You’re sitting on a goldmine, but you can’t touch it—yet. That’s the paradox of “Cash Later” in real estate investing, and it’s precisely why so many investors miss out on building generational wealth. While everyone obsesses over monthly cash flow, the silent wealth-builders focus on the returns that compound invisibly in the background: appreciation and debt paydown.

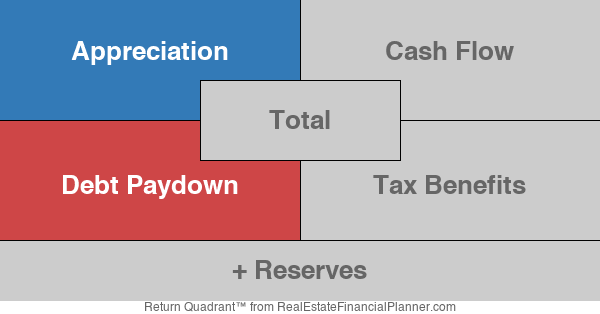

Cash Later represents the equity side of real estate returns—the wealth that accumulates through property value increases and mortgage principal reduction. According to the Return Quadrants™ framework, these two components form half of your total real estate returns, often outpacing the immediate cash benefits over time. Yet because you can’t deposit them in your bank account today, many investors undervalue or completely ignore these powerful wealth-building mechanisms.

In this comprehensive guide, we’ll explore how Cash Later works, why it matters for long-term wealth building, and how to maximize these returns in your real estate portfolio. We’ll show you exactly how to calculate these returns using The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and reveal strategies that experienced investors use to access this trapped equity when the time is right. By the end, you’ll understand why Cash Later might be the most important part of your real estate investment strategy—even if you can’t spend it today.

Understanding the Cash Later Concept

Cash Later encompasses the two Return Quadrants™ that build equity in your properties without putting immediate cash in your pocket. Unlike Cash Now returns (cash flow and tax benefits), these returns accumulate silently, creating a reservoir of wealth that grows with each passing month.

The two components of Cash Later work in tandem:

- Appreciation – The increase in your property’s market value over time, whether through natural market forces or strategic improvements

- Debt Paydown – The reduction in your mortgage balance as you (or your tenants) make monthly payments, converting debt into equity

What makes Cash Later particularly powerful is its compounding nature. As your property appreciates, you’re building equity on an increasingly valuable asset. Meanwhile, each mortgage payment reduces your debt, accelerating the equity accumulation. This dual mechanism creates a snowball effect that can transform a modest initial investment into substantial wealth over time.

The term “Cash Later” perfectly captures the delayed gratification aspect of these returns. Unlike monthly rental income that hits your bank account immediately, appreciation and debt paydown returns remain locked in your property until you choose to access them. This inaccessibility is both a limitation and a strength—it forces a long-term perspective and prevents impulsive spending of your growing wealth.

When you examine the Return Quadrants™, you’ll notice that Cash Later occupies the left side of the diagram. This positioning reflects the fundamental difference in accessibility compared to the right side’s Cash Now returns. While you might wait years or decades to realize Cash Later returns, they often represent the majority of total returns from real estate investing, especially in appreciating markets.

The Power of Appreciation

Appreciation stands as one of the most potent wealth-building forces in real estate, yet its power often goes unrecognized because it happens gradually and invisibly. Unlike the monthly rent check that provides tangible proof of return, appreciation works quietly in the background, potentially doubling or tripling your property value over the ownership period.

Real estate appreciation comes in two distinct flavors:

- Natural Appreciation – The natural, organic increase in property values driven by inflation, population growth, economic development, and supply-demand dynamics

- Forced Appreciation – Value increases created through strategic improvements, better management, or highest and best use conversions

What makes appreciation particularly attractive is its unbounded potential. Unlike debt paydown, which is capped at your loan amount, or depreciation benefits, which are limited to 27.5 or 39 years, appreciation has no ceiling. Properties in prime locations have seen values increase 10x or more over several decades, creating millionaires from middle-class investors who simply held on.

Historical data shows that real estate appreciation has averaged 3-4% annually nationwide, but these averages mask significant geographic variations. Coastal markets and growing metro areas often see 5-7% annual appreciation, while some boom markets experience double-digit growth during expansion cycles. Even conservative 3% annual appreciation doubles your property value in 24 years—a powerful return on your initial investment.

