Are 2 to 3 Rental Properties

Enough to Retire Comfortably

in Northern Colorado?

February 7, 2019

Dear Northern Colorado Real Estate Investor…

Can you retire comfortably in Northern Colorado on 2 to 3 rental properties?

It seems like such a simple question, but it is more nuanced than you might imagine. I’ve been teaching real estate investing classes in Fort Collins since 2003—about 40 different classes each year covering topics from asset protection to deal analysis to bookkeeping for rentals to financing to tenant screening and property management to local market stats and achieving financial independence and retiring early (FIRE). You can attend these classes for free near Drake/Shields in Fort Collins just about every Wednesday and even access previously recorded versions of them or listen to them on the go via our podcast. More info on that in a bit. Back to our story for now…

Do you know one of the things I learned teaching weekly classes and talking to hundreds of real estate investors over that time? Your financial situation is different than most other people. Sure there are similarities, but your income, your tax situation, your charitable giving desires, your extended family of children, grand-children, parents and loved ones, your starting assets and your desired standard of living in retirement are all unique to you.

And, these nuanced personal differences impact the answer to questions like Can you retire comfortably in Northern Colorado on 2 to 3 rental properties? or Can you retire comfortably in Northern Colorado on $1 million?

Heck, your numbers may not even be 2 to 3 rentals. Maybe you already have 5. Or, it might not be can I retire on a million… maybe it’s: can I retire on far less?

Of course, the answer depends on your unique situation and the assumptions you make. I don’t know about you, but I find it annoying when I click through to an news article or listen to a podcast about investing or retiring and they give such a generic example that it is hard to figure out exactly how that even applies to me and my personal situation. Click-bait titles like: “this simple trick to retiring in your 30’s”, or “how johnny went from $0 to retired in 10 years” only lead me to stories of people working $500,000 per year jobs and saving 90% of their income. I could retire in 10 years too if I was saving $450,000 per year for 10 years. So frustrating…

What about the rest of us? Over the years teaching investor classes, I began writing software that would allow us to run what-if scenarios to model a variety of investing strategies and plans. With your permission, I am going to share with you links to be able to copy some of the more common paths to some common goals, but I will be empowering you to change the assumptions to match your personal situation and see how that plan might work for you and your personal assumptions.

We’ll get to the real estate ones in a moment, but let’s first start with a couple basic ones modeling you saving and investing in stocks.

Model Your Personal Situation: Investing $100/mo in Stocks

For this first strategy, we’re going to assume that you’re saving $100 per month and investing in the stock market. The $100 per month is a variable that you can change. I’d rather not sound like a parrot constantly repeating myself that “you can modify each assumption”. Rather than repeat myself incessantly, I will show you numbers that you can easily adjust by include Variable By You after each number that you can adjust to match your unique situation. OK?

So, we’re going to assume this strategy is for you to save $100 Variable By You and earn 8.97% Variable By You per year when invested in the stock market.

Here are some of my other assumptions for this (again, you can adjust these to better match your situation).

- Starting with $0 Variable By You invested in the stock market at the beginning – vary this to see what impact starting with some money at the beginning has when you can retire. What if you do have a small nest egg or a full war chest already? Easily adjust how much you’re starting with by changing the Opening Balance on the

VTSMX with CAGR of 8.97% over 1871-2017 account to the amount you currently have. Easy… now the system will allow you to re-run it and see how that impacts the results of your strategy.

VTSMX with CAGR of 8.97% over 1871-2017 account to the amount you currently have. Easy… now the system will allow you to re-run it and see how that impacts the results of your strategy. - Earning $48,000 per year Variable By You – This is based on you and your spouse earning $12 per hour and working 2,000 hours per year each. 2,000 hours × $12 = $24,000 for you and another $24,000 for your spouse = $48,000 per year. What happens if you make more? What if you’re single? What if you earn less? What if you work two or more jobs or have a side hustle? Just adjust the Paycheck field on the

Paycheck and Personal Expenses rule to change this assumption.

Paycheck and Personal Expenses rule to change this assumption. - Effective Income Tax Rate of 17.49% Per Year Variable By You – This is based on married filing jointly for that $48,000 per year earnings, with exemptions for you and your spouse, but no other deductions. This is both federal tax and state of Colorado tax combined. What if you’ve got deductions or are in a different tax bracket than our assumptions? Easy… just change the Tax Rate on the

Paycheck and Personal Expenses rule.

Paycheck and Personal Expenses rule. - Target Monthly Income in Retirement of $3,900 Variable By You – This is the $4,000 per month that you’re earning minus the $100 Variable By You per month that you’re saving. If you’re earning $4,000 Variable By You and saving $100 you’re really living on $3,900 per month so this is the target to maintain your current lifestyle in retirement. The software will automatically adjust this number for inflation for you. What if you could live on less in retirement? What if your expenses in retirement will be higher? Change the Target Monthly Income in Retirement field on the

Saving $100/mo in Stocks scenario edit page and see the impact when you rerun it.

Saving $100/mo in Stocks scenario edit page and see the impact when you rerun it. - Yearly Safe Withdrawal Rate of 4% Variable By You – This is the percent of your stock market investments that you feel you can safely withdraw each year and not run out of money in retirement. It is kind of an important assumption. We’re using the assumption from the “Trinity Study” here, but some would argue you may want to be more conservative and use 3.25% or even 3%. How does this work? When you your stock market balance has enough money that 4% of it would be greater than or equal to your target income in retirement (for the year), then you’ve reached financial independence where your assets can provide you an income to be able to live your passion and/or retire. What happens if you’re OK running out of money in retirement and want to use a higher safe withdrawal rate than 4%? What if you want to be conservative and use a lower number like 3% or 3.25%? To adjust your assumption from our 4%, change the Yearly Safe Withdrawal Rate on the

Saving $100/mo in Stocks scenario edit page.

Saving $100/mo in Stocks scenario edit page. - Inflation is 3% Per Year Variable By You – $1,000,000 today is not the same as $1,000,000 in thirty years. This is inflation. We’re using an inflation rate of 3% because the long-term US average of CPI has been in the 3% range. Some people believe we may see hyper-inflation. Do you? Some people believe we may see lower inflation. Do you? It is easy to change… just edit the Inflation Rate on the

Saving $100/mo in Stocks scenario edit page. I’m getting ahead of myself, but you can even model periods of high inflation where inflation is higher for a period of time then returns to more common levels using

Saving $100/mo in Stocks scenario edit page. I’m getting ahead of myself, but you can even model periods of high inflation where inflation is higher for a period of time then returns to more common levels using  Rules… everything is customizable and set by you.

