If you are a real estate investor or planning to become one, you must have considered the different loan programs available to you. Choosing the right loan can significantly impact your cash flow, and for that reason, it’s essential to evaluate your options thoroughly. Luckily, we’ve created a loan comparison spreadsheet that can help you compare different loan types and mortgage insurance programs.

Loan Comparison Spreadsheet

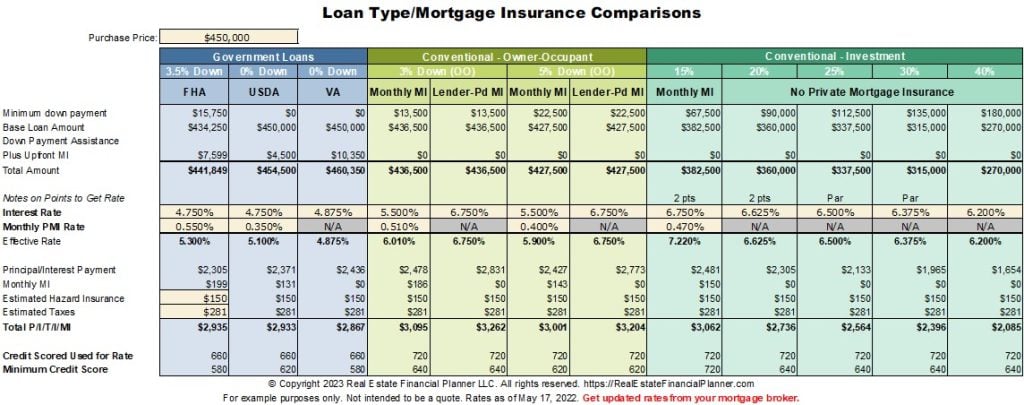

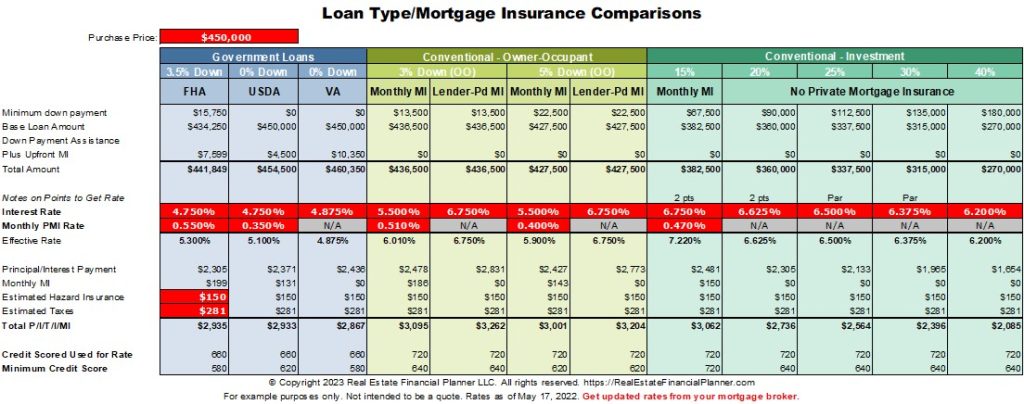

The loan comparison spreadsheet is a tool that allows you to evaluate different loan programs based on their monthly payments, interest rates, mortgage insurance, and more. The tool’s inputs are the purchase price of the property and the different rates for various loan programs. You can call your lender and ask them to provide you with the interest rates and mortgage insurance rates for different loan programs.

The spreadsheet compares different loan programs side by side and shows you the difference in monthly payments. It also calculates your principle and interest payment, your monthly mortgage insurance premium, and your estimated hazard insurance and taxes. You can modify any of the fields in the spreadsheet, especially if any of the formulas change over time.

Evaluating Loan Programs

Call your lender to get the latest mortgage interest rates, private mortgage insurance rates and other loan terms to fill in the spreadsheet. The red fields are the ones you’ll most likely to change.

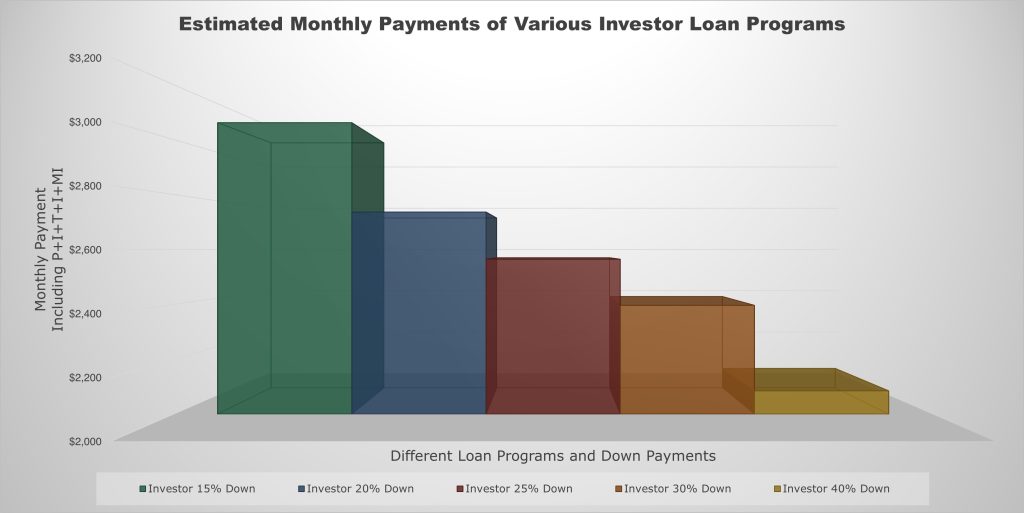

Once you have filled in the spreadsheet with the necessary information, you can evaluate which loan program works best for you. The tool shows you the relative sizes of the monthly payment for each loan program, allowing you to compare and choose the one that optimizes your cash flow.

