Welcome to the exciting world of investing! If you’ve got $10,000 and a desire to grow it in 2024, you’re in the right place. The journey of investing your money is both thrilling and rewarding. With a landscape as vast and varied as the investment world, finding the right place to park your money can feel like navigating a labyrinth. Fear not! Whether you’re drawn to the sturdy foundations of real estate, the dynamic play of the stock market, or the digital frontiers of cryptocurrency, there’s a perfect spot for your investment.

This guide is designed to illuminate the path through that labyrinth, showcasing a variety of investment options that cater to different risk tolerances, financial goals, and interests. From traditional avenues that have stood the test of time to modern opportunities that reflect our changing world, we’ll explore how to best invest $10,000 in 2024. By understanding your own investment goals and risk appetite, you can choose a strategy that not only suits you best but also has the potential to turn your investment into a significant pillar of your financial future.

Investing is not just about making more money; it’s about making smart choices that align with your life’s goals. It’s about planting seeds today whose fruits you’ll harvest tomorrow. So, let’s get started on this journey together, exploring the absolute best ways to invest $10,000 in 2024 and setting the foundation for financial success.

Understanding Your Investment Goals and Risk Tolerance

Before jumping into the myriad of investment opportunities, it’s vital to take a step back and consider what you’re aiming to achieve with your $10,000. Your investment goals can vary widely, from building an emergency fund, saving for a down payment on a house, to generating passive income or even amassing wealth for retirement. Knowing your destination will help chart the course to get there.

Equally important is understanding your risk tolerance. This is all about how much uncertainty you can handle in your investments. Are you the type who loses sleep over the thought of your investment fluctuating day-to-day, or do you relish the possibility of significant returns even if it means enduring volatility? Your risk tolerance is deeply personal and can affect not just the types of investments you choose but also how you react to the ups and downs of the market.

To get a clearer picture of your investment goals and risk tolerance, consider these questions:

- What am I investing for? Identify specific financial goals you’re aiming to achieve.

- How long do I plan to invest? Your time horizon can influence the types of investments you should consider.

- How much risk can I comfortably take? Assess your financial situation and emotional capacity to handle market volatility.

- How will I react to market fluctuations? Imagine your response to a significant drop in your investment value.

Understanding your goals and risk tolerance is not just a one-time task but an ongoing process. As your life changes, so too might your financial goals and how much risk you’re willing to take. Regularly revisiting these questions can help ensure that your investment strategy remains aligned with your current circumstances and future aspirations.

Armed with a clear understanding of your investment goals and risk tolerance, you’re now ready to explore the diverse world of investment options. Let’s dive in and discover the best ways to invest $10,000 in 2024, tailored just for you.

Traditional Investment Options

When we talk about investing, certain time-tested options come to mind. These traditional investment vehicles have been the backbone of portfolios for generations, offering a blend of reliability, predictability, and the potential for steady growth. Whether you’re new to investing or looking to balance your portfolio with some foundational assets, traditional investment options provide a solid starting point. From the tangible assets of real estate to the tried-and-true stability of bonds and the broad market access through stocks and retirement accounts, these options cater to a wide range of investment goals and risk tolerances. Let’s explore how these classic choices can serve as the cornerstone of your investment strategy in 2024.

- Real Estate: Residential and Commercial

- Stock Market: Individual Stocks and ETFs

- Bonds: Government and Corporate

- Retirement Accounts: IRAs and 401(k)s

- High-Yield Savings Accounts and CDs

Real Estate: Residential and Commercial

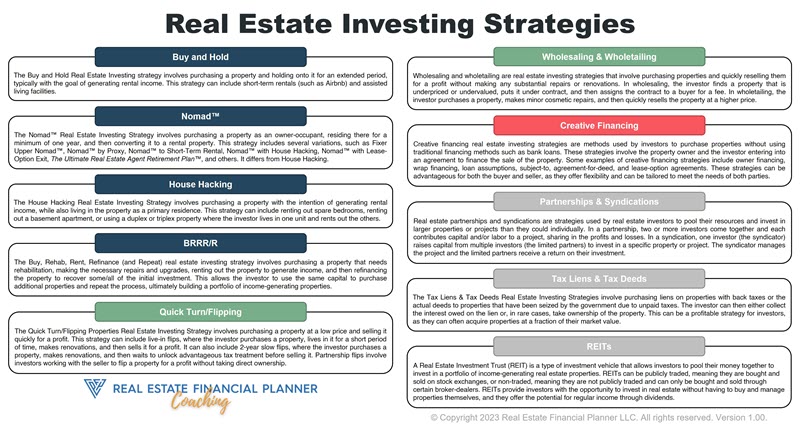

Real estate investment stands as a pillar of wealth-building, offering tangible assets that investors can see and touch. Diving into real estate involves purchasing residential or commercial properties with the aim of generating rental income, benefiting from property appreciation, or both. This sector provides a dual allure: the potential for steady cash flow and long-term value growth.

Residential Real Estate involves buying properties such as houses, apartments, or duplexes to rent out to tenants. It’s a popular choice for many investors due to the consistent demand for housing, offering a relatively predictable stream of income. Common returns on investment (ROI) in residential real estate vary by location, property condition, and market trends but typically range from 5% to 10% annually after expenses but this can vary widely depending on the down payment size and real estate investing strategy utilized.