Rules… everything is customizable and set by you. - Your Paycheck and Personal Expenses Are Increasing With Inflation Variable By You – We are assuming that your expenses are increasing each month with the inflation rate. As is your income. As is your target income in retirement. As is the $100 Variable By You you save each month. You can choose to turn off each of these if you wish. I wouldn’t personally, but that’s the beauty of this software… it allows you to model your perception of reality and not have to deal with the generic garbage you find in articles, blog posts and podcasts across the internet. To change whether these values adjust with inflation just toggle the Inflation Adjusted checkbox on the

Paycheck and Personal Expenses rule page.

Paycheck and Personal Expenses rule page. - Run The Strategy for 720 Months (60 years) Variable By You – This should give you some time to see the results, but if you’re younger than 40 years only, I’d personally adjust this to run until you’re 100 if you think you’ll live that long. What happens if you live past 70? 80? 90? 100? 110!? Change the Number Of Months variable on the

Saving $100/mo in Stocks scenario edit page. Rerun it and see the newest results.

Saving $100/mo in Stocks scenario edit page. Rerun it and see the newest results.

So, is saving $100 Variable By You and investing in the stock market earning 8.97% per year Variable By You enough to allow you to retire comfortably in Northern Colorado? The answer will likely surprise you. Use the button below to copy this  Scenario into your own Real Estate Financial Planner™ account and run it as is or change any or all of the assumptions to better model your unique personal situation.

Scenario into your own Real Estate Financial Planner™ account and run it as is or change any or all of the assumptions to better model your unique personal situation.

This  Scenario

Scenario

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

If you believe this is an error and should be available to copy, please contact support and include a link to this page.

So, how was it? Did you have enough to retire comfortable? How did you know?

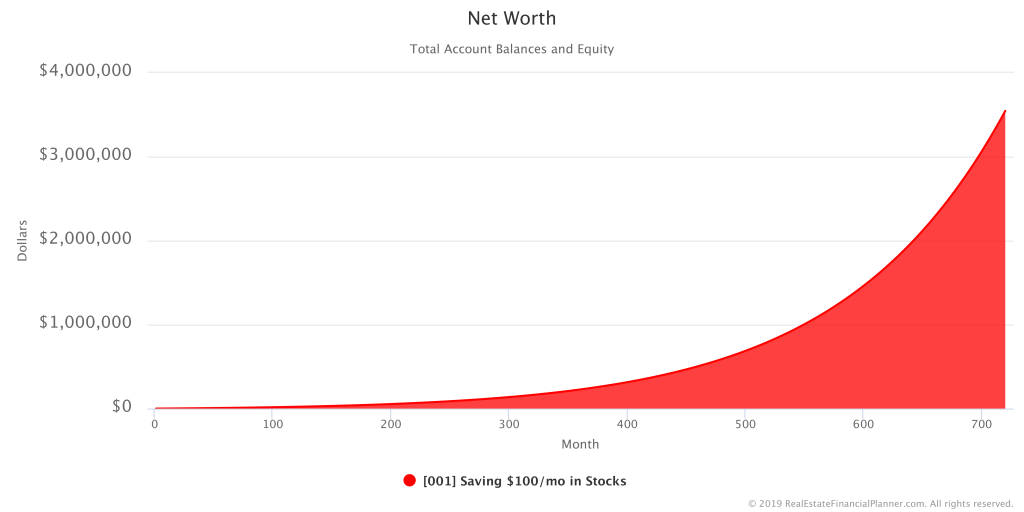

Net Worth

Did you look at the  Chart of Net Worth? How much did you end up with?

Chart of Net Worth? How much did you end up with?

How Do I View Charts? If you need help figuring out how to view charts, check out our help section on that. We have 100+ different  Charts you can view to give an unparalleled insight into any investing strategy.

Charts you can view to give an unparalleled insight into any investing strategy.

Did your Net Worth number seem higher than you thought it was going to be? Remember, $1 million 60 years in the future isn’t the same as $1 million today. Did you click on the Inflation Adjusted button on your Net Worth  Chart to see what that Net Worth is in today’s dollars? Was that eye-opening? Big difference, right?

Chart to see what that Net Worth is in today’s dollars? Was that eye-opening? Big difference, right?

Did You Achieve Financial Independence?

Did you have enough invested in stocks such that, at 4% safe withdrawal rate Variable By You, the returns from stocks could provide you enough income to cover your Target Monthly Income in Retirement? How did you know?

Did you look at your  Goals and specifically the

Goals and specifically the  Goal of Safe Withdrawal Rate and Cash Flow Toward Target Monthly Income in Retirement? That will will show you what percent of your

Goal of Safe Withdrawal Rate and Cash Flow Toward Target Monthly Income in Retirement? That will will show you what percent of your  Goal of hitting your Target Monthly Income in Retirement you’ve achieved.

Goal of hitting your Target Monthly Income in Retirement you’ve achieved.

When you’ve achieved 100% of that  Goal, you’ve reached the point where the income from your safe withdrawal rate and any cash flow from rentals (you don’t have any in this

Goal, you’ve reached the point where the income from your safe withdrawal rate and any cash flow from rentals (you don’t have any in this  Scenario) is meeting your full Target Monthly Income In Retirement. Is that financially independent for you? Everyone has their own definition you know.

Scenario) is meeting your full Target Monthly Income In Retirement. Is that financially independent for you? Everyone has their own definition you know.

Before we get to more sophisticated real estate modeling, let’s do one more common examples with stocks. We can always come back to do different modeling with stocks later.

Model Your Personal Situation: Investing 10% of Your Income in Stocks

In this next  Scenario, we’re going to assume you’re saving 10% of your income Variable By You and investing it in stocks. This is up from the $100 per month you were invested before. Does that make a big difference? How much of a difference does it make?

Scenario, we’re going to assume you’re saving 10% of your income Variable By You and investing it in stocks. This is up from the $100 per month you were invested before. Does that make a big difference? How much of a difference does it make?

We are using the same assumptions as above (the parrot says: which you can still modify), except:

- Target Monthly Income in Retirement of $3,600 Variable By You – This is the $4,000 per month that you’re earning Variable By You minus the 10% per month that you’re saving Variable By You. If you’re earning $4,000 and saving $400 you’re really living on $3,600 per month so this is the target to maintain your current lifestyle in retirement. The software will automatically adjust this number for inflation for you Variable By You. What if you save more or less? To change how much you’re saving adjust your Personal Expenses on the

Paycheck and Personal Expenses rule.

Paycheck and Personal Expenses rule.

