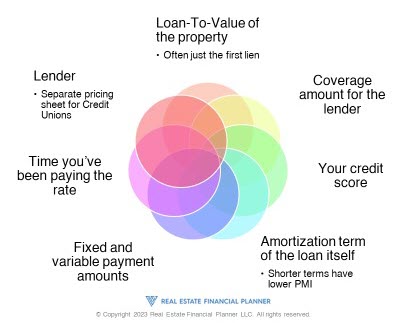

If you’re buying a property and putting less than 20% down, you will likely be required to pay for private mortgage insurance (PMI) to protect the lender in case of default. The rate you will be charged for this insurance is not a made-up number, but is instead determined by several primary factors and additional adjustments. The primary factors that impact your PMI rate include the loan-to-value (LTV) ratio, your credit score, the loan amortization term, the coverage amount required by the lender, fixed or variable payment amounts, and the length of time you’ve been paying the rate.

In addition, there are several secondary factors that can impact your PMI rate, including whether you’re doing a cash-out refinance, whether the property is a second home or an investment property, and whether you’re buying a manufactured home or getting an employee relocation loan. Understanding these factors can help you make an informed decision about your mortgage and how to minimize your PMI costs.

Primary Factors Impacting PMI Rate

When buying a property and putting less than 20% down, you will likely be required to pay for private mortgage insurance (PMI) to protect the lender in case of default. The exact rate you will be charged for this insurance is not a made-up number, but is instead determined by several primary factors and additional adjustments. In this article, we will delve into the primary factors that impact your PMI rate when putting less than 20% down.

Loan-to-Value Ratio

The loan-to-value (LTV) ratio is one of the primary factors that determine your PMI rate. LTV is calculated by dividing the loan amount by the appraised value of the property. The higher the LTV, the riskier the loan is for the lender, and thus the higher the PMI rate will be. If you are only putting 5% down, for example, your LTV is 95%, which is higher risk than an LTV of 81% with a 19% down payment.

Credit Score

Your credit score is another major factor in determining your PMI rate, with higher scores resulting in lower rates. PMI companies view higher credit scores as an indication of lower risk, while lower credit scores indicate higher risk. If your credit score is lower than 680, you may be required to pay a higher PMI rate or even be denied PMI altogether.

Loan Amortization Term

The loan amortization term, or the length of time over which you will pay back the loan, is also a primary factor in determining your PMI rate. Shorter amortization terms, such as 15-year loans, tend to have lower PMI rates than longer terms, such as 30-year loans. This is because shorter terms carry less risk for the lender.

Coverage Amount for the Lender

The amount of coverage that the lender requires also impacts your PMI rate. The lender can choose to require more or less coverage, which will affect the PMI rate accordingly. If the lender requires more coverage, the PMI rate will be higher.

Fixed and Variable Payment Amounts

Whether you choose fixed or variable payment amounts can also impact your PMI rate. Typically, fixed payments will result in a lower PMI rate, as they are viewed as less risky than variable payments.

Time You’ve Been Paying the Rate

The length of time you have been paying the PMI rate can also impact the rate itself. If you have been paying the rate for a longer period of time, you may be eligible for a lower rate.

Lender

Different lenders offer different PMI rates, so it is important to shop around and compare rates. Credit unions, for example, may have a separate pricing sheet for PMI than conventional lenders.

In conclusion, when buying a property and putting less than 20% down, the PMI rate you will be charged is determined by several primary factors, including the loan-to-value ratio, your credit score, the loan amortization term, the coverage amount required by the lender, fixed or variable payment amounts, and the length of time you’ve been paying the rate. It is important to understand these factors so that you can make an informed decision about your mortgage and how to minimize your PMI costs.