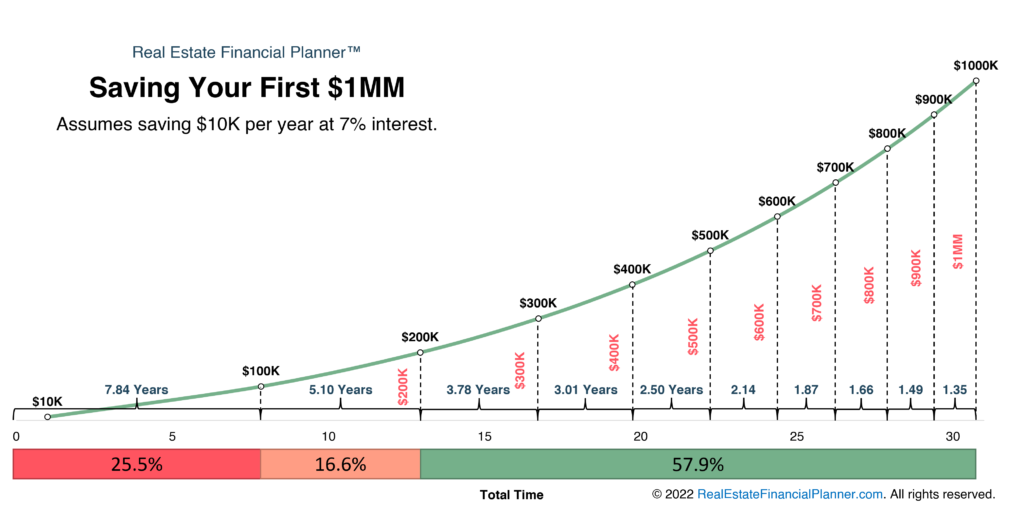

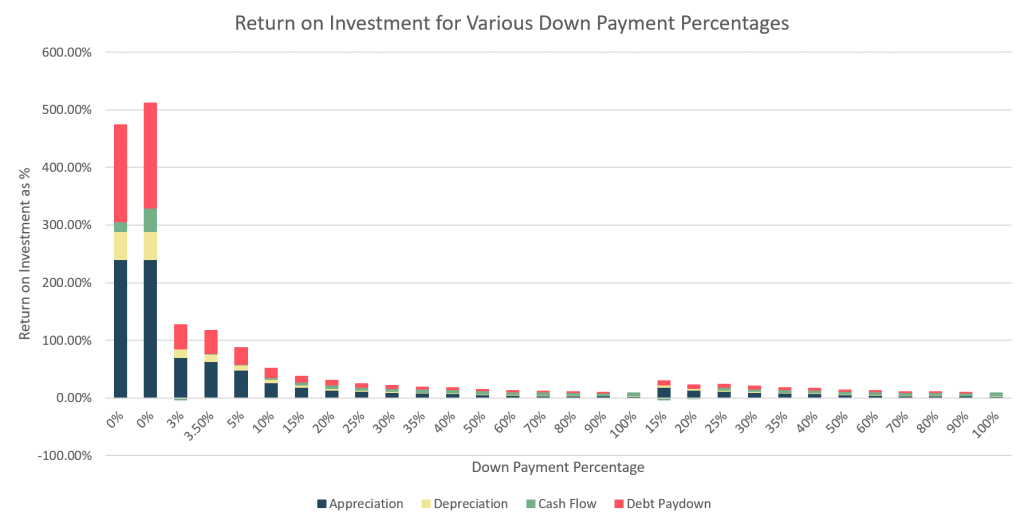

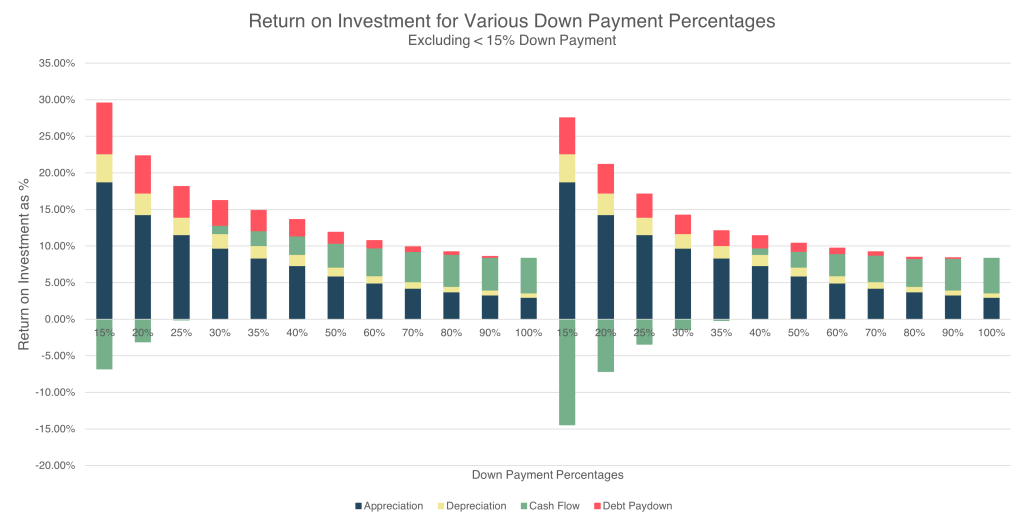

For example, here’s a chart from I class we taught showing the return on investment for rental property assuming a variety of down payments options:

You’ll notice the ROI when you put a small amount down… like $10,000 for example… to acquire a property can be well over 100%. Putting more down, can lower your overall return… as you can see when we remove all the options below 15% down payments.

