Capital expenses, or CapEx, are significant costs related to maintaining or improving your rental properties.

These expenditures, while not frequent, play a crucial role in the long-term success of your real estate investments.

We’ll explore how to distinguish CapEx from regular maintenance, how to budget for these expenses, and the importance of incorporating CapEx into your deal analysis to ensure accurate projections and planning.

CapEx versus Maintenance

As a real estate investor, it’s important to distinguish between maintenance and capital expenses, especially when analyzing deals.

These are both costs you’ll incur to keep your property operating as a rental, but from a tax perspective, they are treated differently.

To keep it simple:

- Maintenance costs tend to be smaller, regular expenses—like fixing a leaky faucet or replacing a broken window—that keep the property functioning.

- Capital expenses (CapEx), on the other hand, are usually larger improvements or replacements—like a new roof or replacing an HVAC system—that extend the life or value of the property.

For tax purposes, the IRS separates the two.

According to Internal Revenue Code (IRC) Section 162, maintenance expenses can be written off in the year they are incurred, while capital improvements must be capitalized and deducted over time. Safe Harbor allows you to write off expenses under $2,500 (per invoice or item) in the year you take them, up from $500 before January 1, 2016. This means you don’t need to capitalize these smaller expenses. If you have audited financial statements, the threshold is even higher at $5,000.

In short, anything under $2,500 can often be treated like a regular maintenance expense, even though it may seem like a capital improvement.

For anything above $2,500, it’s considered CapEx and will need to be deducted over time.

As always, check with your CPA for specific details related to your situation.

Traditional Maintenance vs Capital Expenses

When it comes to analyzing deals, real estate investors typically make their own distinction between what counts as maintenance and what falls under capital expenses.

While we’ve covered the tax perspective earlier, here we’ll focus on how investors might categorize these costs when running their numbers.

Maintenance

Maintenance expenses are the smaller, routine costs you’ll face while managing your rental property.

They’re often related to keeping things in working order and handling the normal wear and tear that happens over time.

Here are some examples:

- Small Turnover Expenses – Costs associated with preparing the property for the next tenant.

- Wear and Tear That Can’t Be Billed Back to Tenant – Natural aging of materials like flooring or paint.

- Repairs to Items That Break – Fixing issues like a malfunctioning toilet or a broken window.

- Service Calls – Hiring plumbers, roofers, HVAC technicians, electricians, handymen, or landscapers for minor repairs or upkeep.

Capital Expenses

Capital expenses are the larger, less frequent costs that improve the property or extend its useful life. These are typically major replacements or renovations.

Investors often categorize the following as capital expenses:

- Replace Roof and/or Gutters – A major overhaul that protects the structure.

- Replace AC and/or Furnace/Boiler – Significant system upgrades for heating and cooling.

- Kitchen/Bathroom Remodels – Large-scale renovations that increase property value.

- Replace Windows – Often necessary to improve energy efficiency and comfort.

- Replace Driveway – A major exterior improvement.

- Replace Appliances – Upgrading or replacing aging refrigerators, stoves, or dishwashers.

- Replace Water Heater – A critical part of the property’s infrastructure.

- Exterior Paint – A full refresh of the property’s exterior.

Separate Maintenance and CapEx?

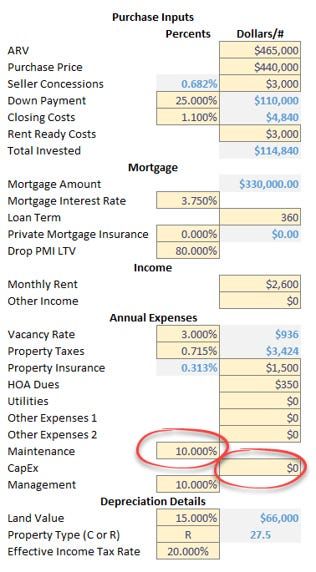

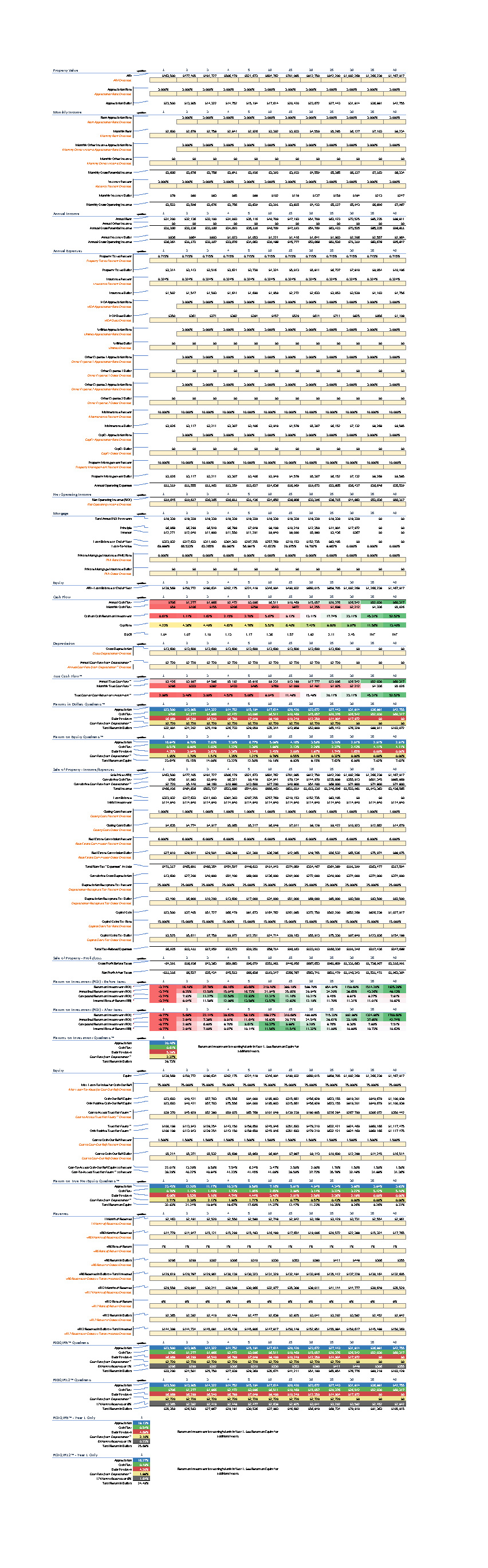

When analyzing deals using The World’s Greatest Real Estate Deal Analysis Spreadsheet™ (TWGREDAS) or the Real Estate Financial Planner™ software, you may wonder whether to separate maintenance and capital expenses.

The short answer is—you could.

