The following is a guest blog post by Jassen Bowman.

As the social and political debate rages on in the United State in regards to the minimum wage and the desire by many to see the minimum increased to $15 per hour, there is one statement that is repeated over and over again: It’s impossible to get ahead in this country on $10 per hour.

Most people acknowledge that absolute minimum wage jobs are difficult to get ahead on, but it’s not impossible. The conversation tends to become an argument for those career paths for which $10 to $12 per hour is about the limit of progress. In other words, starting at minimum wage is OK, but when the job caps out at $10 or $12 per hour, people lose the opportunity to get ahead.

In 2015, this became an even more heated debated when President Obama used his executive authority to increase the minimum wage for federal employees and contractors to $10.10. Many politicians were quoted as saying that, while an improvement, it was still impossible to get ahead on $10.10 per hour. Sen. Marco Rubio stated this on an episode of The Daily Show with Jon Stewart, which is when the debate really caught my ire.

In this post, I will explain that it’s not only possible to get ahead in life on $10 per hour, but also possible to build a multi-million dollar real estate portfolio on that same $10/hr job.

Let’s start with a basic but seldom discussed truth: The real problem isn’t the wage base, but rather the exhaustive consumerism of the standard American lifestyle.

Much has been written about the Standard American Diet (SAD), and it has become mainstream thought to accept the fact that, in general, Americans eat like crap. Two thirds of us (myself included) are fat, and the reason why is not a mystery.

Much less, sadly, has been written about the waste that exists in the average American household. The cadre of bloggers and authors covering the topic is small, albeit vocal within their specific sub-groups. Unfortunately, those of us that embrace simpler, low-budget lifestyles are viewed as oddballs — the idea of living well below your means has not yet crept into the American mainstream. I don’t expect this post to have any impact on that, but I’m at least going to take the time to throw my two cents into the debate.

I’m going to specifically address Sen. Rubio’s comment about not being able to get ahead on the new federal employee minimum wage. All of the numbers I’m about to put out there onto the Interwebs are on a per person basis.

The first fact that I want to mention is that almost everything that we spend money on is a want, rather than a need. Westerners in particular are too quick to confuse the two. My years of international travel taught me this very important lesson.

Needs are things like oxygen, water, and food. Technically speaking, humans don’t need shelter and clothing — they’re simply contrivances that allows us to extend our habitat range. For the sake of this discussion, however, I will put those into the “need” category. Most people will find themselves arrested without clothing, so it’s probably OK to lump it into the “need” category.

Next, I need to point out that a large chunk of what we spend money on is a straight up a waste. The irony never ceases to amaze me when a low-income individual complains about their finances while smoking two packs a day.

So let’s see how to go about living comfortably on $10.10 per hour. I’ll make the assumption that such a person is working 40 hours per week. That’s $404 gross per week, $21,008 per year, $1750 per month. For reference, this is about equal to the US Health & Human Services federal poverty level for a family of three.

Now, let’s start spending!

First, let’s deal with Uncle Sam’s cut. The average American earning $21,000 per year actually has a negative effective tax rate. In other words, due to such things as the Earned Income Credit and the Child Tax Credit, the average low-income worker doesn’t actually pay income taxes, but rather receives a refund for free. In other words, low income people, especially those with children, receive a tax refund via money actually paid in by higher income individuals. This is a wealth distribution mechanism, pure and simple. According to the IRS, the average Earned Income Tax Credit paid out in 2016 was $2,455 per person, and a total of over $67 billion in taxpayer dollars was redistributed to low income families.

For the sake of argument, we’ll consider that this is a single person with no children. For 2017, that makes their combined personal exemption and standard deduction equal to $10,400. This person is not eligible for the EIC or CTC, and thus their taxable income is $10,608 for the year. Federal income tax on this is $1,125, for an effective income tax rate of 5.4%.

Jane Doe now has $19,883 left for the year.

Oh, but let’s not forget Social Security and Medicare. That’s going to eat up another 7.65%, or $1607, from Jane’s paycheck. That leaves her with $18,276 for the year, and an effective federal tax rate of 13%.