Commercial Real Estate, on the other hand, includes office buildings, retail spaces, warehouses, and more. These investments often come with longer lease terms and can lead to higher income potential compared to residential properties. However, they may also require a larger upfront investment and can be more sensitive to economic fluctuations. The ROI for commercial real estate can vary widely but generally falls within a similar range to residential real estate, with potential for higher returns depending on the lease structure and market conditions.

Investing in real estate also comes with unique considerations, such as property management, maintenance costs, and the impact of local and national market conditions. Moreover, the initial capital required can be substantial, though financing options like mortgages can help spread out the investment cost.

For those looking to diversify their investment portfolio, real estate offers a tangible asset class that not only provides potential monthly income but also appreciates over time, contributing to wealth accumulation. Whether opting for residential or commercial properties, real estate investment demands thorough market research, due diligence, and sometimes, a willingness to be hands-on with property management. Yet, for many, the potential for solid returns on investment makes it a compelling choice for allocating a portion of that $10,000 in 2024.

Stock Market: Individual Stocks and ETFs

The stock market offers a dynamic platform for investors looking to grow their wealth. Investing in individual stocks allows you to own a piece of a company, with the potential for significant returns based on the company’s performance. Alternatively, Exchange-Traded Funds (ETFs) provide a way to invest in a diversified portfolio of stocks, reducing the risk associated with individual stocks while still offering the growth potential of the stock market.

Individual Stocks are suited for investors who wish to dive deep into market research, analyzing company fundamentals and market trends to pick winners. While investing in individual stocks can offer high returns, it comes with higher volatility and risk. The ROI from individual stocks can vary greatly depending on the company’s success, market conditions, and timing of the investment. Historically, the stock market has offered an average annual return of about 7% to 10%, adjusted for inflation, but individual stocks can diverge widely from this average.

ETFs, on the other hand, offer a more balanced approach. An ETF holds a basket of stocks, mirroring the performance of a market index, sector, or commodity. This diversification reduces the risk of significant losses from any single stock’s poor performance. ETFs are ideal for investors looking for exposure to the stock market’s growth potential without the time commitment required for individual stock research. The average annual return for ETFs closely follows the underlying index or assets they track, which can also average around 7% to 10% over the long term, similar to the broader stock market average.

Investing in the stock market, whether through individual stocks or ETFs, requires a strategy and patience. Market fluctuations can test investors’ resolve, but those with a long-term perspective and a diversified portfolio are well-positioned to capitalize on the growth potential of the stock market. The key to successful stock market investing is not just selecting the right stocks or ETFs but also managing your portfolio to align with your investment goals and risk tolerance.

For those considering investing part of their $10,000 in the stock market, starting with ETFs might be a wise choice to gain diversified exposure while learning about the market. As you become more comfortable and knowledgeable, you might choose to allocate a portion of your investment to individual stocks, aiming for higher returns by capitalizing on the success of specific companies.

Bonds: Government and Corporate

Bonds are essentially loans that you give to an entity, whether it’s a government or a corporation, in exchange for periodic interest payments plus the return of the bond’s face value at maturity. They are considered a more stable and lower-risk investment compared to stocks, making them an attractive option for conservative investors or those looking to balance their investment portfolio.

Government Bonds are issued by federal, state, or local governments to fund various projects and activities. U.S. Treasury bonds, for example, are backed by the full faith and credit of the U.S. government, making them one of the safest investment options available. The returns on government bonds are generally lower than those on stocks or corporate bonds, reflecting their lower risk. The average annual return can range from 1% to 3%, depending on the bond’s term and current interest rates.

Corporate Bonds are issued by companies to raise capital for business operations, expansion, or other purposes. Since corporate bonds carry a higher risk than government bonds—due to the possibility of corporate default—they typically offer higher interest rates to attract investors. The returns on corporate bonds can vary widely based on the issuing company’s creditworthiness, with average annual returns generally ranging from 3% to 6%.

Investing in bonds provides a steady stream of income through interest payments, usually semi-annually, and can serve as a cushion during volatile market periods. However, bond prices can fluctuate based on interest rate movements and other factors. When interest rates rise, bond prices typically fall, and vice versa. This interest rate risk is something bond investors need to consider, especially for long-term bonds.

For those looking to invest $10,000 in 2024, bonds offer a way to generate income while preserving capital. Whether you lean towards the safety of government bonds or the higher yields of corporate bonds, incorporating bonds into your investment strategy can diversify your portfolio and help manage risk. Balancing bonds with other investment types can create a well-rounded portfolio aligned with your financial goals and risk tolerance.

Retirement Accounts: IRAs and 401(k)s

Retirement accounts like Individual Retirement Accounts (IRAs) and 401(k)s are powerful tools for long-term savings and investment, offering tax advantages that can significantly enhance your investment growth over time. These accounts are specifically designed to help you save for retirement, with various options available depending on your employment status and investment goals.

IRAs come in two main types: Traditional and Roth. Traditional IRAs offer tax-deductible contributions and tax-deferred growth, meaning you won’t pay taxes on the income until you withdraw it in retirement. Roth IRAs, on the other hand, are funded with after-tax dollars, but withdrawals in retirement are tax-free. The choice between a Traditional and Roth IRA will depend on your current tax bracket, expected tax bracket in retirement, and specific financial goals. IRAs allow you to invest in stocks, bonds, ETFs, and mutual funds, providing flexibility in how you grow your retirement savings.

