In this special class, James will walk you through how to buy a rental property from the first meeting with your real estate agent through post-closing.

This class is intended to be an OVERVIEW of the process to buy a rental property with the help of a real estate agent/broker. We have separate classes on finding off-market deals and creative financing.

It is impossible to cover EVERYTHING in-depth in a single class.

Instead, we have detailed classes covering just about EVERY step in this process. Please check the list of classes for more detailed information.

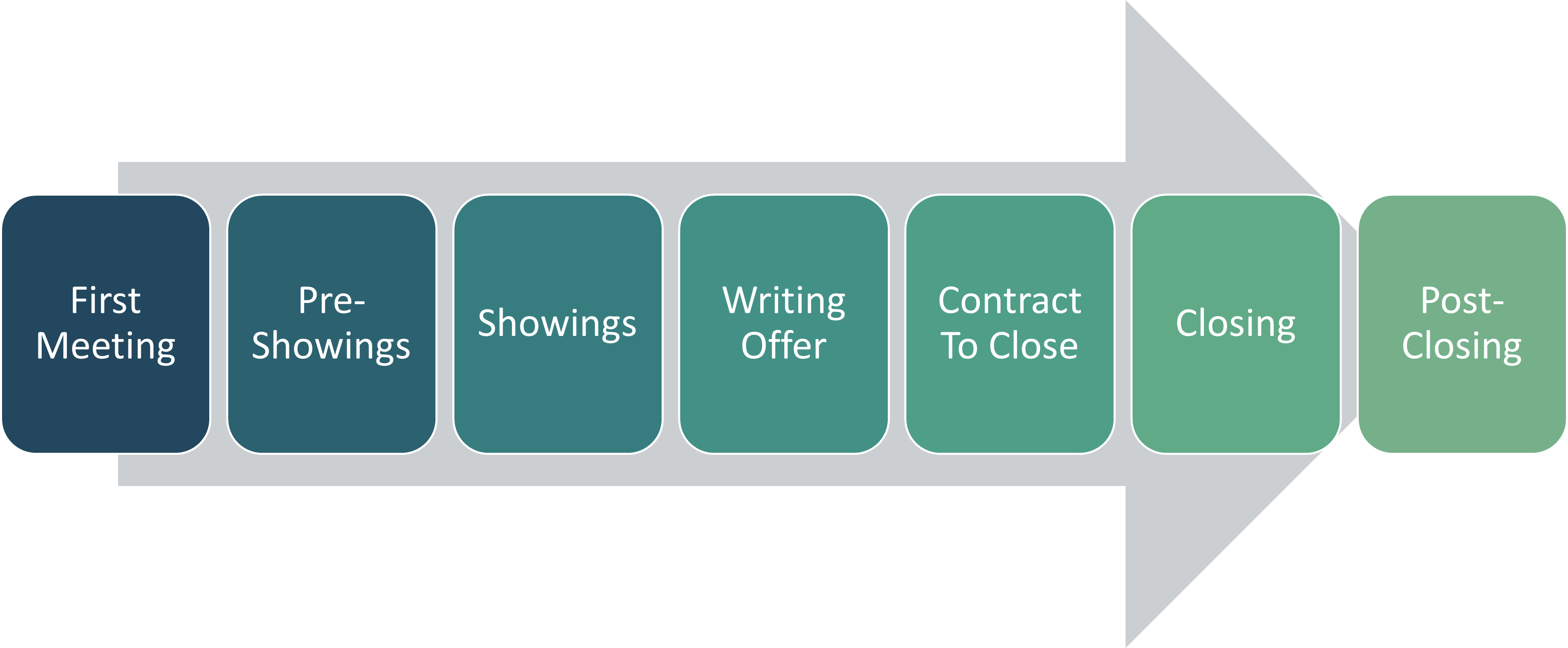

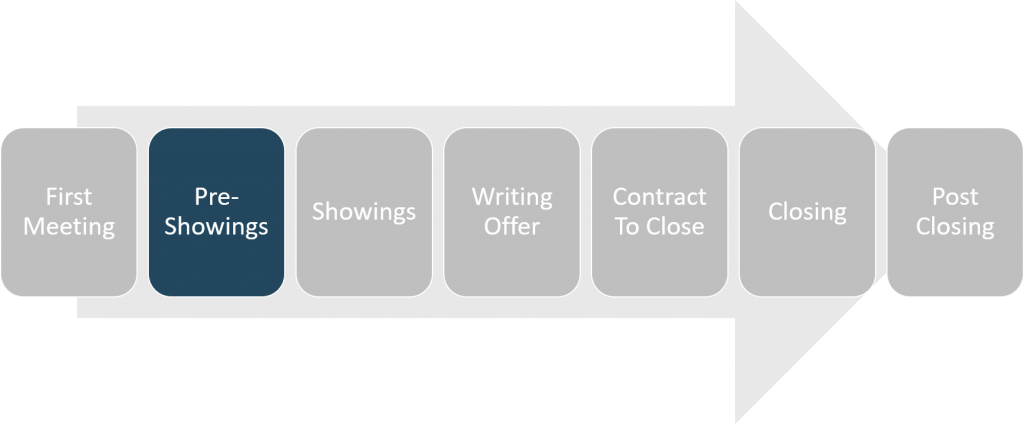

Buying Process Overview

The following is a visual of each of the stages in the buying process when buying a rental property. Many of these are entire classes by themselves. Some are multiple classes.

