Alex stared at the computer screen, the blue glow reflecting off their tired face. Sunday night. Again. Tomorrow meant another week of stand-up meetings, code reviews, and pretending to care about optimizing database queries for a company that sold overpriced subscription boxes.

$120,000 a year should feel like winning, right? Yet here they were, 34 years old, successful by every conventional measure, and absolutely miserable.

That’s when Alex stumbled upon something that would change everything: the Financial Independence Asset Allocation and Cash Flows Engine™ spreadsheet. What started as late-night procrastination turned into a revelation.

The Awakening: Life as a Straight Line

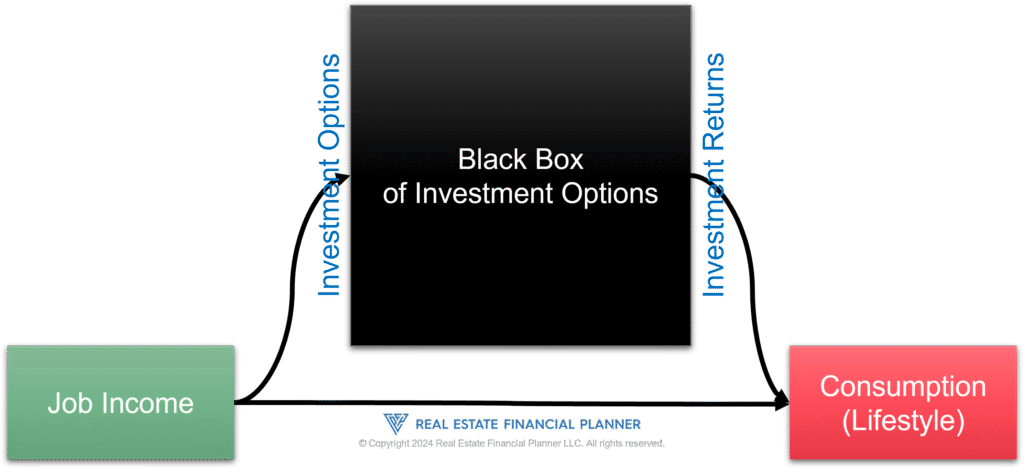

Alex’s financial life was embarrassingly simple:

Money in, money out. Like a hamster on a wheel, except the wheel was made of code commits and the hamster had a 401k.

“Is this it?” Alex muttered, exploring the spreadsheet’s framework. “Work for 30 more years and hope my 401k doesn’t tank?”

But then the Engine revealed its first lesson:

