The following is The Penultimate Guide to Safe Withdrawal Rates.

Why not the “ultimate” guide? Because Karsten Jeske with Early Retirement Now made the ultimate guide already (which you all should read and I link to below). Our guide is intended to be an addendum to the amazing work he’s already done and the second-to-last guide you’ll need in addition to Karsten’s.

I will continue to update this over time as I discover more resources or have more to say about it from modeling done with the Real Estate Financial Planner™ software.

In this guide, I will primarily do two things:

- First, I will curate for you the best resources I know of about Safe Withdrawal Rates.

- And second, I will share with you the information I’ve personally compiled with the Real Estate Financial Planner™ software related to Safe Withdrawal Rates.

We’re focused on building community here, so if you have questions, comments, suggestions for things to add/remove/update, or just want to thank us for the awesomeness below, then please do leave a comment at the bottom. We’d love to hear from you and I do personally try to reply to each comment.

Who Is This For?

This very detailed discussion of Safe Withdrawal Rates is for:

- Retirees and those considering the amount of money they can withdraw in retirement

- People seeking Financial Independence and Retiring Early (FIRE)

- Real Estate Investors (with an emphasis on buy-and-hold real estate investors, house hackers and Nomads™)

- CPAs/Accountants, Real Estate Agents/Brokers, Mortgage Brokers, Financial Advisors/Planners and other professionals looking to advise, directly or tangentially, those listed above

Before we go any further… I just wanted to pause to welcome you all and thank you for being here. We appreciate you and would love for you be involved in our community. Please do introduce yourself in the comments below.

Safe Withdrawal Rate Resources

“If I have seen further it is only by standing on the shoulders of giants.” — Sir Isaac Newton

I very much appreciate those who have done so much work on this topic before me. I’ve learned—and continue to learn and be humbled—by the work of others far smarter than I. Here are some of my personal favorites of work related to safe withdrawal rates.

- As mentioned above, Karsten Jeske with Early Retirement Now and his, justifiably titled, The Ultimate Guide to Safe Withdrawal Rates – Genius. This guy’s work is amazing. He has a 28-part analysis that goes into why the 4% Rule may not be conservative enough. When my friend Jassen sent me a link to his blog post and I started reading, I was in awe.

- Philip L Cooley, Carl M Hubbard and Daniel T Walz from Trinity University’s study on Sustainable Withdrawal Rates From Your Retirement Portfolio – I believe this is the basis of the 4% Rule that you probably hear people mention. A couple interesting things from it, pointed out by Karsten, is that the original study only covered data from 1926 to 1997 and only tested a 30 year retirement period. If you plan to retire early, you’re likely to have longer than a 30 year retirement period.

- I just purchased How Much Can I Spend in Retirement?: A Guide to Investment-Based Retirement Income Strategies by Wade Pfau and I am looking forward to reading that book soon. If I don’t read it before then, I plan to read it while on vacation in Mexico in January. I am super excited about this book and look forward to reading it.

Safe Withdrawal Rate Over Time

For many folks, the Safe Withdrawal Rate is defined at the start of your retirement.

For example, and to make the math easier, if you had a million dollars and you decided you felt comfortable with a Safe Withdrawal Rate of 4% based on the 4% Rule, you could take out $40,000 per year from your $1,000,000 invested (that’s 4%).

In an ideal world, you’re able to invest your million dollars in something that is growing faster than 4%. If it does grow faster than the 4% you’re withdrawing, then, in year 2 you have more money than you did in year 1 even though you withdrew $40,000. If your initial million dollars is growing each year at a rate even with your withdrawal of $40,000 you will never run out of money and can continue to withdraw $40,000 per year indefinitely.

A challenge with this is inflation.

Living on $40,000 today might not be possible 50 years from now.

Safe Withdrawal Rate in  Scenarios

Scenarios

Scenarios

ScenariosThe Real Estate Financial Planner™ software allows you to define what your safe withdrawal rate is on the edit  Scenario page.

Scenario page.

You can also modify your safe withdrawal rate by using  Rules such as the

Rules such as the  Set Value on

Set Value on  Scenarios.

Scenarios.

