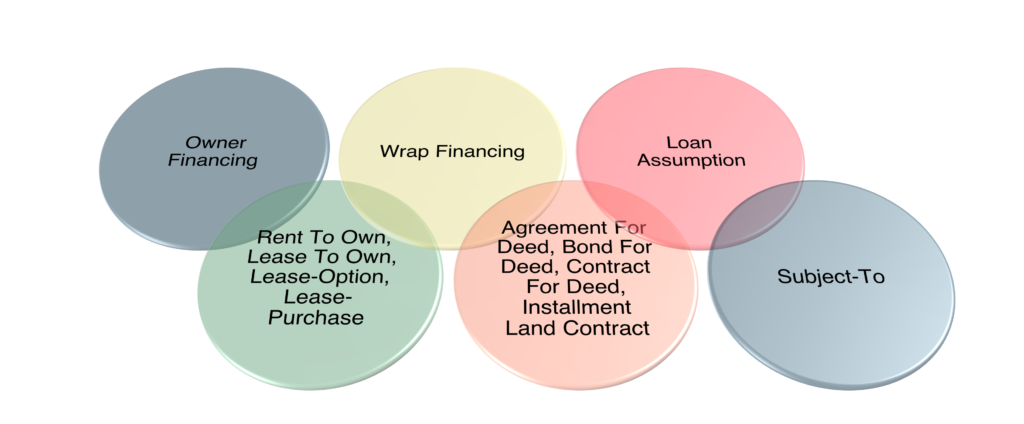

Good morning and welcome everyone. Today, we will delve into the topic of creative financing and whether it means nothing down. The real estate industry has witnessed an increase in creative financing over the years, and it has become an essential tool in the hands of real estate investors. James Orr will lead the class, and it is the last session of Q1 2023. The class includes traditional nothing down options such as private money, hard money, VA loans, USDA loans, and local bank options. In addition, we will explore the family of creative financing, which includes subject two, owner financing, wrap financing, agreement for deed, installment land contracts, and lease options.

Creative financing is an alternative way to fund real estate transactions without having to rely on traditional bank financing. Investors using creative financing techniques can purchase properties with little to no money down. However, it’s important to note that just because a deal is creative financing doesn’t mean it’s necessarily nothing down. In fact, some of these deals may require upfront cash, which includes money to find deals, reserves, repairs, capital expenses, and cumulative negative cash flow.

When it comes to finding deals, there are two primary marketing methods: poor marketing and lazy marketing. Poor marketing is when you don’t have any money, but you’re willing to put in a lot of time and effort to find deals. For instance, you may go door-to-door or contact everyone that’s got a property for rent to find motivated sellers. On the other hand, lazy marketing is where you’re willing to spend money to have deals come to you. You could put up banded signs, have someone else put up banded signs for you, or have someone deliver door-to-door flyers.

It’s important to be prudent and safe when using creative financing techniques. In some cases, you can use the money from a tenant buyer to help offset some of the money you need to do the deal. However, it is not a guarantee that the deal will be no money required. It is essential to have enough reserves to cover any expenses that may come up. Reserves are critical and should be taken seriously. It is recommended that you have six months of reserves for each property you purchase. You cannot use the reserves for another property as reserves for the new property.

Moreover, not having the money to cover expenses can be detrimental, even if you’ve managed to acquire the property creatively with little to no money down. For instance, if the property requires repairs or capital expenses, you’ll need to have some money set aside to cover those costs. You might also need to spend money on marketing to find the right deals.

Be sure to propertly analyze your deals—especially if they are nothing down deals. Consider using the free deal analysis spreadsheet.

In conclusion, while some creative financing deals may be nothing down, it is not a guarantee. It’s important to have some money set aside for any expenses that may come up and to be willing to spend money on marketing to find the right deals. You should also be aware that some deals may require down payment or some equity, and it is crucial to have reserves and be safe and prudent. Remember, having enough reserves is critical, and you should have six months of reserves for each property you own. With the right mindset, skill set, and financial backing, you can take advantage of creative financing to achieve your real estate investment goals.

Real estate investing is not a get-rich-quick scheme. It requires patience, discipline, and a willingness to take calculated risks. By understanding the importance of having some money set aside and being prepared to spend money on marketing, you can acquire properties creatively and build long-term wealth. Remember that creative financing can be a powerful tool to acquire properties with little to no money down, but it’s important to do it wisely and prudently. With the right approach, you can use creative financing to achieve your financial goals and build a successful real estate portfolio.