Good morning and welcome everyone to this class where we will be exploring the benefits of buying 20% down rental properties versus investing in the stock market. Our analysis covers about 305 US cities and aims to determine which strategy is faster, leads to higher net worth, and has more risks.

For the rental property strategy, we assume buying traditional 20% non-owner occupant investment loans on rental properties in each market, using that market’s median home price and estimated rents. The investor saves up until they have enough for a down payment to buy a rental property and invests any extra money in the stock market. The rental properties are not optimized in any way, and we assume no other investment strategies like house hacking, BRRR, or fix and flips.

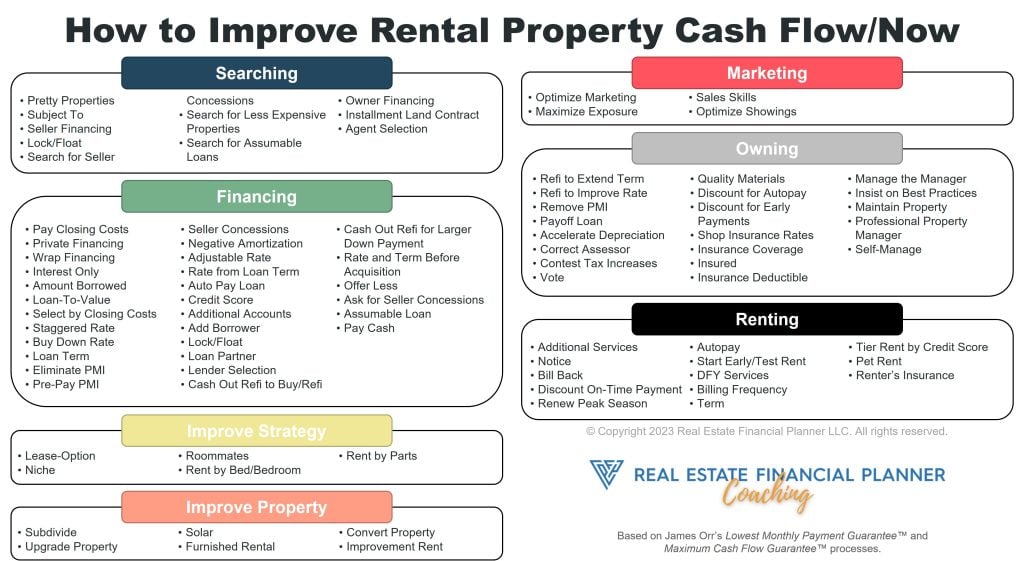

Specifically, they are not utilizing any of the 88 strategies we have for improving rental property cash flow.

For the stock market strategy, the investor invests solely in the stock market with any extra money they have. We assume an average annual rate of return of 7%. Although some people may argue that this rate is low, we believe that it is a defensible assumption, depending on the investor’s investment choices.

We model this over a 100-year period and consider two metrics: time to achieve financial independence and net worth. Surprisingly, in 75 out of the 305 cities, investing in the stock market alone was faster in achieving financial independence. In these cities, the investor’s portfolio of invested assets, like stocks, bonds, and mutual funds, exceeded their living expenses, allowing them to be financially independent.

Watch the video above and/or see the full analysis.

In 229 cities, buying rental properties was faster. The investor saves up until they have enough for a down payment to buy ten rental properties, with each property requiring a minimum of 20% down payment. Once they have all ten properties, they invest any extra money in the stock market. In these cities, the investor’s net positive cash flow from all their rental properties exceeded their living expenses, allowing them to be financially independent.

Interestingly, there were 22 cities where the rental property strategy did not achieve financial independence within the 100-year period. In these markets, the investor’s net cash flow from rental properties did not exceed their living expenses. However, we did not optimize the rental properties in any way, and it is possible to achieve financial independence by applying other investment strategies.

It’s important to note that the investor’s job income varies based on the market they’re in, so they can afford a property in that marketplace. We did not apply any of the ADH strategies to improve cash flow. We also assume that the interest rate for rental properties is about 7%, and if the investor were to buy an owner-occupant property, the interest rate would be about 6.5%.

If you were going to buy rental properties, it would be a really good idea to analyze the deal using a spreadsheet like The World’s Greatest Real Estate Deal Analysis Spreadsheet™ that we offer for free.

Overall, this analysis provides a good starting point for investors to consider which strategy is better suited for their needs. To see all the assumptions and details, go to the real estate financial planner website modeling page. It’s important to remember that every investor’s situation is unique, and it’s essential to do your research and assess your goals and risk tolerance before making any investment decisions.