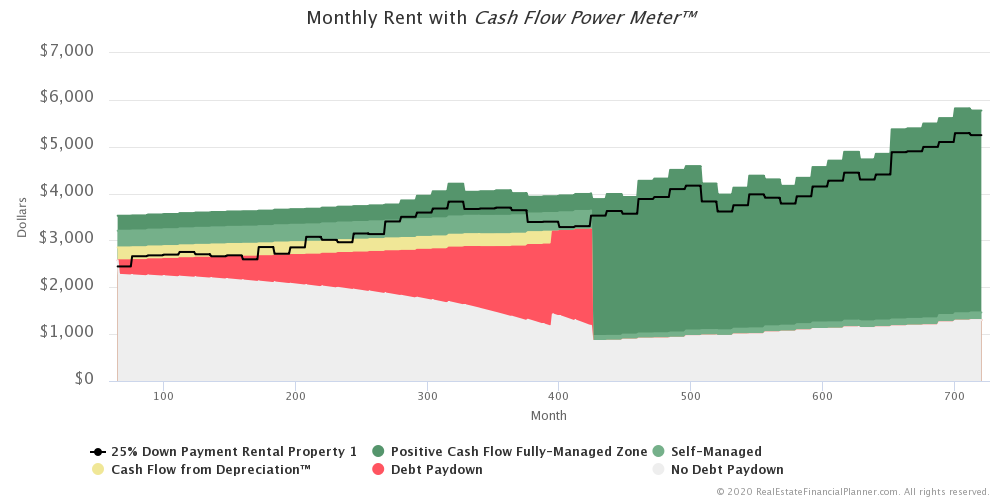

Cash Flow Power Meter™

The Cash Flow Power Meter™ is a new way to evaluate rental property cash flow. It presents information we might otherwise see in a Return in Dollars Quadrant™, Return on Equity Quadrant™ or Return on Investment Quadrant™ in a new, simple and powerful way. Before I start explaining what the Cash Flow Power Meter™ is and how we use it, I want to say: if you invest in a real estate market that has positive cash flow, you should absolutely be buying properties with positive cash flow. The need for the Return in Dollars Quadrant™, Return on Equity Quadrant™ and … Read more