Both systems provide separate fields for tracking maintenance and capital expenses for those who want to distinguish between them. However, some investors choose to combine these costs for deal analysis. When it comes to taxes, though, you’ll still need to follow the $2,500 Safe Harbor rule.

- Maintenance – We calculate this as a percentage of Gross Operating Income (GOI). This means that as rents go up and your GOI increases, the amount you set aside for maintenance rises proportionally. It keeps maintenance costs tied directly to your property’s income.

- CapEx – We handle CapEx differently. It’s calculated in dollars, not as a percentage of income. This is the amount you should be saving each month for major future expenses—like replacing a roof or an HVAC system—regardless of what your rent is. In TWGREDAS, CapEx is adjusted for inflation over time using the CapEx Appreciation Rate in the Overrides tab.

This separation allows you to plan and adjust for both ongoing maintenance and big-ticket replacements while keeping your analysis accurate and realistic.

Paint and Carpet/Flooring

When analyzing deals, one common question for real estate investors is whether repainting the interior and replacing carpet or flooring should be considered maintenance or a capital expense.

Some investors choose to categorize these costs as maintenance when evaluating their deals. After all, they are recurring expenses that happen during tenant turnovers, typically every few years.

Including paint and carpet as a maintenance expense can lead to—what might seem like—abnormally high maintenance percentage when analyzing deals.

Let’s look at an example to explain what I mean.

Impact of Price/Rent on Maintenance %

When analyzing deals, it’s important to remember that the price of your property and the rent it generates can significantly impact your maintenance percentage.

Let’s look at how this works with paint and carpet/flooring replacement as an example, keeping in mind that these costs and frequencies can vary—slightly or significantly—based on your specific property.

Assumptions

- Tenant turnover happens every 2.5 years (though it could be slightly shorter or longer).

- You replace paint and carpet/flooring every two tenant turnovers, or about every five years (but this could happen more or less frequently).

- You’re using the most basic and least expensive materials:

- Paint: $2/sq ft (but costs may vary slightly).

- Carpet/Flooring: $3/sq ft (again, this could be a bit more or less).

For a 1,600 sq ft, three-bedroom property, here’s the estimated cost to repaint and replace the flooring every five years:

- Paint: $2/sq ft × 1,600 sq ft = $3,200

- Carpet/Flooring: $3/sq ft × 1,600 sq ft = $4,800

- Total every 5 years: $8,000, which equals $1,600 per year.

Impact on a $100K Rental Generating $1,000/mo

- Gross Operating Income (GOI) = $12,000 – 3% Vacancy = $11,640

- $1,600 per year just for basic paint and carpet/flooring

- $1,600 ÷ $11,640 = 13.75% maintenance for paint and flooring alone. This excludes other maintenance costs such as occasional visits from handymen, plumbers, or electricians, as well as repairs when things break.

Impact on a $500K Rental Generating $2,500/mo

- Gross Operating Income (GOI) = $30,000 – 3% Vacancy = $29,100

- $1,600 per year just for basic paint and carpet/flooring

- $1,600 ÷ $29,100 = 5.50% maintenance for paint and flooring alone.

Even though these are rough estimates, you can see that the same basic maintenance costs can represent a much larger percentage of income for lower-priced properties.

The exact expenses and frequency may vary slightly, but this gives you a clear picture of how maintenance can disproportionately impact lower-rent properties.

Not Just Paint and Carpet/Flooring

The idea that certain maintenance and capital expenses don’t scale with property price and rent applies to much more than just paint and carpet.

Many of the larger expenses you’ll face as a real estate investor—like replacing a roof, water heater, or windows—tend to cost roughly the same across properties of similar size, regardless of the property’s value or rental income.

While there may be some regional differences in prices and wages, the following costs often don’t change significantly based on the price of the property:

- Roofs – Roof replacements are major capital expenses that can cost thousands of dollars. The price doesn’t vary much between a $100,000 property and a $400,000 property of similar size because materials and labor are relatively consistent.

- Water Heaters – Replacing a water heater is another expense that doesn’t scale with property price. Whether you’re replacing it in a lower-priced rental or a higher-priced one, the cost of the unit and installation are typically the same.

- Windows – Upgrading or replacing windows is a common capital expense. The cost per window remains similar regardless of the value of the property, so a less expensive property may see a larger percentage of its income go toward these replacements.

- Hourly Wages for Trades like Plumbers, HVAC Technicians, Electricians, and Handymen – Hiring skilled labor for repairs and maintenance comes with a set hourly rate that doesn’t change based on your property’s value. Whether it’s a simple repair or a larger project, the cost of hiring professionals is a constant expense, regardless of property price or rental income.

This means that for a lower-priced property—let’s say a $100,000 home—these expenses will take up a much larger percentage of your Gross Operating Income (GOI) compared to a higher-priced property, such as a $400,000 home.

Even though the properties may have similar square footage, the maintenance and capital expense burden will be disproportionately higher on the lower-cost property.

This is also why you can’t just always use 10% for maintenance and why I can’t tell you exactly what percentage to use when analyzing your own properties.

These expenses don’t scale with the value or rent of the property, so a fixed percentage may not give you an accurate picture.

Instead, you should do the math for your specific property—perhaps with the help of the capital expense spreadsheet I’ll provide below—and calculate what expenses you’re likely to face.

From there, determine what maintenance percentage you should use and how much you should set aside for capital expenses as a dollar amount.

You can either separate them out or combine them into one number when analyzing your deals.

This approach ensures you’re planning for real costs, not just applying a general rule of thumb that may not fit your situation.

You Must Do Your Own Due Diligence

While the spreadsheet may come pre-filled in and I may use specific numbers as examples for maintenance and capital expenses, it is important to do your own due diligence on what maintenance and capital expenses are likely to be in your market.

The numbers I am using are rough estimates that may not fully reflect prices in your area.

You’ll need to research how much it will cost you to replace a roof in your market and how long that roof is expected to last.

Costs and longevity can vary depending on your location and local labor rates.

Extreme weather (hot, cold, wet and dry) can shorten the lifespan of materials, meaning more frequent replacements.

You may be able to get discounts or handle small repairs yourself; however, be sure to consider the impact on your asset protection plan if you choose to do the work.

The more research you do, the more accurate your analysis will be, ensuring you’re better prepared for actual maintenance and capital expenses.

Maintenance and Capital Expenses

When it comes to handling maintenance and capital expenses on your rental properties, you have three main options:

- Ignore Them – You can bury your head in the sand and pretend these expenses won’t happen. But this approach is unrealistic and turns your deal analysis into a fantasy. Ignoring these costs will lead to unpleasant surprises down the road, jeopardizing your cash flow and profitability.