For instance, if you’re considering purchasing a $450,000 property and have a 3.5% down payment, the spreadsheet can show you that getting an FHA loan with an interest rate of 6.5% and a monthly PMI rate of 0.55% will result in a monthly payment of $2,935. However, if you’re willing to put down 30%, the investor loan option can improve your cash flow by $660.

Once you’ve entered your numbers, you can see at a glance how the total monthly payment—including principal, interest, private mortgage insurance (if applicable), taxes, insurance—will be for each loan type.

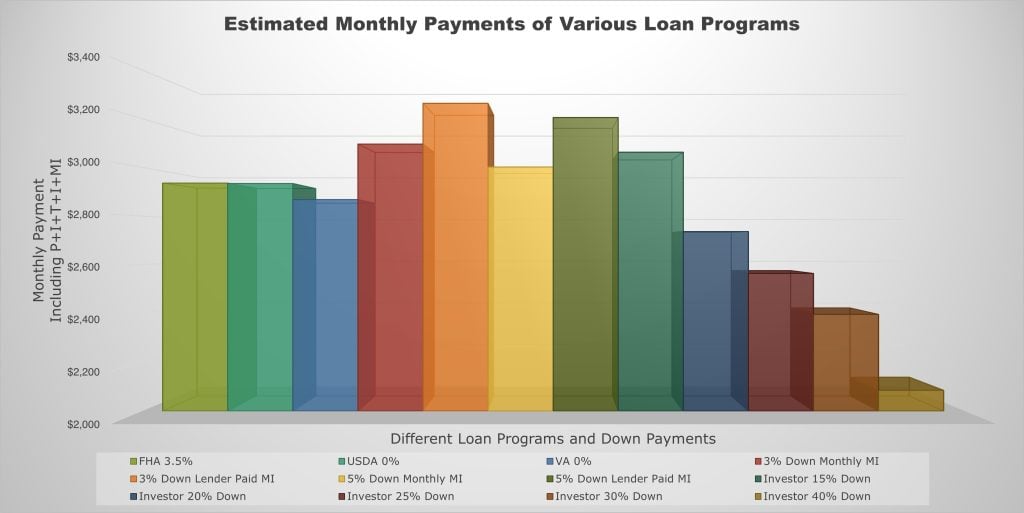

For example, here’s a chart comparing all loan types including owner-occupant loans for house hackers and Nomads™ as well as non-owner-occupant (investment) loans when you plan to purchase the property and not move in.

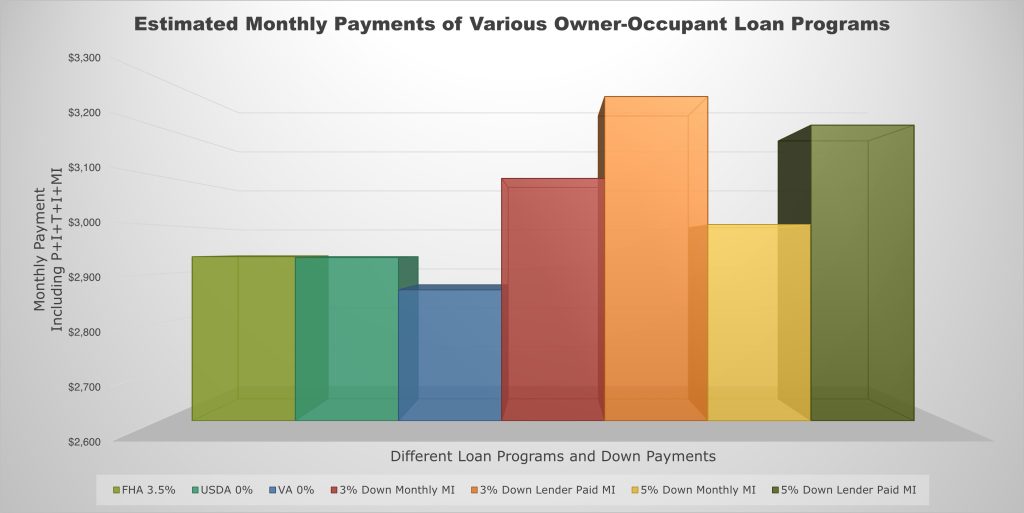

If you know you’re going to utilize the Nomad™ or house hacking strategy and move into the property, you can also just see the total monthly payment comparison for owner-occupant loan options.

And, if you know you’re definitely not going to move into the property, you can also compare just the investment loan options as well.

Tips for Using the Loan Comparison Spreadsheet

To use the loan comparison spreadsheet effectively, you need to follow these tips:

- Call your lender and ask for the interest rates and mortgage insurance rates for different loan programs.

- Don’t just send the spreadsheet to your lender and ask them to fill it out for you. Have a conversation with them and find out the differences between loan programs.

- Fill in the highlighted red fields and modify other fields if necessary.

- Evaluate loan programs side by side and choose the one that optimizes your cash flow.

Since we’re analyzing the same property and therefore income on the property is the same regardless of the loan program, any savings you achieve by improving your monthly payment is improved cash flow.

Once you’ve decided on your loan, use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ (download it for free) to analyze your investment.

Conclusion

In conclusion, the loan comparison spreadsheet is a powerful tool that can help real estate investors evaluate different loan programs. By filling in the necessary information and comparing loan programs side by side, you can choose the one that optimizes your cash flow. Remember to call your lender and have a conversation with them to get the most accurate information. Happy investing!