Investing in rental properties can be a great way to generate passive income and build wealth over time. However, when it comes to purchasing a rental property, the amount you put down can have a significant impact on the returns you earn from your investment. We’ll explore the different returns you can expect when investing in rental properties and how those returns change depending on how much you put down.

The Nomad™ Strategy

To get started, let’s take a look at the returns you can expect from the Nomad™ strategy, which involves purchasing a property as an owner-occupant and then converting it into a rental property after a year. For this strategy, we’ll assume a 5% down payment and a 30-year fixed-rate mortgage.

The returns are if you could rent the property in the first year as a Nomad™… which you can’t since you’re agreeing to owner-occupy the property. We’re also starting the analysis for month 2 because you technically do not have a mortgage payment in the first month and that would impact the cash flow and debt paydown.

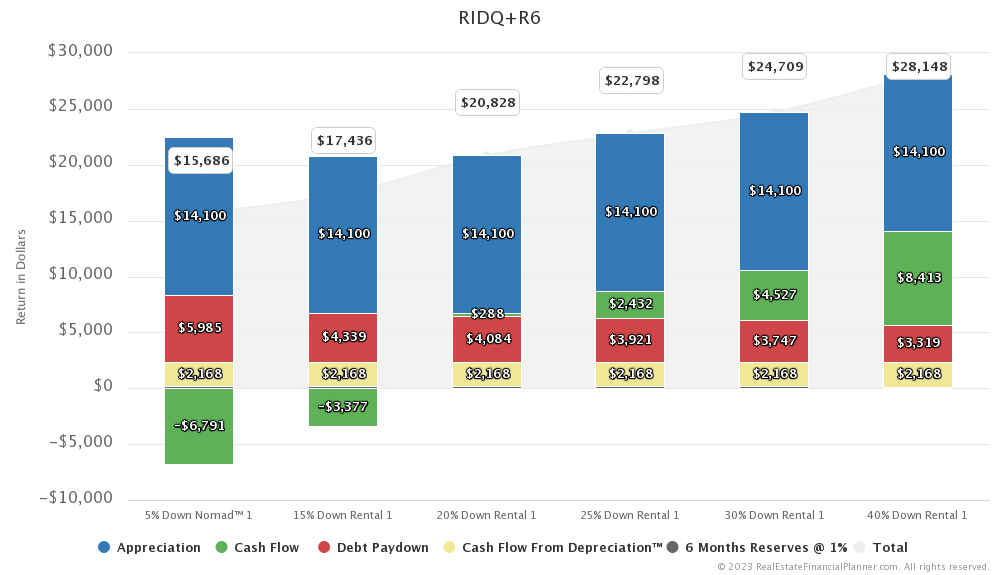

If we look at the return in terms of dollars, you earned $15,686 in total from appreciation, cash flow, debt paydown, Cash Flow from Depreciation™ and the return on the reserves you should have for owning a rental property.

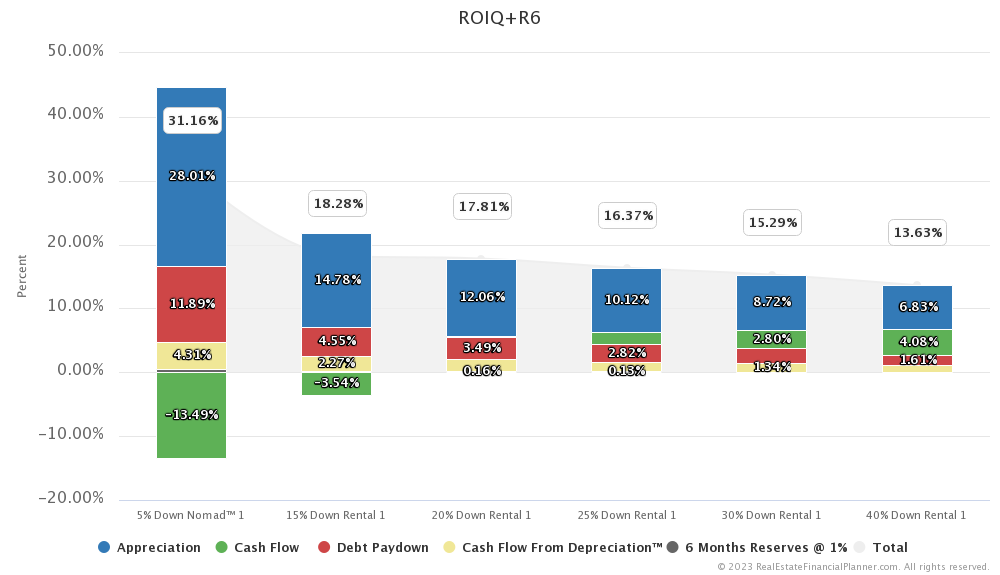

If we divide the dollar amount earned by the total cost to close plus reserves you get the return on investment for the first year shown above.

