Are you considering investing in real estate? If so, you need to understand the risks and rewards involved. In this blog post, we’ll discuss the concept of Resiliency™ and how it relates to your down payment size. By understanding Rent Resiliency™ and Price Resiliency™, you can make smarter investment decisions that will set you up for success. Plus, we have historical data to back it up. So buckle up and get ready to learn. Watch the video and read on to become a smarter real estate investor.

Resiliency™

Welcome to the world of real estate investing where the risks are high, but the rewards can be even higher. Today, we’re going to talk about Rent Resiliency™ and Price Resiliency™ and how the size of your down payment can make all the difference.

Rent Resiliency™ measures how much rent can decline before you have negative cash flow. The more you put down, the more likely you are to have positive cash flow. It’s simple, really. When you’ve got more skin in the game, you’re more likely to win.

Price Resiliency™ measures how much price can decline before you have negative equity. Again, the more you have invested, the better your resiliency to drops in price. This one’s a no-brainer. If you’ve got more money invested, you’ve got a better chance of coming out on top.

But don’t just take our word for it. Historical Case-Shiller data shows us how likely and severe price drops can be. And trust us, they can be pretty severe. The good news is that if you’ve got a healthy down payment, you’re more likely to weather the storm.

So, if you’re thinking about investing in real estate, remember this: a bigger down payment means better Rent Resiliency™ and Price Resiliency™. Don’t skimp on the down payment. It could be the difference between success and failure.

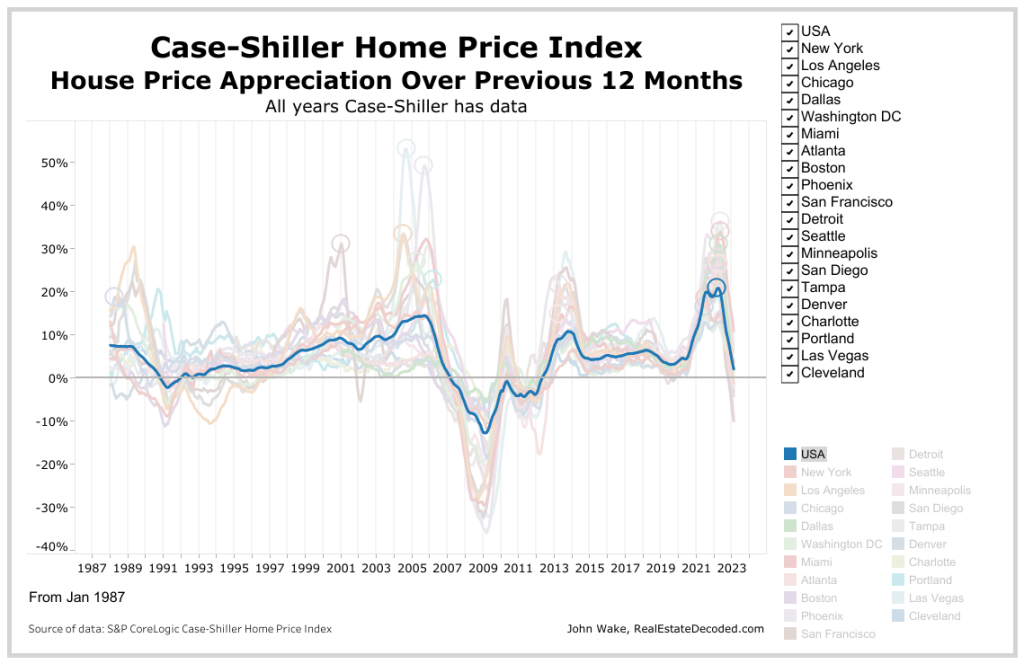

Case-Shiller Home Price Appreciation Over Previous 12 Months

Home prices are a hot topic in the real estate industry. It seems like everyone has an opinion on where they’re headed. But the truth is, no one can predict the future of home prices. Homes prices can go up and down, and the year-over-year appreciation rate can vary by city and individual property.

That being said, we can still learn a lot from historical data. By looking back over 133 years of data, we can get a sense of what’s typical in the past. But it’s important to remember that historical data does not mean that’s necessarily what we will see in the future. The future is always uncertain.

So what does the data tell us? The average year-over-year appreciation rate based on Case Shiller data for the entire United States is 3.61% per year. Of course, this can vary by city and individual property. But one thing is clear: over the long term, real estate has historically been a solid investment.

So if you’re thinking about buying a home, don’t let fear of the unknown hold you back. Consider your options carefully, do your research, and make the best decision for your unique circumstances. And remember, the future is always uncertain, but historical data can give us some clues about what’s typical in the past.

