Real estate investing can be a profitable way to build wealth, but it often requires a significant amount of capital. One of the biggest hurdles for aspiring investors is coming up with the down payment required to purchase a property. Fortunately, there are various low down payment options available to investors, making it easier to get started in the real estate market.

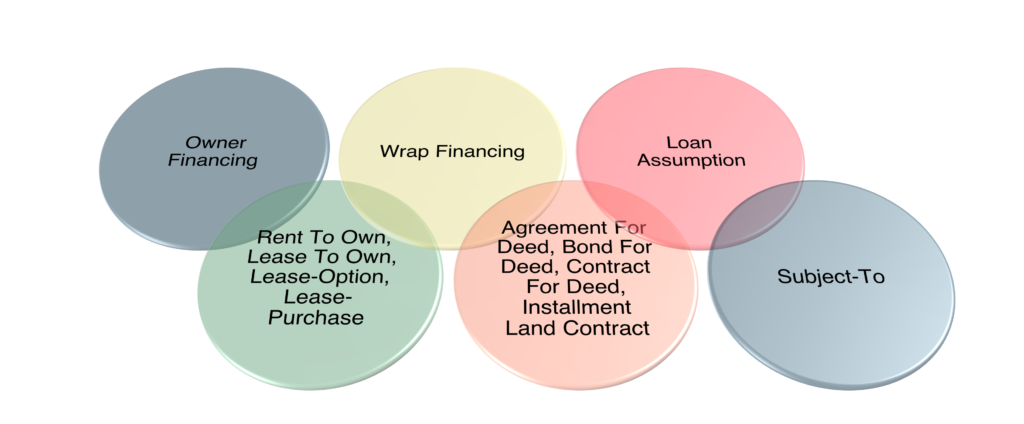

Creative Financing

Creative financing is a strategy that offers low down payment options for real estate investors. It includes strategies such as seller financing, lease options, and subject-to financing. Creative financing can be risky and require extensive knowledge and experience, but it can also offer unique opportunities to invest in real estate with little money down.

Private Money

Private money involves borrowing from individuals or companies rather than traditional lenders. It can offer flexibility and fewer restrictions than traditional financing options, making it a good choice for investors with unique circumstances or those who are just starting out. However, private money typically requires higher interest rates and fees.

Hard Money

Hard money loans are short-term, high-interest loans typically used for fix-and-flip projects. These loans can provide quick access to funding with minimal qualifications, making them a popular choice for investors who need to move quickly on a property. However, hard money loans often require high interest rates and short repayment terms.

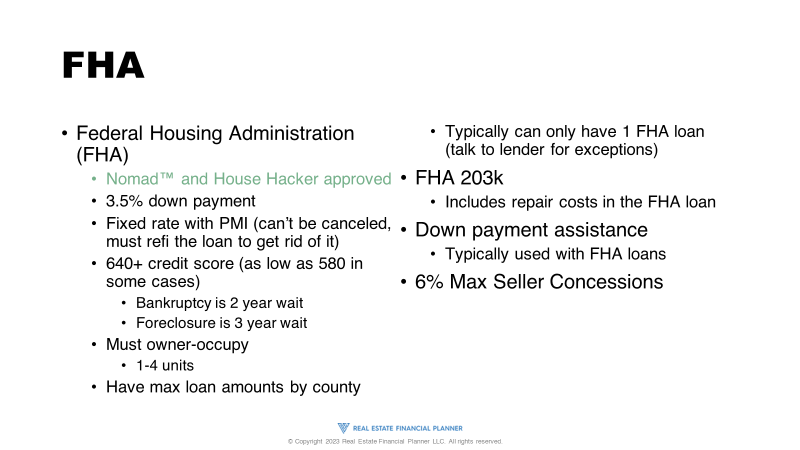

FHA Financing

Federal Housing Administration (FHA) loans are a popular low down payment option for real estate investors. FHA loans require a minimum down payment of 3.5% and are available to individuals with lower credit scores or limited funds. However, mortgage insurance premium (MIP) is typically required for the life of the loan.

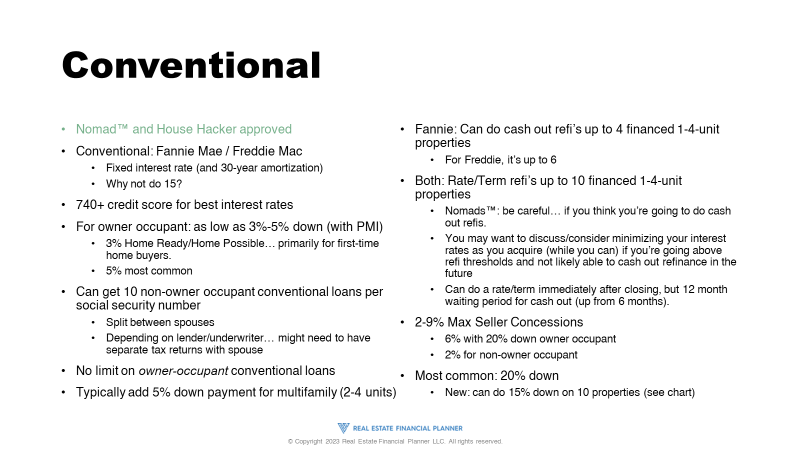

Conventional Financing

Conventional loans are another low down payment option for real estate investors. Conventional loans require a minimum down payment of 3% for owner-occupants and 15% for investors. Conventional loans offer fixed interest rates and longer repayment terms, making them a good choice for investors who plan to hold onto a property for an extended period of time. However, private mortgage insurance (PMI) is typically required for down payments less than 20%.

Down Payment Assistance

Down payment assistance programs may be available through local programs or grants. These programs can help cover the cost of a down payment for eligible individuals, making it easier to invest in real estate with little money down. The requirements and availability of these programs vary by location, so it’s important to research what’s available in your area.

Local Banks

Local banks may offer low down payment options for real estate investors. Requirements and availability of these programs vary by location, but local banks can offer personalized service and local expertise to help investors navigate the real estate market.

Analyzing Low Down Payment Deals

If you’re going to consider buying an investment property with any down payment… including low down payment options… it is critically important that you properly analyze the deal. Consider using something like our free deal analysis spreadsheet.

Conclusion

In conclusion, there are various low down payment options available for real estate investors. It’s important to research and compare different options to find the best fit for your unique circumstances and investment goals. Whether it’s creative financing, private money, hard money, FHA loans, conventional loans, down payment assistance, or local banks, there’s a low down payment option that can help you get started in real estate investing.