State and local taxes are also going to take a bite. The national average for all income earners, of all wage levels, is just under 10% for state and local taxes. I prefer living in states with no state income tax, but others don’t hold that view. Since there is such a wide range of possibilities, I’m going to pick my old home state of Colorado and say that Ms. Doe is paying 4.65% to the state, or $493, on her federal taxable income.

Add that all up, and we see that she’s paying $3,225 in federal and state wage taxes. That’s a combined effective tax rate of 15.3%. Don’t try comparing this number to other articles you find online, because most sources are only taking income taxes into consideration when running these numbers, which simply isn’t accurate.

So Jane is now down to living on $17,783 for the year after taking into consideration the government’s cut. Let’s look at what is normally the biggest chunk of any person’s spending: Housing.

Too many people, when looking at these scenarios, grossly overestimate the housing level required to be comfortable. To put it bluntly, Jane doesn’t need her own apartment. She might want her own apartment, but she sure as hell doesn’t need it. In fact, this becomes particularly important when we look at Jane’s desire to build a multi-million dollar real estate portfolio.

Jane needs some time to save up for her Nomad down payment and closing costs. So for now, let’s have her rent a room in somebody’s home. A quick look on Craigslist shows me quite a few rooms for rent in the $350 to $900 per month range. Let’s pick something for $450, in a nice home living with a married couple without kids. That’s $5400 per year to live quite comfortably by global standards. It’s also not bad for a city like Denver, where the cost of housing index is 85% higher than the US national average.

Jane is now down to just $12,383 per year to live on. Let’s talk about getting around town.

I just checked, and Jane can get an RTD monthly pass for $1,089 per year. This will allow her to get back and forth to work, go get groceries, visit friends, etc. The Denver bus system is quite good by American standards, and Denver has a growing light rail system, also.

I know what some people are saying. “Hold on partner, you expect her to take the BUS?” Yes, that’s correct.

For a city dweller in particular, owning a car is a totally unnecessary luxury. That’s a blasphemous statement in the United States, to be sure, but it’s true. In some cities, such as New York City, it’s more normal not to own a car, but in general, this would be “strange” in most cities.

Cars are a tremendous expense. Even though gas prices are going down, there’s the cost of acquisition, maintenance, parking (in some places), etc. The IRS National Standards allow for a whopping $471 per month car payment and, for Denver, $213 per month in operating costs. These standards, used for calculating ability to pay back tax debts, represent a “middle class” American lifestyle.

Do you realize how much money that is? That’s over $8,200 per year in expected vehicle costs. That’s insane. For several years, I got by just fine without owning a car (granted, I had a motorcycle, which is far cheaper to own and operate, but it mostly just sat in storage). For the types of errands that most Americans run, we do so very inefficiently. By planning ahead and clumping our trips, taking the bus is just fine.

Jane is now down $11,294 to live on. Let’s talk food.

As somebody that’s done it, I can tell you how easy it is to spend $900 per month, as a single person, on food. This is accomplished by eating out for every meal. It’s very easy to do.

What’s also easy, also speaking from experience, is to just cook at home and make simple meals. Simple, healthy meals really aren’t that expensive. I personally believe that the slow cooker is one of the greatest inventions ever. Ten bucks worth of ingredients in the slow cooker can easily feed me for three or four days.

Taking this into account, plus a number of other articles I found online in a super simple Google search, proves my point that a single person can eat quite well on as little as $100 per month. Really, really well on $200 per month — this is about what I currently spend myself. So let’s cut the difference and give Jane a $150 per month food budget.

Jane is now down to $9,494 per year to live on.

Let’s talk health insurance, now that it’s required by law. Jane’s situation qualifies her for a $177 per month Premium Tax Credit to help pay for health insurance. On the Colorado Healthcare Exchange, her cheapest plan is going to run $206 per month (just two years ago, it was $107 per month). Minus the credit, that’s only $29 per month for health insurance, or $348 per year.

