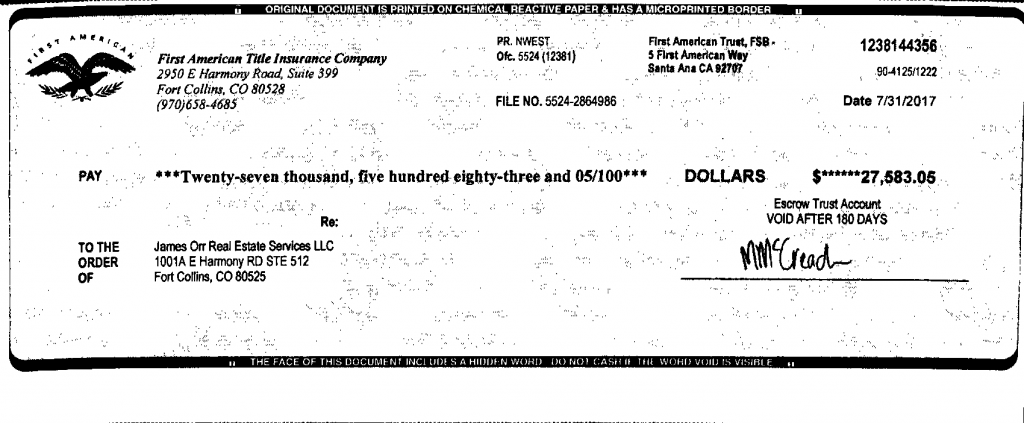

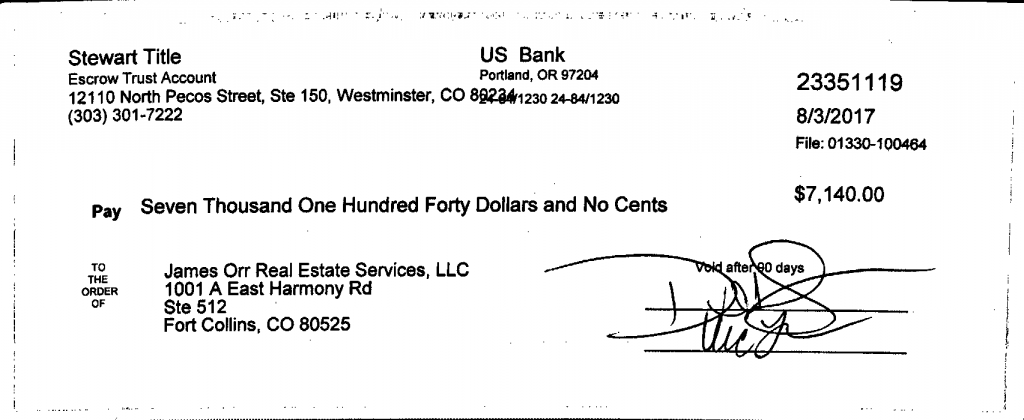

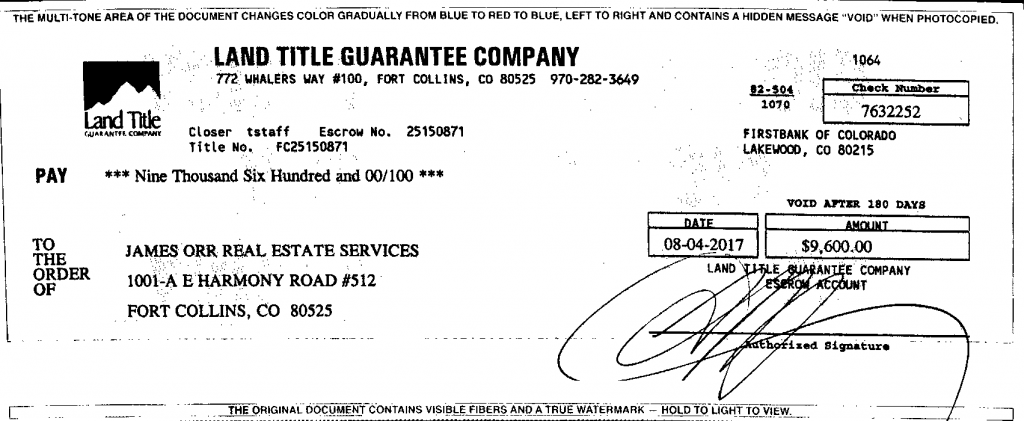

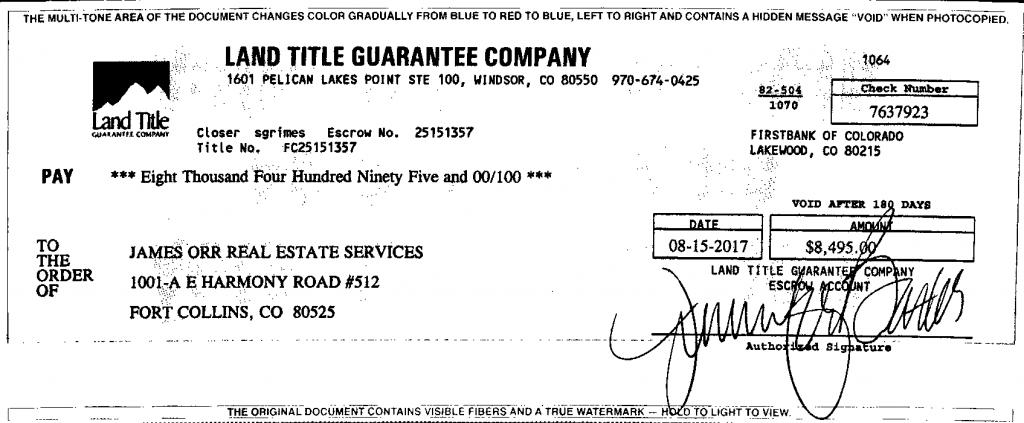

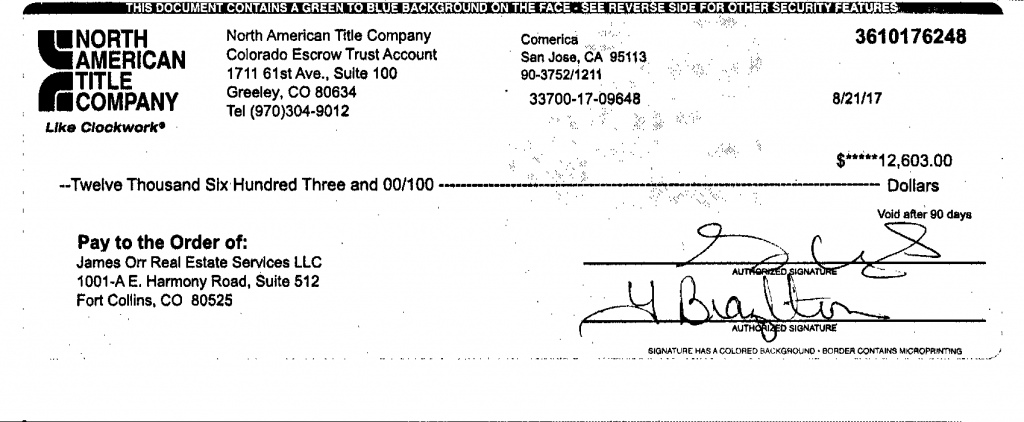

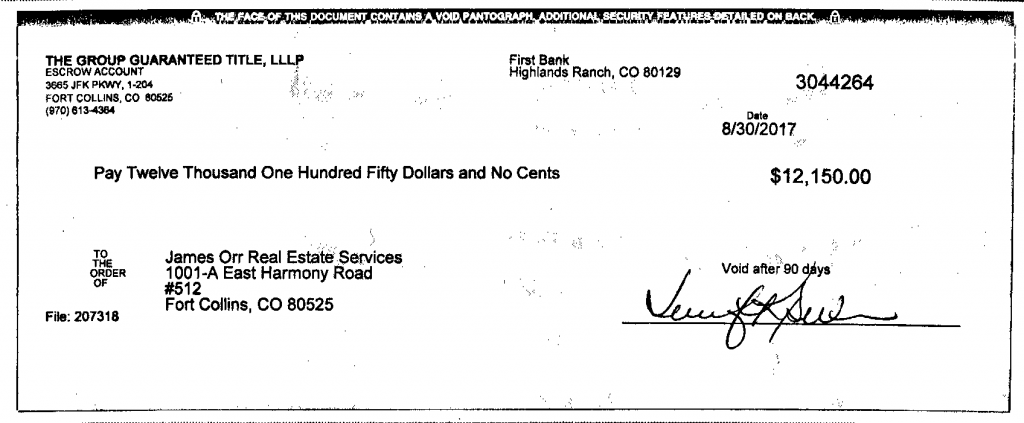

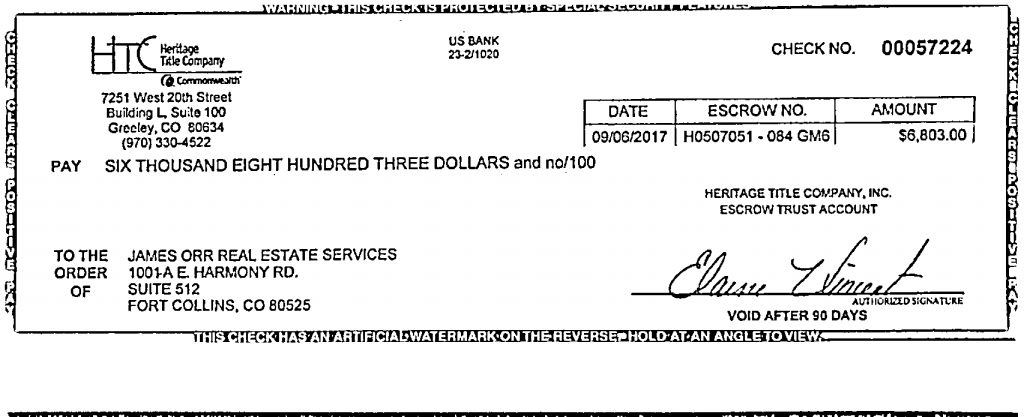

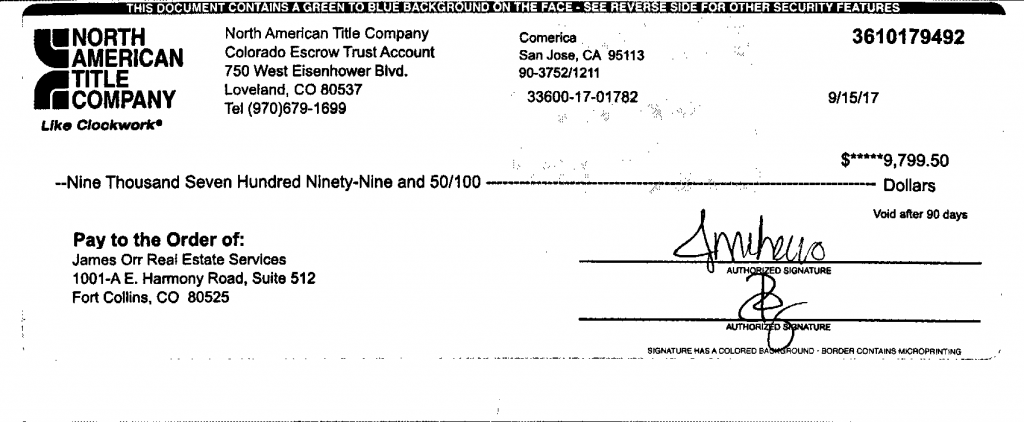

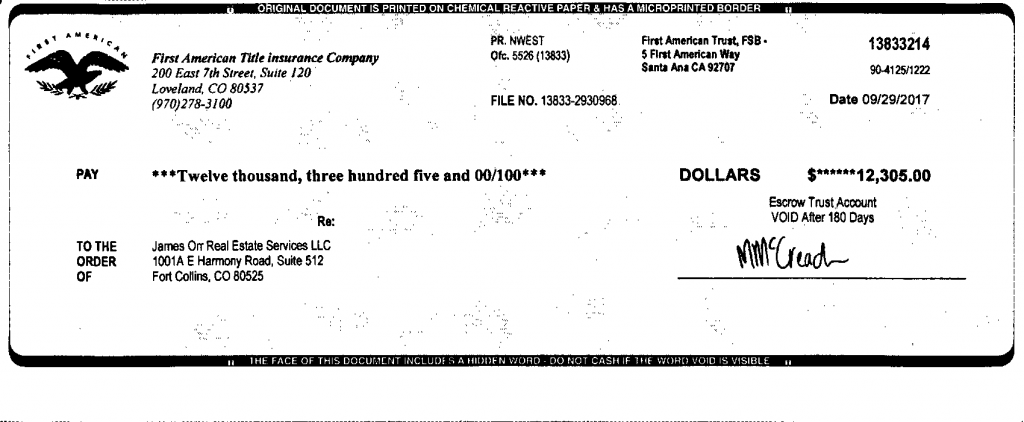

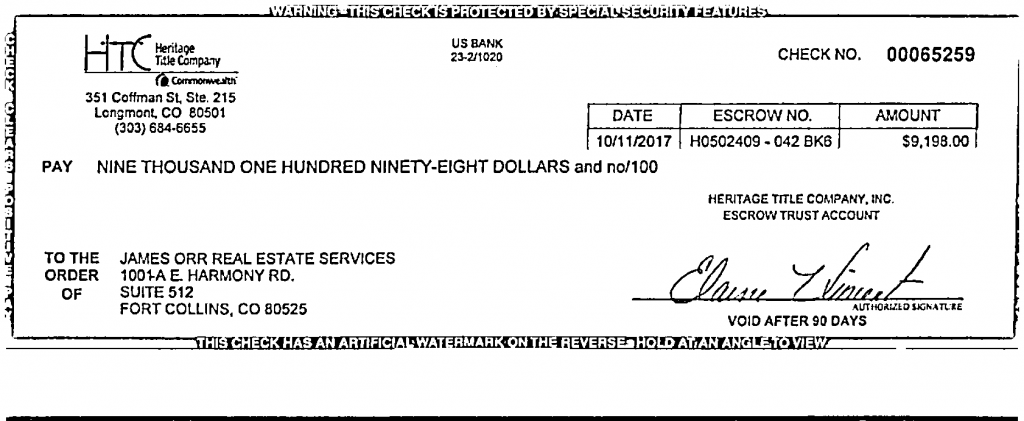

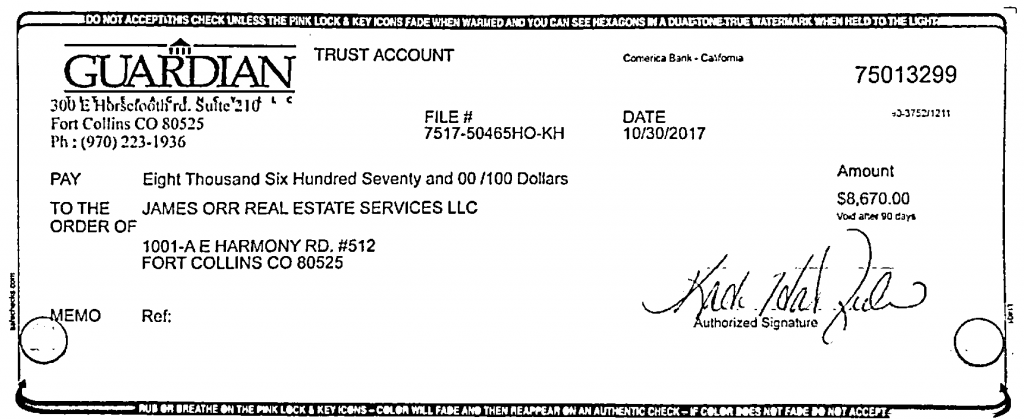

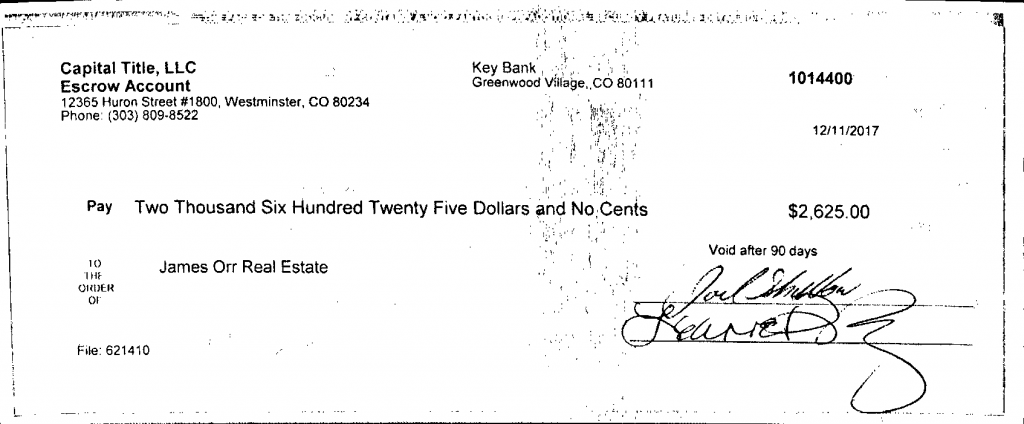

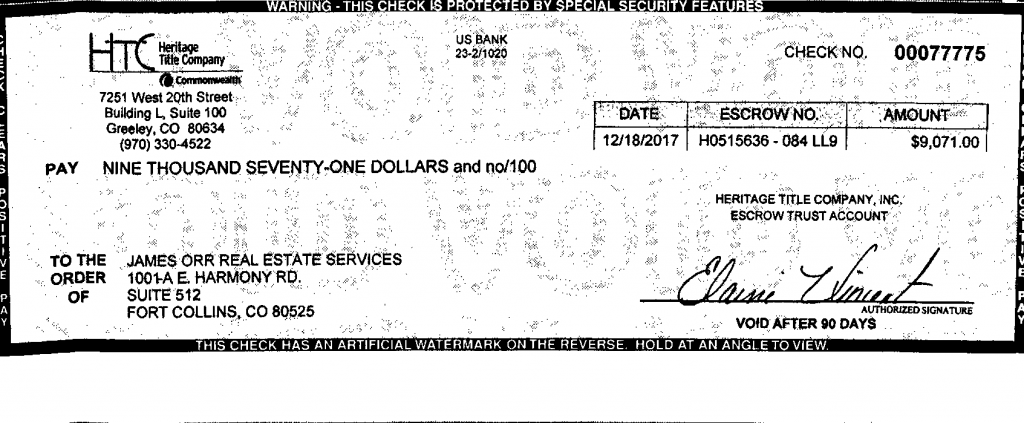

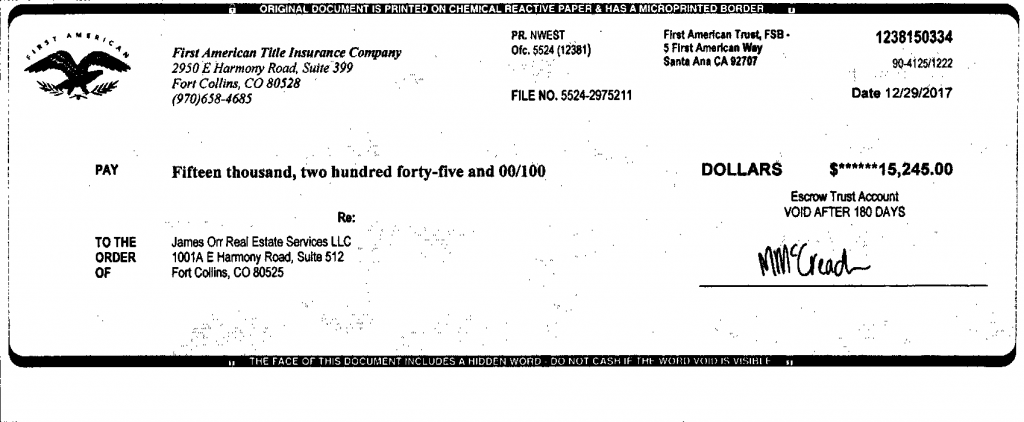

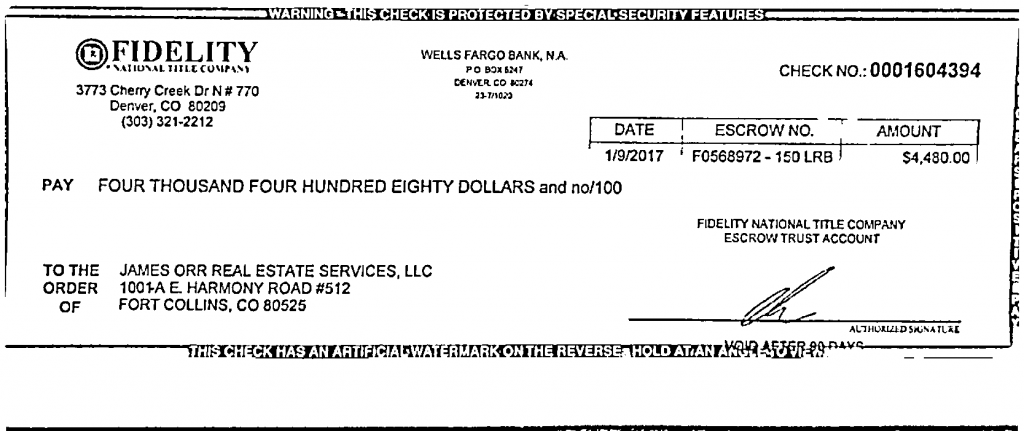

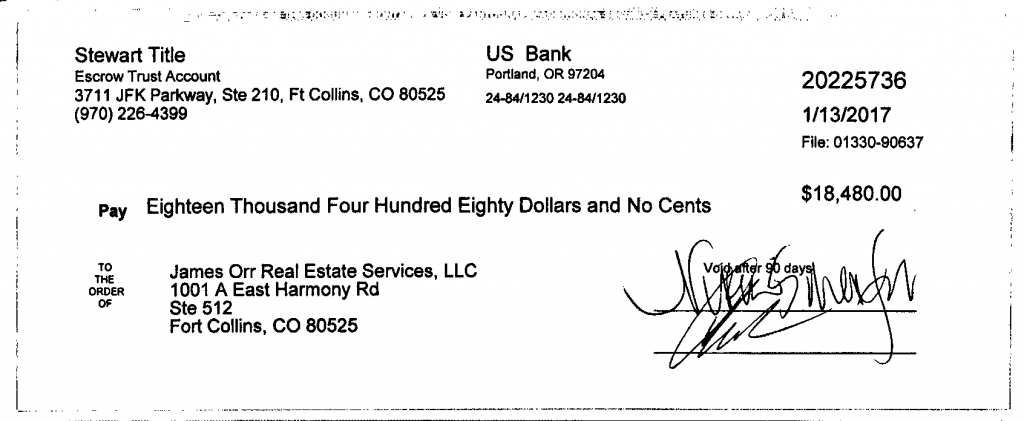

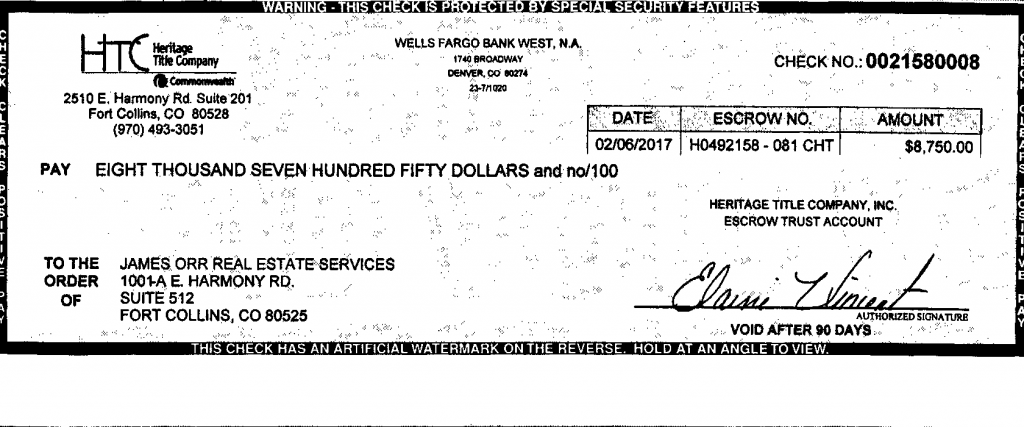

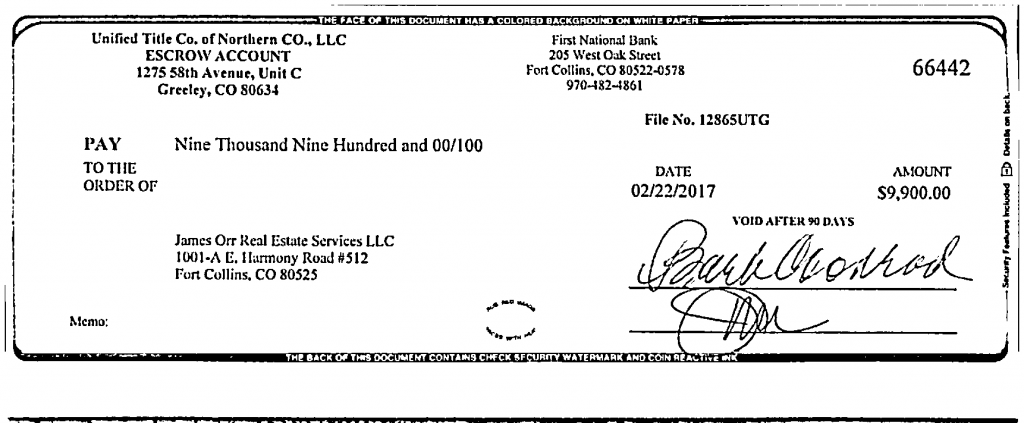

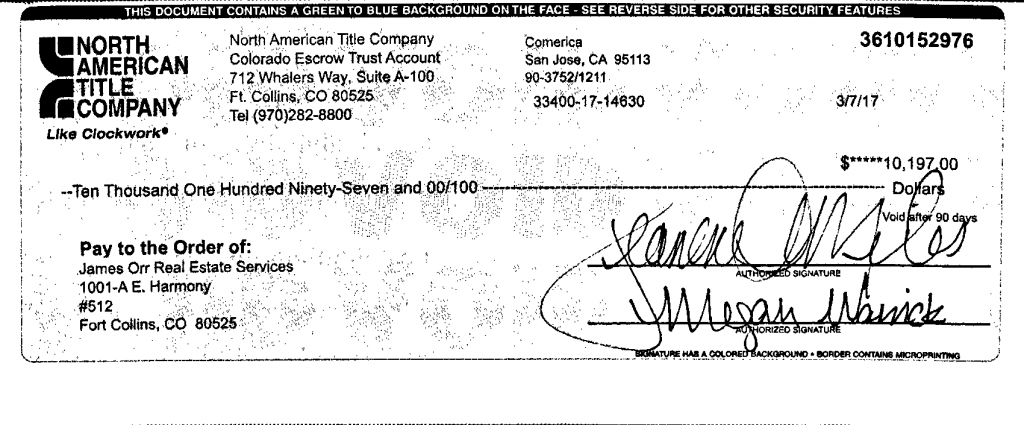

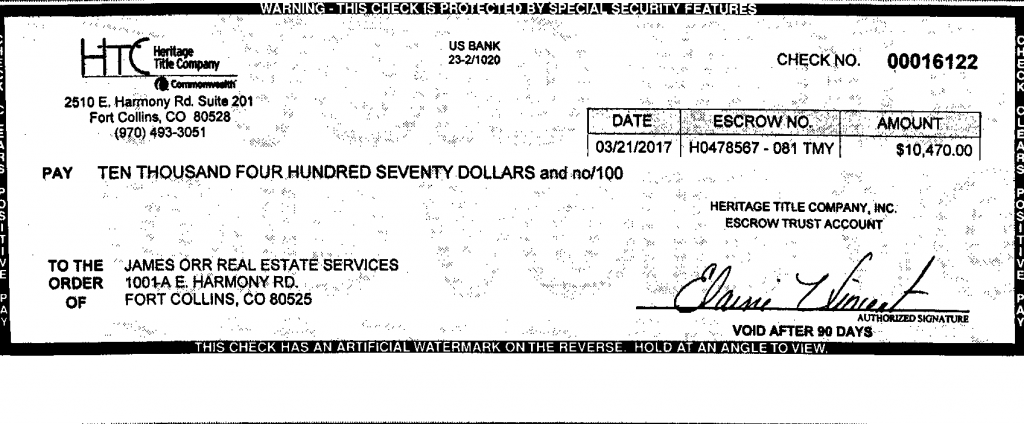

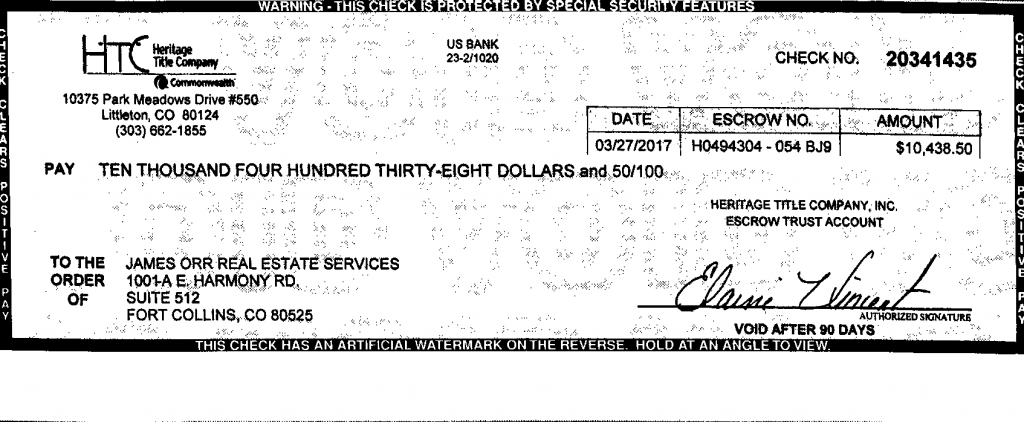