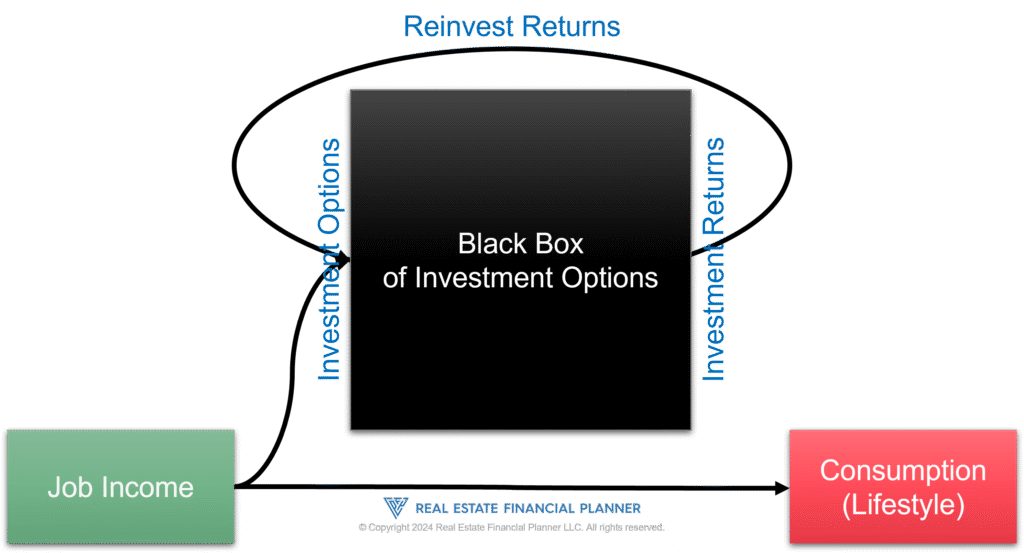

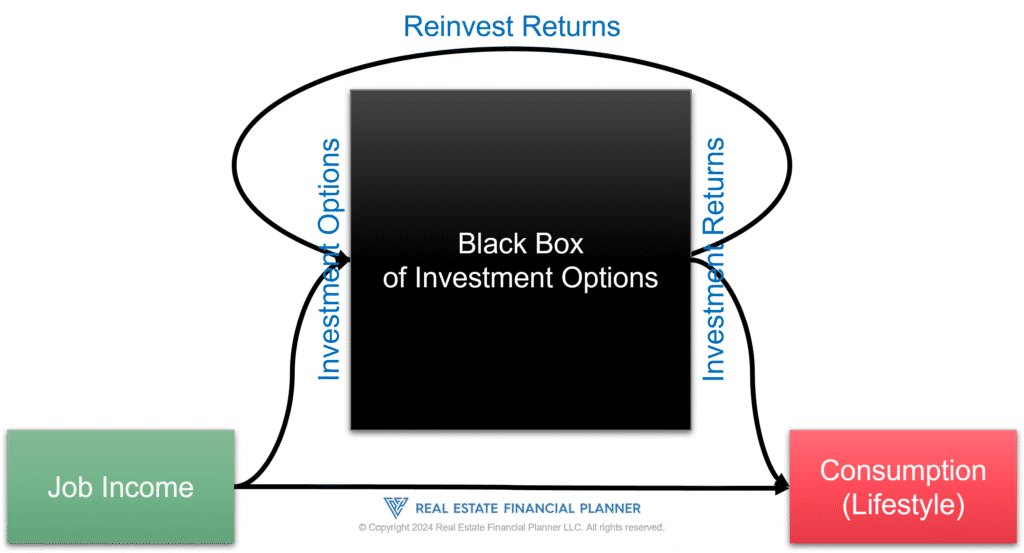

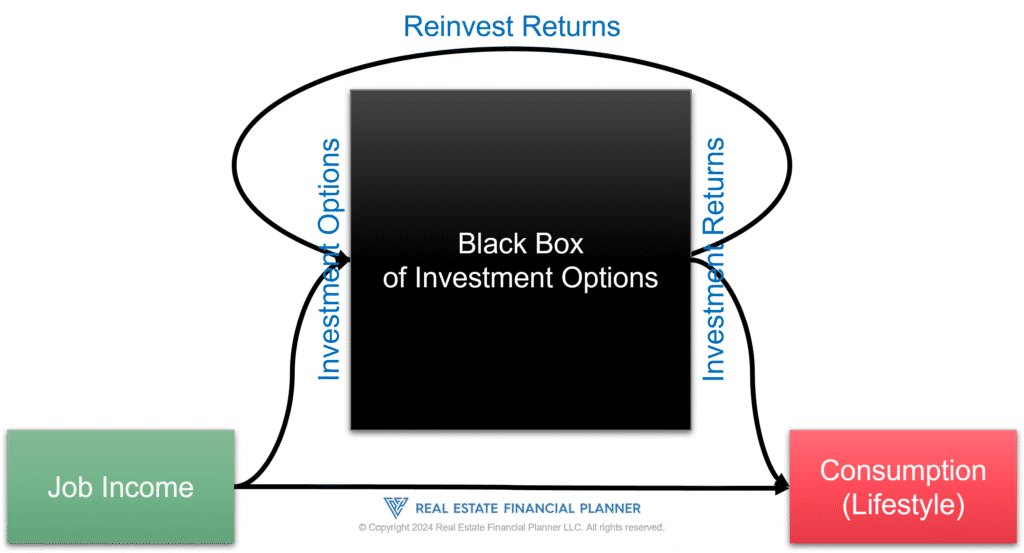

Lesson #1: Your income doesn’t have to flow directly to consumption.

The Engine showed Alex that between earning and spending lies a universe of possibilities. This “Black Box of Investment Options” wasn’t just a concept – it was a systematic way to capture and redirect cash flow.

“Wait,” Alex realized, “I’m thinking about this all wrong. My salary isn’t just income – it’s human capital producing cash flow. And cash flow can be redirected.”

Mapping the Territory: The Engine Reveals Its Structure

The Financial Independence Asset Allocation and Cash Flows Engine™ broke down investments into distinct categories, each with its own row, its own metrics, and its own purpose. This wasn’t just a spreadsheet – it was a complete mental model for building wealth.

