When I help clients evaluate a property, the most important conversations we have happen long before we ever write an offer.

They happen during due diligence.

I’ve seen investors become financially independent because they took due diligence seriously.

I’ve also seen investors lose tens of thousands because they didn’t.

When I rebuilt my own real estate portfolio after bankruptcy, I made due diligence a non-negotiable discipline.

It became the filter between a property that builds wealth and a property that quietly drains it.

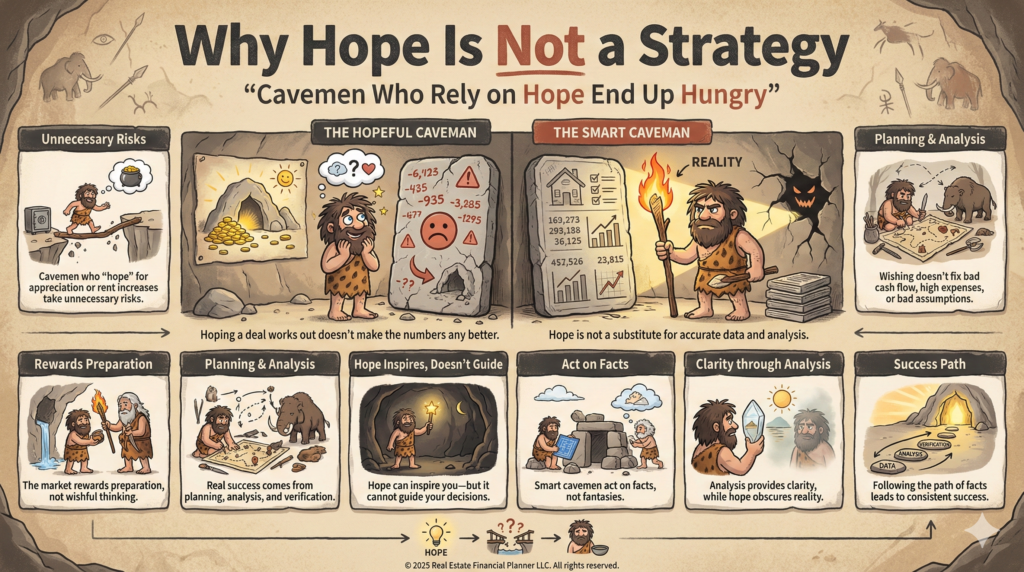

As I discuss in The Caveman’s Guide to Deal Analysis Inputs: In real estate, hope is not a strategy. Due diligence is.

What Due Diligence Really Is

Due diligence is the systematic process of verifying everything about a property before you close.

- It’s not just inspections.

- It’s not just running numbers.

- It’s not just reading leases, walking neighborhoods, or reviewing title.

It’s all of it.

And it’s your only chance to uncover what the seller didn’t tell you — and what the property is trying to hide.

I always tell clients that due diligence is where you make your money, not at closing.

Closing just confirms the decision.

The Four Pillars of Due Diligence

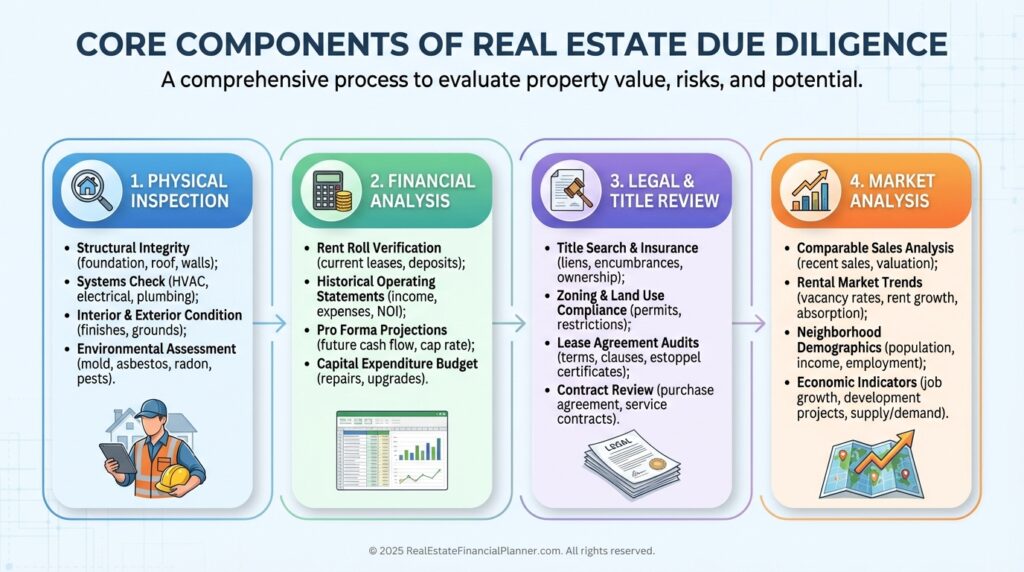

Every property is unique, but every successful due diligence process rests on four core pillars:

- Physical

- Financial

- Legal, and

- Market Analysis

When even one of these is weak, an investment cracks under pressure.