This brings Jane down to $9,146 to live on for the year.

What else does Jane need?

Nothing. Jane doesn’t need anything more.

I’m making an assumption here that Jane has a wardrobe already. If Jane is smart, she’ll recognize the fact that she doesn’t need to spend hundreds of dollars per month on clothes that will just sit in her closet anyway (I’ve read studies showing that, on average, Americans never wear 3/4 of the clothing they own). Maybe Jane needs to replace a worn out piece of clothing occasionally, but this will be only a few hundred dollars per year, at most. Even less if she shops at thrift stores.

Note that I’m not going to the super-extreme here. There are other blogs, such as this one, that advocate mending your own clothing, darning socks, etc. Most people aren’t going to be willing to do that. I know I’m not.

Jane’s going to probably purchase personal care items like soap and deodorant. I’m not suggesting giving those up. But, at most, these items shouldn’t run more than a couple hundred bucks per year.

We’re also going to assume that Jane has no debt. In this scenario, Jane is in her early to late 20’s, and that she’s averse to consumer debt, as she should be.

I used to be a total moron in this regard. Absolute idiot. Dumbest person on the planet. To the point of bankruptcy. I’m not proud to admit it, but filing for Chapter 7 bankruptcy is one of the smartest financial moves I ever made, because now I’m debt free.

But we’re going to assume that Jane is smart, and doesn’t have any debt. Not even student loans, because she didn’t think she could afford college, and her parents didn’t have the money to send her, either.

So look at what we just laid out. Jane is making $10.10 per hour, the new minimum wage for federal employees. I even made her pay for her own health insurance, just in case she’s just a federal contractor and doesn’t get health insurance at work. Jane lives in a room in a nice house in suburban Denver, and pays her own way in life. She earns over $9,000 per year more than she actually needs to live on.

You’ll notice that there are some things Jane doesn’t have. For example, a cell phone. With many cell phone plans breaking the $100 per month mark, this service is yet another example of the extravagance of Western life, and it’s a needless expense.

Blasphemy, yes. But really, it’s true. Jane doesn’t need to be reached at a moment’s notice. She doesn’t need to check Facebook every two seconds. Jane can spend time with her friends face to face. Heck, she can buy the first round of beer because she’s not paying for a cell phone. Ya’ know, the way life was 20 years ago, when hardly anybody had a cell phone.

Does this mean she doesn’t have one? No, it doesn’t. Jane likes the security of being able to call a cab if her friends ditch her at the bar, or to quickly check the bus schedule if she’s on an unfamiliar route. She also calls her mom once a week for half an hour.

Well, guess what? That level of realistic talk and data can be had with a $20 phone and about $20 per quarter in pre-paid cell phone cards. I’m a tax consultant and marketing consultant, for crying out loud — you know, somebody that spends a fair amount of time on the phone — and this is the type of cell phone service I use.

With all this said, and even some cash here and there for entertainment or a round of drinks, the math clearly shows that Jane has well over $8,000 per year extra to do with as she pleases.

The point of all this math was to counter Sen. Rubio’s comment that a person can’t get ahead on $10.10 per hour. Well, using this calculator I was able to determine that full-time attendance at Front Range Community College in Colorado will cost Jane $5,338 in tuition and books. Interestingly, the same calculator states that, since she’s low-income, she’ll receive $8,275 in grant aid (NOT LOANS). This covers her full cost of college.

This handy calculator from the college shows something else pretty awesome. It says that Jane’s room and board cost is only $9,603, plus gives her an allowance of over $5,000 for transportation and miscellaneous expenses. Jeesh, those numbers look familiar, don’t they?

The reality here is that Jane can pay her own way through college at FRCC while working her $10.10 per hour job, even without grant money. She has the cash from her job to do this. BUT, because she gets the grant aid, some much more interesting possibilities open up if Jane saves that $9,000 per year that she has left over. We’ll get to that in a moment.