- Basic Planning – You can estimate costs and determine an average amount to set aside each year. This is what we cover in our Basic spreadsheet. It’s a simple approach that gives you a general sense of what you’ll need for future maintenance and CapEx, allowing you to save steadily over time.

- Advanced Planning – For a more detailed approach, you can plan your cash flow around upcoming expenses. Know what maintenance and CapEx you’ll face, when they’ll occur, and budget accordingly. This is covered in our Advanced spreadsheet. Think of it like parenting expenses: you plan ahead for braces, sports camps, a car for the kids, college, and even future weddings. Similarly, you need to set aside money for property maintenance and capital expenses to avoid being caught off guard.

Advanced planning helps you manage your cash flow more effectively and ensures you’re ready for any major expenses that come your way.

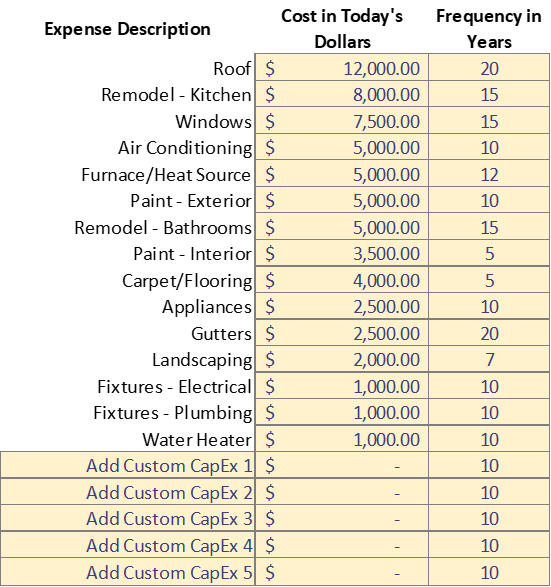

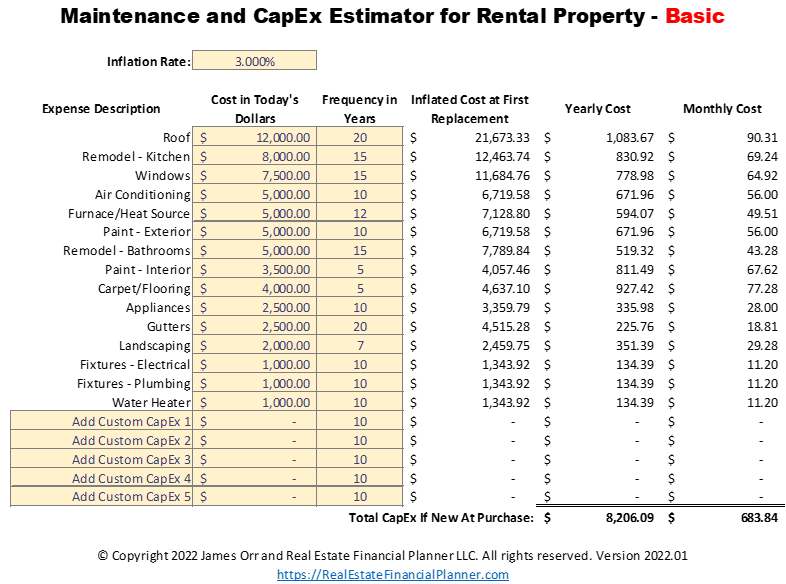

Instructions for Maintenance and CapEx Estimator for Rental Properties – Basic™ Spreadsheet

To get a handle on your maintenance and capital expenses, you can use the Maintenance and CapEx Estimator for Rental Properties – Basic™ spreadsheet.

This tool helps you estimate the future costs of maintaining and improving your rental properties so you can plan your savings accordingly.

- Research and enter the following:

- The Cost in Today’s Dollars for each expense item, such as a roof replacement or water heater.

- The Lifespan or Frequency in Years for replacing each item, which tells you how often you’ll need to make that investment.

- Include any custom expenses by filling in the provided spaces (e.g., “Add Custom CapEx #”) for specific costs unique to your property.

- Enter your Inflation Rate to account for the rising cost of materials and labor over time.

- Use the Yearly Cost or Monthly Cost from the spreadsheet in your analysis to figure out how much you should set aside each year or month for capital expenses.

- Apply your Inflation Rate for the CapEx Appreciation Rate to ensure you’re accounting for inflation over time.

This basic approach will help you manage future expenses and ensure you’re setting aside enough to cover maintenance and capital improvements.

Shortcomings of BASIC Version

The Maintenance and CapEx Estimator for Rental Properties – Basic™ is a great tool for getting started, but it does have its limitations.

For more complex scenarios, it may not cover everything you need to account for when analyzing a deal.

Here are some of the potential shortcomings:

- Older Property with Deferred Maintenance – If you’re buying a resale property where not everything is new, and some maintenance is coming up soon, the Basic version won’t account for items already partway through their lifecycle.

- Different Inflation Rates – What if certain items increase in price faster than others? The Basic version applies one inflation rate across the board, but in reality, costs for things like roofing or HVAC systems may rise at different rates.

- Starting with Set-Aside Funds – If you’ve already set aside some money for known repairs, the Basic version doesn’t allow you to adjust for this starting balance in your analysis.

- Earning a Return on Savings – If you’re earning interest or returns on the money you have set aside for future expenses, the Basic version doesn’t factor in this growth over time.

- Increasing Savings Over Time – As rents increase, you may want to increase how much you’re saving each year for future expenses. The Basic version doesn’t account for this gradual increase in savings.

That’s why I created the advanced version of the spreadsheet: Maintenance and CapEx Estimator for Rental Properties – Advanced™.

This version allows for more flexibility, helping you fine-tune your cash flow planning to better match the reality of your properties and market.