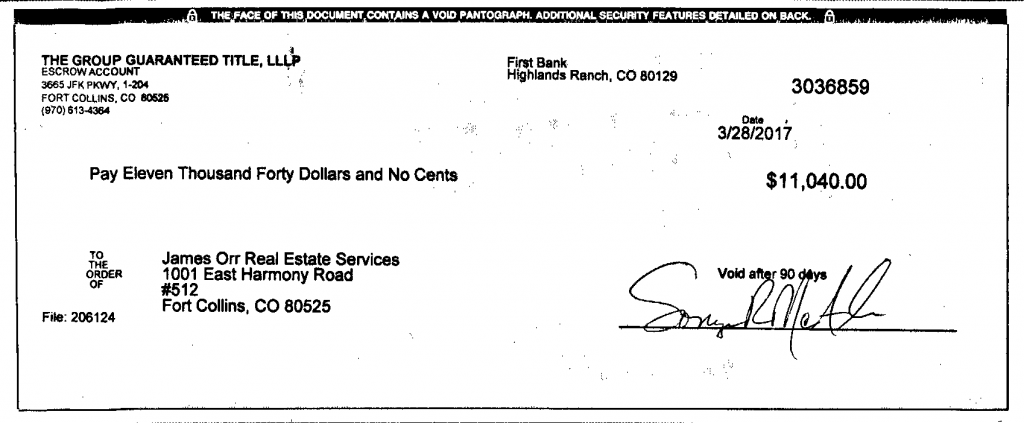

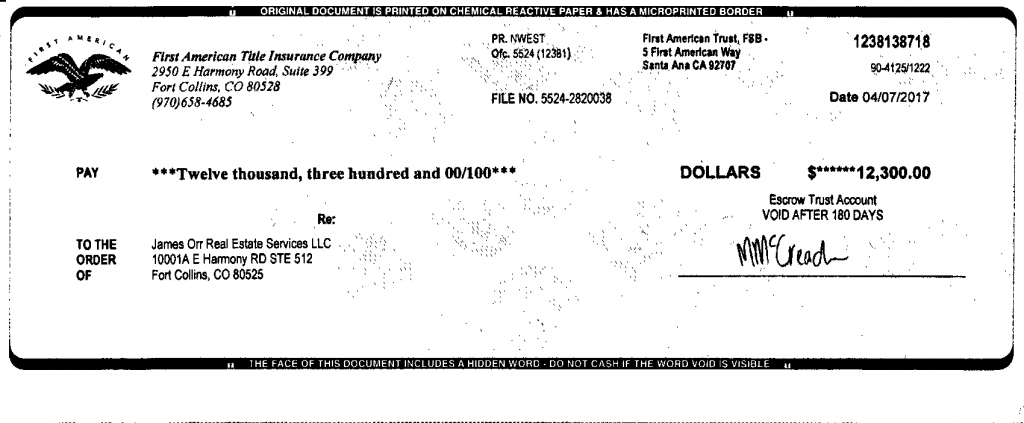

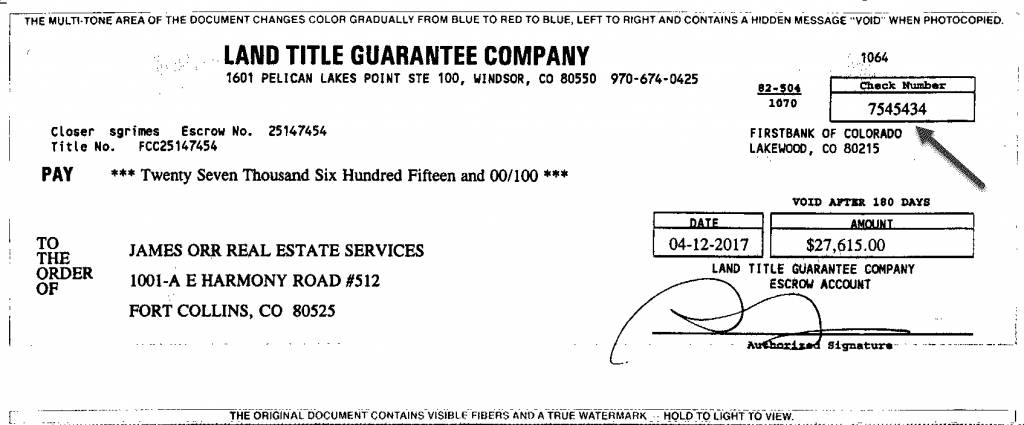

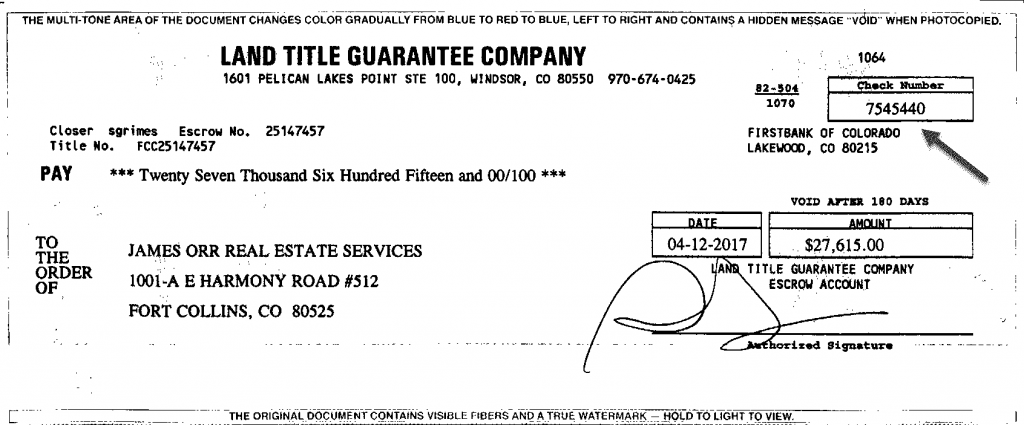

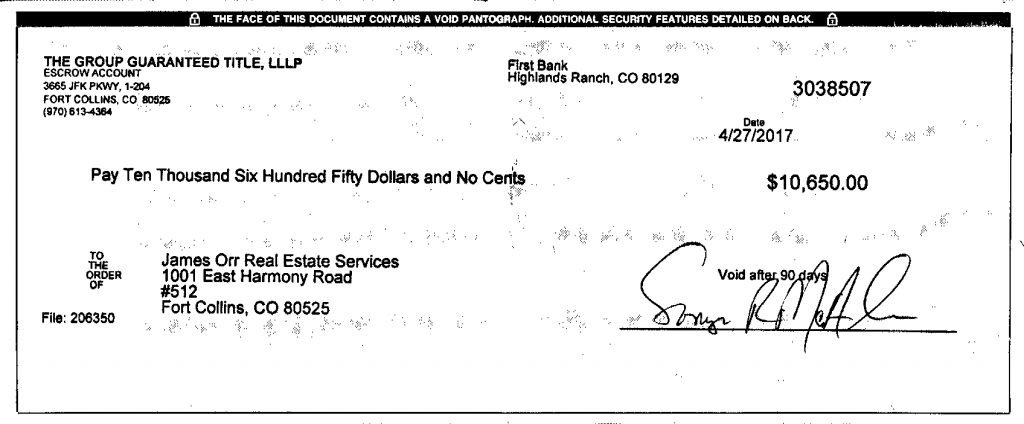

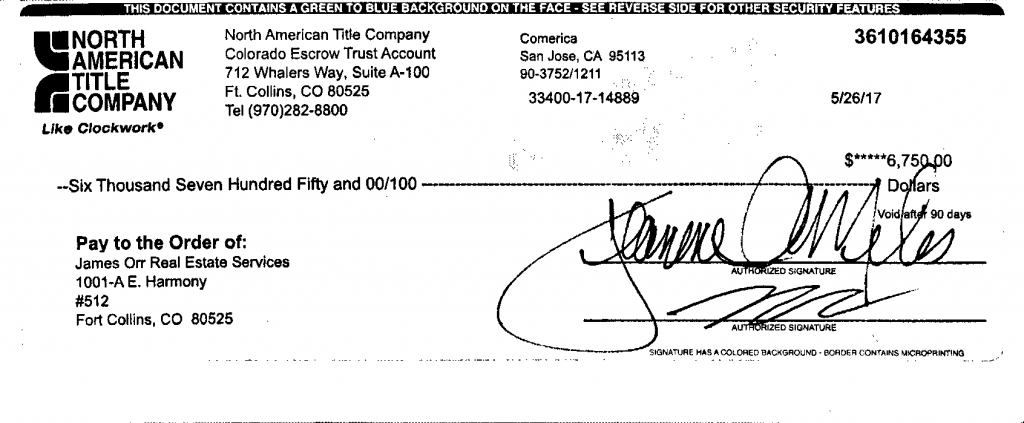

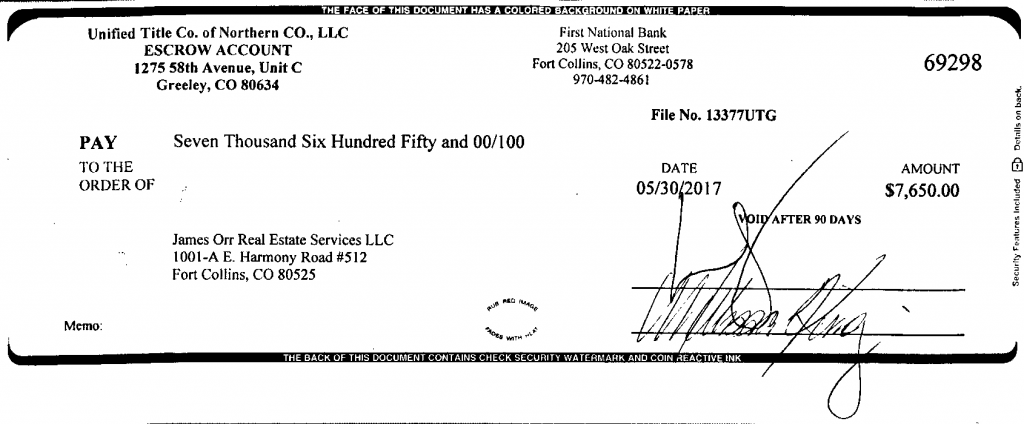

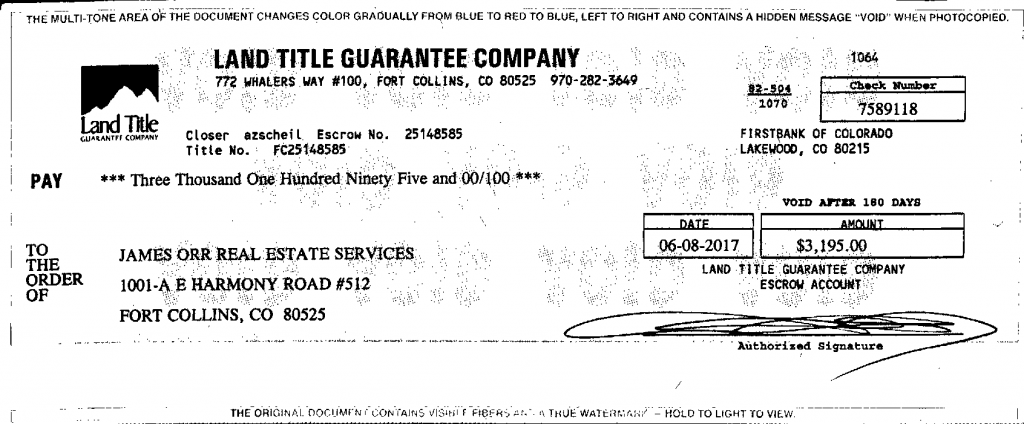

If I were reading this, I’d want to see some proof that what I am saying is real. So, here are the copies of commission checks I downloaded from my bank commission deposits for 2017.

I have redacted the account number on the checks for the title companies and pointed out the different check numbers on two checks of the same amount for the same day that you might have thought to be the same; they are, in fact, different so I drew an arrow to the different check numbers. Other than that, these are the actual checks deposited that I downloaded from my bank account.