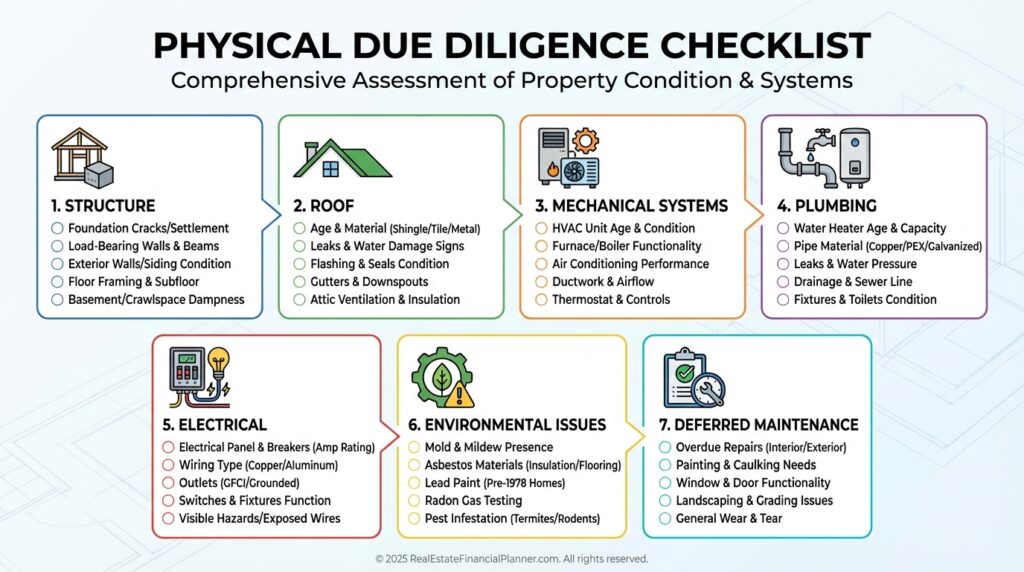

Physical Property Inspection

The physical condition of a property determines your repair risk, your future expenses, and even the types of tenants you will attract.

When I walk properties with clients, I’m looking for the big things first — the expensive things — because that’s where deals fall apart.

A proper inspection goes far beyond a quick walkthrough.

You’re evaluating:

- Structure and foundation stability

- Roof life expectancy

- HVAC, plumbing, and electrical systems

- Environmental hazards

- Deferred maintenance that will soon become your problem

When clients skip this step, they’re not skipping the risk — they’re absorbing it.

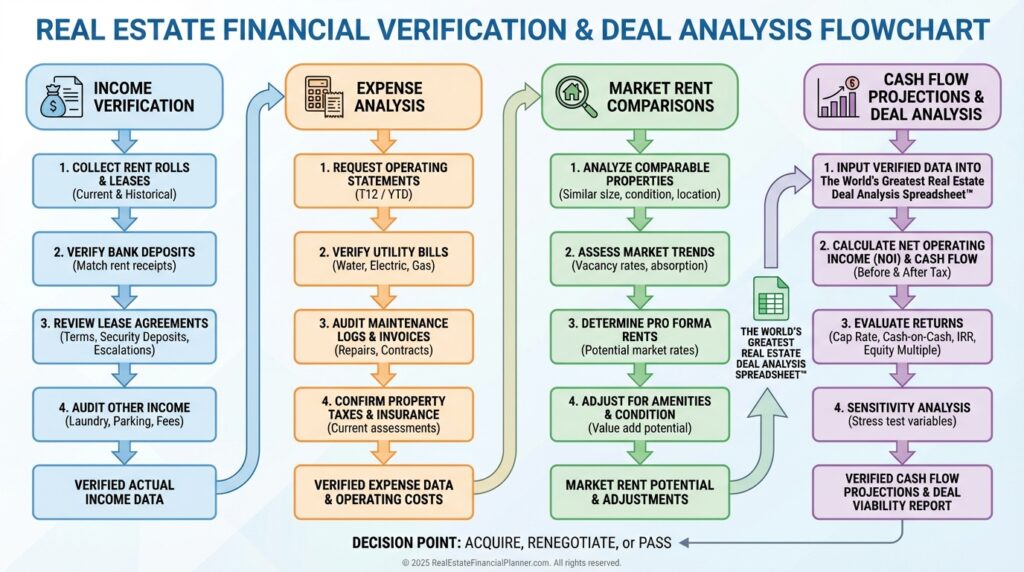

Financial Analysis

Real estate lies. Numbers don’t.

Financial due diligence is where you validate every assumption the seller wants you to believe.

I’ve had clients bring me deals with beautiful marketing packages — glossy brochures, perfect cap rates, pro forma spreadsheets polished to perfection.

But when we dig into actual numbers, those stories fall apart fast.

Financial due diligence includes:

- Verifying income with leases, bank statements, and tax returns

- Auditing 12+ months of operating expenses

- Comparing actual rents to market reality

- Stress-testing cash flow under multiple scenarios

This is where The World’s Greatest Real Estate Deal Analysis Spreadsheet™ becomes your anchor.

It is the truth serum for every deal.