401(k)s are employer-sponsored retirement plans that allow employees to save and invest a portion of their paycheck before taxes are taken out. Some employers offer a matching contribution up to a certain percentage, which can significantly boost your retirement savings. Like IRAs, 401(k) plans offer a range of investment options, including stocks, bonds, and mutual funds.

The common return on investments within IRAs and 401(k)s largely depends on the underlying investments chosen. Since these accounts can hold a mix of stocks, bonds, and other assets, the average annual return can vary widely. Historically, a diversified portfolio of stocks and bonds in these accounts has yielded an average annual return of around 5% to 8%, depending on the market conditions and investment choices. However, the tax advantages of IRAs and 401(k)s can effectively increase your net investment returns, making them a cornerstone of retirement planning.

For those looking to invest $10,000 in 2024, contributing to an IRA or 401(k) offers a strategic way to save for retirement while optimizing for taxes. Whether you’re starting fresh or augmenting existing savings, taking advantage of these accounts can compound your investments’ growth, setting a solid foundation for your financial future in retirement.

High-Yield Savings Accounts and CDs

For those seeking a low-risk investment option, high-yield savings accounts and Certificates of Deposit (CDs) offer a secure way to grow your money. These financial tools are ideal for investors looking to preserve capital while earning a steady return, without the volatility associated with stocks or bonds.

High-Yield Savings Accounts are similar to traditional savings accounts but offer higher interest rates, allowing your money to grow faster. They are accessible, providing the flexibility to deposit or withdraw funds without penalties. This makes them a great option for building an emergency fund or saving for short-term goals. The interest rates on high-yield savings accounts can vary, but they typically range from 0.5% to 1.5% annually, depending on the bank and prevailing economic conditions.

Certificates of Deposit (CDs) are time-bound deposit accounts that offer a fixed interest rate in exchange for locking in your money for a predetermined period. CDs usually offer higher interest rates than savings accounts, rewarding you for the lack of liquidity. The terms can range from a few months to several years, with longer terms generally offering higher rates. The average annual returns on CDs can range from 1% to 3% sometimes a little higher like we’re seeing right now, with rates typically increasing with the term length.

Both high-yield savings accounts and CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per institution, providing an extra layer of security for your investment. While the returns on these options are modest compared to riskier investments, they offer a guaranteed return with virtually no risk of losing your principal.

Investing $10,000 in high-yield savings accounts or CDs in 2024 is a smart move for conservative investors or those looking to keep a portion of their portfolio in a safe, liquid form. Whether you’re saving for an upcoming purchase, building an emergency fund, or simply seeking a risk-free return on your investment, these options provide a reliable way to achieve your financial goals.

Modern Investment Avenues

As we journey further into the 21st century, the investment landscape continues to evolve, offering new and innovative ways to grow your wealth. Modern investment avenues embrace the latest technological advancements and societal shifts, presenting opportunities that were unimaginable just a few decades ago. From the digital realms of cryptocurrency and robo-advisors to the green frontiers of sustainable investments and the collaborative world of peer-to-peer lending, these options reflect the dynamic nature of today’s economy and the changing priorities of investors. This section will explore how you can leverage these modern investment avenues to diversify your portfolio, align your investments with your values, and potentially enhance your returns. Let’s dive into the future of investing and discover how to make your $10,000 work for you in innovative ways.

- Cryptocurrency: Bitcoin and Altcoins

- Robo-Advisors

- Green and Sustainable Investments

- Peer-to-Peer Lending

Cryptocurrency: Bitcoin and Altcoins

In the digital age, cryptocurrency has emerged as a groundbreaking investment option, attracting attention for its potential for high returns and its role in the future of finance. Cryptocurrencies like Bitcoin and a myriad of altcoins (alternative cryptocurrencies to Bitcoin) offer a new form of digital asset based on blockchain technology. This investment avenue is characterized by its high volatility, which can lead to significant gains or losses.

Bitcoin, the first and most well-known cryptocurrency, has seen its value skyrocket since its inception in 2009, making it a lucrative investment for early adopters. However, its price is subject to dramatic fluctuations, reflecting changes in investor sentiment, regulatory news, and developments within the crypto space.

Altcoins, including Ethereum, Ripple (XRP), Litecoin, and others, provide alternative investment opportunities in the cryptocurrency market. Each altcoin has its own unique features, use cases, and underlying technology, offering a wide range of investment possibilities. While some altcoins have the potential for substantial growth, they can also be more volatile and risky than Bitcoin.

The common return on investments in cryptocurrency can be highly variable. Some investors have experienced astronomical gains, with annual returns exceeding 100% during bull markets. However, the market is also prone to sharp corrections and bear markets, where values can plummet dramatically. It’s not uncommon for cryptocurrencies to experience swings of 20% or more in a single day.

Investing in cryptocurrency requires a strong risk tolerance and an understanding of the market dynamics. Potential investors should conduct thorough research, stay informed about regulatory changes, and consider the impact of market volatility on their overall investment strategy. Despite the risks, for those willing to navigate its complexities, cryptocurrency presents an exciting opportunity to be part of the vanguard of digital finance, with the potential for significant returns on investment.

For those considering allocating part of their $10,000 to cryptocurrencies in 2024, it’s essential to start small, diversify across different cryptocurrencies, and be prepared for a rollercoaster ride. As with all investments, never invest more than you can afford to lose, especially in a market as unpredictable as cryptocurrency.