I will also point out that this is business generated on an extremely small budget. I will cover the start-up and running costs in the second book in this trilogy called How To Start a Profitable Real Estate Investor Group for Real Estate Agents: The simple step-by-step process any real estate agent can use to attract and retain an army of investors that know, like, trust, and buy with you.

Simplified, Value Adding Stay In Touch Tool

Finally, what I consider to be the best reason of all to have a real estate investor group: the ability to easily stay in touch with your sphere.

There are 3 real estate agent author/gurus that I am aware of that emphasize staying in touch with your sphere to generate business that I can share with you:

- Gary Keller founder of Keller Williams Realty and author of Millionaire Real Estate Agent

- Larry Kendall founder of The Group Inc and author of Ninja Selling

- Brian Buffini author of Work By Referral, Live the Good Life!

All three are worth buying and reading, but I will share with you one commonality for each and show you why having a real estate investor group when using their strategy makes it both easier and better.

First, let’s look at Gary Keller’s suggestions from the Millionaire Real Estate Agent. Gary suggests that real estate agents spend 3 hours of the day on lead generating activities. In the book, he suggests you initiate an 8×8 (8 contacts over 8 weeks to any new person you add to your database), then follow up with them with 33 touches each year. According to Gary Keller, and the research done for the book over a large number of real estate agents, he claims if you do that you will generate 1 sale and 1 referral for each 12 people that you do this with from your met database.