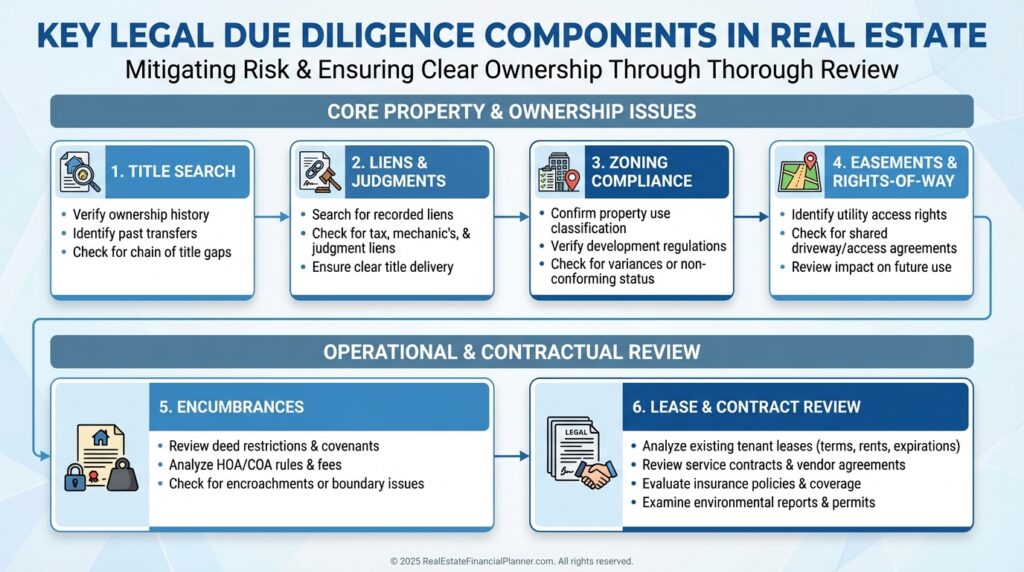

Legal and Title Review

Legal due diligence is where you discover the problems you can’t out-renovate.

I once reviewed a property for a client where everything looked amazing — the numbers worked, the inspection was clean, the neighborhood was improving — but the title work revealed an unresolved boundary dispute from the 1980s.

The deal died instantly.

Legal due diligence includes:

- Full title search and title insurance

- Zoning verification

- Reviewing easements and restrictions

- Analyzing existing leases and service contracts

Miss something here, and no spreadsheet will save you.

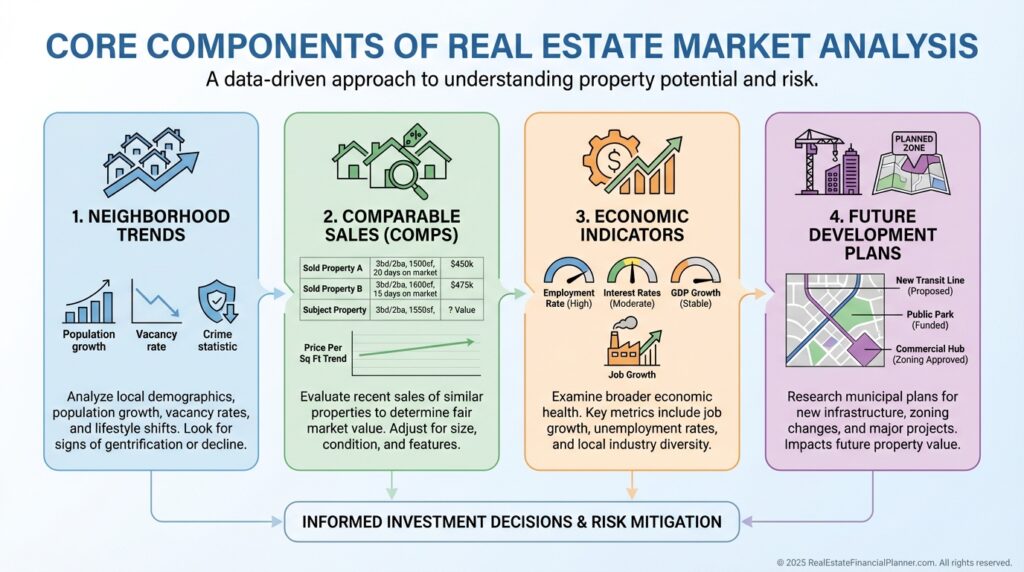

Market Analysis

Even the best property fails in the wrong neighborhood.

When I teach market analysis, I emphasize that investors fall in love with properties — but properties live inside markets.

And markets determine whether your investment appreciates, stagnates, or declines.

A proper market analysis examines:

- Neighborhood conditions and tenant demand

- Crime, schools, and local amenities

- Comparable property values

- Employment and population trends

- Planned development and infrastructure changes

This is where you evaluate not just the property itself — but the future of the property.