Is saving 10% of your income Variable By You and investing in the stock market enough to allow you to retire comfortably in Northern Colorado? Copy this  Scenario saving 10% of your income into your own Planner™ and change any of the assumptions to fit your own personal situation.

Scenario saving 10% of your income into your own Planner™ and change any of the assumptions to fit your own personal situation.

This  Scenario

Scenario

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

If you believe this is an error and should be available to copy, please contact support and include a link to this page.

Now that you’ve had a chance to view it. Here are some questions for you:

Did You Reach Your Target Monthly Income in Retirement?

How much faster did you achieve financial independence by saving 4 times as much ($100 versus 10% or $400 per month) Variable By You? Did you check the  Goal chart? What did it tell you?

Goal chart? What did it tell you?

What’s Your Net Worth Saving 10% of Your Income?

What does your Net Worth  Chart show you?

Chart show you?

How much more (or less) is it than the previous  Scenario?

Scenario?

If you adjust for inflation by clicking on the Inflation Adjusted button on the  Chart page, how much is it like having in today’s dollars?

Chart page, how much is it like having in today’s dollars?

What If You Save More or Less Than 10%?

What if you save 15% or 20% of your income? Or… more? Reduce your personal expenses in your  Paycheck and Personal Expenses rule and adjust your Target Monthly Income in Retirement and rerun the

Paycheck and Personal Expenses rule and adjust your Target Monthly Income in Retirement and rerun the  Scenario. How much faster do reach financial independence?

Scenario. How much faster do reach financial independence?

Model Your Personal Situation: Buying a Home to Owner-Occupy and Investing 10% of Your Income in Stocks

We will eventually loop back around to stocks when we talk about  Monte Carlo modeling later, but let’s change it up.

Monte Carlo modeling later, but let’s change it up.

In this next  Scenario, we are going to add in your first property… a home for you to live in.

Scenario, we are going to add in your first property… a home for you to live in.

We will use the same assumptions for saving 10% (which you can still modify… remember the parrot?), except we’ve added these additional assumptions that you can also modify:

- Save up $5,000 Variable By You in Cash Reserves Plus Down Payment, Plus Closing Costs Before Buying

Property – This is the $5,000 that you have in cash reserves for emergencies. Need more? How much will that impact your ability to achieve financial independence? Adjust the Minimum Account Balance field in the

Property – This is the $5,000 that you have in cash reserves for emergencies. Need more? How much will that impact your ability to achieve financial independence? Adjust the Minimum Account Balance field in the  Buy

Buy  Property When

Property When  Account Has Down Payment to find out.

Account Has Down Payment to find out. - Your Rent is $1,500/month Variable By You Until You Buy A

Property To Live In – Once you buy a property, you’re rent of $1,500 is removed from your expenses and the actual cost of the mortgage, taxes and insurance are included as expenses. What if your rent is higher than $1,500? Or, lower? Does that have any impact? Adjust the Dollar Adjustment After Buying Owner Occupant Property field in the

Property To Live In – Once you buy a property, you’re rent of $1,500 is removed from your expenses and the actual cost of the mortgage, taxes and insurance are included as expenses. What if your rent is higher than $1,500? Or, lower? Does that have any impact? Adjust the Dollar Adjustment After Buying Owner Occupant Property field in the  Paycheck and Personal Expenses after copying it to your Planner™ to find out.

Paycheck and Personal Expenses after copying it to your Planner™ to find out.

These are the assumptions we made about the home you bought to live in. Again, these are all Variable By You… meaning you can change any of them.

| Variables | Typical Home 5% DP |

|---|---|

| Property Type | Dynamic Nomad™ |

| After Repair Value | $300,000 |

| Purchase Price | $300,000 |

| Appreciation Rate | 3% |

| Down Payment | 5% |

| Closing Costs | 2.5% |

| Mortgage Interest Rate | 4.375% |

| Mortgage Term | 360 months |

| Monthly Rent (If Rented) | $1,800 |

| Rent Appreciation Rate | 3% |

| Vacancy Rate | 3% |

| Maintenance Rate | 10% |

| Property Taxes Rate | 0.7% |

| Property Insurance Rate | 0.4% |

| Residential/Commercial | Residential |

| Land Value Percent | 15% |

I will comment on a few of the assumptions we made about your  Property.

Property.

- You’re buying a $300,000 Variable By You home in Northern Colorado. – You can buy less expensive homes locally, but our entry-level price point has been rising rapidly. You can modify Purchase Price and After Repair Value by editing the

Property to change these assumptions.

Property to change these assumptions.  Property Values are Appreciating at 3% per Year Variable By You – The last few years make that number seem ridiculously low. Over a long period of time, that number is pretty close to what we’ve seen on average. Of course, feel free to model it the way you see the world by changing Appreciation Rate on the

Property Values are Appreciating at 3% per Year Variable By You – The last few years make that number seem ridiculously low. Over a long period of time, that number is pretty close to what we’ve seen on average. Of course, feel free to model it the way you see the world by changing Appreciation Rate on the  Property edit page for this

Property edit page for this  Property. And, if you’re super advanced, you can actually use additional

Property. And, if you’re super advanced, you can actually use additional  Rules to change the Appreciation Rate over time. You can model a market dip for a period of months or years or growth then a dip or growth then a dip then more growth… really it is up to you. With

Rules to change the Appreciation Rate over time. You can model a market dip for a period of months or years or growth then a dip or growth then a dip then more growth… really it is up to you. With  Monte Carlo modeling, we can run hundreds of variations with a range of Appreciation Rates, Rent Appreciation Rates, stock market rates of return and much more. Again, I am getting ahead of myself here.

Monte Carlo modeling, we can run hundreds of variations with a range of Appreciation Rates, Rent Appreciation Rates, stock market rates of return and much more. Again, I am getting ahead of myself here.- 5% Down Payment Variable By You – We are assuming you’re getting a 5% down payment mortgage. There are nothing down loan programs now so you could technically do 0% down. And, I am assuming you’ve opted to save up a little more and do a single up-front private mortgage insurance (PMI) payment Variable By You instead of paying the PMI monthly. You could do either… insert parrot here. Adjust the Down Payment Percent field on the

Property edit page to change this. And, adjust the Closing Costs Percent if you’ve been quoted different closing costs or decide to do PMI a different way (there are 3 ways to do it you know… we cover those in the classes on financing which you have access to).

