Are you considering investing in a new construction single-family home? Are you unsure about how to analyze the deal? Look no further! In this blog post, we’ll walk you through the steps to analyze a new construction property and help you make an informed decision.

We know that investing in real estate can be intimidating, especially when it comes to analyzing deals. But with our guidance, you’ll be able to confidently analyze a new construction single-family home property and make a smart investment.

So, what are you waiting for? Let’s dive into the exciting world of real estate investing and learn how to analyze a new construction single-family home property like a pro!

Additional Costs With New Construction

When purchasing a new construction single-family home property, it’s important to keep in mind that there may be additional costs beyond the purchase price. For example, you may need to make the property “rent ready” by installing window coverings, appliances, and other necessary items. These costs can add up quickly, so it’s important to budget for them accordingly.

One way to mitigate these costs is to negotiate with the builder to include some of these items in the purchase price of the property. This can allow you to finance these costs into the purchase and avoid having to come up with a large sum of money upfront for rent ready expenses.

Buying from the builder often comes with a premium, but the advantage is that you can often finance these costs into the purchase. While this will hurt cash flow, it reduces the amount of extra money you’ll need to have available to acquire the property.

Be careful, however, because adding additional costs to the purchase price can increase the likelihood that the property will not appraise at the agreed-upon value. This can leave you paying for some of these costs out of pocket, at their inflated, builder-marked-up prices.

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ (a free download) to determine whether it is better for you to pay the premium to the builder and finance as much of these extra expenses as possible or if it is better for you to set aside money as a Rent Ready cost to pay for them after you close.

Reduced Maintenance on New Construction

When you’re considering purchasing a new construction single-family home property, one of the benefits is that you’re likely to have a period of lower maintenance expenses. Since everything is brand new, you can expect a period of time where you are very unlikely to have any major capital expenditures or significant maintenance type expenses on the property. This timeframe usually lasts for the first five years.

During this time, you’ll have the opportunity to enjoy improved cash flow early on, which can be especially beneficial when you’re just starting out and more likely to be struggling to have positive cash flow. However, it’s essential to keep in mind that while new construction properties are less likely to require maintenance expenses, it’s not a guarantee that you won’t have unexpected expenses during this period.

When it comes to analyzing deals, it’s less conservative to estimate lower maintenance percentages, but you can estimate 2%, 4%, 6%, 8%, and then 10% for your maintenance percentages for the first five years, then continue to use the 10% for maintenance after that. This will help you to achieve improved cash flow early on and account for the potential for lower maintenance expenses.

However, if you’re more conservative, you can always use the full 10% for each year of the property’s life. It’s important to keep in mind that while estimating lower maintenance percentages can be helpful, it’s essential to consider how maintenance expenses will impact your cash flow over time, especially if you’re planning to hold the property for a long period.

In summary, buying a new construction single-family home property can offer lower maintenance expenses during the initial years of ownership, which can help to improve cash flow. However, it’s important to consider the potential for unexpected expenses and to account for maintenance expenses when analyzing deals. Overall, with careful analysis and planning, investing in new construction properties can be a smart and profitable investment.

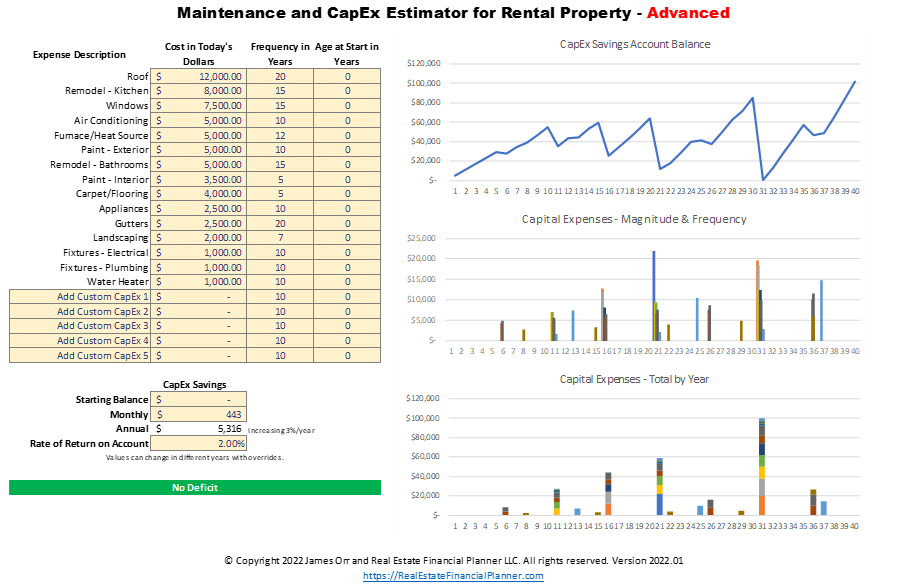

Use the advanced version of Maintenance and CapEx Estimator for Rental Property to help you understand the pros, cons and risks associated with the plan you decide to use.

3-2-1 Interest Rate Buy

When purchasing a new construction single-family home, some builders may offer a unique incentive to buyers: a 3-2-1 interest rate buy down. This means that for the first year of the loan, the interest rate is significantly lower than the normal rate. In the second year, the rate goes up slightly, and then again in the third year. Finally, in year four, the interest rate goes up to the normal rate and remains at that level for the remainder of the 30-year loan.

This can be a significant benefit for buyers, as it can improve cash flow in the short-term. With a lower interest rate in the first year, buyers can enjoy a lower mortgage payment and potentially positive cash flow, even with other expenses factored in.

However, it’s important to keep in mind that the lower interest rate is only for a limited time and that the interest rate will go up over time. Buyers should carefully consider how the interest rate buy down will impact their cash flow over the entire 30-year loan term and whether it’s the right choice for their investment strategy.

Overall, the 3-2-1 interest rate buy down is a unique benefit that some builders offer to buyers of new construction single-family homes. It can be an attractive perk for those looking to improve cash flow in the short-term, but buyers should carefully consider the long-term impact on their investment before deciding to take advantage of this offer.

Use the overrides feature in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to analyze this less common loan program.

Conclusion

Investing in a new construction single-family home as a rental property can be a smart and profitable investment, but it’s important to carefully analyze the deal before making a purchase. In this post, we’ve covered some key considerations to keep in mind, such as additional costs beyond the purchase price, the potential for reduced maintenance expenses, and the 3-2-1 interest rate buy down offered by some builders.

By taking these factors into account, you can make an informed decision about whether a new construction single-family home is the right investment for you. Remember to always start with a fresh copy of the spreadsheet, and use conservative estimates to account for potential expenses. With careful analysis and planning, you can make a smart investment and enjoy positive cash flow for years to come.