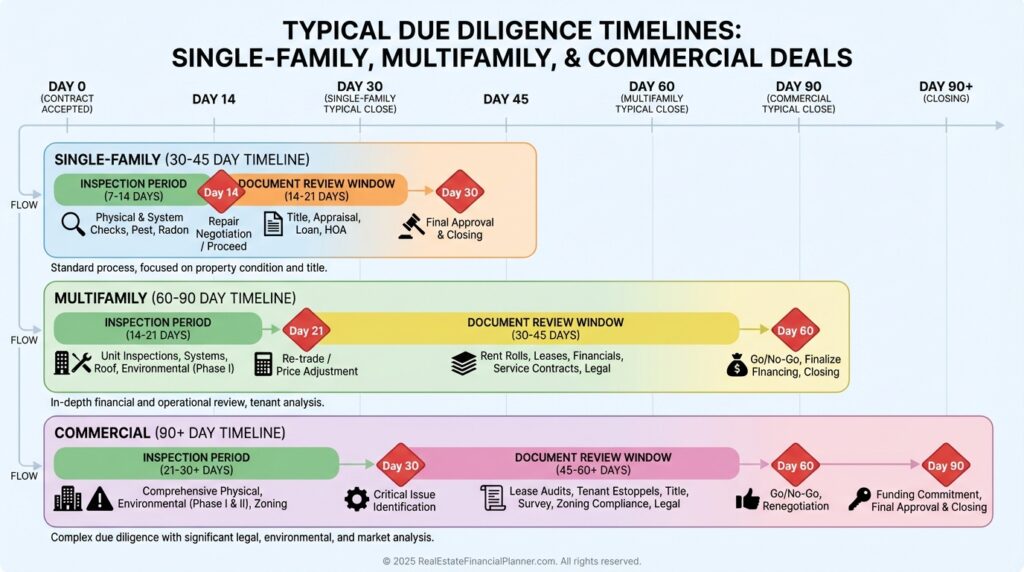

Due Diligence by Property Type

Different properties require different levels of scrutiny.

When I help clients analyze deals, I adjust the due diligence process based on what we’re buying because the risks — and the opportunities — change dramatically.

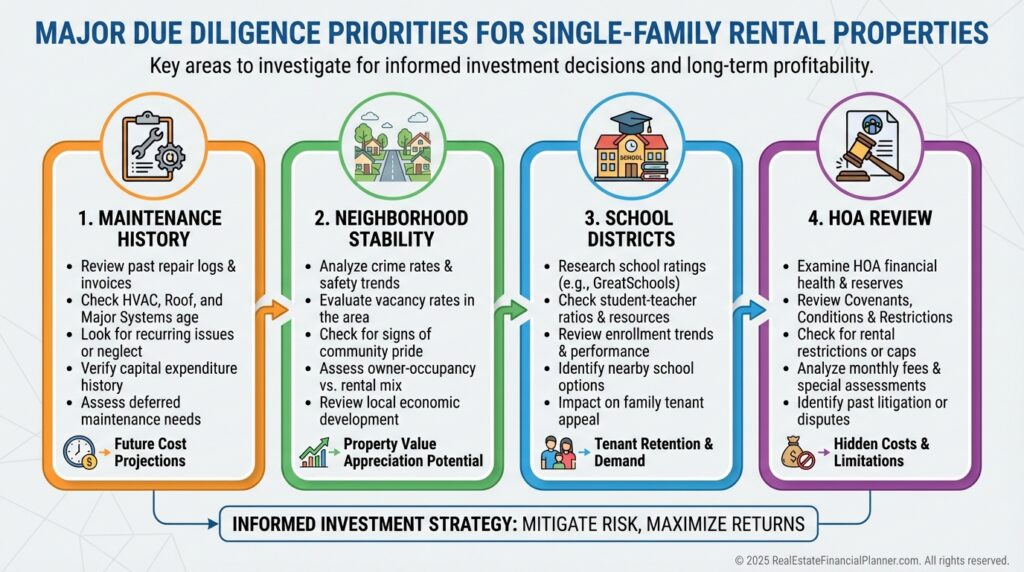

Single-Family Rentals

Single-family homes are often the gateway into real estate investing.

They look simple. They feel familiar.

But simplicity is deceptive.

For single-family rentals, I help clients focus on:

- Maintenance and repair history

- Neighborhood stability and owner-occupancy rates

- School districts and tenant appeal

- HOA rules, finances, and rental restrictions

A great house in a weak neighborhood is still a weak investment.

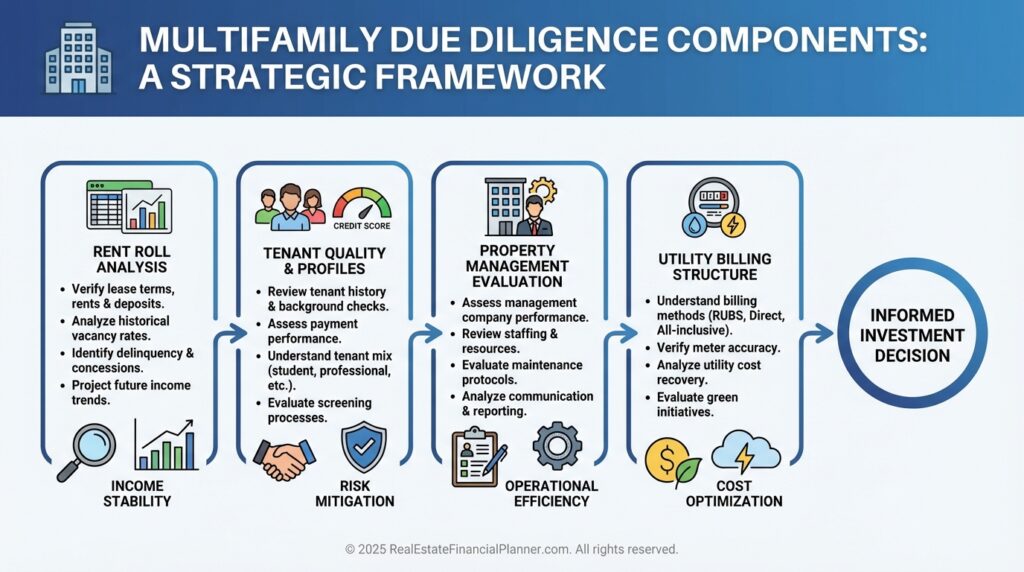

Multifamily Properties

Multifamily properties amplify everything — the cash flow, the complexity, the management, the risk.