Property edit page to change this. And, adjust the Closing Costs Percent if you’ve been quoted different closing costs or decide to do PMI a different way (there are 3 ways to do it you know… we cover those in the classes on financing which you have access to). - Mortgage Interest Rate of 4.375% Variable By You – I am also assuming you’re able to get a mortgage for 4.375% Variable By You. That’s based on a quote from a lender right before I write this. What if this out of date by the time you read this? Oh yeah… that’s right… you can modify all this stuff… so it doesn’t matter. You just use what your lender is quoting you. Adjust the Mortgage Interest Rate on the

Property edit page.

Property edit page. - We’re not using your Monthly Rent, Rent Appreciation, Vacancy Rate, Maintenance Rate becauses we’re not renting the

Property in this

Property in this  Scenario. We will add a rental

Scenario. We will add a rental  Property next! and then we will use those assumptions. Since we’re not renting the

Property next! and then we will use those assumptions. Since we’re not renting the  Property, it doesn’t matter if it is a residential or commercial type of property or what the % of the property purchase price is considered the value of the land for the tax benefits of depreciation.

Property, it doesn’t matter if it is a residential or commercial type of property or what the % of the property purchase price is considered the value of the land for the tax benefits of depreciation.

Does buying a home to live in locally speed up how quickly you’re able to achieve financial independence? Copy it to your own Planner™ and see for yourself. Go look at your  Goals

Goals  Charts and see for yourself.

Charts and see for yourself.

This  Scenario

Scenario

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

If you believe this is an error and should be available to copy, please contact support and include a link to this page.

Now that you’ve had a chance to view it. Here are some questions for you:

How Long Did You Need To Save To Buy Your Home?

How long did it take you to save up to buy a home? Did you check out the  Chart of Number of Properties Owned? That shows you when you buy each

Chart of Number of Properties Owned? That shows you when you buy each  Property and how many

Property and how many  Properties you own in total (1 in this

Properties you own in total (1 in this  Scenario).

Scenario).

This  Chart be especially cool

Chart be especially cool  Chart to look at later when we’re acquiring several

Chart to look at later when we’re acquiring several  Properties at different times.

Properties at different times.

Faster Financial Independence?

So, did buying a home instead of renting speed up your journey to financial independence? Could you retire or live your passion earlier? How much earlier? Did you check out the  Chart of your

Chart of your  Goals to see it for yourself?

Goals to see it for yourself?

Did you make any changes to the assumptions? How did that impact the speed of your journey?

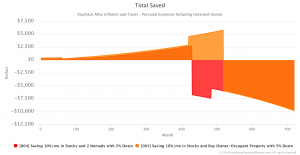

Personal Expenses and Your Standard of Living in Retirement

Did you look closely at the  Chart showing Personal Expenses Including Real Estate?

Chart showing Personal Expenses Including Real Estate?

Did you see the slight increase in personal expenses from buying a personal residence? Did you see what happens though when you pay off your mortgage?

If you’ve been used to living a $3,600 per month Variable By You lifestyle which includes your housing expenses (rent or mortgage, taxes, insurance) and you no longer have a rent or mortgage payment, what does that do to your standard of living? With lower required housing expenses, are you living a higher standard of living or lower? Interesting, right?

Did you also look at the  Chart showing Total Saved? If you maintain the same standard of living (until you retire) and invest what was the mortgage payment, how does that impact your situation? This

Chart showing Total Saved? If you maintain the same standard of living (until you retire) and invest what was the mortgage payment, how does that impact your situation? This  Chart can help answer questions like: What happens to your savings when you buy your house? What happens to your savings rate when you no longer have a mortgage payment? What impact on your ability to achieve financial independence does that have? I’d encourage you to explore them and see.

Chart can help answer questions like: What happens to your savings when you buy your house? What happens to your savings rate when you no longer have a mortgage payment? What impact on your ability to achieve financial independence does that have? I’d encourage you to explore them and see.

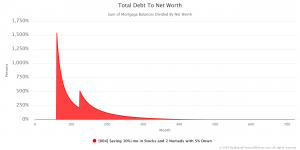

How Risky is Buying a House?

If you’re trying to measure risk, one way to do it is to look at the ratio of your debt to your overall net worth. Did you look at the  Chart showing Debt To Net Worth? How does it look buying just one

Chart showing Debt To Net Worth? How does it look buying just one  Property?

Property?

As you look at other  Scenarios, you will be able to compare this measure of risk across multiple strategies to get a feel for how much risk you’re taking on from debt compared to your net worth.

Scenarios, you will be able to compare this measure of risk across multiple strategies to get a feel for how much risk you’re taking on from debt compared to your net worth.

Your Growing Equity

Did you look at the  Chart of your Equity? There are several “flavors” of equity.

Chart of your Equity? There are several “flavors” of equity.

How about the  Chart of Sell With Agent Equity? That ones shows you how much you might net if you sold the

Chart of Sell With Agent Equity? That ones shows you how much you might net if you sold the  Property with a real estate broker and paid a 6% commission and 1% in closing costs.

Property with a real estate broker and paid a 6% commission and 1% in closing costs.

What about the  Chart of Cash Out Refi Equity? Did you see that one? That one shows you how much money you might be able to borrow from your

Chart of Cash Out Refi Equity? Did you see that one? That one shows you how much money you might be able to borrow from your  Property if you needed it assuming you could go up to 75% loan-to-value.

Property if you needed it assuming you could go up to 75% loan-to-value.

Of course, there is the  Chart showing the difference between what the

Chart showing the difference between what the  Property is worth and what you owe. That’s a plain-vanilla flavor of Equity.

Property is worth and what you owe. That’s a plain-vanilla flavor of Equity.

Net Worth: Are You A Multi-Millionaire?

What was your overall Net Worth? Did you look at the  Chart)?

Chart)?

Net Worth includes your stock market  Account balance plus your equity in any

Account balance plus your equity in any  Properties you own.

Properties you own.

Was your Net Worth more or less than not buying a  Property? With a Premiumn you can compare

Property? With a Premiumn you can compare  Scenarios on the same

Scenarios on the same  Chart side-by-side.

Chart side-by-side.

Model Your Personal Situation: Add A Rental Property!

What if you do the same plan we just discussed above, but with one little addition. After you move into your  Property, you continue to save your money for your next owner-occupant home. When you finally save up enough to buy your second owner-occupant

Property, you continue to save your money for your next owner-occupant home. When you finally save up enough to buy your second owner-occupant  Property, you covert the first property to a rental and move into the new

Property, you covert the first property to a rental and move into the new  Property.

Property.

We call this strategy of buying owner-occupant  Properties and eventually converting them to rentals the Nomad™

Properties and eventually converting them to rentals the Nomad™  strategy because you’re moving from house to house like a nomad on their woolly mammoth might have moved from cave to cave.

strategy because you’re moving from house to house like a nomad on their woolly mammoth might have moved from cave to cave.

