Real estate investing offers multiple paths to wealth creation, but not all returns are created equal. While some investors chase appreciation hoping for a big payday years down the road, savvy investors understand the power of “Cash Now” – the immediate, spendable returns that flow directly into your pocket from rental properties.

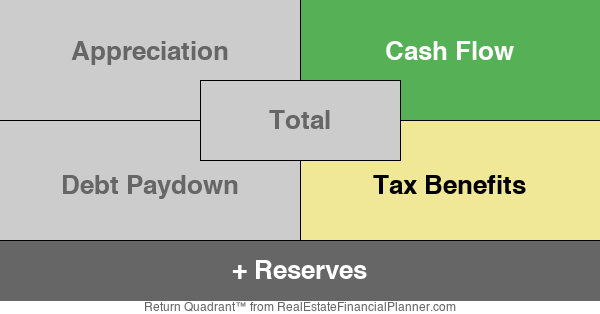

Cash Now represents the right side of the Return Quadrants™ framework, encompassing the two types of returns that generate immediate cash: rental cash flow and tax benefits through depreciation. Unlike appreciation and debt paydown that build equity silently in the background, Cash Now provides the monthly income that pays your bills, funds your lifestyle, and accelerates your journey to financial independence.

This guide will show you exactly how to maximize both components of Cash Now, providing actionable strategies to increase your rental income, reduce expenses, and optimize your tax benefits. Whether you’re analyzing your first rental property or optimizing an existing portfolio, understanding Cash Now is essential for making informed investment decisions. Tools like The World’s Greatest Real Estate Deal Analysis Spreadsheet™ can help you calculate these returns accurately, ensuring you never leave money on the table.

Understanding the Cash Now Quadrants

The Return Quadrants™ framework divides real estate returns into four distinct categories, each occupying a quadrant in a visual representation of your total investment return. The right side of this framework – the Cash Now side – consists of Cash Flow and Cash Flow from Depreciation™, both of which put money in your pocket on a regular basis.

What makes Cash Now particularly attractive is its immediate accessibility. While the left side of the quadrant (Cash Later) requires selling or refinancing to access your returns, Cash Now delivers monthly or quarterly payments you can use immediately. This distinction becomes crucial when planning for financial independence or evaluating investment opportunities.

The Cash Now quadrants share another important characteristic: they’re taxed in the current year. Cash flow appears as rental income on your tax return, while depreciation reduces your taxable income, effectively creating cash through tax savings. This immediate tax impact makes proper planning essential for maximizing your returns.

Understanding how these quadrants work together reveals why some properties that appear marginally profitable on paper can actually deliver strong Cash Now returns when tax benefits are properly calculated. A property showing $200 monthly cash flow might actually generate $500 or more in total Cash Now when depreciation benefits are included.

Cash Flow: The Foundation of Cash Now

Cash flow represents the net difference between all income collected on a property and all expenses paid. While rent typically forms the bulk of property income, successful investors know how to identify and capture additional revenue streams that boost their Cash Now returns.

Calculating true cash flow requires accounting for every dollar in and out. Income includes not just rent, but also application fees, late fees, pet rent, and any additional services you provide. Many investors overlook opportunities like renting storage spaces, charging for parking in urban areas, or installing coin-operated laundry in multi-family properties. These “small” additions can add $50-200 per unit monthly – a significant boost to your Cash Now.

On the expense side, accuracy is equally critical. Beyond obvious costs like mortgage payments and property taxes, you must account for property management, maintenance reserves, insurance, utilities (if owner-paid), HOA fees, and vacancy allowances. Missing even one expense category can turn a seemingly profitable property into a cash flow negative investment.

To maximize cash flow, focus on three key strategies:

- Increasing Rental Income – Conduct thorough market analysis to ensure you’re charging market rates, invest in value-add improvements that justify higher rents, and explore additional income streams specific to your property type and location.

- Reducing Operating Expenses – Implement efficient property management systems, establish preventive maintenance schedules to avoid costly emergency repairs, and optimize utility costs through energy-efficient upgrades or billing adjustments.

- Strategic Financing – Shop multiple lenders to secure the lowest interest rates, consider loan terms carefully (15-year vs 30-year), and evaluate whether points or fees make sense for your investment timeline.

Common cash flow mistakes include underestimating vacancy rates, forgetting to budget for capital expenditures, and assuming rents will increase faster than expenses. The World’s Greatest Real Estate Deal Analysis Spreadsheet™ helps avoid these pitfalls by forcing you to input realistic assumptions for all income and expense categories.

Tax Benefits: The Hidden Cash Now Generator

Depreciation represents one of real estate’s most powerful wealth-building tools, yet many investors fail to fully understand or optimize this benefit. The IRS allows you to deduct the cost of rental property improvements over time, creating a non-cash expense that reduces your taxable income and generates real cash savings.

For residential rental properties, you can depreciate the building value (not land) over 27.5 years. Commercial properties depreciate over 39 years. This means a $275,000 residential rental building generates $10,000 in annual depreciation deductions. For an investor in the 24% tax bracket, this translates to $2,400 in annual tax savings – or $200 per month in additional Cash Now.

