In this 2 hour 13 minute class, James discusses his best ideas for how to get a down payment for your real estate investing.

This class was taught on September 16, 2020.

Topics for this class:

- COVID-19 Update and Rental Property Delinquency Update

- Not Just Down Payment… Down Payment + Reserves

- Two Approaches to Down Payments: Reduce (the need for down payments) and Produce (the needed down payments)

- Price and a discussion of Gary Keller’s “Be In The Middle of the Market” chart from The Millionaire Real Estate Investor book

- Dealing with strong seller’s markets, above market offers, weakening appraisal and inspection terms for the buyer and how it relates to down payments

- Nothing down financing strategies including loans types and when to use each one

- Producing down payments including discussions of:

- “Investment Cards” (aka Credit Cards)

- Security Deposit

- Maintenance Reserves

- Property equity

- Depreciation

- Retirement Account

- Family Members (Legacy Nomad™)

- Sell stuff you don’t need or want

- Saving

- From regular job, part-time, extra job, business to fund your retirement (or build your fortune)

- Partnering

- Rents (including House Hacking)

- Lease-Option Fees

- The most desirable strategies for producing down payments and ones I don’t recommend (even if they are listed above)

- Alternate uses for down payments

- How much should you put down

- How to Acquire a Multi-Million Dollar Real Estate Portfolio with Less than $3,000 class recording

- And much more…

Charts from the Presentation About Down Payments, Interest Rates and Loans

It is important for you to realize that we were in a very unusual mortgage interest rate environment when this class was taught and the charts likely reflect some odd market behavior.

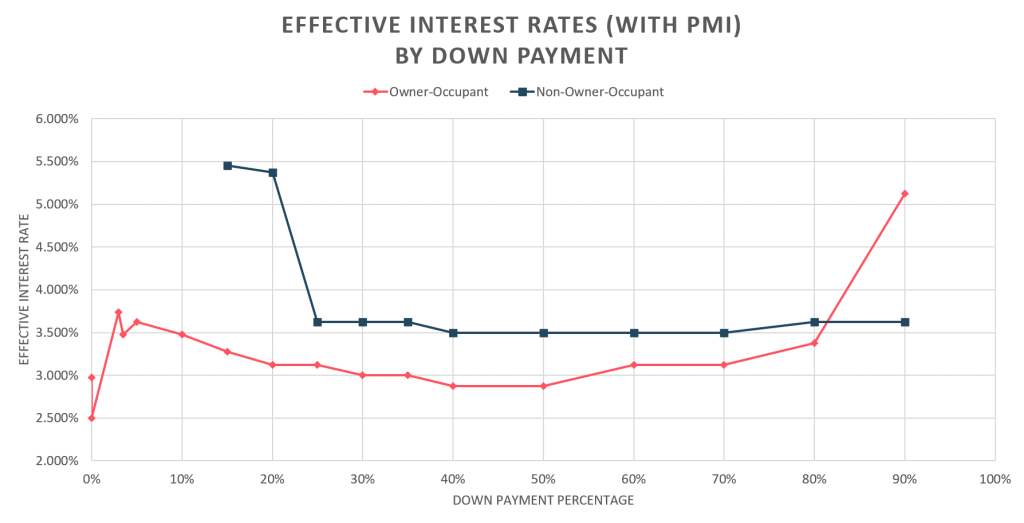

The “Effective Interest Rate” (interest rate + Private Mortgage Insurance rate) for a variety of loan types and down payments.

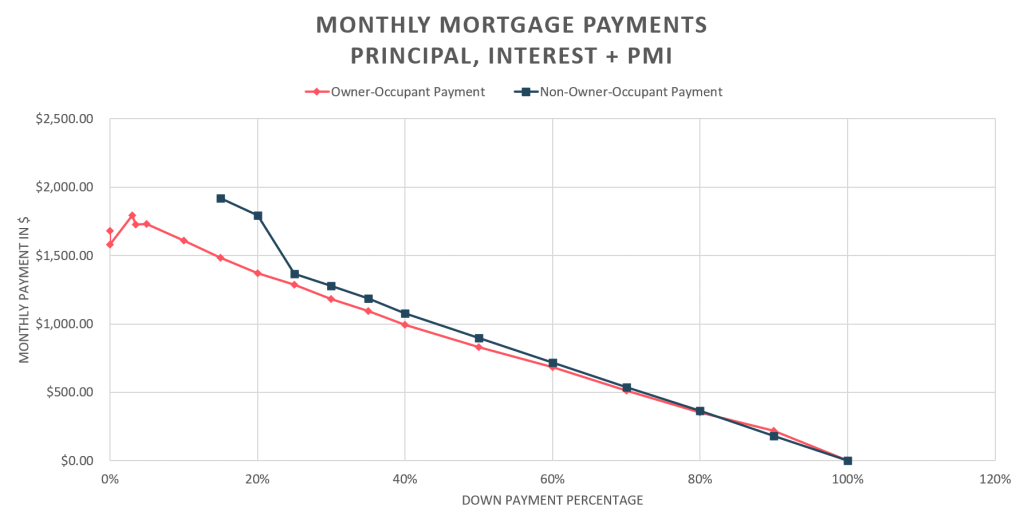

The monthly payments using the “Effective Interest Rate” for a $400K property.