The tax treatment of appreciation adds another layer of benefit. Unlike rental income taxed at ordinary rates, appreciation gains receive favorable capital gains treatment when realized. Better yet, you can access appreciation through refinancing without triggering any tax event, allowing you to deploy your equity into new investments while maintaining your original position.

Calculating appreciation in your Return Quadrants™ requires tracking property values over time. The World’s Greatest Real Estate Deal Analysis Spreadsheet™ automates this process, allowing you to model different appreciation scenarios and see their impact on your overall returns. Whether you’re assuming conservative 2% growth or aggressive 6% appreciation, understanding these projections helps you make informed investment decisions.

Maximizing Debt Paydown Returns

While appreciation gets the glory, debt paydown quietly builds wealth with mathematical certainty. Every mortgage payment splits between interest and principal, with the principal portion directly converting debt into equity. This mechanical wealth-building process requires no market timing, no renovation skills, and no luck—just consistent payments over time.

Understanding mortgage amortization reveals the accelerating nature of debt paydown returns. In a typical 30-year mortgage, early payments go predominantly toward interest, with minimal principal reduction. However, this ratio shifts dramatically over time. By year 20, the majority of each payment attacks the principal, rapidly accelerating equity accumulation. This back-loaded benefit rewards patient investors who understand the long-term nature of real estate wealth building.

Unlike appreciation’s unlimited upside, debt paydown returns are capped at your original loan amount. If you borrow $400,000 to purchase a property, your maximum debt paydown return is $400,000, spread across the loan term according to the amortization schedule. This limitation might seem restrictive, but it also provides certainty—you know exactly what this return will be from day one.

Strategic investors employ several tactics to accelerate debt paydown:

- 15-Year vs 30-Year Mortgages – Shorter terms mean higher payments but faster equity building and lower total interest costs

- Extra Principal Payments – Even small additional payments can shave years off your mortgage and save tens of thousands in interest

- Biweekly Payment Strategies – Making half-payments every two weeks results in 13 full payments annually, accelerating paydown without feeling the pinch

- Refinancing Strategically – Moving to lower rates while maintaining payment amounts can dramatically increase principal reduction

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ excels at modeling these scenarios, showing you exactly how different strategies impact your long-term wealth accumulation. You can compare the total return difference between a 15-year and 30-year mortgage, calculate the impact of various extra payment amounts, and determine the optimal strategy for your situation.

Accessing Your Cash Later

The ultimate test of Cash Later returns comes when you need to access the accumulated equity. Unlike stocks that you can sell with a few clicks, real estate equity requires strategic planning to unlock. Fortunately, several methods exist to tap into your Cash Later returns, each with distinct advantages and considerations.

Three primary methods dominate equity access strategies:

- Cash-Out Refinancing – Replace your existing mortgage with a larger one, pocketing the difference tax-free while maintaining property ownership

- Home Equity Lines of Credit (HELOC) – Establish a revolving credit line against your equity, providing flexible access to funds as needed

- Selling the Property – The ultimate realization event, converting all accumulated equity into cash while potentially triggering tax consequences

Cash-out refinancing stands as the most popular method among sophisticated investors. By pulling out equity tax-free, you can redeploy capital into new investments while maintaining your original position. This strategy works particularly well in low-interest environments or when you’ve experienced significant appreciation. However, increasing your loan balance means higher payments and more interest over time, requiring careful analysis of the trade-offs.

HELOCs offer flexibility that appeals to many investors. Rather than taking a lump sum, you can access equity as needed, paying interest only on what you borrow. This makes HELOCs ideal for renovation projects, down payments on new properties, or emergency reserves. The variable interest rates and potential for banks to freeze credit lines during downturns represent the primary risks.

Selling provides the cleanest equity access but comes with significant considerations. Capital gains taxes can take a substantial bite from appreciation returns, though primary residence exemptions and 1031 exchanges offer mitigation strategies. Transaction costs typically run 6-10% of the sale price, reducing net proceeds. Most importantly, selling eliminates future returns from the property, making timing crucial.

The tax implications of each method vary dramatically. Refinancing and HELOCs create no taxable event, preserving your equity for deployment elsewhere. Selling triggers capital gains on appreciation (though not on debt paydown returns, which were created with after-tax dollars). Understanding these differences helps optimize your equity access strategy for maximum after-tax wealth.