For example, let’s say you decide that to begin an early retirement, you need a safe withdrawal rate of 3.25% to feel comfortable entering into retirement. But, maybe later in the  Scenario you are comfortable increasing how much you’re pulling from your stocks, bonds and other cash

Scenario you are comfortable increasing how much you’re pulling from your stocks, bonds and other cash  Accounts. You can do that using the

Accounts. You can do that using the  Set Value on

Set Value on  Scenarios. In other words, you might decide that once you hit age 70, you’re OK with a 4% or even 5% safe withdrawal rate. That’s something you can choose to model with the Real Estate Financial Planner™ software.

Scenarios. In other words, you might decide that once you hit age 70, you’re OK with a 4% or even 5% safe withdrawal rate. That’s something you can choose to model with the Real Estate Financial Planner™ software.

Here’s another example where you might decide to use a  Set Value on

Set Value on  Scenarios Rule to modify your safe withdrawal rate on your

Scenarios Rule to modify your safe withdrawal rate on your  Scenario. Let’s say you’ve invested heavily in rental

Scenario. Let’s say you’ve invested heavily in rental  Properties, but early on the cash flow from them is not quite enough to support you in retirement. However, you feel very confident that the rental income will be able to support you in the future. In that case you may decide to increase your safe withdrawal rate from your stocks, bonds and cash

Properties, but early on the cash flow from them is not quite enough to support you in retirement. However, you feel very confident that the rental income will be able to support you in the future. In that case you may decide to increase your safe withdrawal rate from your stocks, bonds and cash  Accounts early in the

Accounts early in the  Scenario and then, later, change it. One could argue that they may change it to be higher later (if they want to deplete their stocks, bonds and cash

Scenario and then, later, change it. One could argue that they may change it to be higher later (if they want to deplete their stocks, bonds and cash  Accounts and then live entirely on rental income), or perhaps you want to lower it later to allow your stocks, bonds and cash

Accounts and then live entirely on rental income), or perhaps you want to lower it later to allow your stocks, bonds and cash  Accounts to grow as you live more on your rental

Accounts to grow as you live more on your rental  Property cash flow. The choice is the end-user’s doing the modeling.

Property cash flow. The choice is the end-user’s doing the modeling.

Charting Safe Withdrawal Rate from  Scenarios

Scenarios

Scenarios

ScenariosYou can view the  Chart of your safe withdrawal rate over time from the

Chart of your safe withdrawal rate over time from the  Charts page for your

Charts page for your  Scenario.

Scenario.