Second, Larry Kendall suggests in both his Ninja Selling book and life seminars that you should, in addition to 8 other Ninja habits, have 50 live interviews a week where you discuss Family, Occupation, Recreation, and their Dreams (FORD). Larry suggests that after looking at 50,000 Ninja real estate agents if you work the Ninja system, you will earn $1,000 for every household in your database per year. So, if you have 200 households that you’re staying in contact with using the Ninja system, you might expect to earn $200,000 per year.

And finally, Brian Buffini suggests writing 3 personal notes, making 5 check-in phone calls, and adding 1 person to your database each day plus some additional weekly and monthly tasks you can find in his book Work By Referral, Live the Good Life! I had to go to his referral maker software to get his estimated conversion numbers. According to the referral maker software he sells, “[they’ve] found that most agents getting started working by referral need to make 20 contacts to generate 1 referral, and on average, one out of every 3 referrals turns into a closing.” That means that if you make 60 calls and ask for a referral you might get 3 referrals and one ends up in a sale.

I find it hard to compare these 3 as apples to apples, but I think most people can see that they’re similar: stay in touch with your database with regular contact and you’ll generate both sales and referrals. That’s what makes the real estate investor group so powerful: the simplified way of staying in touch and adding value to the people in your sphere.

I don’t know about you, but my phone for making unsolicited outbound calls weighs a million pounds… it is incredibly challenging for me to pick up the phone and make the calls that Gary, Larry, or Brian are suggesting. So, I had to do something different and, straight up, email is hugely ineffective for replacing the calls and face-to-face contact that these gentleman suggest.

Instead, the real estate investor group allows me to contact the people that have joined the group and are interested at least once a week and almost always twice a week with something of value. Plus, the ones that are most interested, voluntarily come to me (for the class that week) so I can see them face to face, give them a big hug and chat with them briefly before and after class.

Imagine this for a moment. You’re interested in learning about real estate investing, so you look around and discover a group that has classes on real estate investing. The topic looks interesting so you sign up and attend.

