If you’re looking to learn more about mortgage payments with an emphasis on mortgage payments for rental properties, then check out our Ultimate Guide to Mortgage Payments for Rental Properties.

If a mortgage payment is on an amortizing loan (a loan that pays off after a certain period of time like a 15-year or 30-year mortgage) then you will want to use an amortization table, excel, google or a business calculator that does amortization calculations to calculate what the payment is.

For example, in Excel the formula is:

Where:

- PMT is the forumal in Excel

- .0065 is 6.5% annual interest rate

- 360 is 360 months or a 30-year mortgage

- 400000 is the amount you’re borrowing… a $400,000 mortgage amount

- The first 0 is that we are calculating with the final balance being $0

- The second/last 0 is that we’re calculating interest at the end of the month

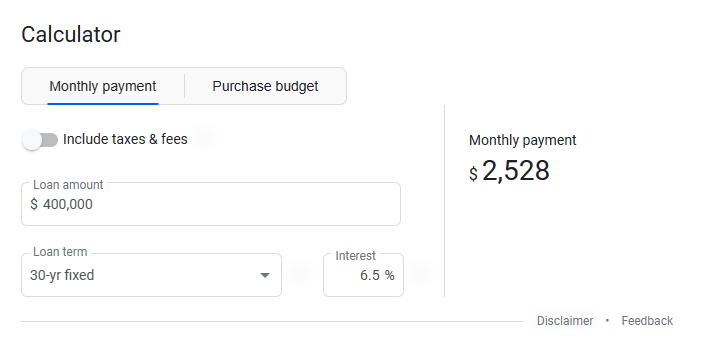

Or, go to google and type in “Mortgage Calculator” to get this simple interface:

How to Minimize Your Mortgage Payment to Boost Cash Flow

While the following video is not exclusively about how to minimize your mortgage payment it does discuss that idea quite a bit while discussing how to maximize cash flow overall on your rental properties.

Secondary Input

Mortgage Payment Secondary is considered a secondary input in the Hierarchy of Real Estate Metrics.

It is used to directly calculate Cash Flow Tertiary.