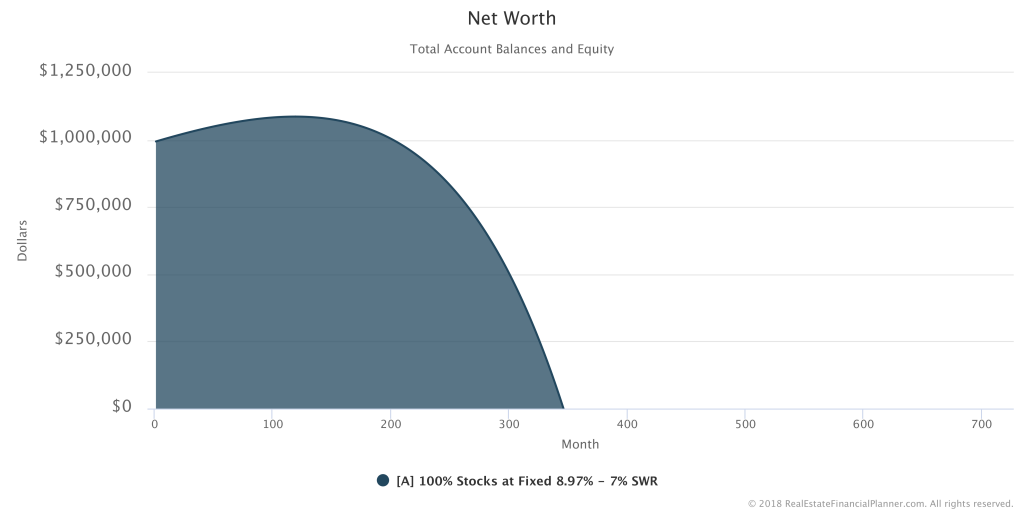

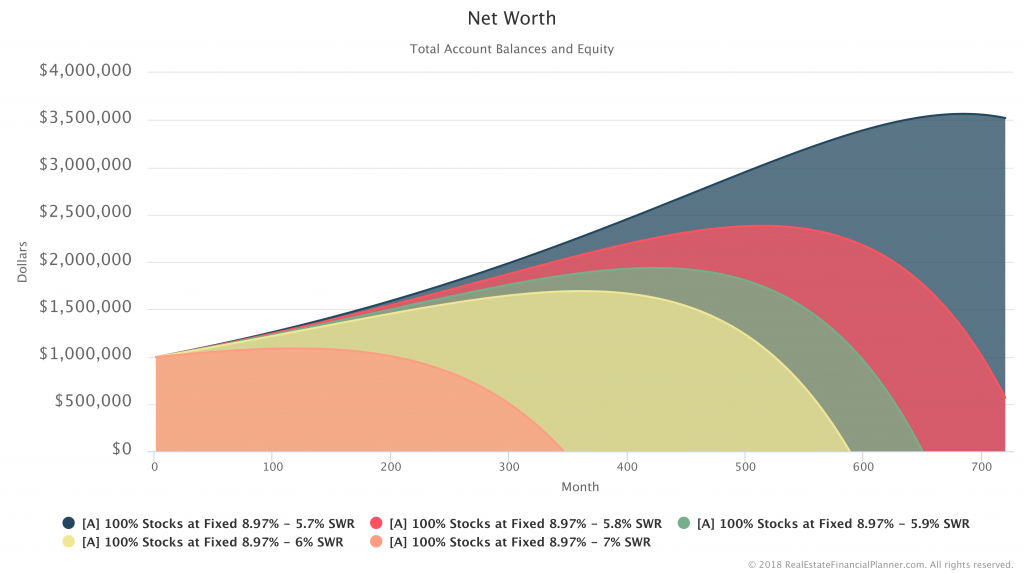

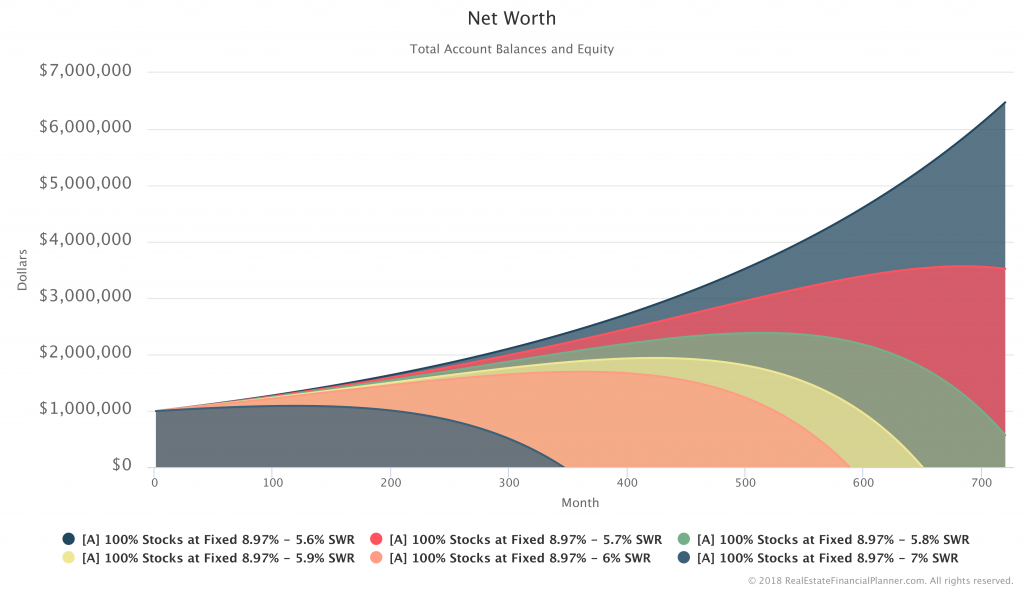

For the What Should I Do With $1 Million Dollars Presentation? I discussed the impact of your withdrawal rate on your net worth over time. Here’s how I set up this series of  Scenarios. First, the premise of the class is that you start with $1 million dollars. So, we started each of the

Scenarios. First, the premise of the class is that you start with $1 million dollars. So, we started each of the  Scenarios with $1 million dollars invested in stocks.