Using these assumptions, we’ll earn a total return of 31.16% in the first year of owning the property. This return includes appreciation, negative cash flow, debt pay down, tax benefits, and the return earned on having six months of reserves investing in savings. However, it’s important to note that this return is based on the total amount of money we had to invest in the deal, including reserves.

The Impact of Down Payments

Now, let’s take a look at how the returns change as we put more money down. We’ll compare the Nomad™ strategy to putting 15%, 20%, 25%, 30%, and 40% down.

15% Down Payment

First, let’s look at the Return in Dollars Quadrant™.

When putting 15% down, we’ll earn a total return of 18.28% in the first year. This return is significantly lower than the return from the Nomad™ strategy, primarily due to the increased down payment reducing leverage. However, the cash flow improves slightly, from a negative $6,791 per year to a negative $3,377 per year.

20% Down Payment

With a 20% down payment, we’ll see further reductions in leverage, resulting in a total return of 17.81%. However, the cash flow improves to a slightly positive $288 per year.

25% Down Payment

A 25% down payment results in a total return of 16.37%, with a slightly higher cash flow of about $200 per month.

30% Down Payment

With 30% down, we’ll earn a total return of 15.29%, with a cash flow of about $400 per month.

40% Down Payment

Finally, a 40% down payment results in a total return of 13.63%, with a cash flow of about $700 per month.

Summary Of All Returns in Dollars

To summarize all the returns in dollars, here they are on one chart.

Summary of All Returns on Investment (and Reserves)

And, the above is summarizing all the returns divided by the initial investment and 6 months of reserves.

Calculating the Return on Investment

It’s also important to consider the return on investment (ROI) for each down payment option. ROI takes into account the total amount invested, including the total cost of close (down payment and closing costs) plus, additionally, reserves, and is calculated by dividing the total return by the total amount invested.

When calculating ROI, we see that the returns decrease significantly as we put more money down. With a 5% down payment, the ROI is 31.16%. With a 15% down payment, the ROI drops to 18.28%. With a 20% down payment, the ROI is 17.81%. With a 25% down payment, the ROI is 16.37%. With a 30% down payment, the ROI is 15.29%. Finally, with a 40% down payment, the ROI is 13.63%.

The Return on Extra Down Payments

One question many investors have is whether it’s worth putting more money down to increase returns. To answer this question, we can look at the return on investment for the extra down payment.

For example, let’s consider going from the Nomad™ strategy to putting 15% down. This change results in a return of 3.88% on the extra down payment. This return is not very attractive, and it’s likely not worth the additional investment in my opinion. That is even though it significantly improves cash flow.

However, going from 15% to 20% down results in a return of 15.74% on the extra down payment, which is much more attractive. The return on the extra down payment then decreases as we put more money down, with a return of 8.83% for going from 20% to 25% down, 8.55% for going from 25% to 30% down, and 7.67% for going from 30% to 40% down.

Cash Flow and Debt Pay Down

When considering the impact of down payments on returns, it’s important to also look at the cash flow and debt pay down. As we put more money down, the cash flow tends to improve while the amount of debt paydown decreases.

For example, with the Nomad™ strategy, the cash flow is negative in the first year. However, as we put more money down, the cash flow improves. With a 40% down payment, the cash flow is about $600 per month.

So really, negative cash flow is deferred down payment. If we had put more down, we wouldn’t have had that negative cash flow.

On the other hand, with the Nomad™ strategy, we see a significant amount of debt pay down in the first year. However, as we put more money down, the amount of debt paydown decreases. With a 40% down payment, the amount of debt pay down is much lower than with the Nomad™ strategy.

Deal Analysis Spreadsheet

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ will do the return quadrant calculations for you and it’s free.

Conclusion

In conclusion, the amount you put down on a rental property can have a significant impact on the returns you earn from your investment. While putting more money down can improve the cash flow, it also reduces leverage and decreases the overall return on investment.

When considering whether it’s worth putting more money down to increase returns, it’s important to look at the return on investment for the extra down payment. It’s also important to consider the impact on cash flow and debt pay down.

Ultimately, the decision of how much to put down on a rental property will depend on your individual goals and financial situation. It’s important to carefully consider all of the factors and run the numbers to determine the best strategy for your investment.