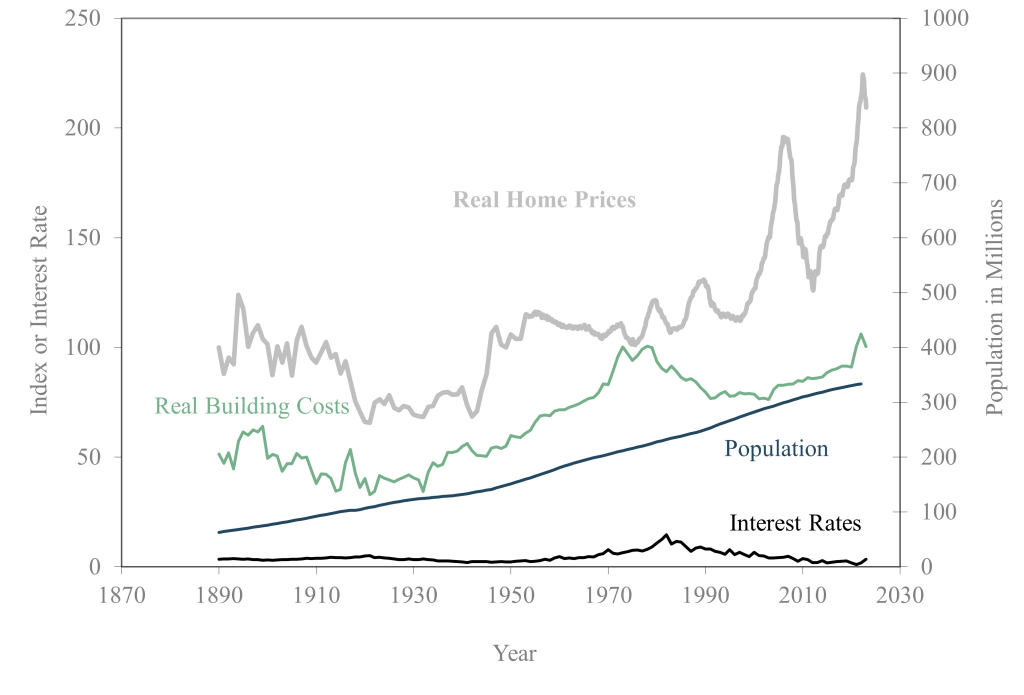

Case-Shiller Chart

Want to see how mortgage interest rates, US population, the real building costs and home prices relate to each other looking back at over 130 years of history? The chart above should give you some insight.

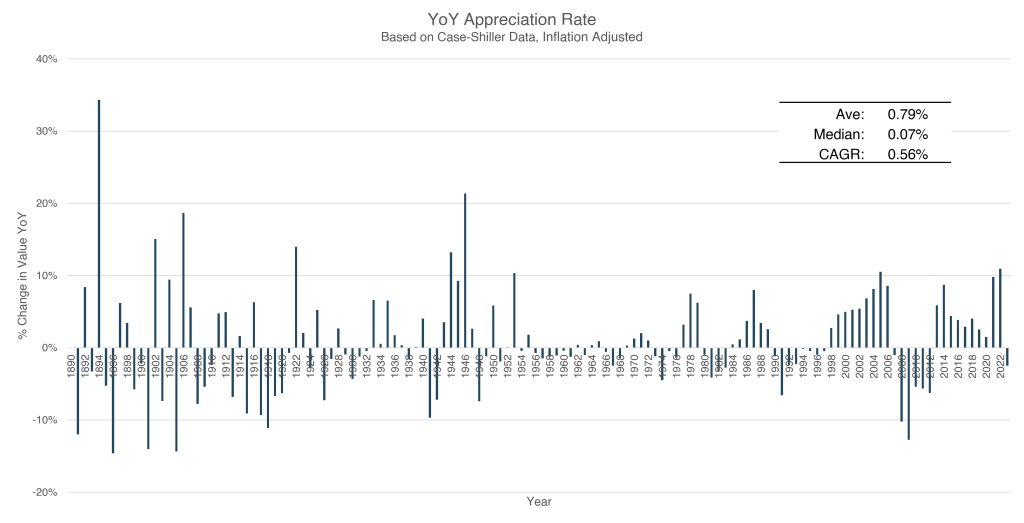

Appreciation Rates Over Time

The following charts show you the year-over-year change in home price values for the entire US. In other words, the yearly appreciation rate. Some years property values declined (negative appreciation). Other years prices when up (positive appreciation). This is based on 133 years of Case-Shiller data.

The chart above shows the year-over-year appreciation when adjusted for inflation.

And, the chart above shows the year-over-year raw appreciation when not adjusted for inflation.

What if we counted up the number of years that had appreciation rates between about -15% and -10%? We could see there were 8. What if we repeated this process counting the number of years that we had appreciation rates between a certain range. We could create the chart above showing how frequently certain year-over-year appreciation rates occured over the last 133 years.