Scenarios with $1 million dollars invested in stocks.

I assumed that you were able to earn a fixed 8.97% return each and every year by investing in the VTSMX total stock market index fund. At the time that I made this presentation that was the compounding annual growth rate (CAGR) of that fund from 1871 to 2017. That’s why I used that number. I fully realize (and you should too) that it is not realistic to think that you can really earn 8.97% per year fixed rate of return by investing in stocks. However, I wanted to model a baseline of a fixed rate of return to show how different withdrawal rates impact if and how quickly you deplete your investment.

For the first  Scenario, I assumed you were taking out $70,000 per year (7% withdrawal rate) and that $70,000 increased by 3% per year (calculated monthly) to account for inflation. If you want to copy the

Scenario, I assumed you were taking out $70,000 per year (7% withdrawal rate) and that $70,000 increased by 3% per year (calculated monthly) to account for inflation. If you want to copy the  Scenario into your own Planner™ to make changes, I have also provided the ability for you to do that as well below the chart. Here’s the chart showing how long it takes to run out of money withdrawing an inflation adjusted $70,000 per year from $1 million dollars when you’re earning 8.97% on your money.

Scenario into your own Planner™ to make changes, I have also provided the ability for you to do that as well below the chart. Here’s the chart showing how long it takes to run out of money withdrawing an inflation adjusted $70,000 per year from $1 million dollars when you’re earning 8.97% on your money.

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

A 100% Stocks at Fixed 8.97% - 7% SWR with 2

A 100% Stocks at Fixed 8.97% - 7% SWR with 2  Accounts, 0

Accounts, 0  Properties, and 1

Properties, and 1  Rule.

Rule.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

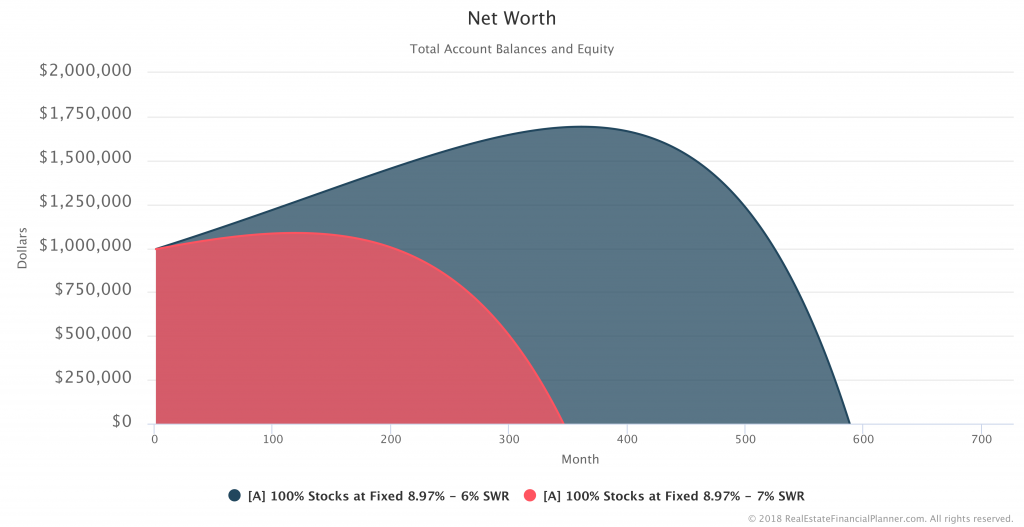

In this next chart, I add in withdrawing $60,000 (6% withdrawal rate) to compare it to the 7% withdrawal rate we were using previously. All the other assumptions are the same.

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

A 100% Stocks at Fixed 8.97% - 6% SWR with 2

A 100% Stocks at Fixed 8.97% - 6% SWR with 2  Accounts, 0

Accounts, 0  Properties, and 1

Properties, and 1  Rule.