Is her schedule going to be hectic? Yes, it is. Is she going to be tired, and have to sacrifice having an iPhone 7 and a daily latte? Yes on all counts.

But come on, those aren’t sacrifices. They’re luxuries. And since Jane wants to get ahead in life, she’s going to spend her nights and weekends going to class and studying. She’s going to apply herself, and avoid wasting money on needless spending. If necessary, she’ll make two trips to work each day in order to accommodate a class she needs for her academic program that is only offered mid-day. (Although it should be noted that many of FRCC’s career certificate programs can be completed entirely via evening classes.)

When she finishes her certificate program, Jane will earn $12 to $20 per hour as a welder, LPN, computer technician, etc. These are one year or less certificate programs. After her career change and significant salary increase, Jane may decide to pursue her Bachelor’s degree in her spare time. Or maybe not, because now she has a valuable skill and a career.

This is how Jane gets ahead on $10.10 per hour. In fact, based on these numbers, and using financial aid, Jane can actually get ahead in life on pure minimum wage.

Oh, but what if Jane is a single parent? Doesn’t that change the equation? Yes, of course it does. Maybe Jane is going to have to suffer the indignity of living at home with her parents for a couple more years (which many 20-somethings are doing already anyway). Maybe she’ll have to work a swing shift job while her father watches her child in the evening, and she can only take two or three classes at a time. Regardless, Jane can still get ahead in life by making the right choices — even on minimum wage.

Bottom line: The assertion that somebody can’t get ahead on a low income is just plain incorrect.

Now let’s take things a step further, and demonstrate how Jane can actually build wealth on her $10 per hour wage.

We’ve already demonstrated that Jane’s tuition and fees can be fully covered by grants and the Colorado Opportunity Fund. So that’s taken care of. Instead of a room in somebody’s else, let’s put her into a small apartment with a roommate. There are plenty of decent apartments in the Denver suburbs that are in the $1000-$1200 per month range. Let’s split the difference, and move her into an $1100/mo apartment in Northglenn that I found right now on Craigslist, or $550/mo for her half. Let’s say they skip cable TV, turn the lights off when not in use, and throw on a sweater instead of jacking the heat up to 72 in the winter. Let’s estimate utilities at $100, for a total housing cost of $650/mo. Although substantially higher than the previous scenario, the extra $2400 per year is well within her budget.

Why do this?

Because Jane has spoken to a mortgage lender about the FNMA Homeready program. The program allows low income homebuyers to purchase a home and use a roommate’s monthly rent to apply toward qualifying income. The roommate rent can be up to 30% of the total gross income used for qualification. In addition, the presence of the non-borrower household income can be used as a compensating factor that allows going up to a 50% debt to income ratio.

If Jane’s roommate sticks around for a full year, and agrees to move in and continue paying rent as a roommate after Jane buys a house, then a fascinating thing happens. Including the rent payment from the roommate, Jane can qualify for a mortgage payment up to $1250 per month, including principal, interest, taxes, and insurance (PITI). This allows her to buy a house up to about $195,000 — plus she had the full year with the roommate to save up for down payment and closing costs, which together will cost roughly $9,000. Remember that number from earlier?

So this means that… Wait for it… 12 months of living in a cheap apartment with a roomie allows a $10/hr worker to buy a decent house.

This is all assuming no other debt and spotless credit.

Are there single family, non-manufactured homes available in the greater Denver? Yes, yes there are.

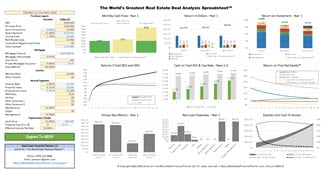

Jane can now pursue the low down payment Nomad model, and buy a new home each year to build her multi-million dollar real estate portfolio. As she finishes her education, her income will go up, improving her ability to qualify for future mortgages.

So there you have it. Real math showing that low income, non-college educated individuals can not only squeak by, but actually build a multi-million dollar real estate portfolio over the course of their life working entry-level jobs.

People who say it cannot be done should not interrupt those who are doing it.