Advanced Version

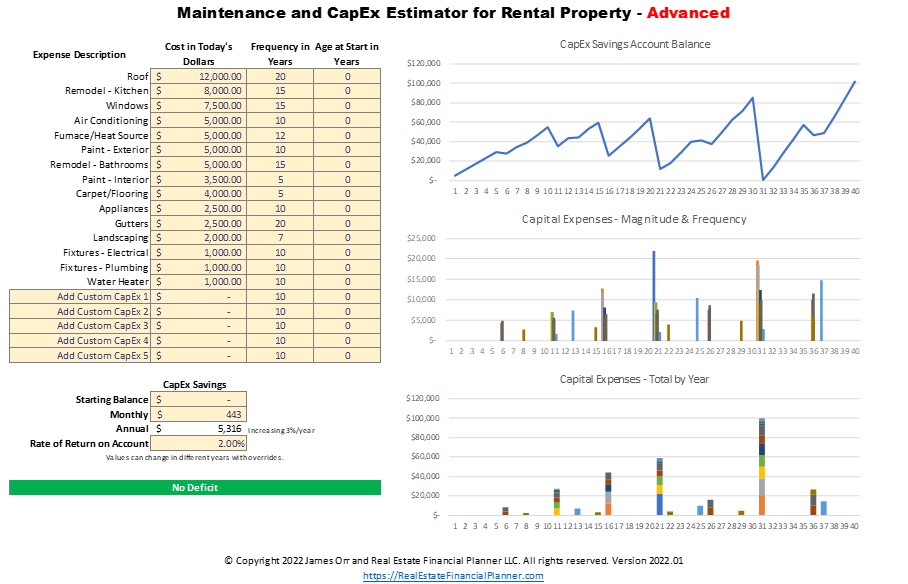

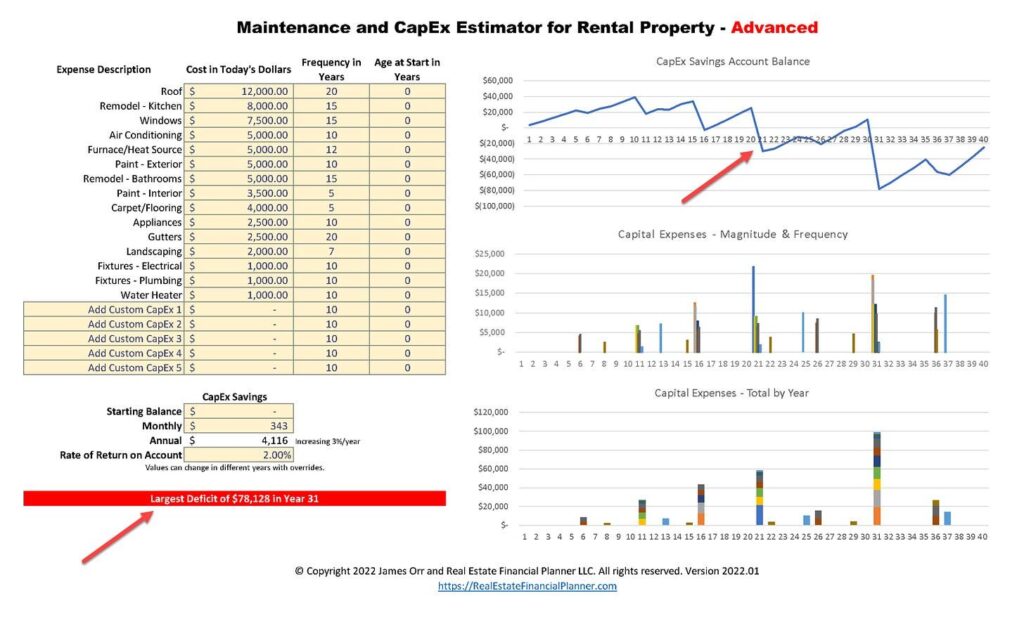

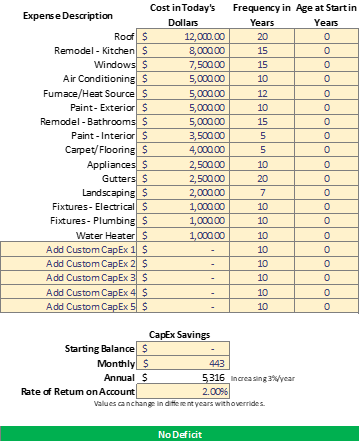

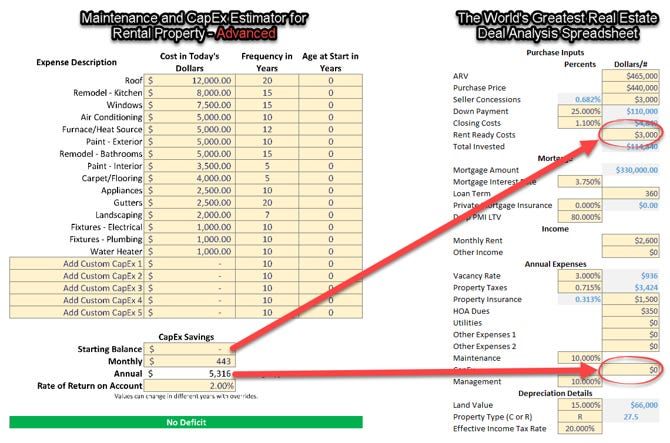

To better plan for long-term maintenance and capital expenses, you can use the Maintenance and CapEx Estimator for Rental Properties – Advanced™.

Here’s how to use it:

- Research and enter:

- The Cost in Today’s Dollars for each expense.

- The Lifespan or Frequency for replacing each item (in years).

- The Age at Start in Years to reflect the current age of the item when you acquire the property.

- Include custom expenses by using the provided spaces to account for unique costs specific to your property.

- Enter a combination of your Starting Balance, Monthly Amount Saved, and Rate of Return on Account:

- Adjust these numbers until you see “No Deficit” (green bar).

- Use Overrides if needed (explained below).

- In your analysis and The World’s Greatest Real Estate Deal Analysis Spreadsheet™, use the following:

- Use the Annual capital expenses savings rate (which is the Monthly costs times 12) to input them as the CapEx on The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

- Add your Starting Balance to the Rent Ready Costs input with any other Rent Ready Costs you have on The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to account for any funds you already have set aside.

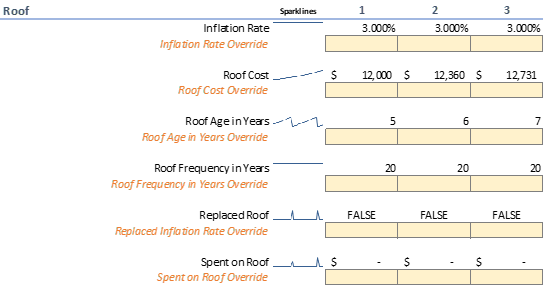

Overrides for Each Expense and Instructions

For each expense, you can make detailed adjustments in the Overrides tab of the Maintenance and CapEx Estimator for Rental Properties – Advanced™ spreadsheet.

This powerful feature allows you to fine-tune your projections for each individual capital expense item.

In the Overrides tab in the Maintenance and CapEx Estimator for Rental Properties – Advanced™ spreadsheet you can customize various parameters for each individual CapEx item.

Here’s what you can adjust for each expense, year by year:

- Inflation Rate – Set a specific inflation rate for that capital expense in any given year.

- Cost – Adjust the cost for a capital expense in any year. This is useful if you know of a specific increase or decrease to a certain dollar amount and want to use that as a starting point for the rest of your analysis.

- Current Age – Modify the effective age of a component. You might increase this if an item has experienced heavy usage or damage. Conversely, you could decrease it if you’ve completed a repair that extended its lifespan.