The stages are:

- First Meeting – This is the first meeting you have with your real estate agent to prepare to buy a rental property.

- Pre-Showings – These are the things that you need to do before you start looking at properties.

- Showings – This is when you’re out actively looking at potential properties to buy.

- Writing Offer – This is all about writing your offer to buy the property.

- Contract To Close – This is when you have your offer accepted and you’re under contract to buy the property. It covers the period from when you are under contract through when you close on the property and you’re the owner.

- Closing – This is the closing itself.

- Post-Closing – Closing on the rental property is just the beginning. What happens after you close on the property? That’s what we will discuss here.

First Meeting

Let’s start with the first meeting you have with your real estate agent or broker.

IMPORTANT NOTE: I am going to share with you largely what I do with clients that I work with. While it may be very similar, each real estate agent will do it slightly differently and your state may have different laws and paperwork.

How much detail do you want?

One of the things I discuss with a client when we first sit down is: how much detail they want. Some investors are brand-new and want ALL the detail. Some of very experienced and just want their specific questions answered. If a client is brand-new, I definitely point out all the additional classes we have covering every aspect of buying, selling and investing in real estate in extreme detail.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™

One thing that is different buying a rental property from a owner-occupant property is that you will want to analyze the property’s ability to cash flow and produce a return on your investment. We use a deal analysis spreadsheet to do that.

I’ve created what I humbly call The World’s Greatest Real Estate Deal Analysis Spreadsheet™ so clients can use it to analyze deals they’re considering.

You can download a copy of it for free to use yourself as well.

Books

Historically, I’ve also give clients an assortment of books at our first meeting. Not every client always gets every book, but they usually get these two:

- Nomad™ – A short book that went over what the Nomad™ real estate investing strategy is and how it works. This is the book I’d often give away when someone attended our local investor meetup; so usually they’d have a copy before we got together for the first time.

- Northern Colorado Real Estate Advisor – A book that walked people through the entire buying, selling and investing process. Plus, had my referral directory of other local dream team members at the back.

And, at times… if I had an extra copy or if I knew it would be helpful, I’d also include some of the other books I wrote like:

- How to Achieve Financial Independence and Live Your Passion Regardless of Age or Income: 10 Paths To Financial Independence Analyzed – The book I wrote to my son on how to do what Tammy and I did to be able to achieve financial independence.

- How to Acquire a Multi-Million Dollar Real Estate Portfolio Starting with Just $3,000 – A book about using lease-options with the Nomad™ strategy to achieve financial independence when you’re starting with very little money.

- How to Acquire a Multi-Million Dollar Real Estate Portfolio Earning Just $5,000 Per Month – A book that describes several different strategies for acquiring rental properties when someone is earning $5,000 per month.

- Ultimate Nomad Checklist™ – A book of all my checklists for doing the Nomad™ real estate investing strategy (although it really applies to all buy-and-hold rental strategies). You can check out the web version of The Ultimate Nomad™ Checklist.

- Acquiring a Portfolio of Cash Flowing Properties in Northern Colorado: A Real Estate Financial Planner Blueprint™ – Literally a printed version of one of our Blueprints™ from the software I wrote that walked them an entire investment strategy.

Paperwork

In addition to the books, often Tammy sends over the paperwork to allow us to help buy a property before we got together. By sending it in advance, clients have time to review it and either sign it or be ready with any questions for our meeting.

Some may choose to have their attorney review the paperwork so they understand how it applies to their situation.

Typically, Tammy sends over:

- Definitions of Working Relationships – It explains all the different ways you can work with a real estate agent.

- Exclusive Right-To-Buy Listing Contract – This is the primary agreement for the relationship we have when I help you buy a rental.

- Professional Services Provided – This goes over who does what in the transaction. I want clients to know what their role is. I also want them to know what my role is and what the role of other professionals are as well.

- Brokerage Disclosure Regarding New Construction – I sell a lot of new construction properties to clients and there are some additional risks associated with buying new construction properties versus resale properties. So, I want them to know about those in advance.

Your real estate agent may have different paperwork.