The distinction between Gross Depreciation and Cash Flow from Depreciation™ matters for accurate planning. Gross Depreciation represents the total deduction amount, while Cash Flow from Depreciation™ shows the actual cash benefit based on your tax rate. Higher-income investors benefit more from depreciation due to their higher marginal tax rates.

To maximize your tax benefits through depreciation:

- Cost Segregation Studies – Accelerate depreciation by identifying components that qualify for 5, 7, or 15-year depreciation schedules instead of 27.5 years, potentially doubling or tripling first-year deductions.

- Property Classification – Ensure properties are correctly classified to maximize depreciation benefits, understanding the differences between residential and commercial depreciation rules.

- Timing Strategies – Place properties in service before year-end to capture a full year of depreciation, and consider the impact of mid-year purchases on your tax planning.

Be aware of income limitations that may restrict your ability to use passive losses. Active real estate professionals can use unlimited losses, while passive investors face restrictions based on modified adjusted gross income. Understanding these rules helps you plan property acquisitions to maximize usable tax benefits.

Combining Cash Flow and Tax Benefits

The true power of Cash Now emerges when you combine cash flow with tax benefits. A property generating modest cash flow can become a Cash Now powerhouse when depreciation benefits are properly calculated and utilized.

Consider this real-world example: A $300,000 rental property with a $240,000 mortgage generates $400 monthly cash flow after all expenses. The building value of $220,000 creates $8,000 in annual depreciation. For an investor in the 22% tax bracket, this adds $1,760 in tax savings, or about $147 monthly. The combined Cash Now return is $547 monthly – 37% higher than cash flow alone suggests.

This combination effect becomes even more powerful with cost segregation studies or when purchasing properties with significant recent improvements. The World’s Greatest Real Estate Deal Analysis Spreadsheet™ calculates both components automatically, showing you the true Cash Now potential of any investment.

The synergy between cash flow and tax benefits also provides downside protection. Even if a property experiences temporary negative cash flow due to vacancy or unexpected repairs, depreciation benefits continue unchanged, softening the blow to your overall returns. This stability makes Cash Now strategies particularly attractive for conservative investors seeking predictable returns.

Cash Now Strategies for Different Investor Types

Different investors should prioritize Cash Now strategies based on their unique situations and goals. Understanding which approach aligns with your circumstances helps maximize returns while meeting your immediate income needs.

Beginning investors with limited capital often focus heavily on cash flow, as they need immediate returns to build reserves and qualify for additional properties. These investors should target properties with strong cash flow even if appreciation potential seems limited. House hacking or small multi-family properties often provide the best Cash Now opportunities for beginners.

Experienced investors seeking passive income can leverage their knowledge to identify value-add opportunities that boost both cash flow and tax benefits. These investors might pursue larger multi-family properties or commercial real estate where professional management maintains their passive status while generating substantial Cash Now returns.

High-income professionals face unique challenges and opportunities. While passive loss limitations may restrict their ability to use depreciation benefits immediately, these investors can become real estate professionals or use cost segregation to accelerate deductions. The higher tax brackets make Cash Flow from Depreciation™ particularly valuable when accessible.

Retirees prioritizing consistent cash flow should focus on stable properties in established areas with long-term tenants. While appreciation becomes less important with shorter investment horizons, maximizing immediate cash flow ensures comfortable retirement income. These investors might accept lower overall returns in exchange for more predictable Cash Now.

Tools and Calculations

Accurately calculating Cash Now returns requires sophisticated analysis tools. The World’s Greatest Real Estate Deal Analysis Spreadsheet™ automates complex calculations, ensuring you capture all components of your investment returns. The spreadsheet calculates both regular cash flow and Cash Flow from Depreciation™, showing your true monthly and annual Cash Now returns.

Key metrics for Cash Now optimization include cash-on-cash return, which measures cash flow relative to invested capital, and Return on Equity calculations that help determine when to refinance or sell. The spreadsheet tracks these metrics automatically, updating as your properties appreciate and mortgages pay down.

Understanding the difference between Return on Investment and Return on Equity becomes crucial for Cash Now strategies. While a property might show modest returns on current equity, the Cash Now returns relative to your initial investment often remain strong, supporting a hold strategy even when Return on Equity suggests selling.

Conclusion

Cash Now represents the lifeblood of successful real estate investing, providing the immediate returns that fund your lifestyle and fuel portfolio growth. By understanding and optimizing both cash flow and tax benefits, investors can create reliable income streams that accelerate their path to financial independence.

The strategies outlined in this guide – from maximizing rental income and minimizing expenses to leveraging depreciation through cost segregation – provide a roadmap for Cash Now success. Remember that while Cash Later returns from appreciation and debt paydown build long-term wealth, Cash Now returns pay your bills today and create the financial flexibility to seize new opportunities.

Whether you’re analyzing your first rental property or optimizing an existing portfolio, tools like The World’s Greatest Real Estate Deal Analysis Spreadsheet™ ensure you never miss Cash Now opportunities. By accurately calculating both traditional cash flow and Cash Flow from Depreciation™, you can make informed decisions that maximize your immediate returns while building lasting wealth.

Start implementing these Cash Now strategies today, and watch as your rental properties transform from long-term investments into immediate income generators. The path to financial independence becomes much clearer when you have cash flowing into your accounts every month, funding your dreams while your properties simultaneously build equity for the future.