What if we cleaned up the ranges of appreciation rates? For example, what if we said how often were appreciation rates negative (less than 0%)? Or, greater than 10% per year? The simplified version is shown directly above.

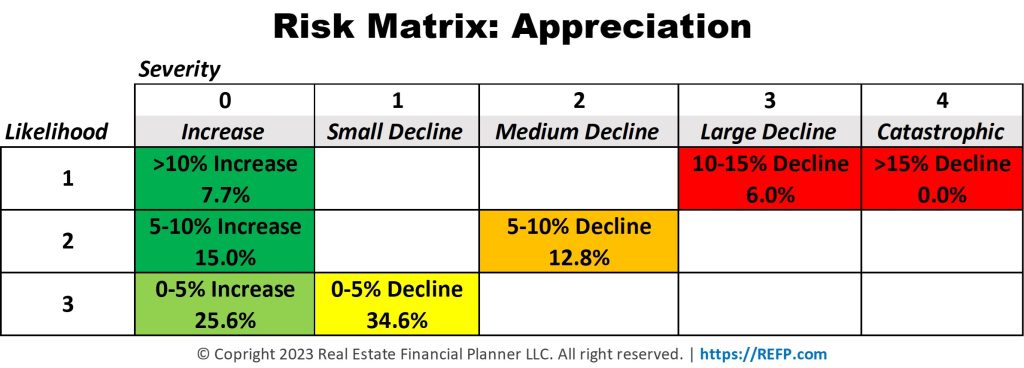

Risk Matrix

In previous classes, like the Warning – Insurable Risks When Investing in Real Estate, I introduced the idea of the Risk Matrix to show that certain risks can be mild or severe and risks can also be low probability or high probability.

The risk matrix attempts to show that the most challenging risks are one that are both severe and frequent.

So, taking the data we now have about frequently and how severe prices on properties can change each year over the last 133 years, we can create a risk matrix specific to appreciation and the risk that property values will go down. That’s shown above.

What Are You Risking?

When investing in real estate, it’s important to understand the risks associated with down payment size. The amount you choose to invest in a deal can significantly impact the risks you take on and the potential rewards you can reap.

The concept of resiliency is crucial when it comes to investing in real estate. Rent Resiliency™ measures how much rent can decline before you have negative cash flow, while Price Resiliency™ measures how much price can decline before you have negative equity. The more you have invested in the deal, the better your resiliency to drops in rent and price. This is because the more you have at stake, the more likely you are to weather negative changes in the market.

However, it’s also important to consider other factors that come with different down payment sizes. For example, if you put nothing down, you’re not losing any of your own money directly, but you could still lose interim “equity” and possibly future money. This means that if property values were to drop multiple years in a row and you actually have negative equity, the property value would drop below what you owe. This could lead to a realized loss if you need to sell the property.

On the other hand, if you put 100% down, you’re much less likely to have a credit issue because you don’t have a loan at all. This means that if property values decline and you bought the property for all cash, you did not necessarily lose any of your own money because you did not have a loan. However, you could still lose interim “equity” and possibly realized loss if you need to sell.

It’s also crucial to consider your debt-to-income ratio, net worth, liquidity, and reserves when deciding how much to invest in a deal. These measures of debt can impact your ability to weather any negative changes in the market. For example, if you have no money in a deal, you’re risking your credit because if for some reason you abandon the property, your credit is what’s at risk. If you have little or nothing down in the deal, you’re much more likely to have negative cash flow, which means your ability to hold onto the property is limited to your ability to continue to feed the property.

On the other hand, if you put a lot of money down, you’re much more likely to have positive cash flow, even if you have to drop rent in order to get a property occupied. And by taking a lot of money and putting it down, you tend to have less months of reserves. However, the amount you need in reserves on a free, clear property is much lower than the amount you need in reserves on a property that has debt.

In conclusion, when it comes to investing in real estate, there are always risks involved. However, by understanding the risks associated with different down payment sizes and measuring your debt accordingly, you can make informed decisions about your real estate investments. Don’t skimp on the down payment, as it could be the difference between success and failure. Instead, consider all the factors involved and make the best decision for your unique circumstances. Remember, investing in real estate can be a lucrative endeavor, but it’s important to do your research and understand the risks before diving in.

Conclusion

In conclusion, investing in real estate is both exciting and risky. To mitigate those risks, it’s critical to understand the importance of down payment size and how it impacts your ability to weather negative changes in the market. By carefully measuring your debt and understanding your resiliency, you can make informed decisions about your investments and maximize your chances for success. Remember, investing in real estate is a long-term game, and the more you put into it, the more you’re likely to get out of it. So don’t skimp on the down payment and always do your research before making any investment decisions.