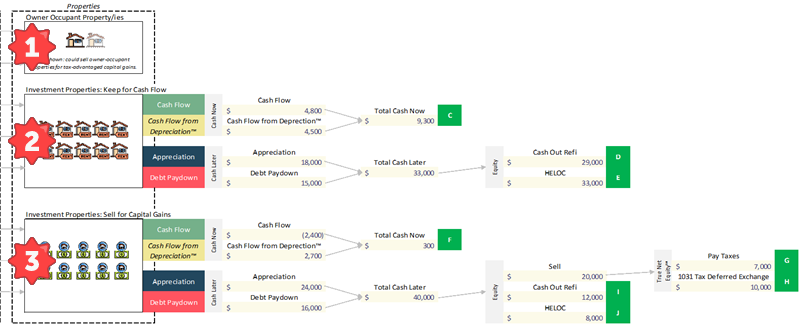

The Property Module: Three Distinct Strategies

The Engine taught Alex that real estate wasn’t monolithic. It identified three separate approaches:

1. Owner-Occupied Properties – The Nomad™ Strategy

The Engine had a dedicated section for owner-occupied properties with specific inputs:

- Down Payment Required: $15,000 (5% on $300,000 property)

- Monthly Cash Flow (after moving out): $400

- Cash Flow from Depreciation™: $833/month in tax benefits

- Total Annual Return on Investment: 89%

“This is insane,” Alex whispered. The Engine showed how living in a property for one year before converting it to a rental transformed the economics completely. Lower down payment, better interest rate, and legitimate tax benefits.

2. Investment Properties: Keep for Cash Flow

The second section modeled pure rental investments:

- Cash Flow calculation: Rent – (Principal + Interest + Taxes + Insurance + Maintenance + Management + Vacancy)

- Appreciation tracking: Both forced (through improvements) and market

- Debt Paydown: Another invisible return

- The Engine’s special calculation: Cash Flow from Depreciation™

Lesson #2: Returns come in multiple forms – cash now, cash later, and tax benefits.

3. Investment Properties: Sell for Capital Gains

The third property section focused on flips and appreciation plays:

- Purchase Price and Rehab Costs

- After Repair Value (ARV)

- Holding Costs

- Tax Implications (with options for 1031 exchanges)

Each section had its own financing options: conventional loans, cash-out refinances, and HELOCs. The Engine tracked them all.

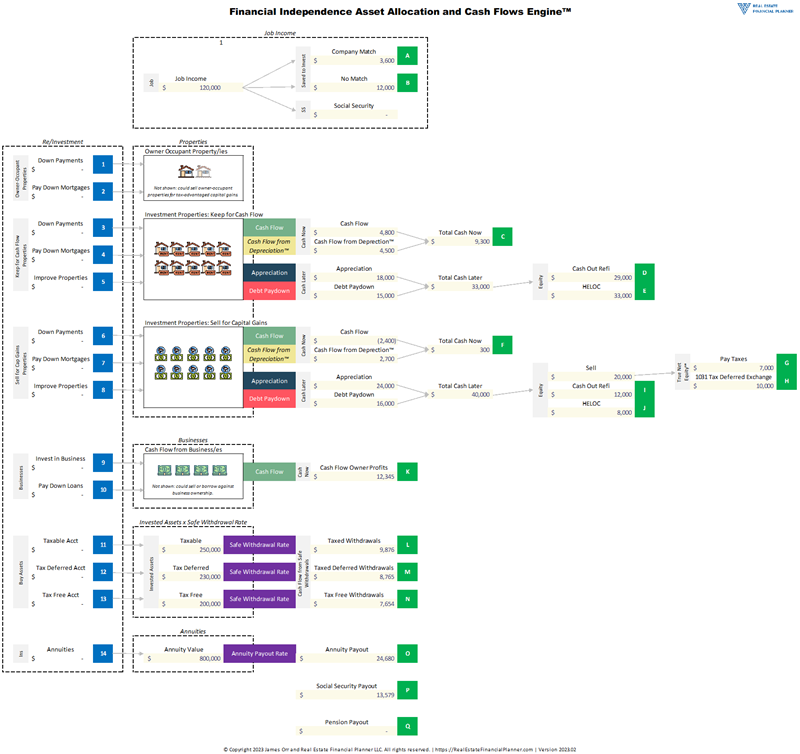

The Complete Architecture: Understanding All Capital Sources

The full Engine interface blew Alex’s mind. It wasn’t just about real estate. The spreadsheet revealed seventeen distinct “Named Outputs” – specific cells that calculated critical metrics across all asset classes.

The Job Income Module

- Output A: Company match opportunities ($3,600/year free money)

- Output B: After-tax income available for investing ($12,000/year)

“My job isn’t just a paycheck,” Alex realized. “It’s a cash flow machine with multiple outputs.”