- Lifespan or Replacement Frequency – Change how long an item lasts before needing replacement. You might find that your items last longer than expected, or perhaps your local climate causes things to wear faster.

- Replaced – Mark when you incurred the expense for a CapEx item. Use this to indicate when you’ve replaced an item.

- Spent – Enter the actual amount you spent or expect to spend on a particular item.

By customizing these parameters, you create a more accurate and tailored financial forecast for your property.

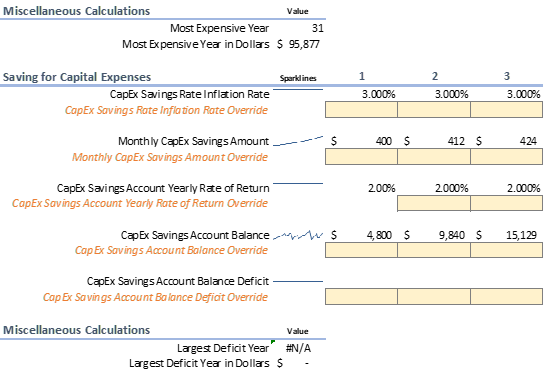

Override for Expense Account

In this part of the Maintenance and CapEx Estimator for Rental Properties – Advanced™ spreadsheet, you can adjust several important variables related to your capital expenses savings account and savings rate:

For any year, you can change:

- CapEx Savings Rate Inflation Rate Override – Adjust how much to increase the amount you’re saving each year to keep pace with inflation or changes in your financial goals.

- Monthly CapEx Savings Amount Override – Set the amount you’re saving monthly or annually for capital expenses.

- CapEx Savings Account Yearly Rate of Return Override – Enter the yearly rate of return for the account where you’re storing your CapEx savings.

- CapEx Savings Account Balance Override – Track the balance in any given year to see how much you have saved for future expenses.

- CapEx Savings Account Balance Deficit Override – Identify the deficit in any given year to see when you’ll run short on funds for capital expenses.

You’ll also be able to see the most expensive year and where your largest deficit occurs. This helps you plan ahead and ensure you’re saving enough to cover all future expenses without hitting a negative balance.

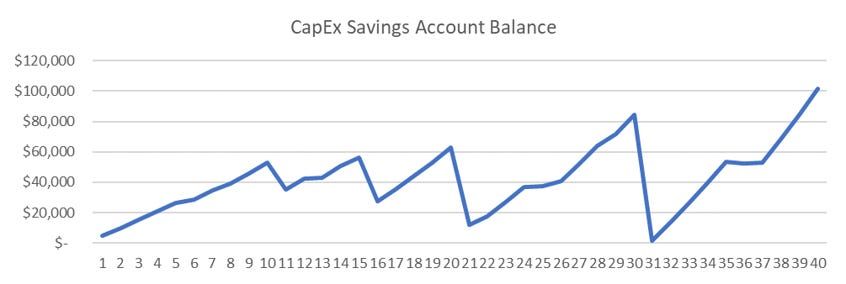

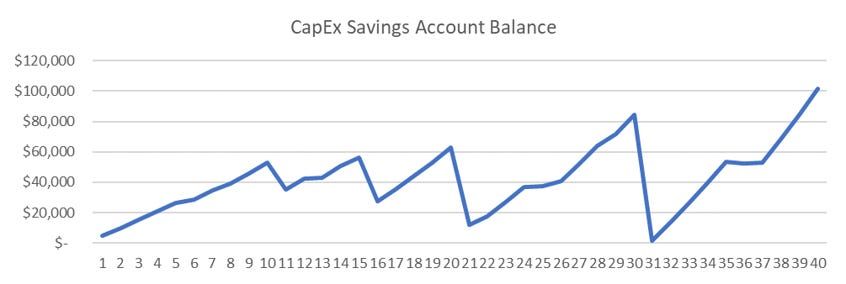

Results

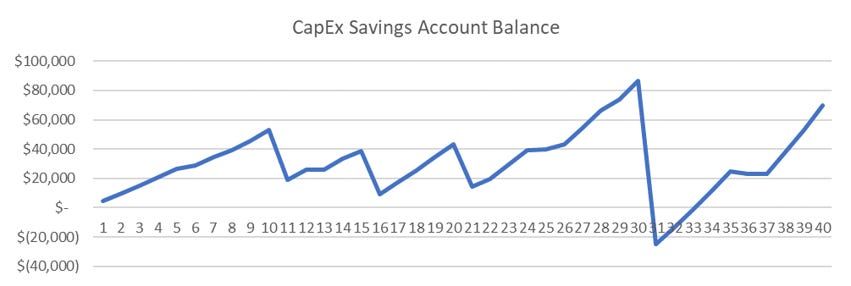

First, there’s a CapEx Savings Account Balance summary chart. This shows you how the balance of the money you’ve set aside for capital expenses changes over time as you:

- Set aside money for capital expenses at the start.

- Add money to the capital expenses savings account each month, which may increase with inflation or based on any overrides you set.

- Earn returns on the money in the account, with the rate of return adjusted by overrides if applicable.

- Pay for capital expenses, with costs adjusted for inflation depending on when the expenses occur, and any overrides accounted for.

Most importantly, this chart helps you track when you’ll run out of money in your CapEx Savings Account. If the balance drops below zero, it indicates that your savings aren’t sufficient to cover estimated capital expenses. We’ll discuss how to address deficits later in this section.