We have probably half-a-dozen two-hour-classes specifically on the Nomad™ strategy that you can access from inside your Planner™ and probably dozens more classes that mention or discuss Nomad™. It is an important strategy because it is one of the best strategies my clients are using in Northern Colorado to acquire  Properties with little or nothing down and then eventually converting them to rentals to build their passive income from rental

Properties with little or nothing down and then eventually converting them to rentals to build their passive income from rental  Properties.

Properties.

FREE Real Estate Investing Classes and FREE Nomad™ Book

We’d love for you to attend our FREE real estate investing classes near Drake and Shields in Fort Collins on just about every Wednesday evening. If you do decide to attend as my guest, I’ll even give you a copy of book on the Nomad™ strategy I wrote. Again, the classes and the book are FREE. I’ll send you an invite to the next class after you copy any  Scenario to your Planner™.

Scenario to your Planner™.

Back to this  Scenario: with this new

Scenario: with this new  Scenario you end up buying two

Scenario you end up buying two  Properties. The first one you bought and lived in. Then, once you buy the second

Properties. The first one you bought and lived in. Then, once you buy the second  Property, you convert the first one to a rental.

Property, you convert the first one to a rental.

All of the previous assumptions are still exactly the same. And, by now, you also know that you can modify any of the assumptions anyway.

In a moment I will provide you with links to copy  Scenarios with 3 and 4 Nomad™

Scenarios with 3 and 4 Nomad™  Properties (that would be 2 and 3 rentals respectively) so you can just copy them. But, you could just as easily modify the Maximum # of this Dynamic

Properties (that would be 2 and 3 rentals respectively) so you can just copy them. But, you could just as easily modify the Maximum # of this Dynamic  Property to Buy in the

Property to Buy in the  Buy

Buy  Property When

Property When  Account Has Down Payment rule to buy more or fewer

Account Has Down Payment rule to buy more or fewer  Properties.

Properties.

Here’s the link to copy the 2 Nomad™  Property

Property  Scenario to your own Planner™. There’s quite a lot to see in this one since it is your first rental. Go ahead and copy into your Planner™ now using the button below.

Scenario to your own Planner™. There’s quite a lot to see in this one since it is your first rental. Go ahead and copy into your Planner™ now using the button below.

This  Scenario

Scenario

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

If you believe this is an error and should be available to copy, please contact support and include a link to this page.

Now that you’ve been able to copy it to your own Planner™ and dig in, here are some questions for you.

Faster Journey Toward Financial Independence with a Rental Property?

So, how much did a single rental  Property help you achieve financial independence? Was it significant?

Property help you achieve financial independence? Was it significant?

Did you check out the  Chart of

Chart of  Goals to see how many months it took you to hit your Target Monthly Income in Retirement number and get out of the rat race? What did you think: was that as interesting to you as it has been for me when I see the results? Did you use a Premium plan to be able to compare the number of months to other

Goals to see how many months it took you to hit your Target Monthly Income in Retirement number and get out of the rat race? What did you think: was that as interesting to you as it has been for me when I see the results? Did you use a Premium plan to be able to compare the number of months to other  Scenarios to see how big of a difference there was?

Scenarios to see how big of a difference there was?

Cash Flow From Rental Property

Are you concerned about the cash flow from the rental and jumped right into looking at those  Charts: in particular Cash Flow and True Cash Flow™?

Charts: in particular Cash Flow and True Cash Flow™?

The Cash Flow  Chart just shows you a full cash flow calculation for the

Chart just shows you a full cash flow calculation for the  Property for each month that you are renting it.

Property for each month that you are renting it.

That means taking all your income on the  Property—accounting for vacancy—then subtracting all your expenses on the

Property—accounting for vacancy—then subtracting all your expenses on the  Property like property taxes, property insurance, maintenance and property management. That’s if you had property management—we assumed you’re managing your property in this particular

Property like property taxes, property insurance, maintenance and property management. That’s if you had property management—we assumed you’re managing your property in this particular  Scenario. But, you know what I am going to tell you right… you can modify and add in property management by editing the

Scenario. But, you know what I am going to tell you right… you can modify and add in property management by editing the  Property and changing the Property Management field and re-running the

Property and changing the Property Management field and re-running the  Scenario to see the new results. Heck… with a Premium plan you can even run the

Scenario to see the new results. Heck… with a Premium plan you can even run the  Scenario with and without property management and compare them side-by-side… see for yourself how much faster or slower you achieve financial independence when you have a property management.

Scenario with and without property management and compare them side-by-side… see for yourself how much faster or slower you achieve financial independence when you have a property management.

*GASP* Negative Cash Flow!

Did you have negative negative cash flow at first? If you zoom in on the Cash Flow  Chart for first years what do you see? Is there negative cash flow on this

Chart for first years what do you see? Is there negative cash flow on this  Property?

Property?

Other  Charts to check are: Total Cumulative Negative Cash Flow and Total Invested in Rentals Including Negative Cash Flow. Each shows a slightly different perspective of cash flow.

Charts to check are: Total Cumulative Negative Cash Flow and Total Invested in Rentals Including Negative Cash Flow. Each shows a slightly different perspective of cash flow.

If you had put 20% down payment down and bought this  Property as a straight rental instead of putting only 5% down payment and living in the

Property as a straight rental instead of putting only 5% down payment and living in the  Property for a period of time before converting it to a rental… would it have had negative cash flow then? Change the assumptions by adjusting Down Payment Percent on the

Property for a period of time before converting it to a rental… would it have had negative cash flow then? Change the assumptions by adjusting Down Payment Percent on the  Property edit page and check for yourself.

Property edit page and check for yourself.

How about another question: if you did have negative cash flow, how much negative cash flow did you end up paying until cash flow became positive? Hint: go look at the  Chart of Total Cumulative (Invested and Negative Cash Flow). That

Chart of Total Cumulative (Invested and Negative Cash Flow). That  Chart will show you how much you invested total including any negative cash flow and the initial down payment. Now, after looking at this

Chart will show you how much you invested total including any negative cash flow and the initial down payment. Now, after looking at this  Chart, let me pose a question: if you had invested a full 20% down payment (which is going to be at least $60,000 in this case since the

Chart, let me pose a question: if you had invested a full 20% down payment (which is going to be at least $60,000 in this case since the  Property started at $300,000), would you have invested more by putting 20% down payment or 5% down payment plus all the negative cash flow? Another way of wording this same question is: did you invest more than $60,000 when you put 5% down payment and all the negative cash flow?

