Purchasing a property is a significant milestone in most people’s lives, but it’s not always easy to come up with a 20% down payment. Many conventional loans require a borrower to put down 20% of the purchase price, but some lenders may allow you to put down less. However, if you decide to put less than 20% down, you may be required to purchase private mortgage insurance (PMI).

What is PMI

PMI is a type of insurance that protects the lender, not you, if you stop making payments on your loan. Essentially, if you put down less than 20%, the lender may require you to purchase PMI to protect them from the risk of losing money if you stop paying your mortgage. It shifts some of the risk of you defaulting from the lender to the insurance company.

The Consumer Financial Protection Bureau says the following about PMI:

How to Avoid PMI

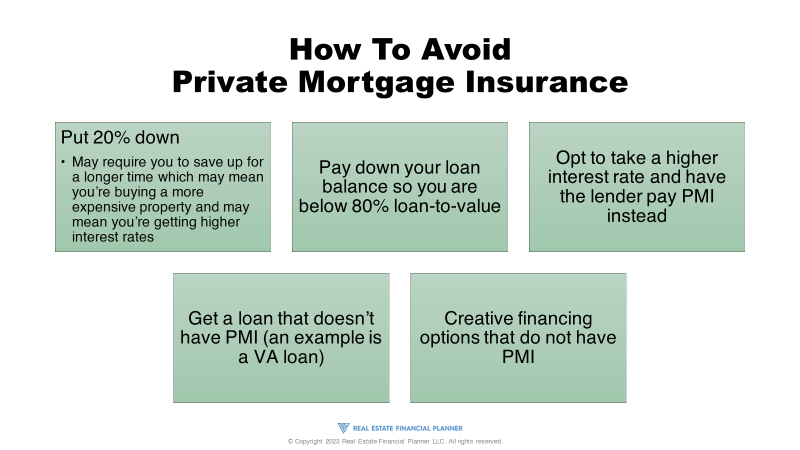

There are several ways to avoid PMI:

- Put down 20% or more: Lenders prefer borrowers to put 20% down, and if you can come up with the funds, it’s the easiest way to avoid PMI.

- Pay down your loan balance: If you already have a mortgage and you’re paying PMI, you can pay down your loan balance so that you are below 80% loan-to-value. Once you reach this threshold, you may be able to request that the lender remove PMI.

- Voluntarily take a higher mortgage interest rate: In some cases, you may be able to avoid PMI by taking a higher mortgage interest rate and paying a one-time upfront mortgage insurance premium. This option is not always the best choice, as it means you’ll be paying a higher interest rate for the life of the loan.

- Get a loan that doesn’t require PMI: Some loans, like VA loans, don’t require PMI. However, you’ll need to meet certain eligibility requirements to qualify for a VA loan.

- Do creative financing type deals: Creative financing deals like owner financing, lease options, or subject-to loans don’t require PMI. However, these deals can be more complicated and may come with their own risks.

Conclusion

While lenders prefer borrowers to put down 20%, there are several ways to avoid PMI if you can’t come up with that much money for a down payment. Paying down your loan balance or taking a higher mortgage interest rate are options to consider if you already have a mortgage. Alternatively, you can explore alternative financing options that don’t require PMI. Whatever you choose, make sure you understand the risks and costs associated with each option, and seek advice from a financial professional if you’re not sure.