What does the Real Estate Financial Planner™ software do?

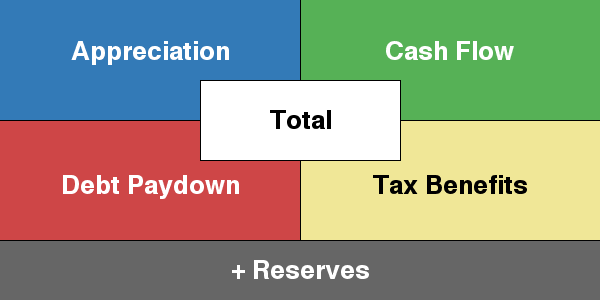

The Real Estate Financial Planner™ software allows you to model your investing strategy including: Savings accounts Stocks Bonds Social security Annuities Just about any income stream or asset And especially real estate investments like rental properties You don’t start building a house without a complete blueprint and detailed plan. “Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it?” — Luke 14:28 This is what the Real Estate Financial Planner™ software allows you to do: to make a detailed plan for your … Read more