Rule.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

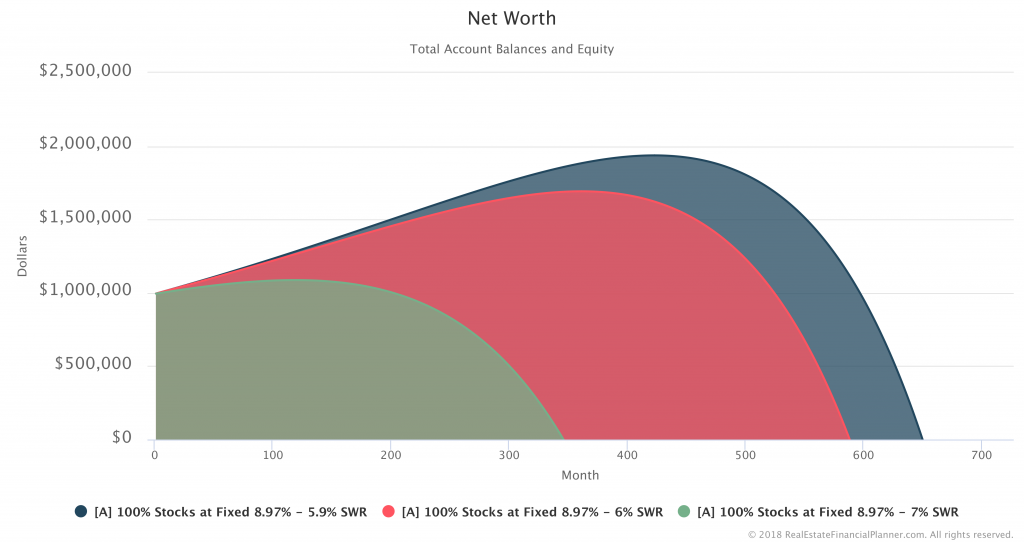

Continuing with the comparison, I’ve added a  Scenario where you are withdrawing $59,000 per year (a 5.9% withdrawal rate), I am still adjusting each of them for inflation using the same 3% annual inflation rate (but applied monthly). You can see the we continue to extend out when we’re likely to run out of money from our initial $1 million dollar investment.

Scenario where you are withdrawing $59,000 per year (a 5.9% withdrawal rate), I am still adjusting each of them for inflation using the same 3% annual inflation rate (but applied monthly). You can see the we continue to extend out when we’re likely to run out of money from our initial $1 million dollar investment.

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

A 100% Stocks at Fixed 8.97% - 5.9% SWR with 2

A 100% Stocks at Fixed 8.97% - 5.9% SWR with 2  Accounts, 0

Accounts, 0  Properties, and 1

Properties, and 1  Rule.

Rule.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

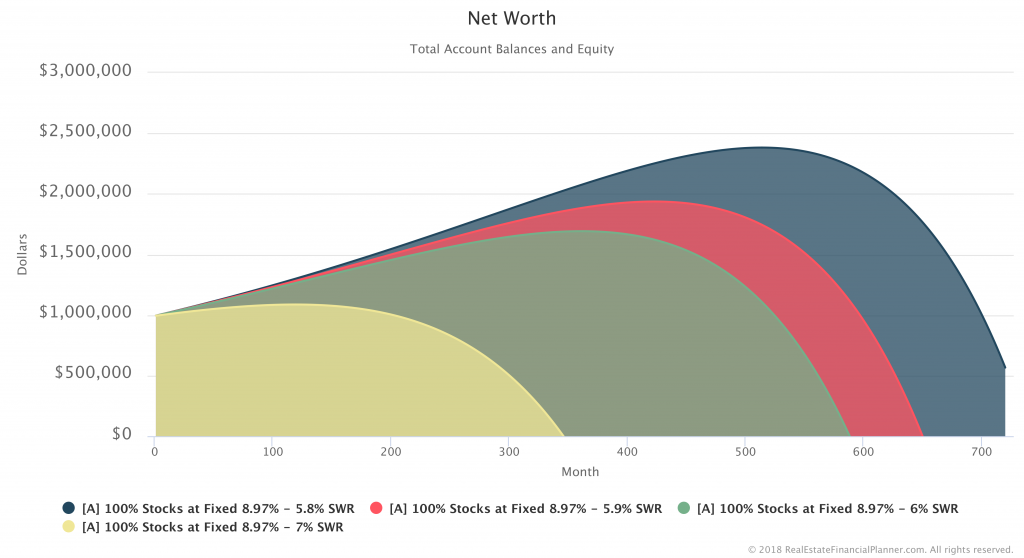

Continuing to lower the withdrawal rate, the following chart includes a 5.8% annual withdrawal rate and a link to copy that  Scenario if you’d like to do some of your own modeling.