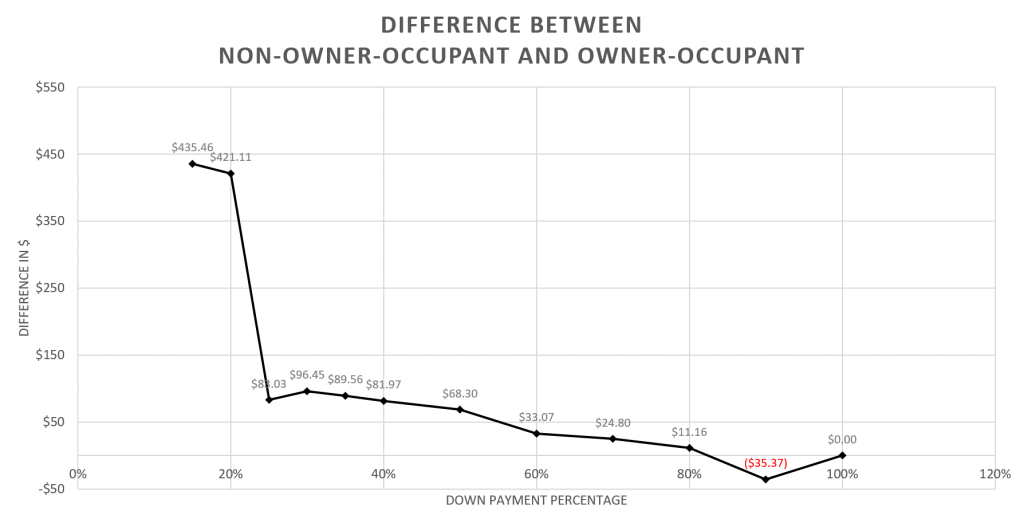

The difference in monthly payments comparing the owner-occupant interest rate versus the investor, non-owner-occupant interest rate.