Property started at $300,000), would you have invested more by putting 20% down payment or 5% down payment plus all the negative cash flow? Another way of wording this same question is: did you invest more than $60,000 when you put 5% down payment and all the negative cash flow?

That’s an interesting question to pose for many folks. Even with a little bit of negative cash flow (if there is any), it may have required less of an investment from you than putting a full 20% down payment.

Of course, if you can find a  Property that is a good rental that does not have negative cash flow, buy those before you buy

Property that is a good rental that does not have negative cash flow, buy those before you buy  Properties with negative cash flow; that just makes sense. That’s not what we’re discussing here.

Properties with negative cash flow; that just makes sense. That’s not what we’re discussing here.

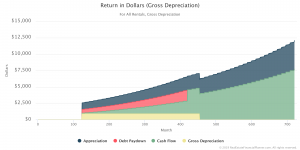

Is Cash Flow Really Negative?

Furthermore, even if you are showing negative cash flow… which you’ll need to check the  Chart to see… is it really money of pocket to you each month? Maybe, maybe not.

Chart to see… is it really money of pocket to you each month? Maybe, maybe not.

I told you above that we were going to ignore the tax benefits of depreciation for the  Property we were living in. But, when we have a

Property we were living in. But, when we have a  Property that we are renting, we do get tax benefits from owning rental

Property that we are renting, we do get tax benefits from owning rental  Property that we can depreciate.

Property that we can depreciate.

If you check the  Charts related to depreciation you can see the tax benefits we get from depreciation by owning this rental

Charts related to depreciation you can see the tax benefits we get from depreciation by owning this rental  Property.

Property.  Charts like Total Cumulative Depreciation. But you might be most interested in seeing what happens to when we look at what depreciation does when we multiply it by your Effective Tax Rate Variable By You and see how much extra cash in our pocket we get from being able to depreciate the buildings (not the land) on the rental

Charts like Total Cumulative Depreciation. But you might be most interested in seeing what happens to when we look at what depreciation does when we multiply it by your Effective Tax Rate Variable By You and see how much extra cash in our pocket we get from being able to depreciate the buildings (not the land) on the rental  Properties. I called this Cash Flow from Depreciation since it is money you get back by not paying taxes in your paycheck or money you get back at the end of the year by not having to pay taxes then; how you end up getting it depends on how you set up your exemptions on your paycheck.

Properties. I called this Cash Flow from Depreciation since it is money you get back by not paying taxes in your paycheck or money you get back at the end of the year by not having to pay taxes then; how you end up getting it depends on how you set up your exemptions on your paycheck.

When we talk about cash flow plus cash flow from depreciation and any capital expenses you have on the  Property, I call that True Cash Flow™. Did you look at the

Property, I call that True Cash Flow™. Did you look at the  Chart of True Cash Flow™? What did you see there? Did you have negative cash flow at all? Significantly less? Or, maybe it took slightly positive cash flow and made it more positive?

Chart of True Cash Flow™? What did you see there? Did you have negative cash flow at all? Significantly less? Or, maybe it took slightly positive cash flow and made it more positive?

Another Measure of Risk

Do you remember me mentioning that the ratio of your Debt to Net Worth is one measure of risk for your  Scenario? Did you compare that

Scenario? Did you compare that  Chart to this

Chart to this  Scenario? How much riskier is having a second

Scenario? How much riskier is having a second  Property? Does that surprise you? It surprises a lot of folks that see it.

Property? Does that surprise you? It surprises a lot of folks that see it.

There are other  Charts that can give us insight into risk as well. One is Resiliency™. That’s the measure of how much something like rent can drop before you have negative cash flow. The more resilient your portfolio is to declines in things like rents, the less risky it is from that perspective.

Charts that can give us insight into risk as well. One is Resiliency™. That’s the measure of how much something like rent can drop before you have negative cash flow. The more resilient your portfolio is to declines in things like rents, the less risky it is from that perspective.

Did you check out the  Charts for resiliency like Average Rent Resiliency™ Dollar which shows, on average for all your rentals…even though you just have one in this

Charts for resiliency like Average Rent Resiliency™ Dollar which shows, on average for all your rentals…even though you just have one in this  Scenario… how many dollars rent can drop before you have negative cash flow. Or, the Average Rent Resiliency™ Percent which measures, again on average for all your rentals, what percent rents can drop before you have negative cash flow.

Scenario… how many dollars rent can drop before you have negative cash flow. Or, the Average Rent Resiliency™ Percent which measures, again on average for all your rentals, what percent rents can drop before you have negative cash flow.

When you get more rentals, you may also want to look at Total Rent Resiliency™ Dollar and Totla Rent Resiliency™ Dollar which shows up the total amount for all your rentals

Net Worth

Did you check out the  Chart of your Net Worth? Pretty cool, right? How things change when you have a rental

Chart of your Net Worth? Pretty cool, right? How things change when you have a rental  Property and your owner-occupant

Property and your owner-occupant  Property plus the extra you had left over for investing in stocks, right?

Property plus the extra you had left over for investing in stocks, right?

Speeding It Up

How long did it take you to buy your first  Property? The second

Property? The second  Property?

Property?

You can tell this by looking at the  Chart of Number of Properties Owned. That

Chart of Number of Properties Owned. That  Chart shows you when you bought each

Chart shows you when you bought each  Property and how many

Property and how many  Properties you own at any given time in the

Properties you own at any given time in the  Scenario.

Scenario.

So, it begs some questions: if you could buy  Properties sooner, would that allow you to achieve financial independence earlier? Try it and see… maybe add some money to your

Properties sooner, would that allow you to achieve financial independence earlier? Try it and see… maybe add some money to your  Account when you start if you have some money that you’re starting with. Or, maybe increase the percentage of your income that you’re saving. Or, maybe adjust the price of the

Account when you start if you have some money that you’re starting with. Or, maybe increase the percentage of your income that you’re saving. Or, maybe adjust the price of the  Property you’re trying to buy. Or, maybe reduce your cash reserves required before you buy a

Property you’re trying to buy. Or, maybe reduce your cash reserves required before you buy a  Property. Obviously, some of these strategies are better than others in real-life. The Real Estate Financial Planner™ software allows you to quickly see the impact on your overall plan though.

Property. Obviously, some of these strategies are better than others in real-life. The Real Estate Financial Planner™ software allows you to quickly see the impact on your overall plan though.

