Debt paydown on rental properties is an important part of successful real estate investing.

It can help investors maximize the return on their investments and make informed decisions about when and where to invest, refinance, payoff, sell and more.

In this blog post, we’ll discuss the importance of debt paydown on rental properties, the return from debt paydown, the strategies available, when you might want to use them.

Read on to learn how to make the most of your rental property investments with smart debt paydown strategies.

What is Debt Paydown?

Debt paydown is the amount of principal of the mortgage paid down over the time period being measured. The time period is usually a year.

It answers the question: how much debt did I pay down on the mortgage this year?

Debt Paydown: A Guaranteed Return?

Debt paydown is just one of 5 areas of return you could get from owning a rental property.

You only get it if you have financing on a property. If you bought the property for cash without a mortgage, then your debt paydown return would be zero since there was no loan to pay off.

The other four areas are:

- Appreciation

- Cash Flow

- Depreciation (usually in the form of Cash Flow from Depreciation™)

- Return from Reserves

The bottom half of the Return Quadrants™ (which includes debt paydown and depreciation) are the returns that are more certain and less speculative in nature. In some cases, we can think of these as quasi-guaranteed returns that prop up the other returns on the property. They do not require the real estate market to do well for you to receive the benefits.

If you’ve got a loan on the property and you’re making regular payments, you’re going to get the debt paydown return. It doesn’t matter if the market or rent goes up or down or if you have a bunch of repairs on the property or not.

As for depreciation, you’re getting that return unless they change the tax laws.

That’s why these are quasi-guaranteed returns… if the tax law remains the same and if you make payments on your loan, you get these two, bottom-half returns.

The left half of the Return Quadrants™ (which includes appreciation and debt paydown) are cash later returns.

Because paying down the debt on a property just adds to your equity in the property with an amortizing mortgage, it does not typically improve cash flow in the short-term. Just like appreciation increases equity.

You can only access the benefits of this increased equity by selling the property, or pulling cash out of the property with a cash out refinance.

Eventually, when you pay off the mortgage completely and eliminate the monthly payment completely, that will improve cash flow. And, many times that is a significant increase in cash flow when the loan is paid off.

Debt Paydown in Deal Analysis

To analyze a potential property you’re considering buying you should use a deal analysis spreadsheet. For example, you might consider downloading a free copy of The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

When you enter in the potential deal, the spreadsheet will automatically calculate how much debt on the property you’re going to pay off each year and show you the debt paydown return on the dashboard.

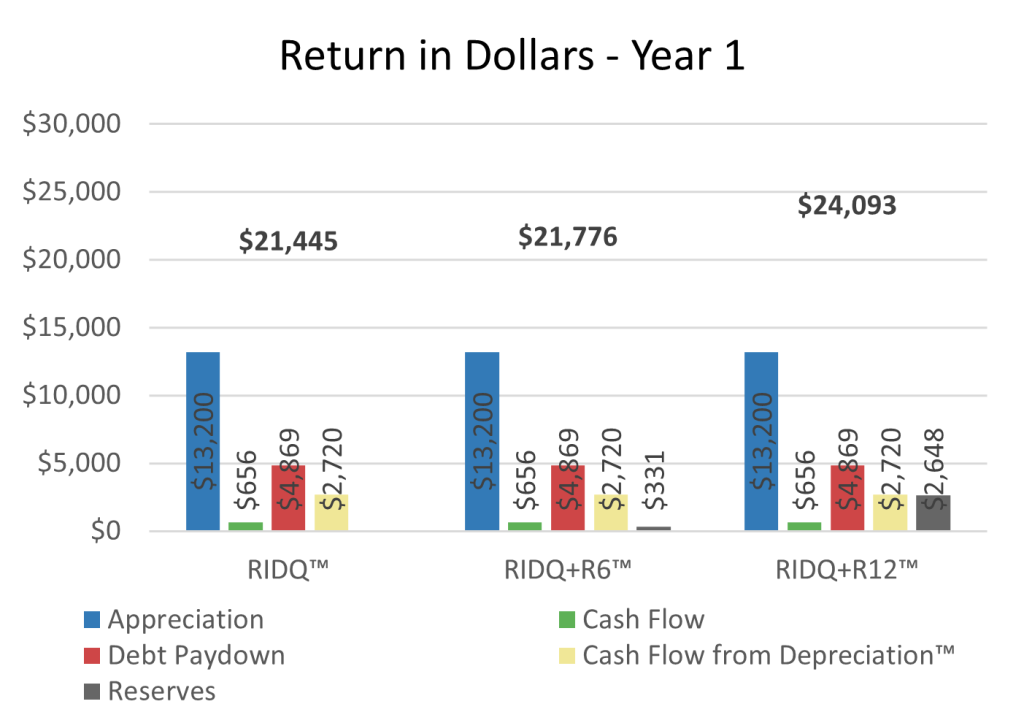

For example, you can see the red bars representing the amount of the mortgage that you paid off in the first year in the Return in Dollars Quadrant™ – Year 1 section of the spreadsheet.