Robo-Advisors

Robo-advisors represent the fusion of technology and financial planning, offering automated, algorithm-driven investment services with minimal human intervention. This modern investment avenue provides a cost-effective, accessible way for individuals to enter the world of investing, making it an attractive option for both novice and experienced investors alike. By leveraging vast amounts of data and sophisticated algorithms, robo-advisors can tailor investment strategies to individual financial goals, risk tolerance, and time horizons.

When you invest with a robo-advisor, your money is typically placed in a diversified portfolio of ETFs, which can include stocks, bonds, and other asset classes. This diversification helps spread out risk while aiming for steady growth over time. The robo-advisor continuously monitors the portfolio, rebalancing assets as needed to maintain the desired asset allocation, responding to market changes, and optimizing for tax efficiency.

The common return on investment (ROI) with robo-advisors can vary based on the underlying assets and the market conditions. However, most aim to match the performance of the market indices they track, minus any fees. On average, investors can expect annual returns in the range of 5% to 8%, similar to traditional investment portfolios of stocks and bonds. It’s important to note that, like all investments, returns are not guaranteed and can fluctuate based on market performance.

One of the key benefits of using a robo-advisor is the lower fees compared to traditional financial advisors. Lower management fees can significantly impact your investment growth over the long term. Robo-advisors also offer the convenience of setting up and managing your investment online, with many providing tools and resources to help investors understand and navigate their investment journey.

For those looking to invest $10,000 in 2024, robo-advisors offer a straightforward, hands-off approach to investing. They can be an excellent way to achieve diversified, growth-oriented investment without the need to actively manage your portfolio. Whether you’re saving for retirement, building an emergency fund, or working towards another financial goal, robo-advisors can help you get there with minimal fuss.

Green and Sustainable Investments

In an era where environmental consciousness is more than a trend, green and sustainable investments have surged in popularity. These investments focus on supporting businesses and projects that have a positive impact on the environment, from renewable energy companies to firms pioneering sustainable agriculture and clean technology. By investing in these areas, individuals not only aim for financial returns but also contribute to the broader goal of a more sustainable and eco-friendly future.

Green and sustainable investments can take many forms, including stocks in green technology companies, green bonds issued to finance environmental projects, and mutual funds or ETFs that focus on sustainable businesses. As the demand for cleaner alternatives and sustainable practices grows, these investments offer the potential for robust growth.

The common return on investments (ROI) in green and sustainable sectors can vary widely depending on the specific area of investment and market conditions. Generally, as these industries are on a growth trajectory, they can offer competitive returns. Renewable energy stocks and green bonds, for instance, have shown strong performance in recent years, often outpacing traditional energy investments. Investors might see annual returns ranging from 5% to 10% or higher, reflecting the sector’s growth potential and the increasing consumer and corporate shift towards sustainability.

However, it’s important to conduct thorough research and consider the volatility inherent in emerging sectors. While the long-term outlook for green and sustainable investments is positive, driven by global trends towards environmental sustainability and government policies supporting green initiatives, short-term returns can fluctuate with market sentiment and regulatory changes.

For those allocating part of their $10,000 investment in 2024 towards making a positive impact on the environment while seeking financial growth, green and sustainable investments offer a compelling choice. Not only do they allow investors to align their portfolios with their values, but they also tap into the growth potential of sectors critical to the future of our planet. As with any investment, diversification and a clear understanding of your risk tolerance are key to navigating the green investment landscape successfully.

Peer-to-Peer Lending

Peer-to-Peer (P2P) lending has revolutionized the way individuals borrow and invest money, bypassing traditional financial institutions to directly match lenders with borrowers through online platforms. This innovative investment avenue allows investors to fund loans for individuals or businesses, earning interest as borrowers repay their loans. P2P lending platforms offer a variety of loans, including personal loans, debt consolidation, and business loans, providing a unique opportunity for investors to diversify their portfolios and tap into a new source of income.

Investors in P2P lending can expect to earn interest on the loans they fund, with the rate of return depending on the risk category of the borrowers they choose to lend to. Higher-risk loans typically offer higher interest rates to compensate for the increased risk of default. The common return on investment in P2P lending can vary widely, but investors can often achieve annual returns ranging from 5% to 12%, depending on the platform, loan types, and individual borrower risk profiles.

However, it’s important to note that P2P lending comes with its own set of risks, including the risk of borrower default. While platforms mitigate this risk through credit checks and diversification—allowing investors to spread their investment across multiple loans—there is still the potential for loss. Therefore, investors should carefully consider these risks and conduct due diligence when selecting loans to invest in.

For those looking to invest $10,000 in 2024, P2P lending offers a compelling way to diversify your investment portfolio beyond traditional stocks and bonds. It provides the dual benefit of potentially higher returns and the satisfaction of directly supporting individuals or businesses in need of funding. By carefully selecting loans that align with your risk tolerance and diversifying across many borrowers, P2P lending can be a valuable addition to your investment strategy, offering both financial returns and a positive impact on the broader community.

Alternative Investments

Beyond the familiar realms of stocks, bonds, and cash, lies the diverse world of alternative investments. These options, ranging from art and collectibles to commodities and private equity, offer unique opportunities to diversify investment portfolios and tap into non-traditional sources of returns. Alternative investments typically don’t correlate directly with the stock and bond markets, providing potential risk mitigation and return enhancement benefits. This section delves into the intriguing possibilities that alternative investments present, exploring how they can add depth to your investment strategy, offer exposure to distinct market dynamics, and potentially unlock higher returns. Whether you’re drawn to the tangible allure of art and collectibles or the strategic complexity of private equity and commodities, alternative investments invite you to think outside the conventional investment box. Let’s explore how incorporating these options into your portfolio can enrich your investment journey and contribute to achieving your financial goals in 2024.