During multifamily due diligence, I’m looking for patterns.

Inconsistent rents, uneven maintenance, sudden turnover spikes — these patterns tell stories.

Key checkpoints include:

- Rent roll accuracy and payment history

- Tenant quality and turnover rates

- Property management effectiveness

- Utility allocation methods and cost exposures

Great multifamily verification requires skepticism and structure.

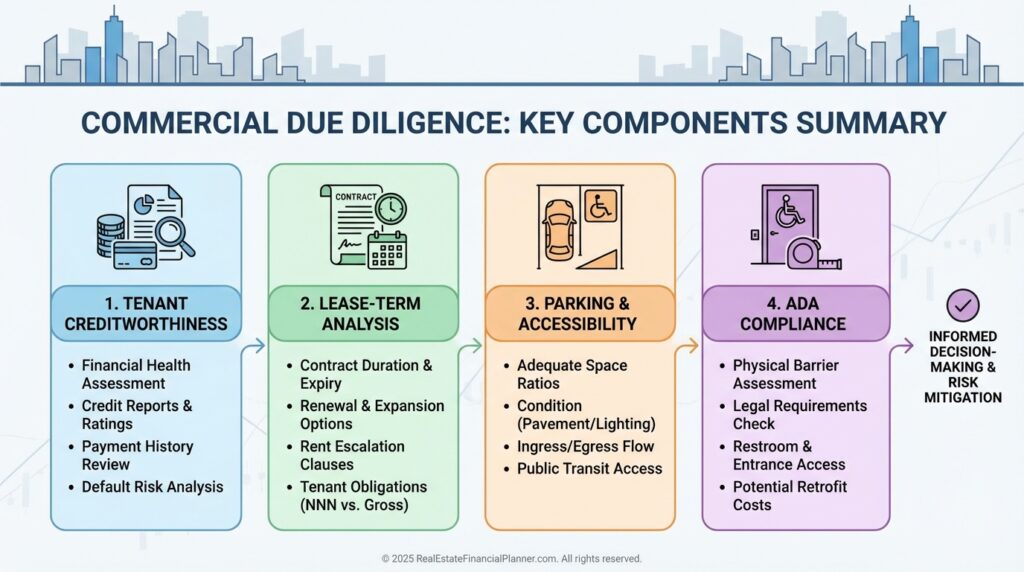

Commercial Properties

Commercial investing lives and dies by the quality of the tenants and leases.

If you get those wrong, no renovation will save you.

Commercial due diligence requires:

- Tenant financial review

- Detailed lease analysis, including escalations

- Parking ratios and accessibility

- ADA compliance assessments

A commercial building is only as good as the paper the leases are printed on.

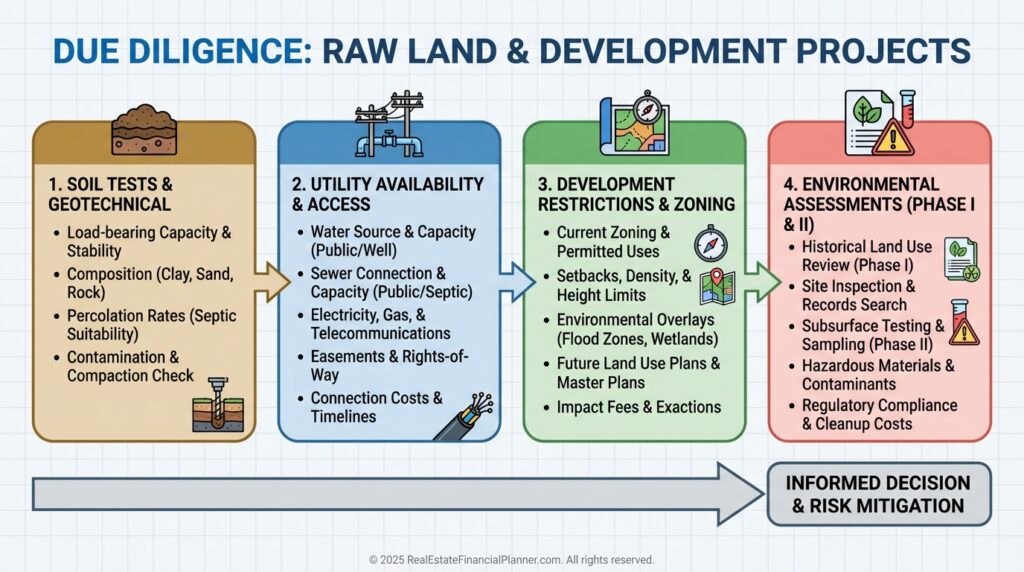

Raw Land / Development Deals

Raw land is a different world.

Everything looks promising until the tests come back.