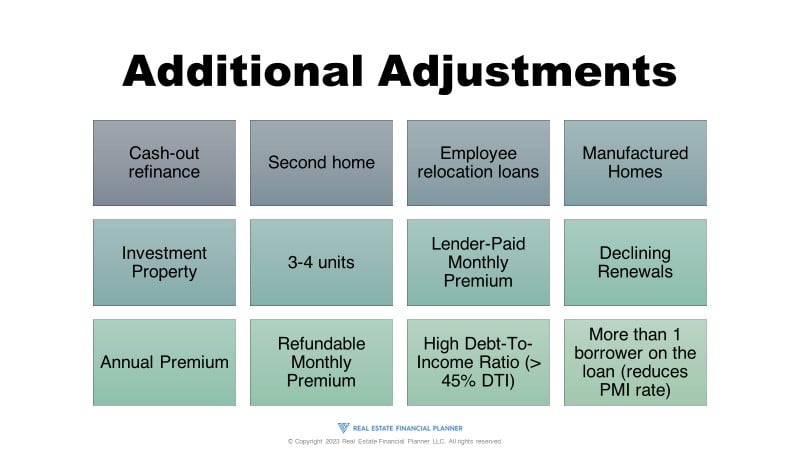

Secondary Adjustments to Private Mortgage Insurance Rate

Private mortgage insurance (PMI) is a type of insurance that lenders require when borrowers put less than 20% down on a property. The purpose of PMI is to protect the lender in case the borrower defaults on their mortgage payments. While the primary factors impacting PMI rates are well-known, there are also several secondary factors that can impact the rate you’ll be charged. In this article, we’ll delve into the most important secondary factors that can impact your PMI rate.

Cash-out Refinance

If you choose to do a cash-out refinance loan and you still have PMI left on your property, you can expect a penalty to your PMI rate. This is because the PMI company views a cash-out refinance as an additional risk factor.

Second Home

If you’re not buying a property as your primary residence, but rather as a second home, you’ll likely pay a higher PMI rate. The PMI company considers a second home to be a higher risk, and thus charges a higher rate.

Employee Relocation Loans

If you’re getting an employee relocation loan, you may actually get a discount on your PMI rate. This is because the PMI company views employee relocation loans as a lower risk factor compared to other types of loans.

Manufactured Homes

If you’re buying a manufactured home, you can expect a penalty to your PMI rate. The PMI company views manufactured homes as a higher risk factor due to their unique construction process.

Investment Property

If you’re buying an investment property and putting less than 20% down, you can expect a higher PMI rate. The PMI company views investment properties as a higher risk factor, since they’re not the borrower’s primary residence.

3-4 Units

If you’re buying a property with three or four units, you can expect a higher PMI rate. The PMI company views properties with multiple units as a higher risk factor, since they’re often used for rental income.

Lender-Paid Monthly Premium

If your lender is paying your monthly PMI premium, you can expect a rate adjustment. This adjustment can either be an increase or decrease, depending on the lender.

Declining Renewals

If you’re paying PMI on a declining renewal basis, you can expect a penalty to your rate. This is because the PMI company views declining renewals as a higher risk factor, since the insurance coverage decreases over time.

Annual Premium

If you choose to pay your PMI premium annually, you can expect a rate adjustment. This adjustment can either be an increase or decrease, depending on the PMI company.

Refundable Monthly Premium

If you’re paying a refundable monthly premium for your PMI, you can expect a rate adjustment. This adjustment can either be an increase or decrease, depending on the PMI company.

High Debt-to-Income Ratio

If your debt-to-income (DTI) ratio is greater than 45%, you can expect a penalty to your PMI rate. This is because the PMI company views a high DTI ratio as a higher risk factor, since it indicates that you may have trouble making your mortgage payments.

More Than 1 Borrower on the Loan

If there’s more than one borrower on the loan, you can expect a rate reduction. This is because the PMI company views having multiple borrowers as a lower risk factor compared to having just one borrower.

While the primary factors impacting PMI rates are well-known, the secondary factors can also have a significant impact on the rate you’ll be charged. It’s important to be aware of these factors when shopping for a mortgage, as they can affect your monthly payments and overall affordability. By understanding the primary and secondary factors that impact PMI rates, you can make an informed decision about your mortgage and how to minimize your PMI costs.

Conclusion

Private mortgage insurance (PMI) is a type of insurance that lenders require when borrowers put less than 20% down on a property. The PMI rate you will be charged is determined by several primary factors, including the loan-to-value ratio, your credit score, the loan amortization term, the coverage amount required by the lender, fixed or variable payment amounts, and the length of time you’ve been paying the rate.

There are also several secondary factors that can impact your PMI rate, including cash-out refinance loans, second homes, employee relocation loans, manufactured homes, investment properties, properties with three or four units, lender-paid monthly premiums, declining renewals, annual premiums, refundable monthly premiums, high debt-to-income ratio, and having multiple borrowers on the loan.

To minimize your PMI costs, it is important to understand these factors and shop around to compare rates from different lenders. Ultimately, lenders prefer borrowers to put 20% down and avoid having to pay for PMI altogether. But if you do have to pay for PMI, understanding these factors can help you make an informed decision about your mortgage and how to minimize your PMI costs.