The group itself is adding people to my database every week. For the last 12 weeks or so, here is the number of new members per week that opted to have me stay in touch with them about the investor classes by joining our real estate investor group.

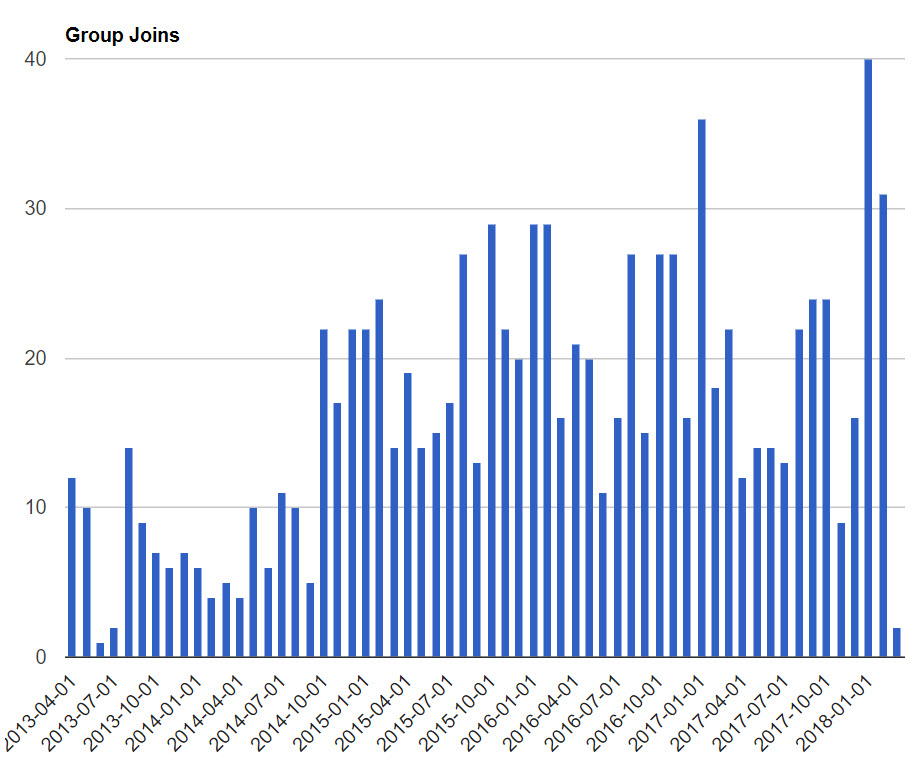

Each column represents a week of new member joins. There are some weeks where we get 1 or 2 new members, but more often than not, we’re seeing more than 4 new members each week. The chart below shows the total number of people that have joined since we moved to using software to help run the group.

Now each column represents a month. Early on, we’d see a few members join each month. Some months, more than 10, but for the first year or so, I’d estimate by looking at the chart that we were closer to 5 new people per month. I got smarter in year 2 and rarely saw a month with less than 10 member joins. I think the upward trend has been and will continue to be more people joining each month.

So, having a real estate investor group can put meeting new people largely on auto-pilot. Plus, these are not low grade ore… buyers and sellers doing 1 or 2 transactions every decade. These are folks that are saying they may be interested in buying multiple properties. Some are Nomads that will want to buy 10 properties every 10 years. That’s 5 times more valuable than just meeting a typical homeowner that may buy and sell with you every 10 years (2 transactions: 1 buy and 1 sell).

But growing your database is just one piece of the puzzle. Remember, Gary, Larry, and Brian all emphasize the importance of staying in touch with your people. That’s really where the investor group shines. I have a legitimate, welcome reason for contacting them each week: to tell them what the topic for the week’s class is. They want this information and are looking forward to receiving it. In fact, they complain if you don’t tell them and they miss a class they were interested in.

I can’t stress enough the valuable difference between this type of weekly contact and a random, “do you know anyone looking to buy or a sell a home” phone call you might do. Sure, you might to create a good reason to call folks that isn’t just asking for referrals, but for real estate investors, I haven’t found anything better than a personal invitation to attend the amazing class we’re holding this week and expressing that we’d love to see them and catch up. I’ll show you examples of the emails we send in the third book in this trilogy, How To Run a Profitable Real Estate Investor Group for Real Estate Agents: Become the dominant real estate agent in your market working with repeat buyers that invest from the MLS.

As you’ll discover when I talk about running a real estate investor group, it is not just one email a week. Usually, I’ll send two emails. The first email invites them to the live class. The second suggests if they missed the class, that they watch or listen to the recording of the class. Again, both emails are value adding emails that people are grateful for. We can compound the impact of these emails by using the same invitation and recording in other forms like on social media websites.

So, whether they attend a class or not, real estate investor group members are getting more than the recommended contacts per year. But these are largely emails and, in my opinion, on the hierarchy of communication, emails are not very impactful. Phone is better than email, but I’ve personally not been willing to get on the phone. However, face-to-face meetings are better than the phone and that’s what happens with dozens of people a week. Remember, the email is just an invitation to a face-to-face meeting at class.

In the chart below, I show you the number of people that actually go to a class that I see face-to-face each month.

Yes… when you first start your real estate investor group, you’ll have fewer members and so you might only have a few people show up to your first meetings, but over time, you typically see more people showing up to each class. Our classroom only seats about 35 people so we sometimes have waiting lists and have to turn people away from coming to our meetings. From time to time I’ll do a special meeting at a larger venue and we’ll see a larger up-tick in people attending. But, I’ll see about 100 different real estate investors each month attending meetings. That’s like making 3 pop-bys a day except it all happens one evening a week.

So, to recap, I might email about 900 real estate investors once or twice a week and see about 100 of those real estate investors per month face-to-face in-person at the class and do about $400,000 per year in gross commission income holding a single real estate investor class a week.

Not all the people that come to class are clients or will become clients. Some actually are other real estate agents. Some are smart lenders or other dream team members that want to work with real estate investors and realize the benefit of showing up to the meetings. There are people in your contact management database that you’re supposed to be staying in touch with that are not your clients either. In fact, some of them may have gotten their real estate license or married a real estate agent since you added them. Same thing with our list of real estate investors in our real estate investor group.

One of the biggest advantages of having a group with a common interest of investing in real estate is that it makes communicating with them as a group much easier. My monthly, mailed newsletter can be, and actually is, real estate investor oriented. It talks about investing in real estate and the classes. My emails to my group are investor focused and value adding with tips, tools, upcoming classes, and class recordings.

Commissions are my primary way of monetizing my real estate investor group, but it actually doesn’t have to be. In the next chapter, I will share with you various ways to monetize your real estate investor group.