Total Saved

Some of these  Charts can be truly nuanced. For example, did you get a chance to look at Total Saved and especially using a Premium plan where you can look at how much you’re saving toward your financial independence between buying just one

Charts can be truly nuanced. For example, did you get a chance to look at Total Saved and especially using a Premium plan where you can look at how much you’re saving toward your financial independence between buying just one  Property to live in versus the 2

Property to live in versus the 2  Properties with one as a rental? It is a fascinating

Properties with one as a rental? It is a fascinating  Chart to see and really think about what is happening? Which are you saving more with? What if you decided to pay off loans more aggressively (you can use

Chart to see and really think about what is happening? Which are you saving more with? What if you decided to pay off loans more aggressively (you can use  Rules to do that, you know).

Rules to do that, you know).

Return On Investment and Return on Equity

Maybe you like numbers like me. If you do, I bet you’d love to dig into all the return on investment and return on equity  Charts. For example, you can look at the return on investment for each of the four primary areas of return for rental properties: appreciation (the tendency for property values to go up over time… often from inflation), debt pay down (paying off what you owe on the mortgage), cash flow (the profit after collecting rent and paying all your expenses on the property including your mortgage, taxes, insurance, vacancy and maintenance) and finally the tax benefits from depreciation. There are individual

Charts. For example, you can look at the return on investment for each of the four primary areas of return for rental properties: appreciation (the tendency for property values to go up over time… often from inflation), debt pay down (paying off what you owe on the mortgage), cash flow (the profit after collecting rent and paying all your expenses on the property including your mortgage, taxes, insurance, vacancy and maintenance) and finally the tax benefits from depreciation. There are individual  Charts for each of those both for each individual rental and also the entire

Charts for each of those both for each individual rental and also the entire  Scenario as a whole.

Scenario as a whole.

The same holds true for return on equity which shows you the return you get divided by the current equity in the  Properties. Return on investment tells you how well you are doing for the amount of money you initially invested. But, over time as the loan is paid off and the

Properties. Return on investment tells you how well you are doing for the amount of money you initially invested. But, over time as the loan is paid off and the  Property likely increases in value, your equity grows. If you sold the

Property likely increases in value, your equity grows. If you sold the  Property, you could take that money and invest it elsewhere. So, looking at the return you’re getting on the equity you could access and invest elsewhere becomes a more important metric and

Property, you could take that money and invest it elsewhere. So, looking at the return you’re getting on the equity you could access and invest elsewhere becomes a more important metric and  Chart to look at.

Chart to look at.

We have return in raw dollars, return on investment and return on equity  Charts. You’re welcome. 🙂

Charts. You’re welcome. 🙂

So, you can really drill down and get views of your investments and strategies you just can’t get anywhere else. Did you check out some of these  Charts for yourself? They’re amazing!

Charts for yourself? They’re amazing!

For each of the possible changes to you investing strategy that you can make, how much does it change you achieving your  Goal of financial independence? With a Premium plan you can compare multiple

Goal of financial independence? With a Premium plan you can compare multiple  Scenarios on the same

Scenarios on the same  Chart and quickly and easily see.

Chart and quickly and easily see.

Model Your Personal Situation: Two and Three Rentals

So, our entire story began with me asking you a question. Do you remember it at this point? Can you retire comfortably in Northern Colorado on 2 to 3 rental  Properties? Moment of truth. Fingers crossed. What do you think?

Properties? Moment of truth. Fingers crossed. What do you think?

We will keep all the same assumptions we’ve had to this point, except we will set our  Buy

Buy  Property When

Property When  Account Has Down Payment rule to limit us to buying 3

Account Has Down Payment rule to limit us to buying 3  Properties and 4

Properties and 4  Properties respectively.

Properties respectively.

The  Scenario with the 3

Scenario with the 3  Property limit will mean we have 2 rentals and a

Property limit will mean we have 2 rentals and a  Property to live in. The

Property to live in. The  Scenario with 4

Scenario with 4  Properties will have 3 rentals and 1

Properties will have 3 rentals and 1  Property to live in.

Property to live in.

Without further delay, I give you the  Scenario with 2 rentals (3

Scenario with 2 rentals (3  Properties total) to copy to your own Real Estate Financial Planner™ account:

Properties total) to copy to your own Real Estate Financial Planner™ account:

This  Scenario

Scenario

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

If you believe this is an error and should be available to copy, please contact support and include a link to this page.

And, here is the  Scenario with 3 rentals (4

Scenario with 3 rentals (4  Properties total):

Properties total):

This  Scenario

Scenario

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

If you believe this is an error and should be available to copy, please contact support and include a link to this page.

I can hardly wait until you get a chance to copy them to your own Planner™ and see for yourself what I am so excited about. Did you do it? Did you copy them to your own Planner™? What do you think?

Net Worth of Real Estate Magnate

So, how much of an impact did buying the extra  Properties have on your Net Worth? Did you view the

Properties have on your Net Worth? Did you view the  Chart? Was it worth buying the extra

Chart? Was it worth buying the extra  Property?

Property?

Retiring Young and Rich

Did buying the extra rentals get you to the point where you could reach your Target Monthly Income in Retirement fast enough that you’re able to retire young and rich if you so desire?

Do you wonder what would happen if you bought more rentals? Here comes that pesky parrot: you can change the assumption for the number of  Properties you buy. Just change the maximum on the current

Properties you buy. Just change the maximum on the current  Rule and it will buy that many

Rule and it will buy that many  Properties.

Properties.

A Secret?! Do Tell James!

I’m going to tell you something now that was a huge reveal for a special 2 hour class I did where I really dug into these models. Not to get too far off topic, but it is a class recording you have access to in your Planner™ by the way. Back to the secret. Well, it is not so much a “secret” because the answer has always been in front of us this whole time; few people ever took the time to do this level of analysis and share it with you. Are you ready for it? Here it is: sometimes buying fewer houses will get you to financial independence faster, but often buying more  Properties will increase your standard of living once you are living on your investments. That’s it. Seems obvious, but now you can add (or subtract) rentals and see this for yourself by comparing the

Properties will increase your standard of living once you are living on your investments. That’s it. Seems obvious, but now you can add (or subtract) rentals and see this for yourself by comparing the  Goals using the Premium plan.

Goals using the Premium plan.

The End or Just The Beginning?

I started off asking Can you retire comfortably in Northern Colorado on 2 to 3 rental  Properties? and I think I delivered on that promised answer.

Properties? and I think I delivered on that promised answer.

Not only did I give you the answer, I gave you a specific, personalized answer that reflects your unique financial situation. You can copy the  Scenario you’re most interested in to your Planner™ and change any of our assumptions to see if *you* can retire comfortably. Not just anyone, but you specifically… with your income, your savings rate, your family and loved ones, your perception of your reality of our stock and real estate markets, your standard of living and much more.

Scenario you’re most interested in to your Planner™ and change any of our assumptions to see if *you* can retire comfortably. Not just anyone, but you specifically… with your income, your savings rate, your family and loved ones, your perception of your reality of our stock and real estate markets, your standard of living and much more.

So, is that the end of the story? I hope not.

Here’s what I do hope:

- I hope you enjoyed this enough to check out the 200+ hours (over 130 class recordings) that we have, for free, in your Planner™.

- I hope you attend a free, local, live class on Wednesday evenings near Shields/Drake in Fort Collins to see the latest info, get your questions answered and meet other local real estate investors implemented variations of these

Scenarios. I will also give you a free Nomad™ book for coming. A link to RSVP is located in your Planner™ as well.

Scenarios. I will also give you a free Nomad™ book for coming. A link to RSVP is located in your Planner™ as well. - I hope you’ll analyze your own real estate deals and consider using what I consider to be the best deal analysis spreadsheet ever designed for Excel. You can download a copy of that spreadsheet for free and there are probably a dozen different recorded classes on how to use the spreadsheet and analyze deals as well. Links again in your Planner™.

- If you want to listen to the classes on the road in your car, while out and about or while you’re keeping busy around the house, we also have the 130+ classes available as a free podcast. Again, linked in your Planner™.

- When you buy your first or tenth rental, you may want to know what we use to do bookkeeping and accounting. Some of my clients do use Quickbooks, but most use the special free bookkeeping and account spreadsheet we give out for free. Plus, as you may have guessed, we have classes on how to set up your bookkeeping and best practices. It is one of the 130+ classes.

- I hope you might decide to become a serious student of your own investment strategy and run your own, customized

Scenarios using the Real Estate Financial Planner™ software.

Scenarios using the Real Estate Financial Planner™ software. - If you want to be able to run more sophisticated

Scenarios or want to compare

Scenarios or want to compare  Scenarios side-by-side, we have a Premium plan for that.

Scenarios side-by-side, we have a Premium plan for that. - If you want to do advanced modeling or need a little one-on-one time with me to go over your strategy, we have a Premium plan for that.

- If you decide to upgrade to a

Premium, paid plan from a free one, I do appreciate you supporting the on-going development of the software and all the other resources (recordings, spreadsheets and more) you now have access to—that’s access now whether you opt to pay for a

Premium, paid plan from a free one, I do appreciate you supporting the on-going development of the software and all the other resources (recordings, spreadsheets and more) you now have access to—that’s access now whether you opt to pay for a  Premium plan or not.

Premium plan or not. - And, finally, if you decide you want to buy a home in Northern Colorado (or be referred to another agent in another real estate market), I hope you’ll consider calling me to give me the honor to represent you in the purchase or sale of your property as a real estate broker.

- If you use me to buy or sell a home (or allow me to refer you to another agent in another market and get paid a referral fee), I will rebate any fees you paid to get a Premium plan.

- If you do decide to buy or sell a property with me, you will also get access to my $6,000 lease, lease-option and related leasing documents plus access to the special classes we taught that go over the lease and lease-option paperwork.

- And, finally, my clients also get access to our special asset protection class recordings; anyone can attend when we do them live, but the recordings of the two asset protection classes are only available to clients.

Model Your Personal Situation: Additional Basic Scenarios

These are some additional  Scenarios that you may want to copy to your Planner™ and adjust to match your personal situation. These will work in Premium plan.

Scenarios that you may want to copy to your Planner™ and adjust to match your personal situation. These will work in Premium plan.

- Saving 10%/mo in Stocks and 4 Nomads with 5% Down Payment and 10% Property Manager

- Saving 10%/mo in Stocks, You Rent, Buy 1 20% Down Payment as Rental

- Saving 10%/mo in Stocks, You Rent, Buy 10 20% Down Payment as Rentals

- Starting with $100K, Saving 10%/mo in Stocks and 4 Nomads with 5% Down Payment

- Saving 10% in Stocks, 11 Nomads with 5% Down Payment – 10 Rentals and Your Owner Occupant

Model Your Personal Situation: More Sophisticated Scenarios

These are more sophisticated  Scenarios that you may want to copy to your Planner™ to model your personal situation. These require a

Scenarios that you may want to copy to your Planner™ to model your personal situation. These require a  Premium plan like a Premium plan.

Premium plan like a Premium plan.

- Saving 10% in Stocks, 4 Nomads, $400/mo Side Hustle For The First 5 Years

- Saving 10%/mo in 60% Stocks/40% Bonds (Rebalanced Monthly) and 4 Nomads with 5% Down Payment

- Saving 10%/mo in Stocks and 4 Nomads with 5% Down Payment, Pay Down Mortgages ASAP

- Saving 10%/mo in Stocks and 4 Nomads with 5% Down, Two Roommates at $600/mo Each for First 3 Years

- Saving 10%/mo in Stocks and 4 Nomads with 5% Down, $1,400/mo in Social Security Starting in May, 2030

This  Scenario

Scenario

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

If you believe this is an error and should be available to copy, please contact support and include a link to this page.

Model Your Personal Situation: Even More Advanced Scenarios

These are our most advanced and sophisticated  Scenarios that you may want to copy to your Planner™ to model your personal situation. These require the highest level

Scenarios that you may want to copy to your Planner™ to model your personal situation. These require the highest level  Premium plan: the Premium plan.

Premium plan: the Premium plan.

- 100

Monte Carlo runs: Saving $100/mo in Stocks, Stock Market Return Variable

Monte Carlo runs: Saving $100/mo in Stocks, Stock Market Return Variable - 100

Monte Carlo runs: Saving 10%/mo in Stocks, Stock Market Return Variable

Monte Carlo runs: Saving 10%/mo in Stocks, Stock Market Return Variable - 100

Monte Carlo runs: Saving 10%/mo in Stocks, Buy Owner Occupant Property with 5% Down, Stock Market and Real Estate Returns Variable

Monte Carlo runs: Saving 10%/mo in Stocks, Buy Owner Occupant Property with 5% Down, Stock Market and Real Estate Returns Variable - 100

Monte Carlo runs: Saving 10%/mo in Stocks, 2 Nomads with 5% Down, Stock Market and Real Estate Returns Variable

Monte Carlo runs: Saving 10%/mo in Stocks, 2 Nomads with 5% Down, Stock Market and Real Estate Returns Variable

This  Scenario

Scenario

Scenario into my Real Estate Financial Planner™ Software

Scenario into my Real Estate Financial Planner™ Software

If you believe this is an error and should be available to copy, please contact support and include a link to this page.