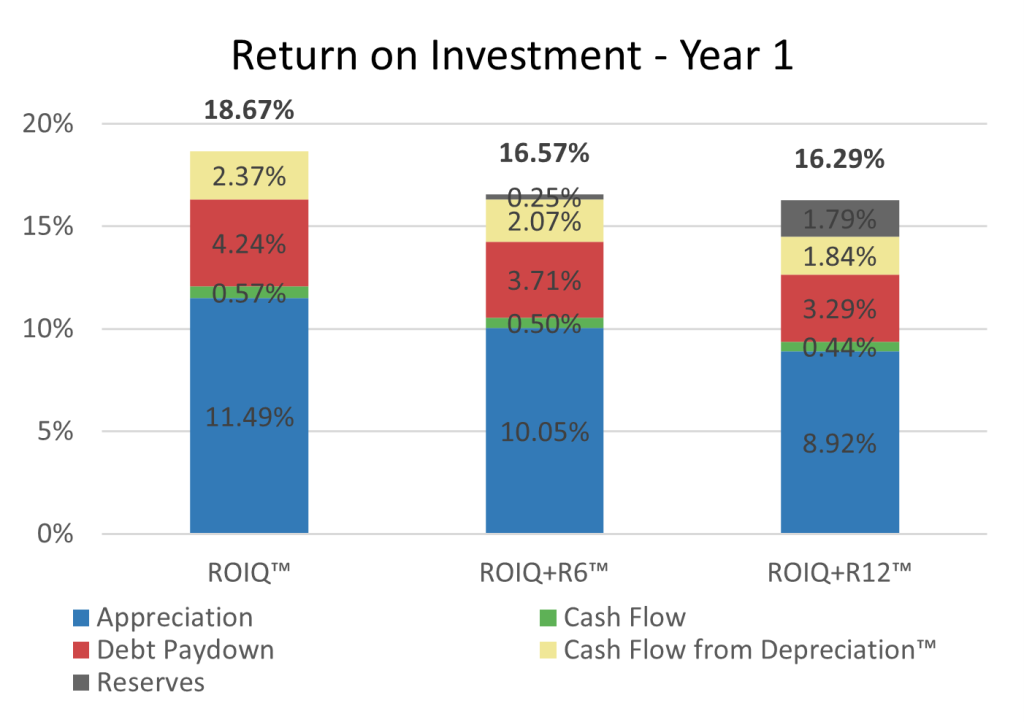

Plus, you can see debt paydown represented as a percent of the amount you invested to buy the property in the Return on Investment Quadrant™ – Year 1 section as well. Again, it is the red bar in the chart below.

What Impacts Debt Paydown Return

So, what impacts how much you’re paying down on the mortgage on a rental property?

Well, you could choose to make additional principal payments. That’s if your property doesn’t have pre-payment penalty or you’re willing to pay the penalty anyway.

However, there are other factors that determine how much you pay down and when it gets paid down.

Interest Rate

For example, the lower your interest rate on your mortgage the more you pay off earlier in the mortgage. A mortgage at 4% pays off more in the first year than a 7% mortgage interest rate with the same mortgage balance even though the payment is lower on the 4% mortgage. Later in the mortgage, the 7% mortgage will be paying off more as you get closer to paying off the entire mortgage.

Term of the Mortgage

This one is probably obvious, but the term of the mortgage will impact how much you pay off on the mortgage each year. A 15-year amortizing mortgage will pay off in 15 years and that means it needs to be paying off a larger amount of principal with each payment compared to a 30-year amortizing mortgage of the same starting balance.

Return on Investment from Debt Payoff

Those are the factors that impact the size… in dollars… of the amount paid off on a mortgage. But, in terms of a percent of the amount you had to invest, it might help to think of this as a black box math problem.