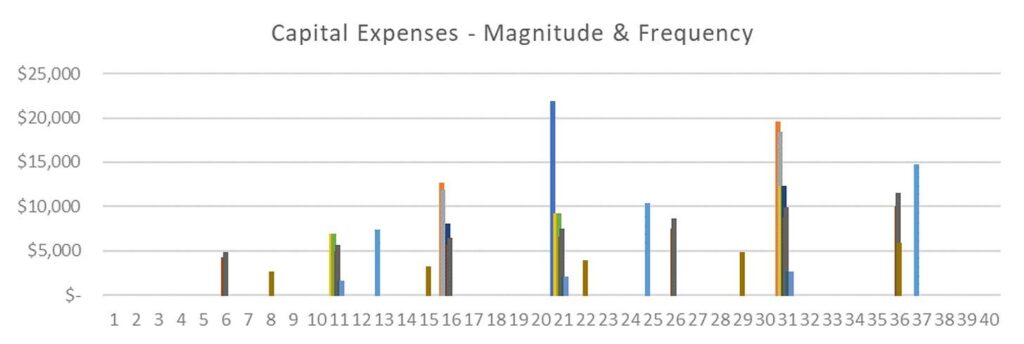

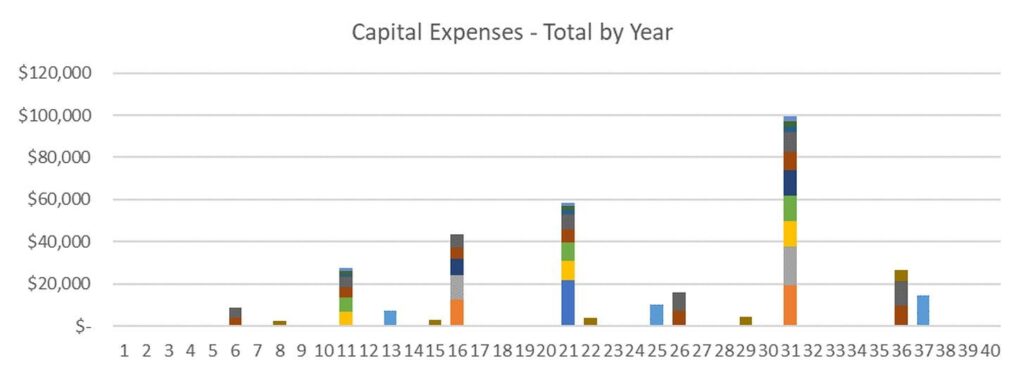

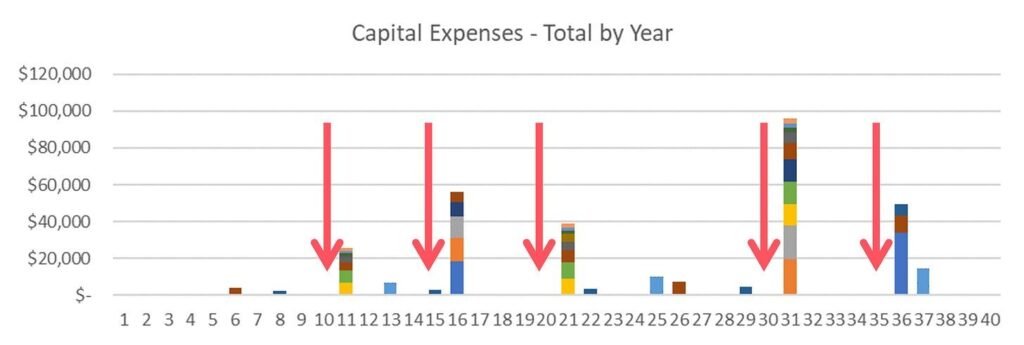

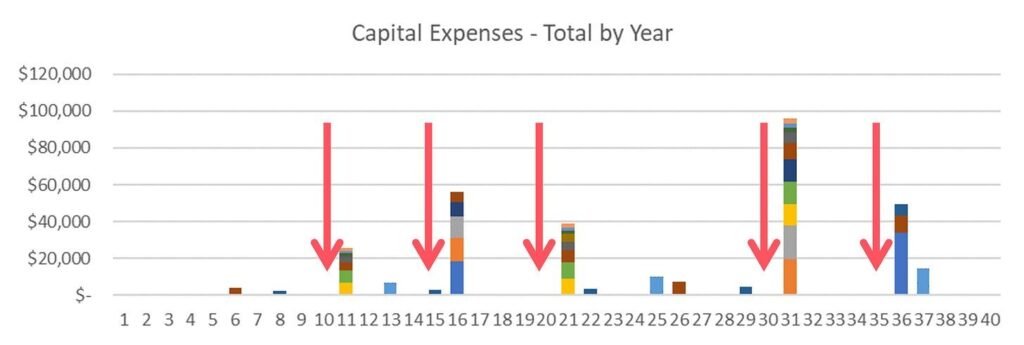

Next, there are two additional charts below the CapEx Savings Account Balance chart:

The Capital Expenses – Magnitude & Frequency chart provides a detailed breakdown of individual expenses, showing both their size and when they occur.

This allows you to see at a glance which expenses are significant and how frequently they’ll arise.

The benefit of this chart is that it helps you prepare for large, irregular expenses well in advance. You can easily spot which years will have high-cost events, such as a roof replacement or major system upgrades, and plan your cash flow accordingly.

By understanding both the magnitude and timing of each expense, you can ensure that you’re adequately saving and are less likely to be caught off guard by sudden, large costs.

The Capital Expenses – Total By Year chart provides a stacked view of all your expenses for each year, showing the combined total magnitude of all capital expenditures at a glance.

It’s the same data but presented in a slightly different way.

This allows you to see which years have the highest total expenses, helping you prepare for those financially demanding periods in advance. By having a clear picture of the total expenses for each year, you can ensure that your savings plan aligns with your future financial needs, avoiding any potential shortfalls.

The benefit of this chart is that it consolidates individual expenses, giving you a more comprehensive view of your overall capital expense needs in any given year.

Identify Deficits

In the CapEx Savings Account chart, you can identify where the balance dips below zero. This indicates that you haven’t saved enough based on several factors:

- How much you set aside initially.

- The amount you save each month.

- The returns you earn on the money saved in your CapEx account.

- The actual capital expenses you face—adjusted for inflation—based on the cost of items when you purchased the property, how often they need replacement, and their age when you acquired the property.

To ensure you have sufficient funds for future capital expenses, you’ll want to consider one or more of the following options:

- Set aside more money at the start.

- Increase the amount you save monthly.

- Plan for an additional lump sum contribution in the future (this can be modeled in the Overrides tab).

- Earn more on your saved funds (though be cautious of the risks that come with investing capital that you’ll need in the future).

- Lower your capital expenses by investing in better quality items, securing insurance, or altering your strategy so someone else is responsible for these costs, like selling the property via a lease-option to a tenant-buyer.

This section helps you plan more effectively to avoid deficits and ensures your capital expense savings are sufficient to meet your needs.

Once you make the necessary adjustments, the spreadsheet will update and indicate whether you’ve resolved the deficit.

In this case, you can see the green “No Deficit” bar at the bottom, which means that the adjustments you’ve made—whether by increasing your starting balance, saving more each month, or earning a higher return—are sufficient to cover all future capital expenses.

The No Deficit status ensures that your savings plan is aligned with the expected costs, and you won’t likely run into a negative balance when those capital expenses arise.

It’s a simple but effective way to validate that your financial planning is on track, giving you peace of mind knowing that you’re adequately prepared for future costs.

Where To Enter Them on The World’s Greatest Real Estate Deal Analysis Spreadsheet™

When using the Maintenance and CapEx Estimator for Rental Properties – Advanced™, you’ll want to input the numbers into The World’s Greatest Real Estate Deal Analysis Spreadsheet™ (TWGREDAS) to maintain consistency across your financial projections. Here’s where and how to enter the information:

- Starting Balance – Add the Starting Balance from your estimator into the Rent Ready Costs field on TWGREDAS. Include this alongside any other rent-ready costs you might have.