I’ve seen clients fall in love with land because of “potential.”

Potential is expensive until proven otherwise.

Land due diligence includes:

- Soil testing and percolation analysis

- Utility availability and hookup costs

- Development limitations and easements

- Phase I environmental assessments

The most expensive mistake… and maybe the most common that I’ve seen… in land investing is assuming it can be built on.

The next most expensive is assumptions about what can or will be built around it.

Due Diligence by Investment Strategy

Your strategy determines your risk — and therefore your due diligence priorities.

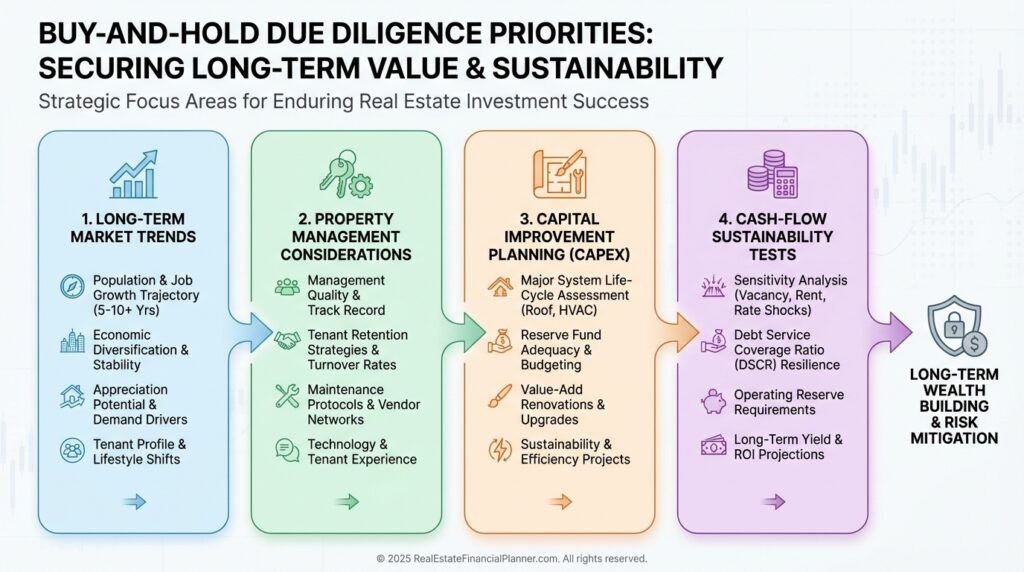

Buy and Hold Strategy

Buy-and-hold investors need to account for long-term sustainability.

When I help clients model these deals, the time horizon forces deeper analysis.

For long-term deals, focus on:

- Long-term market health

- Property management feasibility

- 5–10 year capital improvement planning

- Stress-tested cash flow models

These decisions compound — for better or worse — over decades.

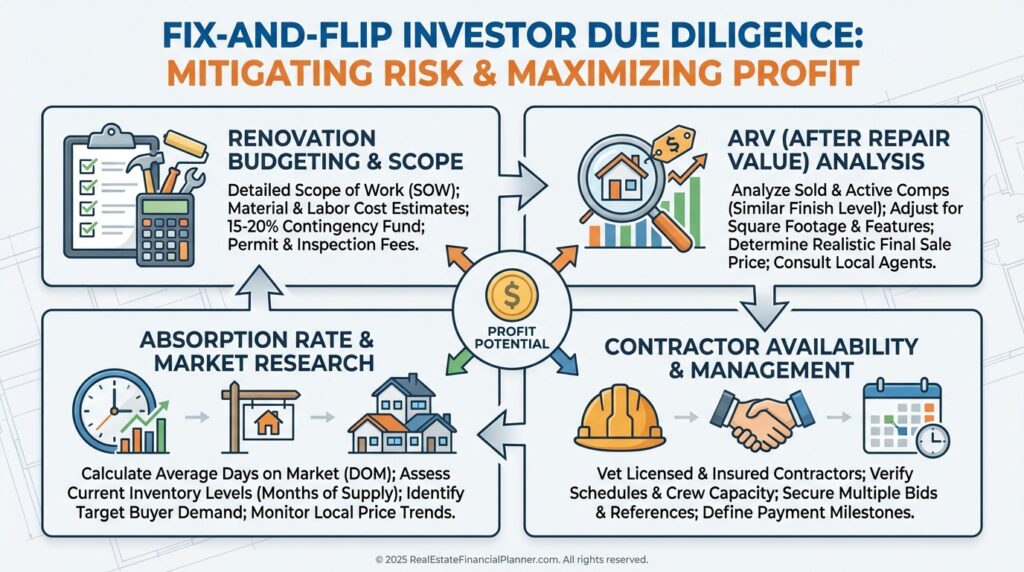

Fix-and-Flip Strategy

Flips reward accuracy and punish optimism.

Your numbers must be brutally honest.

Flip-focused due diligence includes:

- Detailed renovation bids with contingency

- Accurate After Repair Value (ARV) analysis

- Contractor timeline and reliability checks

- Market absorption rates to project hold periods

Most flips fail because of unrealistic assumptions, not bad properties.