The Business Module

The Engine had dedicated space for business ventures:

- Output K: Business cash flow after expenses

- Investment in business growth (equipment, marketing, hiring)

- Business loan paydown strategies

Lesson #3: Every income source can be optimized and redirected.

The Invested Assets Module

This section revolutionized how Alex thought about traditional investing:

Taxable Accounts (Output L)

- Not just for retirement

- Source of funds for real estate down payments

- Options trading capital

Tax-Deferred Accounts (Output M)

- 401k contributions and growth

- The compound effect of tax deferral

- Safe withdrawal rate calculations

Tax-Free Accounts (Output N)

- Roth IRA contributions and conversions

- Tax-free growth visualization

- Early access strategies

The Engine calculated safe withdrawal rates across all accounts, showing how a $100,000 portfolio could generate $4,000/year indefinitely.

The Alternative Income Module

Annuities (Outputs O, P, Q)

- Current value

- Payout rates

- Integration with other income streams

Social Security

- Projected benefits

- Timing optimization

- Impact on overall plan

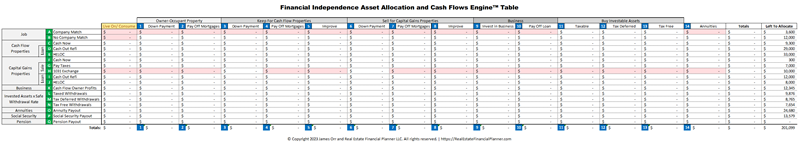

The Allocation Matrix: Where Strategy Meets Execution

This was the Engine’s masterpiece – a comprehensive allocation matrix with 14 distinct buckets across all asset categories. But it wasn’t just about spreading money around.

Lesson #4: Allocation isn’t diversification – it’s strategic positioning.

Alex discovered that the Engine forced critical thinking:

The Consumption Column

“Wait, there’s a column for lifestyle spending?” Alex noticed. “This isn’t about deprivation – it’s about conscious choice.”

The Engine showed that every dollar allocated to consumption was a dollar not building future cash flow. But it also acknowledged that life is for living.

The Property Allocation Columns

Six separate columns for real estate:

- Owner-Occupant Down Payments

- Owner-Occupant Mortgage Paydown

- Cash Flow Property Down Payments

- Cash Flow Property Mortgage Paydown

- Property Improvements

- Capital Gains Property Investments

“Each strategy needs its own capital allocation,” Alex realized. “I can’t just say ‘I invest in real estate’ – I need to know exactly which strategy and why.”

The Business Column

The Engine treated business investment as seriously as any other asset class:

- Capital for growth

- Loan paydown

- Cash flow reinvestment

The Traditional Asset Columns

Three columns for paper assets:

- Taxable (flexibility)

- Tax-Deferred (compound growth)

- Tax-Free (future income)

Lesson #5: Tax treatment is as important as returns.

