Hello, fellow real estate investors! I’m James Orr, and today I want to talk to you about one of the most exciting topics in real estate investing: nothing down financing options.

You see, many people believe that in order to invest in real estate, you need to have a lot of money saved up for a down payment. But that’s simply not true! With the right financing options, you can invest in real estate with little or no money down.

The Current Market

Before we dive into the details of nothing down financing, let’s take a moment to talk about the current real estate market. Right now home prices have been on the rise for a few years but are starting to stall out in some markets. Interest rates are also up, and rents are not quite high enough to offset these increases. As a result, many investors are struggling to find cash flow in their real estate investments.

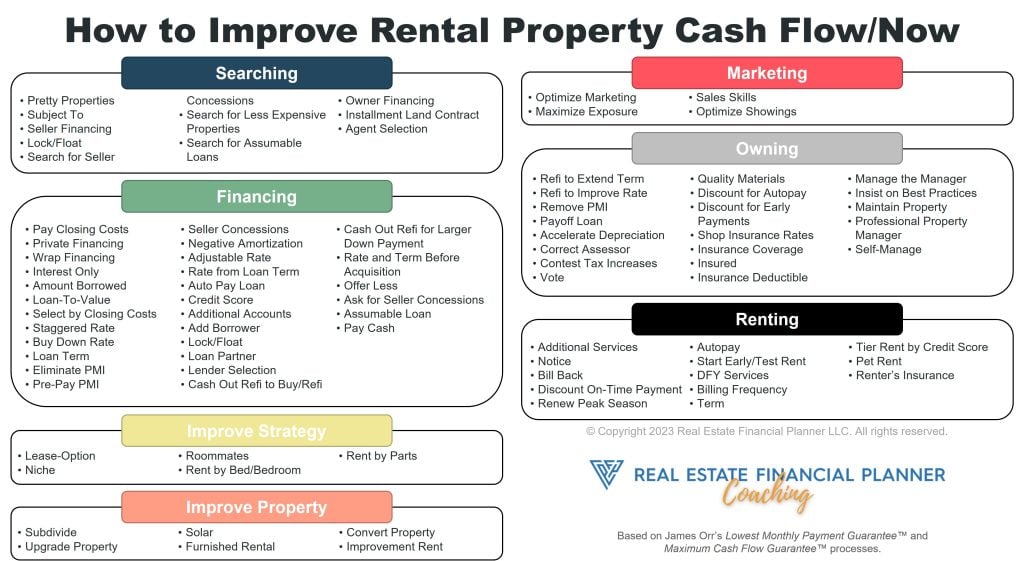

If you’re in the same boat, don’t worry! Nothing down financing options might still be able to help you achieve your real estate goals and our 88 cash flow improving strategies can help you improve cash flow and maximize your real estate investments.

Creative Financing Options

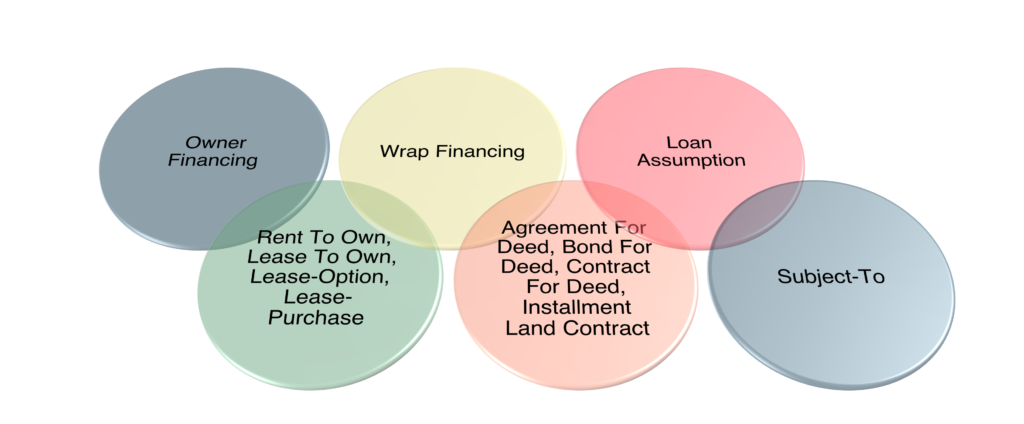

One of the most popular nothing down financing options is creative financing. This family of options includes strategies like owner financing, wrap financing, and lease options. With creative financing, you negotiate directly with the seller to come up with terms that work for both of you. While not all creative financing options will be nothing down, you have the flexibility to find terms that work for your investment goals.

Private Money and Hard Money

Another option for nothing down financing is private money and hard money. Private money lenders are individuals who lend money for real estate investments, while hard money lenders are companies that specialize in lending money for real estate deals. While these lenders may charge higher interest rates, they may also be more flexible in their terms than traditional lenders.

Nothing Down Financing for House Hackers and Nomads™

If you’re a house hacker or Nomad™, there are two primary nothing down financing options available to you: VA loans and USDA loans. VA loans are available to veterans and can be used to purchase single-family homes, duplexes, triplexes, and fourplexes. USDA loans are available for rural properties and can be used to purchase single-family homes.

Always Analyze Your Nothing Down Deals

It is critically important that if you’re going to utilize a nothing down real estate investing strategy that you analyze your real estate deals. We recommend using The World’s Greatest Real Estate Deal Analysis Spreadsheet™ (which is free).

Check out our other resources to learn how to calculate cash flow or how to calculate cash on cash return on investment on your properties and be sure to consider the entire return with the Return Quadrants™.

Conclusion

As you can see, there are many nothing down financing options available to real estate investors. Whether you choose creative financing, private money and hard money, or one of the other options we’ve discussed today, the key is to find terms that work for your investment goals.

So get out there and start investing in real estate with little or no money down! Remember, the only thing standing between you and financial freedom is your willingness to take action. Happy investing!