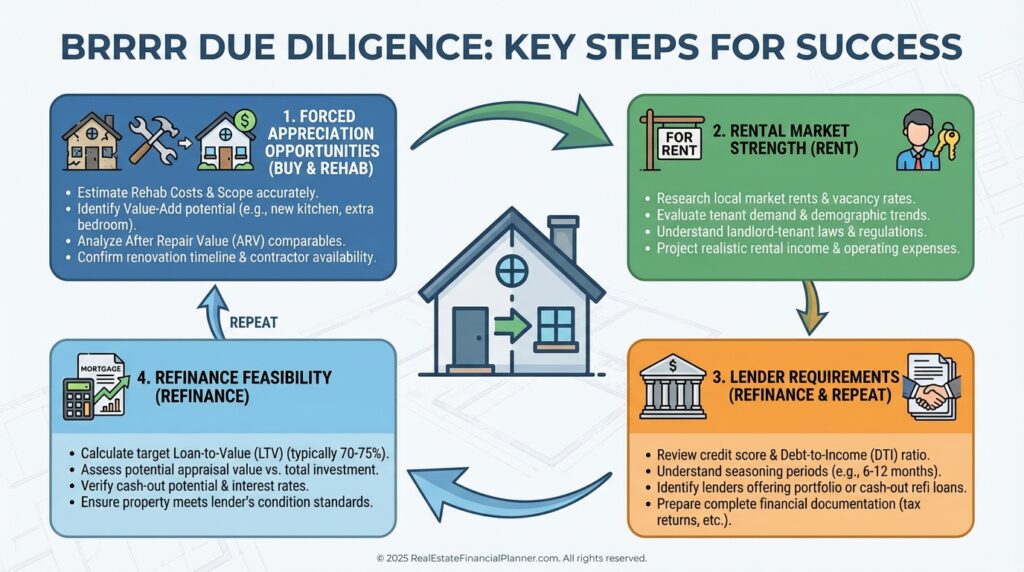

BRRRR Strategy

BRRRR combines the risks of flipping with the risks of rentals.

You must verify both exit paths.

BRRRR due diligence asks:

- Will this qualify for the refinance we need?

- What improvements drive the most value?

- Will the rental market support post-rehab rents?

- What lender conditions must be met?

A BRRRR without a refinance is just an expensive flip lesson.

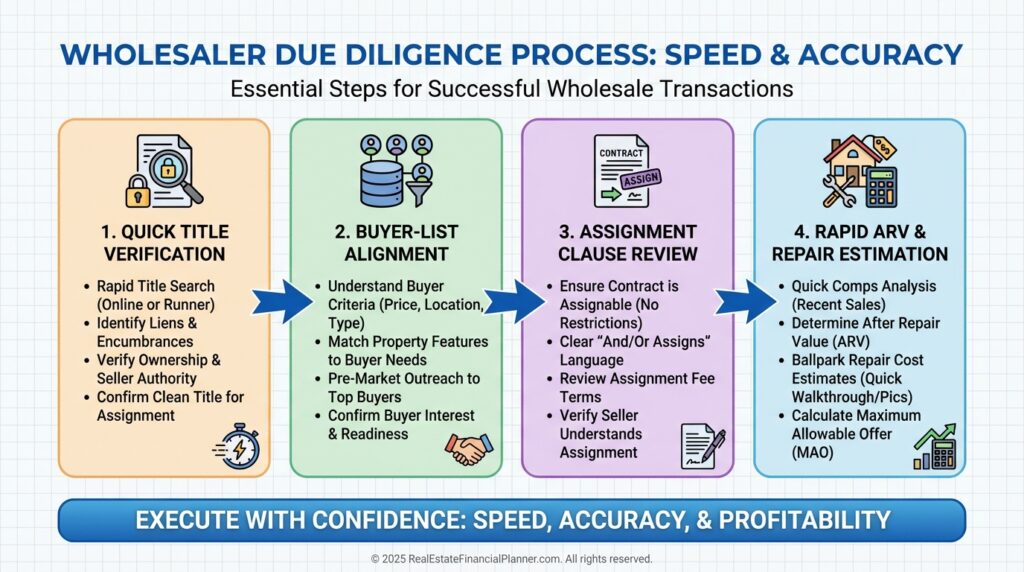

Wholesale Strategy

Wholesalers need speed without sloppiness.

Their due diligence focuses on fast, accurate valuation.

Wholesalers must:

- Verify title issues fast

- Ensure the contract allows assignment

- Match property traits to buyer criteria

- Estimate ARV and repairs quickly and accurately

Speed matters, but accuracy matters more.

Of course, you should make sure there aren’t laws prohibiting you from wholesaling in your local marketplace before any of this.