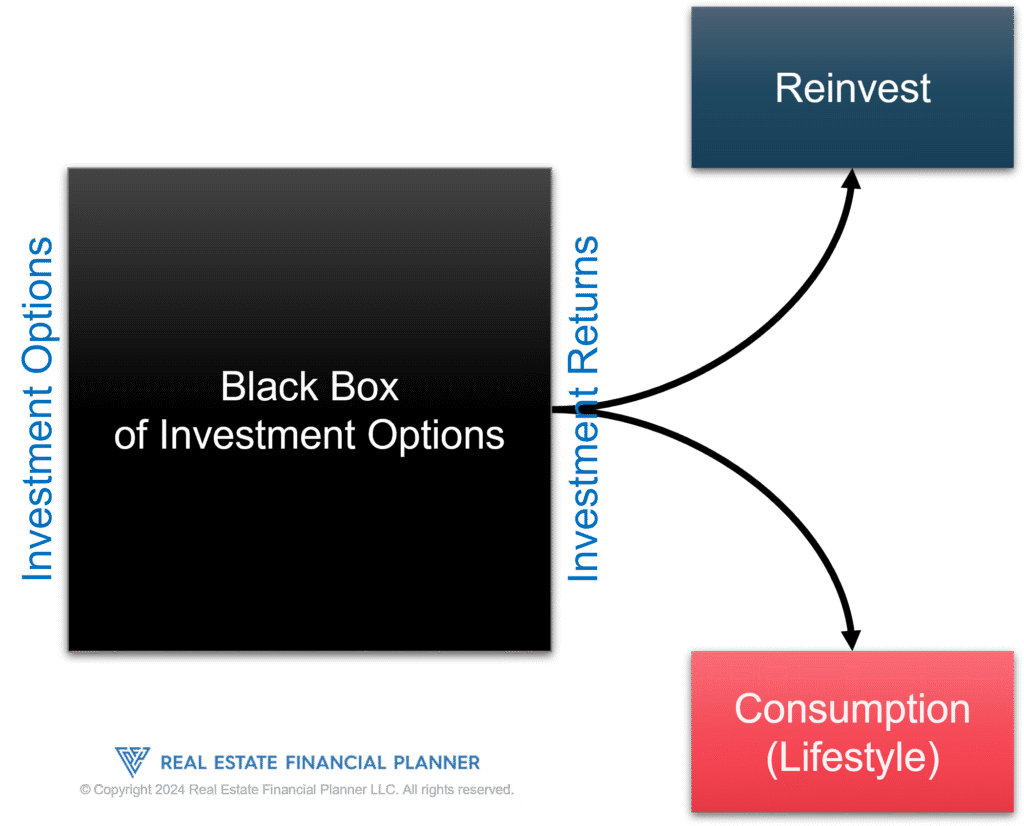

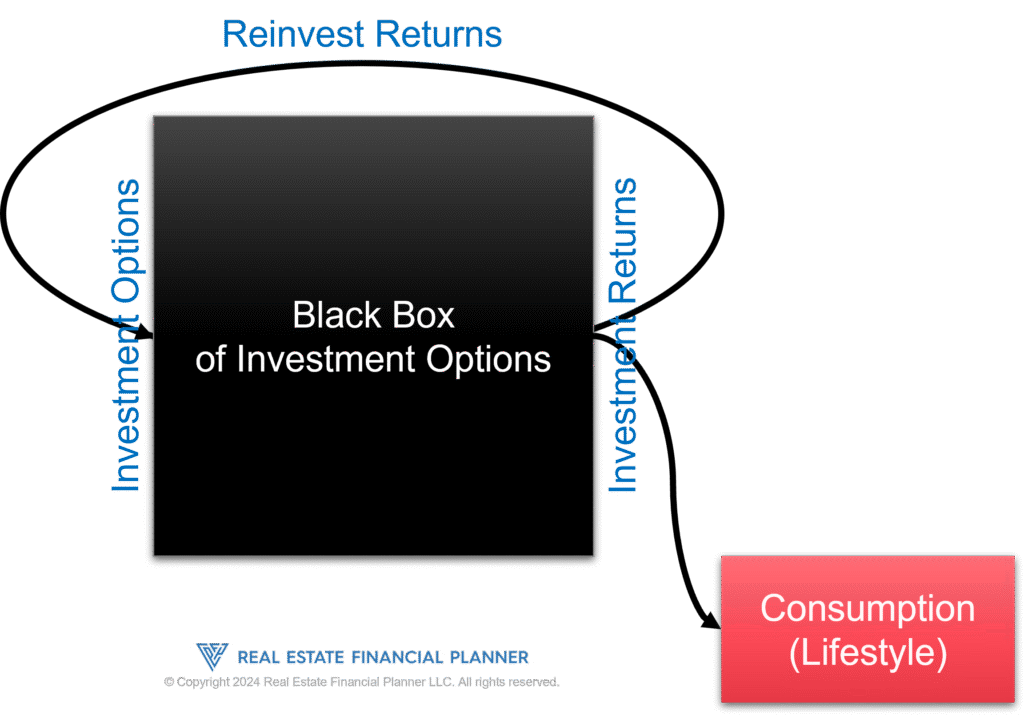

The Feedback Loop: Understanding Compound Cash Flow

Six months into using the Engine, Alex experienced its most powerful feature: the reinvestment feedback loop.

“Every investment I make starts producing its own cash flow,” Alex explained to their skeptical spouse. “Look at this.”

The Engine showed:

- Rental Property #1: $300/month cash flow + $833/month depreciation benefit

- Options Trading: $500/month income

- Side Business: $1,000/month profit

Total: $2,633/month in new cash flow to reallocate.

Lesson #6: The Engine creates exponential growth through systematic reinvestment.

Each month, the Engine posed the same question: reinvest or consume? The spreadsheet tracked both choices without judgment, but the math was clear. Reinvested cash flow created more cash flow.

