The Ultimate Guide to Debt Paydown for Rental Properties

Debt paydown on rental properties is an important part of successful real estate investing. It can help investors maximize the return on their investments and make informed decisions about when and where to invest, refinance, payoff, sell and more. In this blog post, we’ll discuss the importance of debt paydown on rental properties, the return from debt paydown, the strategies available, when you might want to use them. Read on to learn how to make the most of your rental property investments with smart debt paydown strategies. What is Debt Paydown? Debt paydown is the amount of principal of the … Read more

The Ultimate Guide to Rental Property Depreciation

Are you looking to make the most of your rental property investments? Rental property depreciation is an important tax benefit. It can help you maximize your returns and improve your overall cash flow. In this blog post, we’ll discuss the basics of rental property depreciation, including how to calculate depreciation, rental property tax deductions, and more. With this information, you’ll be on your way to financial freedom. What is Rental Property Depreciation? Rental property depreciation is a tax deduction that allows landlords to deduct a portion of the cost of their rental property over a number of years. This is … Read more

The Ultimate Guide to Real Estate Appreciation

Real estate appreciation can be an incredibly powerful tool for creating wealth and achieving financial freedom. Understanding how to effectively use real estate appreciation is essential for anyone looking to get the most out of their real estate investments. In this blog post, we will discuss the fundamentals of real estate appreciation and how to maximize your returns. We’ll look at what appreciation is, some of the key benefits of real estate appreciation and provide tips and strategies for making the most of it. Whether you’re a veteran real estate investor, or new to the world of real estate, this … Read more

The Ultimate Guide to the Types of Real Estate Investors

Are you considering investing in real estate but aren’t sure which type of investor you should be? Knowing the different types of real estate investors can help you make an educated decision. In this blog post, you’ll learn about the different types of real estate investors, their strategies, the pros and cons of each type, and more. Read on to learn all about the types of real estate investors and how to choose the best one for your goals. You could group these investor types in a variety of ways, but I’ve broken them out below into strategies (listed alphabetically): … Read more

What Does Financially Independent Mean?

Wikipedia defines financial independence as: Financial independence is the status of having enough income or wealth sufficient to pay one’s living expenses for the rest of one’s life without having to be employed or dependent on others. But, what does that mean more mathematically? And, practically? And, specifically, how does that look different for real estate investors than investors in more traditional stocks, bonds and other asset classes? How I Define Financial Independence My definition of financial independence is a little different. I define it as when the following 3 major sources exceed your personal expenses: 1. Passive Income I … Read more

Why You Still Might Want to Invest in Real Estate Despite High Prices, High Interest Rates, and Lagging Rents

This class was taught live by James Orr on January 5, 2023. In this class James discusses: Why the First $100K Is The Hardest Return Quadrants™ and how that can help you achieve your first $100K and first million Some real estate financial modeling

Protected: Compare Return on Equity Quadrants™

There is no excerpt because this is a protected post.

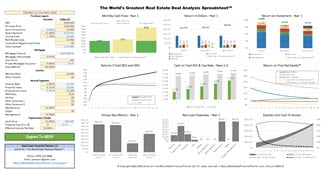

The Ultimate Guide to Vacancy on Rental Properties

If you’re looking to learn more about vacancy on rental properties, then check out our Ultimate Guide to Vacancy on Rental Properties. Vacancy is the money lost from Gross Potential Income due to the property being unoccupied or in non-payment from the current tenants. It is important to estimate vacancy when analyzing deals you’re considering buying. It is one of the primary inputs on The World’s Greatest Real Estate Deal Analysis Spreadsheets™ for you to enter when you start your deal analysis. You can download the spreadsheet for free. Vacancy is a combination of skill of management and price you’re … Read more