- Art and Collectibles: Rare Finds and NFTs

- Commodities: Gold, Silver, and Oil

- Angel Investing and Venture Capital

- Real Estate Crowdfunding

Art and Collectibles: Rare Finds and NFTs

Investing in art and collectibles is a fascinating journey into a world where passion meets profit. This domain encompasses everything from paintings, sculptures, and rare books to vintage wines, classic cars, and even digital assets like Non-Fungible Tokens (NFTs). Unlike traditional investments, art and collectibles offer tangible or digital items that investors can appreciate beyond their financial value. This investment avenue appeals to those who have a keen interest in culture, history, and the arts, providing a unique way to diversify investment portfolios.

The market for art and collectibles is nuanced, with returns on investment varying widely based on factors such as rarity, condition, historical significance, and current market trends. While some pieces of art or collectibles can appreciate significantly over time, others may not perform as well, making thorough research and sometimes expert advice crucial to success in this field. On average, art and high-quality collectibles have shown to provide an annual return of around 5% to 10%, but exceptional items with a high demand can exceed these figures significantly.

NFTs, representing ownership of unique digital content on blockchain technology, have introduced a new dimension to collecting, merging art with digital innovation. The volatility of the NFT market is notable, with some NFTs selling for millions of dollars while others may lose value. The returns on NFT investments can be highly unpredictable, potentially offering high rewards but also carrying significant risks.

Investing in art and collectibles, including NFTs, requires a passion for the items being collected, a deep understanding of the market, and patience, as significant returns may take years to materialize. Additionally, factors such as authenticity, provenance, and the liquidity of the market play critical roles in the investment’s success. For investors willing to navigate its complexities, the art and collectibles market can provide not only financial returns but also the intrinsic satisfaction of owning rare and beautiful items.

For those considering allocating part of their $10,000 to art and collectibles in 2024, it’s essential to start with what you love and understand. Whether it’s traditional art, rare collectibles, or cutting-edge NFTs, investing in what you’re passionate about can make the journey as rewarding as the potential financial gains.

Commodities: Gold, Silver, and Oil

Commodities such as gold, silver, and oil offer investors a tangible asset class that can serve as a hedge against inflation and currency devaluation. Traditionally, commodities have been considered a safe haven during times of economic uncertainty, with gold being the quintessential example. Investing in these resources allows for diversification beyond the traditional stock and bond markets, tapping into different global economic dynamics.

Gold is renowned for its ability to retain value over the long term, often rising in price during economic downturns or when inflation rates increase. It is not only a hedge against inflation but also a diversification tool that can reduce portfolio risk. Historically, gold has provided average annual returns of approximately 5% to 10%, although this can vary significantly depending on market conditions and timing.

Silver, while similar to gold in its safe haven properties, also has industrial applications that can influence its price. Silver’s dual role means it can be more volatile than gold, but it also offers the potential for significant growth during periods of strong industrial demand. Returns on silver can be highly variable, with periods of high returns followed by sharp declines.

Oil is a critical energy commodity with a price influenced by geopolitical events, supply and demand dynamics, and global economic conditions. Investing in oil can offer high returns, especially during times of tight supply or strong demand. However, it can also be highly volatile, with prices susceptible to dramatic changes based on geopolitical tensions and technological advancements in energy production. The return on oil investments can fluctuate widely, offering potential for high rewards but also significant risks.

Investing in commodities requires an understanding of the global economic factors that influence their prices. While they can offer diversification benefits and protection against inflation, the commodities market is known for its volatility. Investors should be prepared for the possibility of sudden price swings and should consider commodities as part of a broader diversified investment strategy.

For those looking to invest $10,000 in 2024, allocating a portion to commodities like gold, silver, and oil could provide a strategic hedge against inflation and currency risks. It’s important to carefully research and monitor market trends, as commodities can play both a defensive and speculative role in an investment portfolio.

Angel Investing and Venture Capital

Angel investing and venture capital offer the opportunity to get in on the ground floor of innovative startups and emerging companies. These investment avenues are not just about financial returns but also about supporting entrepreneurs and being part of potentially disruptive innovations. Angel investors typically provide capital to startups in their early stages, while venture capitalists usually invest larger amounts in businesses with proven growth potential.

The allure of angel investing and venture capital lies in the potential for substantial returns if a startup succeeds. Success stories like Uber, Airbnb, and many tech giants illustrate the high rewards possible. However, it’s important to note that investing in startups is highly risky, with a significant portion of new businesses failing within their first few years. Therefore, investors should be prepared for the possibility of losing their entire investment in some cases.

The common return on investment in angel investing and venture capital can vary widely, but successful investments can yield returns ranging from 10x to 100x the initial investment, depending on the growth and success of the business. However, these outcomes are rare, and the overall portfolio return across multiple startup investments is often lower, reflecting the high risk and potential for loss in this investment category.

For individuals considering angel investing or venture capital as part of their $10,000 investment in 2024, it’s crucial to conduct thorough due diligence on potential investment opportunities. This includes evaluating the startup’s business model, market potential, management team, and competitive landscape. Diversification is also key, as investing in a single startup increases risk significantly. Participating in angel investor networks or investing through venture capital funds can provide access to a broader range of opportunities and help spread risk across multiple companies.