Charts from Presentation About Returns for Various Down Payments

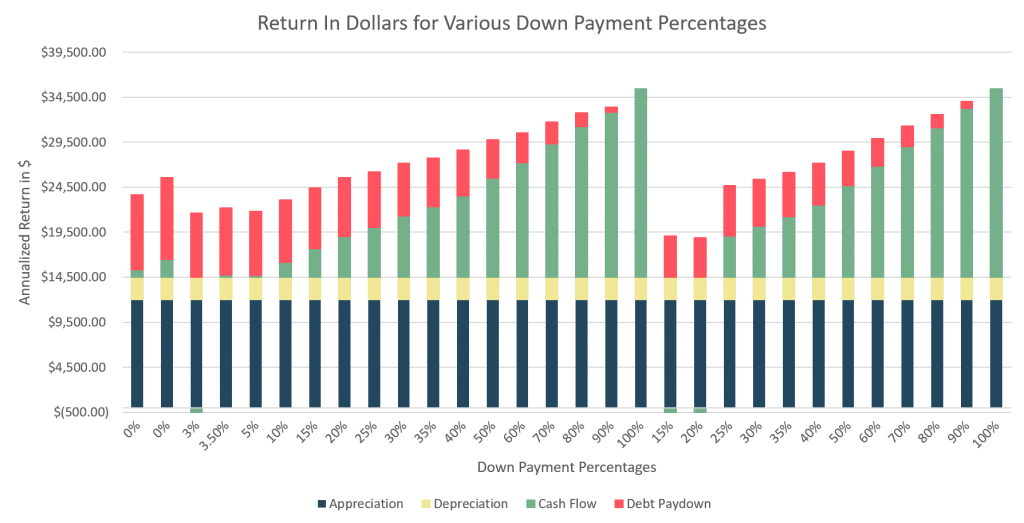

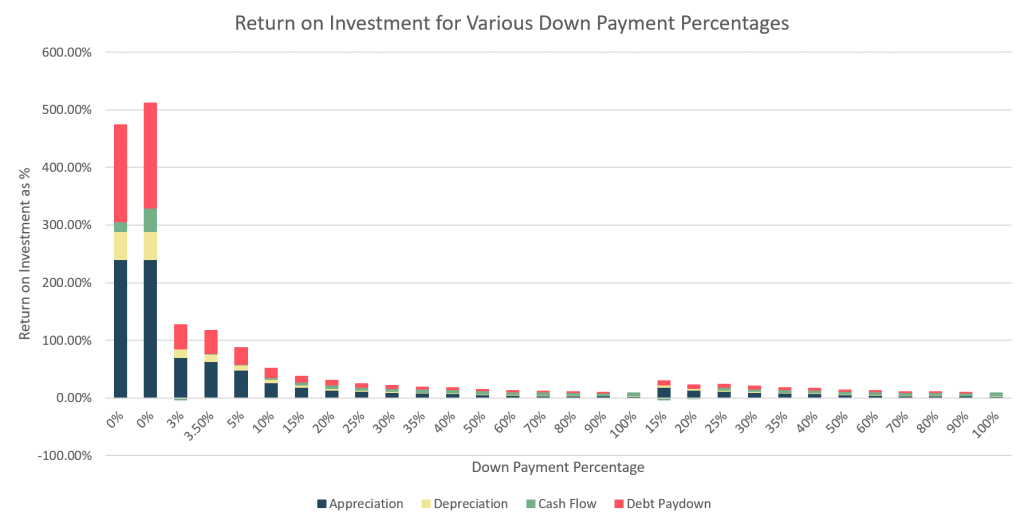

The return in dollars for a variety of down payment percentages and loan types.

The return in dollars divided by the down payment and $5,000 in closing costs.

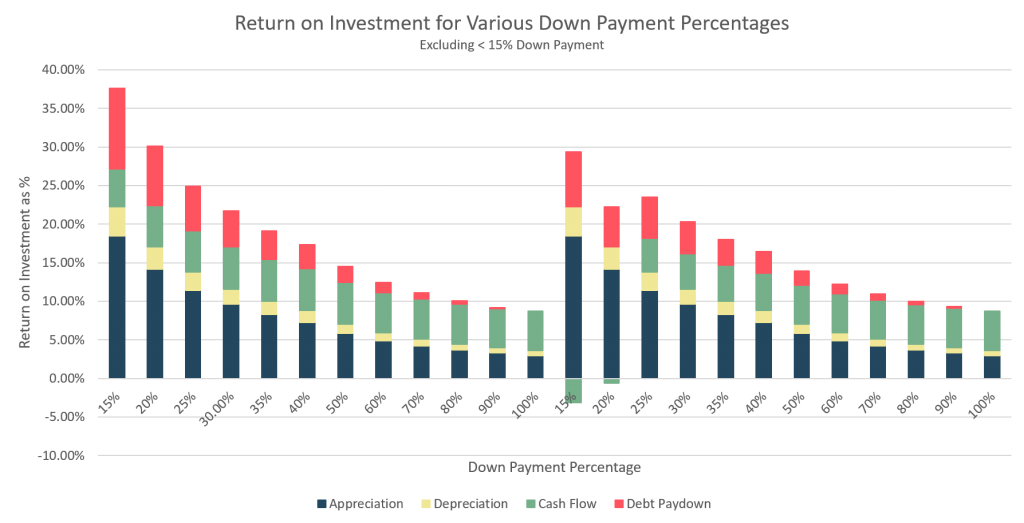

To make it easier to see the differences in the majority of cases, we removed the down payment options with less than 15% down.

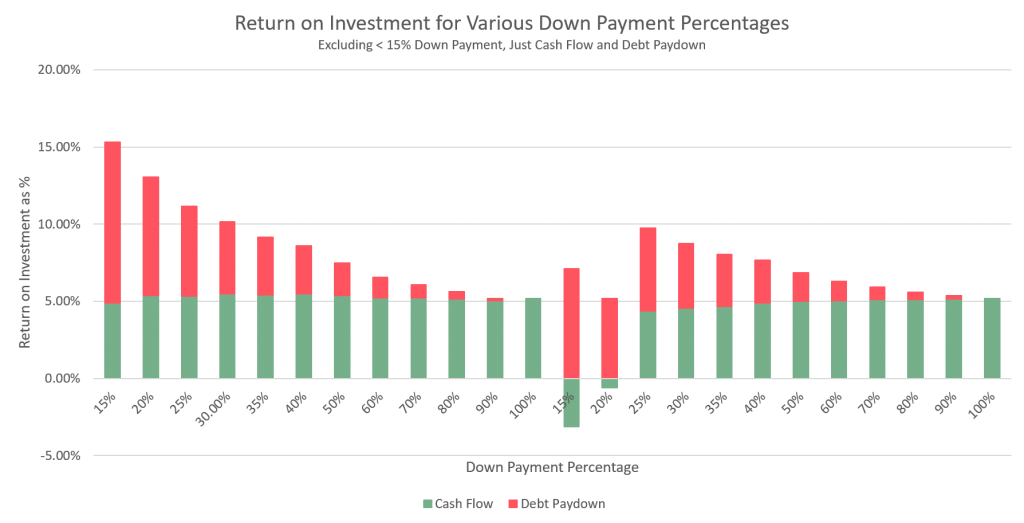

And, since the raw dollars from appreciation and depreciation don’t change based on down payment and loan type, the following chart removes them so you can just compare the cash flow and debt paydown portions of the returns as returns on investment.

Down Payment Classes

To see other classes about coming up with a down payment for real estate investing, check out these other classes: