1% Rule, 2% Rule, 3% Rule, 4% Rule, Rule of 72, Rule of 144, and many more… if you’re interested in learning more about all the different real estate investing rules of thumb, then you’ve found the right place.

Below is a list of each rule of thumb along with a very brief description of what the rule is and how it is used.

1% Rule

The 1% Rule suggests that a rental property should have monthly rent that exceeds 1% of the purchase price.

For example, if you’re buying a duplex for $280,000, you would need to have the total of the gross rents equal to at least $2,800 ($1,400 per side).

There are a number of real estate markets where it is possible to find a decent selection of properties that meet the 1% rule. In some other real estate markets, it is incredibly difficult to find properties that meet this 1% criteria.

The 1% rule tends to work better on lower priced properties.

In some cases you may be able to change the characteristics of the investment to take a property that wouldn’t normally meet the 1% rule and force it. For example, you might be able to take a property where rent for a typical year long lease would not meet the 1% rule. However, if you use that property as a short-term rental instead of a year-long lease, you might be able to easily get a full 1% of the purchase price in monthly rent.

Property taxes tend to be higher (as a percentage of purchase price) in markets where you can more easily find properties that meet the 1% rule.

Buying properties at a discount will help you find properties that meet the 1% rule.

2% Rule

The 2% rule is similar to the 1% rule. Instead of the monthly rent exceeding 1% of the purchase price, the rent for the 2% rule must exceed 2% of the purchase price.

If you thought finding properties that meet the 1% rule was difficult, the 2% rule raises the bar even higher.

Previous comments about the 1% rule concerning property taxes, changing the characteristics or use of the investment and buying at a discount still apply for the 2% rule.

3% Rule for Estimating Rental Property Depreciation

If you take 3% of the purchase price of the property, it should approximately estimate the gross depreciation benefit of owning that property as a rental property.

Let’s look at an example.

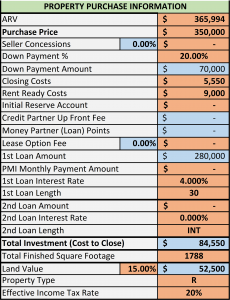

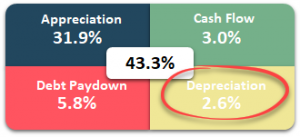

If we were to buy this example new construction property in Windsor, Colorado for $350,000… we might estimate our gross depreciation benefit to be 3% of the purchase price. That would be:

However, what happens if we do a more thorough calculation for the gross depreciation?

We can only depreciate the value of the building—not the value of the land. So, first we need to estimate what the value of the building is.

In our spreadsheet input you can see that we estimate that the land to be worth 15% of the purchase price or $52,500.

The remaining 85%, or $297,500, is the value of the building.

On residential rental properties, the value of the building can be depreciated over 27.5 years.

So, take the $297,500 and divide by 27.5 years and you get a gross depreciation of $10,818. We can see this on the spreadsheet as well.

Estimating your gross depreciation benefit as $10,500 using the 3% rule when it really is $10,818 is close enough for what we’re using it for.

Speaking of using it, how do you use this rule of thumb? When out looking at properties, you can use this rule to quickly estimate how much gross depreciation you will get by owning this property as a rental.

Then, if you know your top tax bracket (or more conservatively… your effective income tax rate), you can multiply the gross depreciation amount by your tax rate to determine how much cash flow from depreciation you will receive.

Continuing with our example above, if you estimate you’re paying an effective tax rate of 20% (across all your tax brackets), you can take 20% of $10,500 or about $2,100 and that’s how much cash flow from depreciation you will receive.

This means you’re property will appear to be cash flowing about $2,100 more per year when you take into account the tax benefits of owning the property. So, this property will give about $175 more in cash flow (from depreciation) than you think you’re getting from your traditional cash flow calculation.

The actual cash flow from depreciation calculation (when using the $10,818) in the spreadsheet is $2,163.64. That’s pretty close to the $2,100 we’d get by estimating it with the 3% rule.

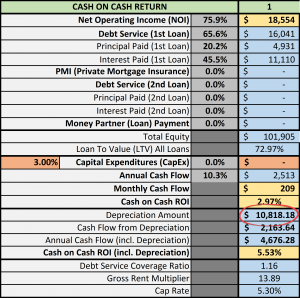

The cash flow from depreciation is the number in yellow, in the bottom right corner of the Return on Investment Quadrant™. In the image below it is shown as a percentage return on your initial investment in year 1.

4% Safe Withdrawal Rate Rule

If you have a million dollars invested for retirement, how much can you safely withdraw each year if you want to make reasonably sure you don’t run out of money?

That’s what the 4% Safe Withdrawal Rate Rule tells us.

The 4% safe withdrawal rate is based on a study done by three Trinity University professors (commonly called the Trinity Study if you want to look up more info on it).

It basically states that:

So, as an example, if you started with a million dollars invested in stocks and bonds, you can withdraw $40,000 per year in the first year. In the second year, you can safely withdraw $40,000 plus an adjustment for inflation. Each subsequent year the original $40,000 is adjusted for inflation so that you maintain the same “buying power”.

A few interesting points about this rule of thumb.

- First, it does not apply to real estate investments. It was intended to be used when investing in stocks and bonds. For real estate, we typically look at a combination of cash on cash return on investment (when we have a mortgage on the property) and cap rate once the property is paid off.

- Second, it only looked at a 30 year retirement period. If you plan to retire early or live longer, this rule of thumb may no longer apply.

- Third, in a large number of the test scenarios to evaluate the 4% rule, you end up with more money than you started with. In a small number of the test scenario cases, you do run out of money. If you continued to live beyond 30 years and needed to continue to withdraw money, you’d run out of money in a larger number of cases.

70% Rule of After Repair Value on Cash Offers

In many real estate markets, the formula for the Maximum Allowable Offer (MAO) you can make when buying a property for cash (or with a hard money loan) is defined by the 70% Rule:

(70% of After Repair Value (ARV)) – Cost of Repairs

For an example, let’s assume the following:

- After Repair Value (ARV) is $200,000 – the property will be worth $200,000 once you’re done fixing it up

- The property needs $30,000 in repairs

So, the Maximum Allowable Offer you could make to purchase this property would be:

It is important to realize that is the maximum offer you could make. You may want to start lower than this.

This rule was originally designed for lower priced properties.

In more expensive markets—and especially competitive or hot markets—some investors will use alternative formulas for making offers.

For example, they might do something like this: Maximum Allowable Offer = After Repair Value – $30,000 Profit – Cost of Financing – Cost of Closing Costs – Cost of Repairs.

Rule of 72 for Compound Interest

If you have $100,00 invested in something earning 10% annual return, how long will it take for your $100,000 to double in value to be worth $200,000?

That’s what the Rule of 72 can tell us. It states:

So, to continue with our opening question. Here’s how the math would work for our example:

It will take 7.2 years for our initial $100,000 investment to be worth $200,000 if it is earning 10% per year.

Rule of 144 for Compound Interest with Regular Periodic Investments

The Rule of 72 works great if you have a lump sum amount of money you’ve started with and want to know how long it will take to double.

However, what if you’re investing $1,000 per year and earning 10% per year on it? How long will it take for you to have twice as much as you invested?

That’s what the Rule of 144 deals with: periodic investments at a fixed rate. It states:

144 ÷ Yearly Interest Rate

To continue with our example, if you’re investing $1,000 per year and earning 10% per year, how many years will it take for you to have twice as much as you’ve invested?

144 ÷ Yearly Interest Rate

So, it will take you 14.4 years before you have twice as much as you’ve invested in your account.

We then need to figure out how much you’ve invested to that point. If you’re investing $1,000 per year for 14.4 years, then you’ve invested $14,400. So, at the 14.4 year point, you should have approximately $28,800 total in your account using the Rule of 144.

2:1 Rule of Creative Deal Structuring

The 2:1 Rule with creative deal structuring is best explained with an example.

Let’s say you’ve been sending out postcards to get motivated seller calls. A seller calls you in the following situation:

- Property is worth $300,000

- Seller owes $250,000

- You can offer the seller $280,000 if you can buy the property subject to the existing financing

What are some offers you could make to the seller?

One offer is that you offer to buy the property subject to the existing financing (taking over the payments on their mortgage) and pay the seller their equity of $30,000 in payments of $100 per month until paid.

This would be a nothing down deal for you.

What if the seller wants to some money? How do you adjust your offer?

That’s what the 2:1 Rule addresses.

If the seller insists on getting $10,000 from you up front, you expect to get a discount for having to come up with money up-front. For every dollar you need to give the seller up front you need to reduce the price by a dollar. So, you get $2 for every $1 you give the seller up-front.

Using the 2:1 Rule and the $10,000 the seller would like up front, the new offer might be: you will buy the property subject to the existing financing, pay the seller $10,000 up front and ask the seller to accept payments of $100 per month on the remaining $10,000.

The final offer price would be $270,000:

- $250K on original loan

- $10K in cash

- $10K financed at $100 per month

This rule is helpful when negotiating with a seller face to face as a really quick way to adjust your offer numbers depending on how much cash they need when buying properties creatively.

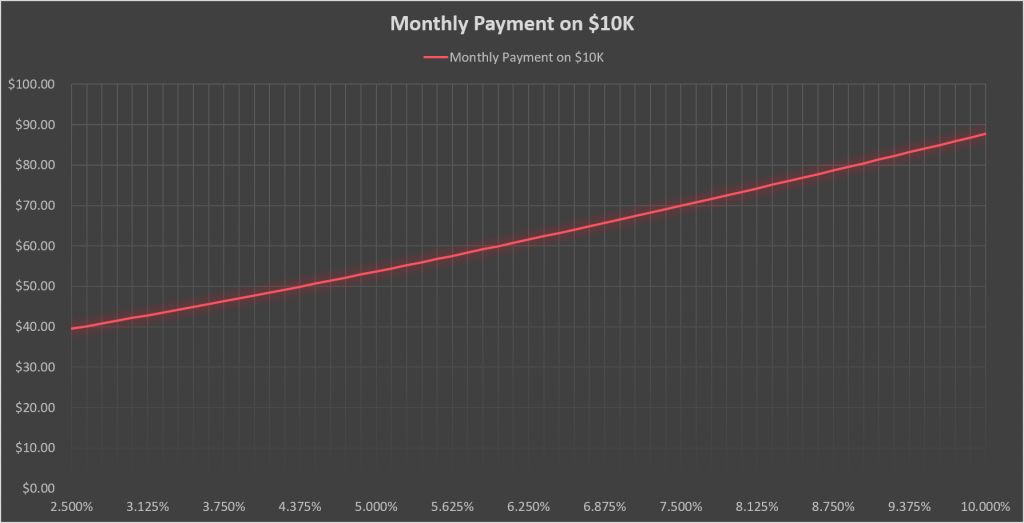

$50 Rule of 30-Year Financing

When I was a teenager my father taught me that the payments on a house were about $7 per $1,000 borrowed on a 30 year amortizing loan. With this rule of thumb in mind, you can quickly estimate how much monthly payment principal and interest payment would be when buying a property with, let’s say, $80,000 in debt (80 times $7 = $560 per month).

However, this rule changes with the current mortgage interest rate.

In our current, lower-interest-rate environment, the rule is more like $5 per $1,000. I like to explain it to clients as $50 for every $10,000 borrowed.

When I taught a class on this, someone in the class suggested based on the chart below, that it really is the interest per $1,000 borrowed. That’s a really rough approximation.

With interest rates in the low 4% range (which is where they are at the time of this writing), you can see that the payment for every $10,000 borrowed is $50 per month. That’s $5 per $1,000.

It is important to note that this is just the principal and interest part of the payment. It does not include taxes or insurance or private mortgage insurance (PMI).

It also assumes you’re getting a 30 year mortgage. Mortgages of different durations will have differing rules of thumb.

8:1 Rule of Showings and Offers

The 8:1 rule suggest that for every 8 showings on a property, you should expect to receive 1 offer.

Does that mean that if you’ve had 9 showings and did not receive an offer that something is wrong? Nope. You might have 14 showings with no offers than on showing 15 and 16 get an offer.

This rule can vary for any given property. Desirable, under-priced properties should expect a higher percentage of offers than 1 out of 8. However, if you’re getting great showings (over time) and not seeing offers, you may be over-priced… some might even argue significantly over-priced and discouraging offers because of it.

This rule can vary based on market conditions. In a low inventory, hot market… for a reasonably priced property… you might see 8 offers on 8 showings. In a high inventory, soft market… for a reasonably priced property… you might still not see an offer with 8 showings. If a buyer has the choice of 10 properties that meet their needs because there is a lot of inventory… they tend to pick the best 1 or 2 to pursue. Your property… while reasonably priced… may always be the third property: always a bridesmaid, but never a bride.

Rule of Future Dollars Today

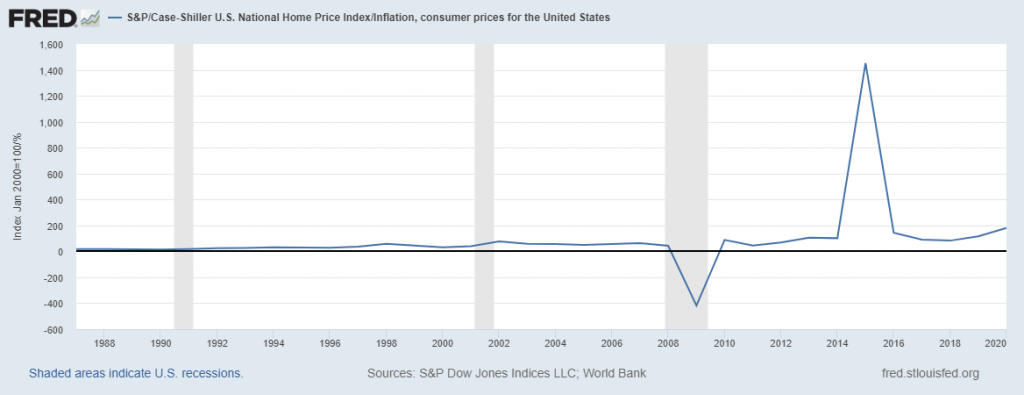

Critics of real estate investing will sometimes cite Case-Shiller’s chart showing that the home price index has basically just kept pace with inflation over a long period of time.

If you believe that home prices and/or rents will just keep pace with inflation, then you can easily think about inflated future values in terms of buying power in today’s dollars.

For example, if you bought a $350,000 property today. 30 years from now it might be worth over one million dollars. However, if home prices merely kept pace with inflation… even though it is worth over a million dollars 30 years from now, it is like have $350,000 in buying power in the future. That’s if you assume that the inflation rate is equal to the appreciation rate.

Similar with rents… if you’re getting $2,000 per month in rent today. In 30 years, rents may be over $6,000 per month… but if rent appreciation rate is equal to the inflation rate then you really still have about $2,000 per month in buying power in today’s dollars even though the rent is $6,000 per month.

1/3 of Rent for Expenses and 2/3 Rule for Free and Clear Properties

In some markets (Northern Colorado… where I am located… being one of them) you can estimate that about 1/3 of the rent on a property covers the expenses for the property.

For example, with a $2,100 per month rent… about 1/3 or $700 per month… covers expenses on the property like taxes, insurance, vacancy, maintenance, (and sometimes) property management, etc. Expenses except the financing.

That means that about 2/3 of the rent needs to cover the financing on the property and any profit you expect to make.

To continue with this same rule… that means that if you own the property free and clear of any mortgages (no financing on the property), that you can ESTIMATE your cash flow on the free and clear property for doing mental math.

For example, using the same $2,100 per month in rent… if you don’t have a mortgage on the property and you know that $700 per month covers the expenses on the property that means that 2/3 or $1,400 per month is net cash flow.

So… to estimate how much cash flow you might be seeing on your properties when they’re paid off… you might say… I got 10 properties with each of them renting for about $2,400 per month… that means that when they’re all paid off I’ll have about $1,600 per month (2/3 of $2,400) for each property in free and clear cash flow after expenses. Times 10 properties = $16,000 per month in cash flow.

And, if you believe that rents will just keep pace with inflation… you can think of that as having the same spending power as $16,000 today (even though the dollar amount itself may be higher).

Debt Paydown Return on Investment

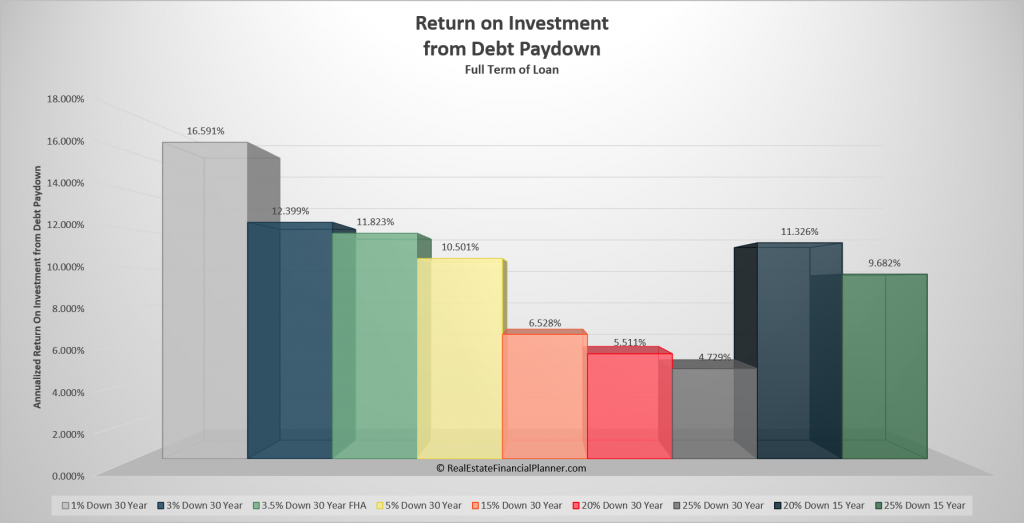

There are two rules of thumb that I tend to remember for the return on investment you get from paying down a loan on a property over 30 years: 20% down payment and 5% down payment.

If you don’t look over a full 30 year period, the return on investment number will be different. It changes with each payment you make.

If you don’t look over a full 30 year period, the interest rate of the mortgage also matters. However… if you go the full 30 years, it does NOT matter what the interest rate was because… regardless of interest rate… you start with 20% down and end up with the same free and clear property.

That means for Nomads™ they are getting a baseline return of 10.501% per year, every year, on their initial down payment not counting any returns they might be getting from cash flow, Cash Flow from Depreciation™ or appreciation.

The return we’re talking about is just this one from the Return Quadrants™:

If you want to know the return for other loan types, the chart below shows a variety of loans and their compounding annual return on investment for the full 30 year period.

In general, the less you put down the higher the return on investment is from debt paydown.

These returns are NOT market dependent… it doesn’t matter if the property value goes up or down or if you have negative cash flow or positive cash flow. Those returns are represented elsewhere in the Return Quadrants™ (the Appreciation and Cash Flow sections).

That means… if you make the payments on your property as you agreed with your lender according to your mortgage or deed of trust (a contractual agreement), these returns are… all but “guaranteed”. Meaning you get them regardless of market conditions.

Off-Market Deal Finding Rule of Thumb

How many houses do you need to look at to find a deal?

Looking at properties outside the Multiple Listing Service (MLS) is different than trying to find properties listed for sale on the MLS.

Here are some rules of thumb for finding deals.

From the book “Real Estate Riches” by Dr. Dolf De Roos here suggests the 100:10:3:1 Rule. You need to look at and analyze 100 properties to find 10 where the numbers works and you make offers on them to get 3 accepted to close on 1.

From the “No Down Payment” course by Carleton Sheets he has the 50:1 rule. You need to analyze and look at 50 properties to buy 1.

From the book “Millionaire Real Estate Investor” by Gary Keller et al, on page 216 they suggest the 30:10:3:1 rule. You need 30 properties that meet your basic criteria that need investigating, 10 warrant serious consideration. Of those 10, 3 were worth making an offer on and 1 turned into a deal.

From the book “Weekend Millionaire’s Frequently Asked Real Estate Questions” by Mike Summey and Roger Dawson they suggest a 30:1 rule. Got to look at 30 deals to find 1.

Are your numbers different? If your deal-making numbers are better than this, maybe you’re willing to do worse deals.

If your deal-making numbers are worse than this, maybe your expectations are unrealistic for your current market.

Motivated Seller Calls To Deals Done Rule of Thumb

When you’re sending out marketing (like postcards) to get motivated sellers calling you to sell you their property… historically it was about 15 motivated seller calls to get 1 deal done.

Today, in our strong seller’s market, you end up spending a lot more to get the calls and might be doing a little better than 15:1.

A lot of this depends on your deal criteria though. If you are only willing to buy properties with nothing down and/or zero percent financing you might find your conversion from calls to deals is much lower.

If you can handle a wide range of deals that meet your investment criteria, maybe it is slightly better than that.

Motivated Seller Postcard Response Rates

If you’re wondering what is the rule of thumb for response rates from postcards to get motivated seller calls… it can vary widely depending on what list you’re mailing to and your marketing message.

For example, consider 3 different marketing messages on your postcard: “we can pay full price” versus “we can pay a fair price” versus “we can pay 70% of appraised value”.

You might imagine that you’d get more calls using “we can pay full price” versus “we can pay 70% of appraised value” and you’d probably be right (although I’ve honestly never tested those head to head for what I hope will be obvious reasons).

Also, you may get staggered and delayed responses to boost reply. In other words, you might get 1 call out of 100 postcards mailed within the first 14 days of the postcard hitting. But, you might also get an additional call within 180 days from the same mailing.

So, your overall response rate is really closer to 2 calls out of 100 (over 180 days) when you might think it is 1 call out of 100 in the first 2 weeks.

Reasonably paced multi-hit campaigns typically improve response so repeated mailings to the same list spaced out over time helps.

Your marketing message can also impact your conversion rate from call to closed deal. With “I buy houses for 30% of what it is worth” messaging, you might not get many calls at all but you might convert a high percent of the ones that do call. If your marketing message is “I buy properties for full price” you might get more calls but might not find a high percentage of the calls from sellers you receive meet your criteria for actually buying the property.

80/20 Rule aka Pareto’s Principle

From economist Vilfredo Pareto.

He suggested that about 80% of your results come from about 20% of your activities. It is the idea of the trivial many versus the vital few.

Focusing on doing the right things… can make all the difference.

For real estate investors in acquisition mode that’s probably talking to motivated sellers or analyzing deals in the MLS.

1.25 Debt Service Coverage Ratio (DSCR)

Debt Service Coverage Ratio (DSCR) is the ratio of Net Operating Income (NOI)/Mortgage Payment (Principal and Interest).

Most lenders want to see a DSCR of at least 1.25.

For the $350,000 rental we’ve been using as an example, it has a DSCR of 1.16 (lower than what the lender would ideally like to see).

Lenders also use 75% of the rent to see if it covers the mortgage payment. In this case, that would be covered with $238 to spare.

$100 Per Door

You might hear real estate investors say they want to invest where they are getting “$100 per door”.

While in theory, this sounds like a reasonable thing to say and strive for, there are significant challenges with this rule of thumb.

For example, to get $100 per door, what percentage down payment are you using? In almost all investments, I can come up with a large enough down payment where you can get $100 per door.

I think many investors would say either with none of my own money in the deal or with 25% down (a typical minimum down payments for buying multi-family investment properties with more than one door). However, Nomads™ can acquire multi-family rental properties with nothing down (VA financing) or FHA financing with 3.5% down. Does that mean that this $100 per door should apply here as well?

What interest rate of loan? As interest rates rise, maybe $100 per door isn’t reasonable. What if you can buy down the interest rate?

In general, I prefer to use cash on cash return on investment instead because it accounts for your loan terms and takes into account differences in down payments rather than just a blanket $100 per month per door rule of thumb.

Deal Analysis Rules of Thumb

When analyzing deals using a deal analysis spreadsheet, what are the rules of thumb for the assumptions?

Before I share these, I need to tell you that all of these “rules” are “made to be broken” and will vary A LOT in different real estate markets but, here you go:

- 3% vacancy – assumes you’re starting at least 60 days prior to lease expiration to replace tenants that do not renew.

- 10% maintenance – assumes a higher priced property and that you’re not including capital expenses in this maintenance number.

- 10% property management – assumes that your property manager is not charging you extra for new tenant placement and lease renewals or extra marketing fees. Or, that you’re getting a discount for multiple properties with the same property manager and that any additional fees make it happen to be 10% total.

- .65% of the value of the property for taxes – very market specific for Northern Colorado. Your market will undoubtedly be different.

- .4% of the value of the property for insurance each year – very market specific for Northern Colorado. Your market will undoubtedly be different.

- 3% appreciation and rent appreciation – very market specific for Northern Colorado. Your market may be different but this happens to be a relatively common number.

Rules of Thumb for Estimating Repairs

This is NOT my area of expertise and these are dated and probably VERY low at this point… you should get an idea of what it might run in your local market and memorize your own versions of these:

- $4 per sq ft for carpet installed

- $2 per sq ft for paint

- $400 per window installed

- $1,200 for water heater

- $3,000 for furnace

- $4,000 for AC

- $10K for roof

- $4,000 paint exterior of typical rental

- $2K for appliance package

- $6K kitchen remodel

- $3.5K bathroom remodel

You may also be able to “get a deal” and/or do some of the work yourself (not usually recommended for liability reasons) so your prices may be very different.

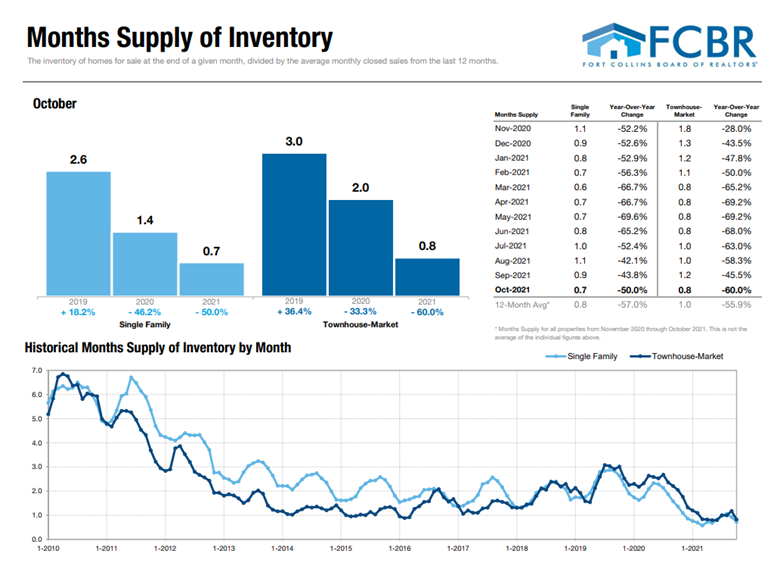

Balanced Real Estate Market

Historically, 6 months of inventory is considered a balanced real estate market.

Recently, we’ve seen a much lower number.

Real Estate Investing Rules of Thumb Class Recording

On September 4, 2019 I taught a special 2 hour class on these real estate investing rules of thumb for our local club that caters to people interested in investing in Fort Collins investment real estate. Check it out in the video below or on… what I consider to be… the best real estate investing podcast.

If you want to apply these rules to analyze your investment strategy, check out the best real estate investment analysis software available anywhere.

Hey James, enjoyed the class last night. Your energetic and enthusiastic approach kept me alert for the whole two hours!

NOMB but I think each rule above should have a link to a popup of your relevant presentation slide. Just sayin’.

Thanks Flash. Glad you enjoyed class and I could keep you entertained. 🙂

Yes… so I do have on my list of things to do (in my spare time) to go in and actually write blog posts on each of these rules of thumb to expand on the info in more detail. So, be on the lookout for that.

Thanks again! Hope to see you at future classes.