Angel investing and venture capital are not for everyone, requiring a high tolerance for risk and a long-term investment horizon. However, for those passionate about innovation and willing to embrace the risks, these investment avenues can offer not only financial rewards but also the satisfaction of contributing to the success of new ventures and technologies.

Real Estate Crowdfunding

Real estate crowdfunding has democratized access to real estate investing, allowing individuals to participate in property investment opportunities with relatively small amounts of capital. This innovative approach pools funds from multiple investors to finance real estate projects or property investments, ranging from commercial developments to residential properties. It combines the potential for solid returns associated with real estate investing with the accessibility and flexibility of an online platform.

Investors can choose from a variety of projects, each with its own risk profile, investment horizon, and expected return. This allows for diversification within the real estate sector and the ability to tailor investments to individual preferences and risk tolerance. Real estate crowdfunding platforms offer both debt investments, where investors receive regular interest payments on loans provided to property developers, and equity investments, where investors gain a share of the property’s rental income or sale proceeds.

The common return on investment in real estate crowdfunding can vary significantly based on the project type, location, and structure of the deal. Debt investments tend to offer more predictable returns, generally ranging from 8% to 12% annually. Equity investments, while potentially more lucrative, carry higher risk and variability in returns, with potential annual returns of 10% to 20% or more, depending on the success of the real estate project.

However, like all investments, real estate crowdfunding involves risks, including market risk, liquidity risk, and the risk of project failure. Investors should carefully research platforms and projects, paying close attention to the fees, project details, and the track record of the individuals behind the projects.

For those looking to invest $10,000 in 2024, real estate crowdfunding offers a compelling way to gain exposure to the real estate market without the need to buy property outright. It provides an opportunity to invest in a diversified portfolio of real estate assets, with the potential for attractive returns and the added benefit of supporting the development of tangible projects.

Diversification and Portfolio Management

Diversification is a key strategy in managing investment risk and optimizing potential returns. By spreading investments across various asset classes, industries, geographical regions, and investment vehicles, investors can reduce the impact of poor performance in any single investment on their overall portfolio. Effective portfolio management involves not just diversification but also regular assessment and adjustment to align with changing market conditions and personal financial goals.

Why Diversify? The primary goal of diversification is to minimize risk. Different investments respond differently to economic events; when some investments are down, others may be up. Diversification can help smooth out those ups and downs, potentially leading to more consistent investment returns over time.

Portfolio Management Strategies include:

- Asset Allocation: This involves dividing your investment portfolio among different asset categories, such as stocks, bonds, real estate, and cash. The allocation should reflect your risk tolerance, investment horizon, and financial goals.

- Rebalancing: Over time, the initial asset allocation can shift due to differing returns from various assets. Periodic rebalancing ensures your portfolio remains aligned with your investment strategy by adjusting the proportions of each asset class back to your target allocation.

- Review and Adjust: Regularly review your investment strategy and portfolio performance. Life changes, such as a new job, marriage, or retirement, can affect your financial goals and risk tolerance, necessitating adjustments to your investment approach.

Considerations for Diversification

- Investing in a mix of asset classes can protect against significant losses. Historically, the returns of stocks, bonds, and other assets have not moved up and down at the same time. By including different asset classes in your portfolio, you can reduce the risk of losing money.

- Consider both traditional and modern investment avenues. Including investments like stocks and bonds along with newer options such as cryptocurrencies or green investments can further diversify your portfolio.

- Diversification within asset classes is also crucial. For example, within the stock portion of your portfolio, consider different sectors, company sizes, and geographical regions.

For those looking to invest $10,000 in 2024, crafting a diversified portfolio tailored to your financial goals and risk tolerance is essential. Through thoughtful diversification and ongoing portfolio management, you can navigate market volatility more smoothly and work towards achieving your investment objectives.

Understanding Variability in Investment Returns

Investing is inherently tied to the concept of risk and return, with the potential for higher returns usually accompanied by higher risk. The variability in investment returns can significantly impact your portfolio’s performance and the likelihood of achieving your financial goals. It’s essential to understand that while some investments may advertise high potential payoffs, the probability of actually realizing those returns can vary widely.

High-Risk, High-Reward Investments: Ventures such as cryptocurrency, angel investing, and venture capital are known for their high volatility but also for the potential of delivering substantial returns. While stories of investors reaping massive rewards from these types of investments are common, it’s crucial to recognize that these outcomes are not the norm. The likelihood of achieving such high returns is generally low, and investors should be prepared for the possibility of losing their entire investment.

More Predictable, Lower-Risk Investments: On the other end of the spectrum, investments like bonds, high-yield savings accounts, and CDs offer more predictable returns with lower risk. The trade-off for this stability is typically lower potential returns. These investments are better suited for conservative investors or those with shorter investment horizons who prioritize the preservation of capital over high growth.

Diversification and Expected Returns: Diversification across a range of investment types can help balance the risk and return in your portfolio. By spreading investments across different asset classes and risk levels, you can mitigate the impact of poor performance in any single investment. However, diversification itself does not guarantee a profit or protect against loss in declining markets. It’s a strategy to manage risk and aim for more consistent returns over time.

Setting Realistic Expectations: It’s important for investors to have realistic expectations about their potential returns, based on the risk profile of their investments and historical performance of similar assets. Understanding the variability in returns and the factors that influence investment performance can help set realistic financial goals and avoid disappointment.