Scenario if you’d like to do some of your own modeling.

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

A 100% Stocks at Fixed 8.97% - 5.8% SWR with 2

A 100% Stocks at Fixed 8.97% - 5.8% SWR with 2  Accounts, 0

Accounts, 0  Properties, and 1

Properties, and 1  Rule.

Rule.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

Including a 5.7% withdrawal rate in the chart below.

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

A 100% Stocks at Fixed 8.97% - 5.7% SWR with 2

A 100% Stocks at Fixed 8.97% - 5.7% SWR with 2  Accounts, 0

Accounts, 0  Properties, and 1

Properties, and 1  Rule.

Rule.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

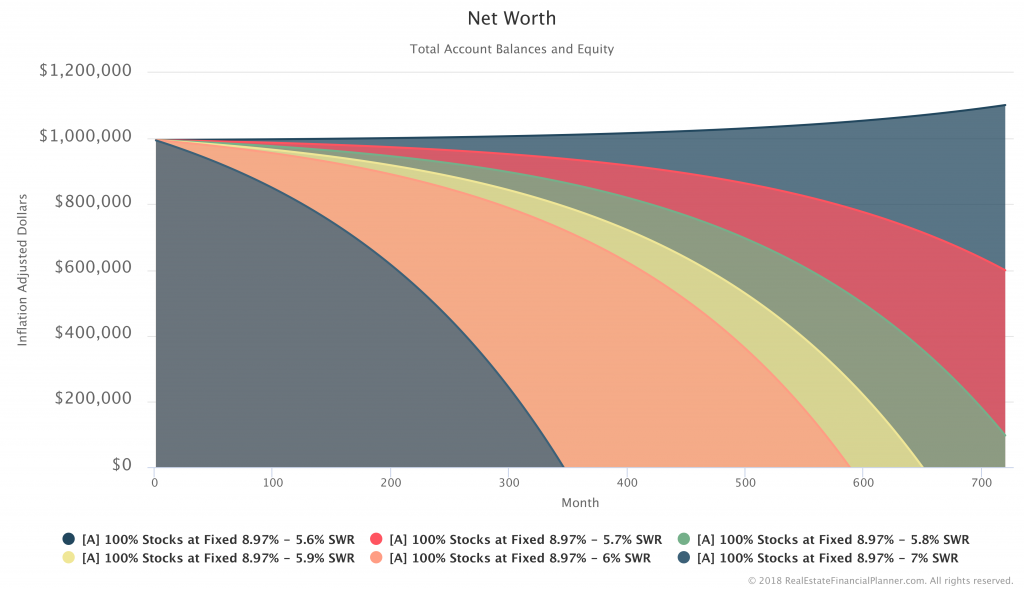

With a 5.6% withdrawal rate and a fixed 8.97% growth rate in our investment account, it appears that our  Account balance will actually grow over time. Of course, this does not take into account any sequence of return risks; it assumes a fixed 8.97% rate of return for our investment which is extremely unlikely.

Account balance will actually grow over time. Of course, this does not take into account any sequence of return risks; it assumes a fixed 8.97% rate of return for our investment which is extremely unlikely.

Login to copy this  Scenario. New? Register For Free

Scenario. New? Register For Free

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

A 100% Stocks at Fixed 8.97% - 5.6% SWR with 2

A 100% Stocks at Fixed 8.97% - 5.6% SWR with 2  Accounts, 0

Accounts, 0  Properties, and 1

Properties, and 1  Rule.

Rule.

Or, read the detailed, computer-generated, narrated  Blueprint™

Blueprint™

If we show the same chart as above except we adjust for inflation, you can see that our initial $1 million dollar investment is growing.