- Annual CapEx Savings – Enter the Annual amount you plan to save for capital expenses into the CapEx field on TWGREDAS. This ensures that you’re accounting for the yearly amount you need to set aside for major future expenses.

- CapEx Inflation Rate – If you’ve adjusted the inflation rate for capital expenses in the Maintenance and CapEx Estimator for Rental Properties – Advanced™, make sure the CapEx inflation rate in TWGREDAS matches. This keeps your estimates accurate and aligned between the two tools.

By ensuring that the numbers in both tools reflect the same assumptions, your deal analysis will be more accurate, helping you to plan effectively for future capital expenses.

Why A Starting Balance?

When using the Maintenance and CapEx Estimator for Rental Properties – Advanced™, it’s important to have a starting balance in your capital expense savings account, especially if you’re buying a resale property that may already have upcoming or deferred maintenance needs.

Why?

Imagine you purchase a property and know it will need a new roof in the next two years. Relying solely on the monthly cash flow to save enough for that large expense might be difficult or impossible, particularly within such a short time frame.

To avoid scrambling to cover the cost, you can set aside an initial amount—labeled as Rent Ready Costs on The World’s Greatest Real Estate Deal Analysis Spreadsheet™ or Starting Balance on Maintenance and CapEx Estimator for Rental Properties – Advanced™—to seed your capital expense account.

By doing this, you give yourself a financial buffer to handle upcoming maintenance.

Then, you can use the Maintenance and CapEx Estimator for Rental Properties – Advanced™ to calculate how much you’ll need to save each month moving forward to avoid running into a deficit including this fast-approaching capital expense in 2 years and all your other capital expenses as well.

This same approach can be applied to any major upcoming or deferred maintenance costs you anticipate regardless of their time frame.

Your capital expense account becomes a combination of the initial amount you set aside, the monthly savings contributions, and the expenses you’ll need to cover over time.

You could increase your starting amount or the monthly to make sure you have enough to cover your capital expenses.

Not Reserves

It’s important to understand that the money you’re setting aside for capital expenses is not the same as reserves. These two concepts are often confused, but they serve different purposes in real estate investing.

Reserves are funds you keep on hand for emergencies or unexpected short-term expenses, like a sudden vacancy or a costly repair. These funds are your safety net when something unexpected happens.

For example, if a tenant loses their job and stops paying rent, it could take time to evict them and restore the property. There might also be higher-than-normal turnover costs if the tenant leaves the property in poor condition. If this all happens during a slow rental season, you may face delays in filling the vacancy or may need to rent the property for less than expected. Reserves help cover these unforeseen expenses during difficult periods.

On the other hand, the money you’re setting aside for capital expenses is for predictable, long-term improvements. These are larger, less frequent costs, like replacing a roof, upgrading windows, or installing a new HVAC system. These expenses are inevitable, and you save for them over time to avoid financial strain when they arise.

While reserves act as a cushion for unexpected issues, capital expense savings are for planned, major future costs. Both are essential, but they serve very different purposes, so it’s important to maintain separate funds for each.

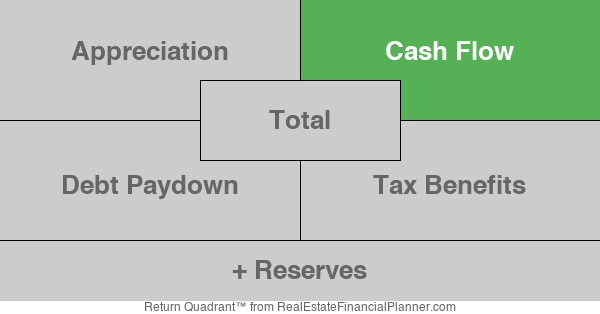

Capital Expenses Show Up in Cash Flow

In the Return Quadrants™, capital expenses are reflected in the Cash Flow quadrant.

These expenses directly impact your property’s cash flow, as they are ongoing costs that need to be accounted for over time.

While they may not happen every year, they still reduce the overall cash flow you generate from the property, which is why it’s important to save for them in advance and include them in your deal analysis.

Properly planning for capital expenses ensures your cash flow projections are realistic and sustainable.

Cash Flow Isn’t Everything

Many investors focus heavily on cash flow, but it’s important to recognize that cash flow is just one part of the overall financial picture in real estate investing. When you account for the true cost of capital expenses, your cash flow may be lower than anticipated.

However, even with these expenses, you’re still earning appreciation, debt paydown, and tax benefits. These factors contribute significantly to your overall return on investment, even if cash flow is impacted by capital expenses.

The key point is that most investors don’t fully consider capital expenses until they arise. These costs are real and inevitable, so it’s essential to save for them today. Proper planning ensures that your investment remains financially sound over time while still benefiting from the broader returns that real estate offers.

Compare New Construction to Resale

When comparing new construction properties to resale properties, one of the key differences is the timing of capital expenses.

- With a new construction property, everything is new when you buy it. You won’t need to replace major systems like the roof, HVAC, or windows for many years, allowing you to build your capital expense savings over time.

- In contrast, a resale property often comes with components that are already partway through their lifespans. You might need to replace major items sooner than you would in a new construction, leading to earlier and potentially higher capital expenses.

Let’s assume you start with the same amount saved and continue to save the same amount for capital expenses for both a new construction and a five-year-old resale property.

- With new construction, you’ll have more time to build up your savings before major expenses arise. You’re less likely to encounter a deficit in your capital expense account because you won’t need to make any significant repairs or replacements for several years.

- For a resale property, however, you may face expenses much sooner, like replacing the roof or furnace 5 years sooner because it is a 5-year old property.

Even if you’re saving the same amount in both scenarios consistently, these early expenses can cause a deficit in your capital expense account on the five-year-old resale property of $38K deficit.

The takeaway is that you’ll likely need to save more for capital expenses with a resale property because many items may need to be replaced sooner.

This principle doesn’t only apply when comparing new construction to resale but also between different resale properties. Some may have more deferred maintenance or aging systems than others, leading to higher costs down the road.

When analyzing deals, make sure to estimate the timing and cost of each capital expense for the specific property you’re considering.

Portfolio Planning

When building your rental property portfolio, it’s essential to think strategically about the types of properties you want to include.

Older properties often come with higher maintenance and capital expenses, while newer properties may require less upkeep in the early years. However, more expensive properties can still have higher costs.