Continuous Review and Adjustment: Regularly reviewing and adjusting your investment portfolio is crucial. Economic conditions, market trends, and personal financial circumstances change over time, which can affect the performance of your investments and the likelihood of achieving your desired returns. Being proactive about portfolio management can help you stay aligned with your financial objectives and risk tolerance.

In summary, while the allure of high returns can be tempting, it’s vital to approach investing with a clear understanding of the risks involved and the actual likelihood of achieving those returns. A well-considered investment strategy that includes a mix of asset types and risk levels, along with ongoing portfolio management, can help navigate the uncertainties of investing and work towards your financial goals.

Making Your Investment

After exploring the diverse landscape of investment options and understanding the importance of diversification and risk management, you’re ready to take the next step: making your investment. Whether you’re a seasoned investor or new to the game, the process of investing your $10,000 in 2024 should be approached with careful planning and consideration. Here’s how to get started:

- Set Clear Investment Goals: Begin by defining what you hope to achieve with your investment. Are you looking for long-term growth, generating income, or perhaps a mix of both? Your goals will guide your investment choices and strategy.

- Assess Your Risk Tolerance: Revisit your comfort level with risk, as this will influence the types of investments you select and how you allocate your funds across different asset classes.

- Research Your Options: Dive deeper into the investment options you’re considering. Look at historical performance, potential returns, risks, and how each investment fits into your overall strategy.

- Create a Diversified Portfolio: Based on your goals and risk tolerance, allocate your $10,000 across different investments to create a balanced and diversified portfolio. This may include a mix of traditional stocks and bonds, modern avenues like cryptocurrencies or robo-advisors, and alternative investments such as real estate crowdfunding or art.

- Choose the Right Platforms: Select the appropriate platforms or financial institutions for making your investments. This could involve opening a brokerage account, using a robo-advisor service, or registering on a real estate crowdfunding platform.

- Start Small: If you’re trying out new investment types, consider starting with a smaller amount to understand the process and gauge the investment’s performance before committing more funds.

- Monitor and Adjust: Investing is an ongoing process. Regularly review your portfolio’s performance and make adjustments as needed to stay aligned with your investment goals and adapt to changing market conditions.

Making your investment is just the beginning of your journey. Stay informed, keep learning, and be ready to adapt as you gain more experience and as the market evolves. With careful planning and a proactive approach to portfolio management, you can work towards achieving your financial goals and growing your $10,000 investment in 2024 and beyond.

Monitoring and Adjusting Your Investments

Investing your $10,000 is an important step towards achieving your financial goals, but it’s not the end of the journey. The financial market is dynamic, with changes influenced by economic indicators, geopolitical events, and market sentiment. Regular monitoring and timely adjustments to your investment portfolio are crucial for long-term success. Here’s how to effectively manage your investments:

- Set Regular Review Intervals: Schedule periodic reviews of your investment portfolio, such as quarterly or bi-annually, to assess performance against your goals. This doesn’t mean reacting to every market fluctuation, but rather ensuring your investments are on track.

- Analyze Performance: Evaluate how each investment has performed relative to its benchmarks and expectations. Look at overall portfolio performance as well as the performance of individual assets.

- Reassess Your Financial Goals: Life changes, and so might your financial goals and risk tolerance. Regularly reassess your investment objectives to ensure your portfolio remains aligned with your current needs and future aspirations.

- Consider Market Changes: Stay informed about the broader economic and financial market trends. Understanding these can help you anticipate shifts that might affect your investments and identify new opportunities.

- Rebalance Your Portfolio: If your asset allocation has drifted from your target due to differing performance of investments, rebalance your portfolio to get back on track. This might involve selling some investments and buying others to maintain your desired level of risk and diversification.

- Adjust Based on Performance: If certain investments consistently underperform without prospect of recovery, consider reallocating those funds to more promising opportunities. Conversely, take profits from overperformers to avoid being overly concentrated in any single investment.

- Keep an Eye on Fees: Investment fees can eat into your returns over time. Regularly review the costs associated with your investments and consider more cost-effective alternatives if necessary.

Monitoring and adjusting your investments is an ongoing process that requires diligence and patience. By staying engaged with your portfolio and making informed decisions, you can navigate the complexities of the financial markets and work towards achieving your investment goals. Remember, the key to successful investing is not just in selecting the right assets but in managing them effectively over time.

Conclusion

Investing your $10,000 wisely in 2024 presents a myriad of opportunities, each with its own set of potential rewards and risks. From the solid foundations of traditional investments like real estate and stocks to the innovative realms of cryptocurrency and green investments, the choices are as diverse as they are exciting. The journey of building and managing a diversified portfolio is both an art and a science, requiring a careful balance of risk, return, and personal financial goals.

As you embark on this investment journey, remember that the key to success lies not just in choosing the right investments, but also in managing them thoughtfully over time. Regularly monitoring your portfolio, staying informed about market trends, and being willing to adjust your strategy as needed are crucial steps in navigating the ever-changing investment landscape.

Investing is a journey filled with learning and growth opportunities. Embrace the process, stay committed to your financial goals, and maintain a long-term perspective. With careful planning, a proactive approach to portfolio management, and a willingness to adapt, you can work towards turning your $10,000 investment into a cornerstone of your financial future.

Remember, the most important step is to start. Your future self will thank you for the investment decisions you make today. Here’s to a prosperous 2024 and beyond!