Cash on Cash Return On Investment as a Quasi-Safe Withdrawal Rate Equivalent

I will be creating an entire separate resource on this idea alone, but I don’t want to mention it here. If you’re interested in that, please do leave a comment below and I will try to work on that sooner than later.

If you think about Safe Withdrawal Rate as the amount of money that you can safely spend from your stocks, bonds and cash  Accounts where you will have enough remaining to completely fund your retirement, then what is the equivalent of the Safe Withdrawal Rate when you have rental

Accounts where you will have enough remaining to completely fund your retirement, then what is the equivalent of the Safe Withdrawal Rate when you have rental  Properties?

Properties?

I would argue the quasi-equivalent of Safe Withdrawal Rates for rental  Properties is Cash on Cash Return On Investment.

Properties is Cash on Cash Return On Investment.

Cash on Cash Return On Investment is the amount of cash produced by a rental property after you account for all the income and expenses on your property.

Income might include some or all of the following:

- Rents

- Other income like laundry, utility bill-back

Expenses might include some or all of the following:

- Principal and interest from any mortgage payments or loans against the property

- Any Private Mortgage Insurance premiums (if applicable)

- Taxes on the property

- Insurance on the property

- Landlord paid utilities

- Vacancy allowance to plan for times when the property is unoccupied

- Property management expenses for the property

- Maintenance on the property

- Capital improvements on the property

If you take the income you generate from the property and subtract out all your expenses, you will have the cash flow for the property. Cash flow can be positive or negative. Ideally, the properties you’re buying have positive cash flow.

When you take the positive cash flow on your property and divide by the amount of money you invested, you get the cash return on the cash that you invested into the property. We call this your Cash on Cash Return On Investment.

If you had taken the same amount of cash and invested in stocks or bonds or in your savings, you can use your safe withdrawal rate to determine how much you could take out and spend. In my mind, the Cash On Cash Return On Investment is like the Safe Withdrawal Rate for rental properties.

To continue with the comparison, we discussed earlier that many folks are increasing the dollar amount they are taking out of their investments to keep pace with inflation. If you believe that rents keep pace with inflation, it is very likely that the amount of cash flow generated from your rental properties will increase faster than inflation. I’ll explain by comparing two different  Scenarios:

Scenarios:

- You have a million dollars invested in stocks where you feel comfortable with a 4% safe withdrawal rate

- You have rental properties you purchased with $1,000,000 in down payments that have a 4% cash on cash return on investment

If inflation is 3%, the extra cash flow you’d get from raising your $40,000 withdrawal from stocks by 3% would be lower than cash flow you’d see from an increase of rents by 3%. This is due to leverage from your mortgage.

Some people would likely argue that your leverage buying the real estate does increase your risk and I plan to produce the Ultimate Guide to Evaluating Real Estate Investing Risk where I discuss and measure this risk (and many others). If you’re interested in seeing that, please do leave a comment below and I will move up the priority of creating that for you.

Things to Add

The following are things I plan to add and update on this page. Is there anything else you’d like to see added? Anything you want to see sooner than later? Let me know in the comments and I will prioritize those for you.

- Michael Kitces comment from Mad FIentist’s podcast that originally the complaint in the financial advising industry was that the safe withdrawal rate discussed in the Trinity Study was too low.

- Go read and reference/discuss the original studies cited in Trinity Study

- Talk about how varying the safe withdrawal rate assumptions on

Scenarios impact the date you can retire (

Scenarios impact the date you can retire ( Goals) in the Real Estate Financial Planner™ software. Maybe show a few examples of charts with this.

Goals) in the Real Estate Financial Planner™ software. Maybe show a few examples of charts with this. - Best practices for SWR for REFP folks

- Adjusting SWR over time (inflation)

- Alternative adjustments (fixed withdrawal rates – ie always 4%)

- Add

Scenarios and provide link to copy them into the user’s own Real Estate Financial Planner™ software.

Scenarios and provide link to copy them into the user’s own Real Estate Financial Planner™ software. - Add videos of this and related classes to this post

- Create podcast episode on Safe Withdrawal Rates