You also need to consider whether to focus on acquiring more less expensive properties or fewer higher-priced properties. Each approach has its trade-offs:

- Loan Spots – You only have a limited number of spots for fixed-rate, long-term financing, so each property choice matters.

- Asset Protection – If you put each property in its own LLC, managing more LLCs increases your time and cost overhead.

- Tax Returns – More properties, especially in separate LLCs, may mean more tax returns, which can raise your expenses.

The same or similar dollar amount in maintenance and CapEx for different properties can result in very different percentages of Gross Operating Income (GOI). Larger portfolios require more careful planning to ensure the numbers work in your favor.

We cover this topic in much more detail in our portfolio optimization materials, which dive deeper into these strategic decisions.

Can You “Time” Maintenance and Capital Expenses?

One strategy to manage capital expenses is to time your investments around major costs.

This is easy to say in theory, but a lot more effort to actually do it.

This could involve selling a property before significant expenses are due or buying a property after these expenses have already been handled by the previous owner.

Selling Before Major Expenses

If you know a major capital expense is coming up, like replacing a roof or HVAC system, you might consider selling the property before the expense hits.

To evaluate whether this makes sense, you should model it to see how your costs of sale (real estate commissions, closing costs, capital gain taxes, and depreciation recapture taxes) compare to the upcoming expenses. Will you save more pay the costs of sale (including maybe deferring some with a 1031 tax deferred exchange) or will it cost you more to sell and replace the property with another investment—whether that’s more property or something else entirely.

- Selling Traditionally – You could sell the property through a real estate broker or For Sale By Owner (FSBO). Depending on the market, this may or may not result in a vacancy while you market the property. Hot markets make it easier to sell with deferred maintenance, while softer markets might make it harder.

- Selling to a Tenant-Buyer – Selling to a tenant-buyer could help you save on real estate commissions and some closing costs, making it a more attractive option for certain investors.

- 1031 Exchange – If you’re looking to avoid paying capital gains and depreciation recapture, you could do a 1031 Exchange to roll those proceeds into a new investment property.

Additionally, selling before major expenses can also improve your Return on Equity if you re-leverage into a new property with a higher return potential.

Depending on the actual cost of the upcoming expenses, this might be a lot of work and costs of sale to save some money on the capital expenses. You have to do the math to see for yourself.

Buying After Major Expenses

On the flip side, buying a property after the current owner has already taken care of major capital expenses can be a smart move. For instance, purchasing a property with a new roof, remodeled kitchen, and recently installed AC can save you from incurring those expenses yourself for years to come.

Timing your investments this way can help reduce unexpected costs and improve your financial planning.

New Roof vs 10-Year-Old Roof at Purchase

When purchasing a rental property, one key factor to consider is the age of major capital expense items like the roof. Let’s compare two scenarios: buying a property with a new roof versus one with a 10-year-old roof, while setting aside the same amount for capital expenses in both cases.

Most of us aren’t naturally inclined to think about these irregular, long-term expenses. A roof replacement, for example, might only come up once every 20-30 years, but you need to save consistently over time to avoid a financial hit when that expense occurs. You’re not just saving for a big, one-time expense; you’re also accounting for inflation and possibly earning returns on what you save.

New Roof at Purchase

If you purchase a property with a new roof, you’ve got more time to save before needing to replace it. Spreading out the savings over a longer period allows you to avoid financial strain, as your capital expense fund grows steadily.

10-Year-Old Roof at Purchase

However, when you purchase a property with a 10-year-old roof and save the same amount each month, you’re likely to face a significant deficit when the roof needs to be replaced sooner. In fact, under the same savings assumptions, you could end up with a $25K deficit by Year 31. This is because the expense comes much sooner, and the amount you’re setting aside isn’t enough to cover it in time.

In short, the age of major capital items like the roof plays a crucial role in how much you need to save and have significant impacts over time.

Alternative to Saving for Capital Expenses

When it comes to handling capital expenses on your rental properties, saving for them over time is the ideal approach.

But what if you haven’t saved enough, or an expense comes up unexpectedly? There are some alternatives you can consider:

- Borrow the Money – Instead of saving for capital expenses upfront, you could borrow the funds when the need arises. This could be through a traditional loan or another form of financing. Keep in mind, this means taking on debt and paying interest, which increases your overall costs.

- Borrow from Yourself – You might choose to borrow from your own reserves and repay that amount over time. This can be helpful in the short term, but it reduces the reserves you have for other emergencies or unexpected property issues. It’s a temporary solution but one that depletes your safety net.

- Use External Financing – You could also borrow from a bank, tap into a Home Equity Line of Credit (HELOC), use a credit card, or consider a cash-out refinance on this or another property. While this provides immediate access to funds, you’ll be paying a premium in the form of interest instead of earning a return on the money you would have saved.

Each of these options comes with trade-offs.

While borrowing might provide a short-term solution, it increases risk by either reducing your reserves or adding debt.

Ideally, planning ahead and setting aside savings for capital expenses allows you to avoid these scenarios altogether.

Insurance Claims

Sometimes, you might get lucky with capital expenses, and an insurance claim could cover part or all of the cost.

While it’s not something you can rely on every time, there are scenarios where insurance might step in to relieve you of a significant financial burden.

For example, if you need to replace a roof that’s only partway through its lifespan, you may qualify for an insurance claim. In areas prone to hail, like where I live, hail damage is a common reason to file a claim and get your roof replaced without bearing the full cost yourself.

Once an insurance claim covers a major expense, you can go back to your capital expense plan. Rerun your numbers in the Maintenance and CapEx Estimator for Rental Properties – Advanced™ to adjust your savings based on the updated age, lifespan, and cost of the item. You may find that you don’t need to save as much monthly now that a portion of the expense has been covered.

This same principle applies to other capital expense items. If an insurance event qualifies—whether it’s for an HVAC system, water heater, or another costly repair—insurance could ease the financial impact, allowing you to adjust your savings strategy accordingly.

Home Warranty

A home warranty can be a smart move for your rental properties, especially if you know the odds are in your favor that you’ll need to use it. While not all expenses are covered under a home warranty, if you time it right, you can save a lot of money on major repairs.

If your home warranty provider allows you to purchase a policy at any time, you might consider buying one when you know you’re approaching a significant repair that the warranty covers.

For example, let’s say your air conditioner has lasted beyond its expected lifespan. If you know that it’s likely to fail soon, you could purchase a home warranty that includes AC coverage. This way, you’ll have protection in place when the inevitable happens, and you can avoid paying the full replacement cost out of pocket and pay for the insurance policy from the money you set aside for that replacement.

Home warranties are typically limited to specific items, so make sure to review the coverage to see if it aligns with the potential expenses you’re anticipating.

Planning ahead in this way can help minimize unexpected financial hits from major property repairs.