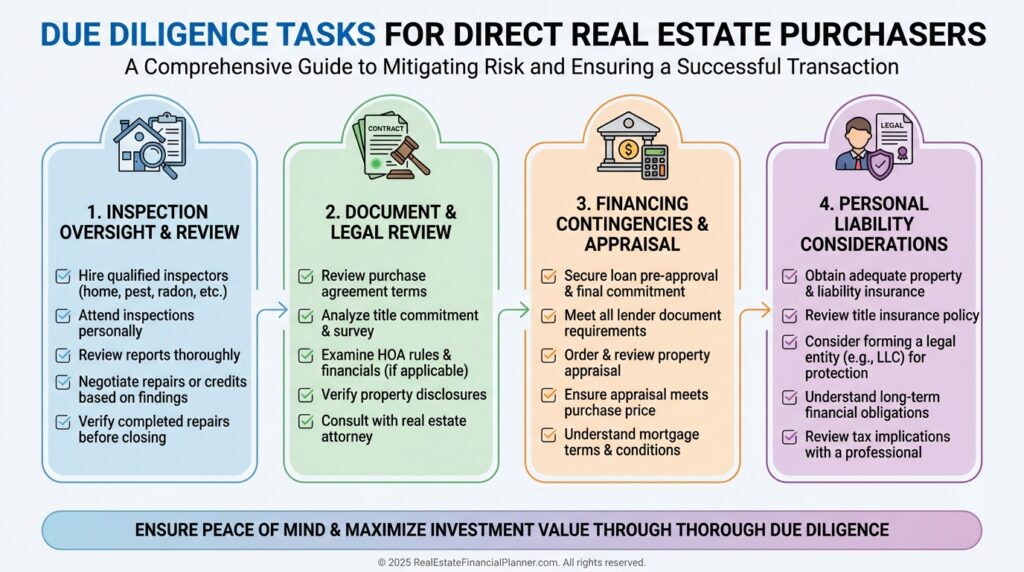

Direct Purchase vs Partnership/Syndication Due Diligence

When I help clients evaluate partnerships or syndications, I remind them: You are not just buying real estate — you’re buying into the sponsor.

Due Diligence for Direct Purchases

Direct buyers control every inspection and every decision.

That freedom also comes with full liability.

Focus areas include:

- Attending inspections

- Reviewing all documents personally

- Understanding your liability

- Structuring proper contingencies

Direct ownership means direct responsibility.

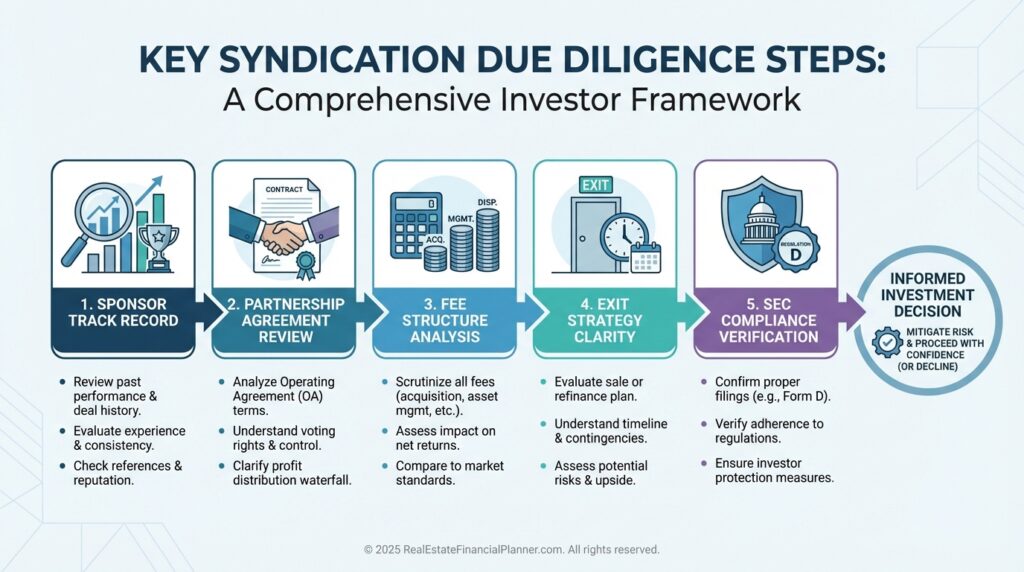

Due Diligence for Partnerships/Syndications

A strong property cannot save a weak sponsor.

This is where inexperienced investors get burned.

Critical checks include:

- Sponsor credibility and prior performance

- Understanding of fees and waterfalls

- Deal exit strategy transparency

- SEC compliance

If you wouldn’t trust someone with your retirement account login, don’t trust them with your syndication capital.

Due Diligence Timeline and Process

Successful due diligence is structured, scheduled, and time-bound.

You cannot improvise your way through it.

And despite our numbers below, these are general guidelines; your contract and paperwork will dictate the actual timeline.

A strong due diligence timeline:

- Organizes tasks by priority

- Schedules inspections and document reviews

- Includes decision points for continuing or exiting

- Tracks findings in The World’s Greatest Real Estate Deal Analysis Spreadsheet™

Rushed due diligence is expensive due diligence.

Red Flags and Deal Breakers

Not every flaw kills a deal — but some absolutely should.

Red flags include:

- Major structural problems

- Unresolvable title defects

- Environmental contamination

- Manipulated or false financials

- Markets with declining demand

When a property shows you who it really is — believe it.

With that being said, one man’s trash is another man’s treasure and sometimes you will find yourself the guy/gal that takes on specific issues that other investors pass on because you have knowledge and skills to address that issue.

Conclusion

Thorough due diligence is not optional.

It is the shield that protects your capital and the lens that reveals the truth about a property.

Use it to uncover risks, validate assumptions, and align the investment with your goals.

And always document your findings inside The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Proper due diligence does not guarantee success. But skipping it guarantees risk.