Advanced Strategies: The Engine’s Hidden Power

As Alex grew more sophisticated, the Engine revealed deeper strategies:

Cash Flow Stacking

The Engine taught that small streams create rivers:

- Property 1: $300/month

- Property 2: $350/month

- Property 3: $400/month

- Options Income: $700/month

- Business Income: $1,500/month

- Dividend Income: $200/month

Total: $3,450/month – more than many people’s full-time salary.

Time Arbitrage

The Engine separated immediate cash flow from future benefits:

- Cash Now: Rental income, business profit, options premiums

- Cash Later: Appreciation, equity buildup, business value

- Tax Benefits: Depreciation, business expenses, retirement account growth

Risk Layering

Different assets provided different risk profiles:

- Real Estate: Stable, leveraged, tax-advantaged

- Options: Higher return, requires active management

- Business: Scalable but demanding

- Traditional Assets: Liquid, passive, market-dependent

Lesson #7: True diversification means multiple asset classes, not just multiple stocks.

The Five-Year Transformation: Proof in the Numbers

Five years later, Alex’s Engine showed a complete transformation:

The Portfolio Dashboard:

- Human Capital: Still $120,000/year, but now optional

- Real Estate Portfolio: 5 properties, $2,400/month cash flow

- Options Account: $50,000 generating $1,200/month

- Business: $2,500/month semi-passive income

- Traditional Investments: $125,000 across all accounts

- Total Passive Income: $3,600/month

- Total Semi-Passive: $3,700/month

The Engine’s Key Metrics:

- Passive Income Coverage Ratio: 72% of living expenses

- Total Income Streams: 7 distinct sources

- Years to Full FI: 3.5 at current pace

- Net Worth Growth Rate: 34% annually

“The Engine didn’t just track my money,” Alex reflected. “It changed how I think about money.”

The Engine’s Core Teachings: A New Financial Philosophy

Looking back, Alex identified the Engine’s fundamental lessons:

1. Everything is a Cash Flow Decision

The Engine reframed every financial choice:

- Buying a car: What’s the opportunity cost in lost cash flow?

- Choosing a house: Can it become a rental later?

- Taking a vacation: Consume now or invest for 10 vacations later?

2. Human Capital Has an Expiration Date

The Engine’s structure made it clear: job income is temporary, but assets can produce forever. The race was to convert human capital into permanent cash-flowing assets before burnout or obsolescence.

3. Taxes Are the Hidden Wealth Killer

By tracking Cash Flow from Depreciation™ and separating account types, the Engine showed that tax strategy could literally double returns:

- Rental property depreciation: 27.5-year write-off

- Business expenses: Immediate deductions

- Retirement accounts: Decades of tax-free growth

4. Small Actions Compound Dramatically

The Engine proved that $300/month in cash flow, reinvested at 10% returns, becomes $1,000/month in seven years. Start small, but start now.

5. Optionality Beats Optimization

Having multiple strategies running simultaneously beat trying to find the “perfect” investment. The Nomad™ strategy, BRRRR, options income, and business cash flow all worked together.

Beyond the Numbers: Life Transformation

“You’ve changed,” Alex’s manager noted during a performance review.

“Have I?” Alex smiled, knowing exactly what had shifted.

The Financial Independence Asset Allocation and Cash Flows Engine™ had done more than organize finances. It had:

- Gamified wealth building: Each cell filled was progress toward freedom

- Created clarity: No more vague “investing” – every dollar had a specific purpose

- Enabled courage: With multiple income streams, job loss wasn’t catastrophic

- Fostered abundance: The Engine showed money as a tool, not a goal

The Engine’s Ultimate Message

The Financial Independence Asset Allocation and Cash Flows Engine™ taught Alex one overarching truth:

Financial independence isn’t about having millions in the bank. It’s about building a system where your assets produce more cash flow than your lifestyle consumes.

The Engine made this tangible by:

- Tracking every income source

- Calculating every return type

- Enabling strategic allocation

- Measuring progress in cash flow, not just net worth

Alex still works at the tech company, but everything has changed. Sunday nights are for updating the Engine, analyzing new deals with The World’s Greatest Real Estate Deal Analysis Spreadsheet™, and planning the next investment.

The cubicle remains, but it’s no longer a cage. It’s just another cash flow source in an ever-growing engine of financial independence.

Lesson #8: The Engine doesn’t create wealth – it reveals the path. Walking it is up to you.

The Financial Independence Asset Allocation and Cash Flows Engine™ isn’t just a spreadsheet. It’s a complete system for transforming income into freedom, one calculated decision at a time.