Cash Later in Your Investment Strategy

Successful real estate investors understand that Cash Later returns aren’t just a nice bonus—they’re often the primary driver of long-term wealth creation. Integrating Cash Later thinking into your investment strategy requires balancing immediate income needs with long-term wealth accumulation goals.

The balance between Cash Now and Cash Later returns shifts based on your life stage and financial goals. Young investors with stable W-2 income often prioritize Cash Later, accepting break-even or negative cash flow in exchange for properties in high-appreciation areas. They’re playing the long game, building equity that will fund their eventual financial independence. Conversely, retirees typically prioritize Cash Now, needing immediate income to cover living expenses while caring less about 20-year appreciation projections.

Portfolio diversification across the Return Quadrants™ creates resilience and flexibility. Some properties might excel at Cash Now returns—older buildings in stable neighborhoods with solid cash flow but minimal appreciation. Others might be Cash Later plays—properties in the path of development or emerging neighborhoods where current rents barely cover expenses but future potential appears enormous. This diversification ensures you’re not overly dependent on any single return source.

The Return on Equity Quadrant™ becomes particularly valuable for hold/sell decisions. As properties appreciate and mortgages pay down, your equity position grows substantially. However, this trapped equity might earn relatively low returns compared to fresh investments. By calculating your Return on Equity across all four quadrants, you can identify when it’s time to harvest Cash Later returns and redeploy capital into higher-returning opportunities.

Age and timeline considerations can’t be ignored when emphasizing Cash Later returns. A 30-year-old has decades for appreciation and debt paydown to work their magic. A 60-year-old might not want to wait 15 years to access equity returns. Your investment timeline should directly influence how much weight you give to Cash Later versus Cash Now returns in property selection and portfolio construction.

Advanced Strategies and Calculations

Sophisticated investors go beyond basic Cash Later calculations, incorporating advanced concepts that provide a more accurate picture of true returns. These strategies separate amateur investors from professionals who maximize every dollar of return across all four quadrants.

True Net Equity™ calculations revolutionize how we think about equity returns. Rather than using gross equity (property value minus loan balance), True Net Equity™ subtracts all costs of accessing that equity—selling costs, commissions, taxes, and closing fees. This provides a realistic view of accessible wealth, particularly important when using Return on Equity calculations for hold/sell decisions. A property showing 12% returns on gross equity might only generate 8% on True Net Equity™, potentially changing your investment decision.

The impact of reserves on Cash Later returns often goes uncalculated, leading to overestimated returns. Maintaining 6-12 months of expenses in reserves is prudent risk management, but these funds could otherwise be invested for returns. The Return in Dollars + Reserves Quadrant™ (RIDQ+R™) and Return on Investment + Reserves Quadrant™ (ROIQ+R™) account for this drag, providing more realistic return projections that include the opportunity cost of reserve requirements.

Combining strategies amplifies Cash Later returns beyond what single tactics achieve. For example, purchasing in an emerging neighborhood (appreciation play) with a 15-year mortgage (accelerated debt paydown) while making strategic improvements (forced appreciation) creates multiple vectors for equity growth. The World’s Greatest Real Estate Deal Analysis Spreadsheet™ models these combined strategies, showing how they interact to boost overall returns.

Scenario modeling becomes essential when projecting Cash Later returns across different market conditions. The Real Estate Financial Planner™ software allows you to create multiple scenarios—optimistic, realistic, and pessimistic—showing how your Cash Later returns perform under various appreciation rates and market conditions. This analysis helps you stress-test investment decisions and ensure they align with your risk tolerance and financial goals.

Conclusion

Cash Later returns—appreciation and debt paydown—represent the silent wealth builders in real estate investing. While they lack the immediate gratification of monthly cash flow, these returns often constitute the majority of total investment returns over time. Understanding and optimizing Cash Later returns separates investors who achieve true financial independence from those who merely supplement their income.

The key to maximizing Cash Later returns lies in patient, strategic investing with a long-term perspective. Choose properties in areas with strong appreciation potential, structure financing to balance cash flow needs with equity building, and develop a clear strategy for eventually accessing accumulated equity. Use tools like The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model scenarios and make data-driven decisions.

Your next steps should include analyzing your current portfolio through the Cash Later lens. Calculate your Return on Equity for each property, project future appreciation and debt paydown returns, and identify opportunities to optimize your strategy. Whether through strategic refinancing, targeted improvements, or portfolio rebalancing, focusing on Cash Later returns will accelerate your journey to financial independence and generational wealth.