First Meeting with Real Estate Agent

So, what do we typically discuss at the first meeting?

- Paperwork – Go over the paperwork required to allow me to help you buy a rental and answer any questions.

- Professional Services Provided – Talk about who does what in the transaction: what I do you, what you as the buyer does, and what the other professionals involved do.

- Your Real Estate Goals – Discuss what are you trying to accomplish and how will buying this rental move you toward achieving those goals.

- Financing – Discuss how financing works, different loan programs and where to go next.

- Receive Property Lists – Establishing criteria for searching in the Multiple Listing Service (MLS) and setting up so that you receive the lists of properties from the MLS automatically based on your criteria.

- Analyze Deal – How to analyze the properties you’re receiving via email from the MLS using The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

- Write Offer – What we will need when you find a property you’re interested in to write the offer.

Paperwork

When I discuss the paperwork, I go over the Definitions of Working Relationships, Exclusive Right-To-Buy Listing Contract and the Brokerage Disclosure Regarding New Construction

Professional Services Provided.

Professional Services Provided

I originally got this list from our attorney, but here’s a list showing who does what in the transaction:

- Appraisal of the Property – Licensed Appraiser

- Assistance with Showings – Realtor® – Any MLS Property

- Condition of the Property – Buyer/Inspector (Not Realtor®)

- Contract Acceptance – Buyer/Seller determines terms of the Contract

- Contract Drafting – Attorney at Law

- Contract Preparation – Realtor® – Fill in blanks

- Home Warranty – Home Warranty Company

- Improvement Location Certificate – Surveyor

- Inspection (Recommended) – Inspector

- Inspector Selection – Buyer

- Legal Advice – Attorney (Prohibited for Realtor®)

- Lender Selection – Buyer

- List of Home Inspectors – Realtor® and/or Buyer

- List of Lenders – Realtor® and/or Buyer

- Loan Rate/Term Decision – Buyer

- Market Evaluation – Realtor® – Not appraisal

- Megan’s Law (sex offenders) – Buyer and local law enforcement

- Methamphetamine – Industrial Hygienist

- Mold Inspection – Mold Inspector – Environmental Professional

- Negotiations – Realtor®

- Neighborhood Crime (all areas have some) – Local Police or Sheriff

- New Loan – Bank or Your Mortgage Company

- Structural – Structural Engineer

- Survey (not ILC) – Surveyor

- Taxes – CPA or Accountant

- Termites – Termite Inspector

- Title Examination – Title Company or Your Attorney

Knowing who does what in the transaction makes it easier to identify who you need for your real estate investing dream team.

Here’s my recommended list in priority order:

- Real Estate Agent/Broker

- Lender

- Type of lender will vary depending on your strategy

- Private lender, loan partner, hard money, commercial lender, traditional residential financing

- Insurance Agent

- Home Inspector

- Title Agent/Closer

- Accountant/CPA/Bookkeeper

- Property Manager

- Attorney/ies

- Professional Trades

- Handyman, Electrician, Plumber, HVAC, Carpet Installation/Cleaning, House Cleaner, Painter, Roofer, Yard Card/Landscaper, Snow Removal

In fact, a really good real estate agent can probably introduce you to the other members of your dream team.

Your Real Estate Goals

One of the things I often end up discussing with clients during this first meeting is what they’re trying to accomplish. In other words: what are the goals they are COMMITTED to achieving?

- Buy and owner-occupant property?

- Use the Nomad™ investing strategy?

- Acquire buy-and-hold rentals?

- Use the lease-options investing strategy?

- Looking for Fix-and-Flip properties?

- Looking for BRRR/R properties?

- Trying to do more real estate entrepreneurship, creative transactions and other off MLS deals?

Most of these strategies requires a significant amount of additional knowledge, expertise and discussions. We have separate classes on most of them and a bunch of other real estate investing strategies.

Then, we discuss how buying this rental property fits into achieving their goal. We have entire classes on setting and achieving goals for real estate investors too.

This tends to be a very, very basic discussion of goals and Real Estate Financial Planning™. Of course, clients can reach out and we can grab lunch to discuss their on-going goals.

Financing

Another significant part of what is discussed when I get together with a client is often financing.

If you’re buying a rental property with traditional financing, you’ll typically be putting 20% or 25% down. There are loan programs where you can put 15% down with private mortgage insurance.

If you’re willing to owner-occupy one of the units (like a duplex, triplex or fourplex) you can also use the 3.5% down FHA loan. Or, if you’re also a veteran you may also be able to get a nothing down VA loan.

If you’re willing to live in the property for a year before converting it to a rental, you may want to consider the Nomad™ real estate investing strategy. That will open up additional low down payment (3% and 5% down conventional financing) and nothing down loans (at least the USDA loan for more rural properties).

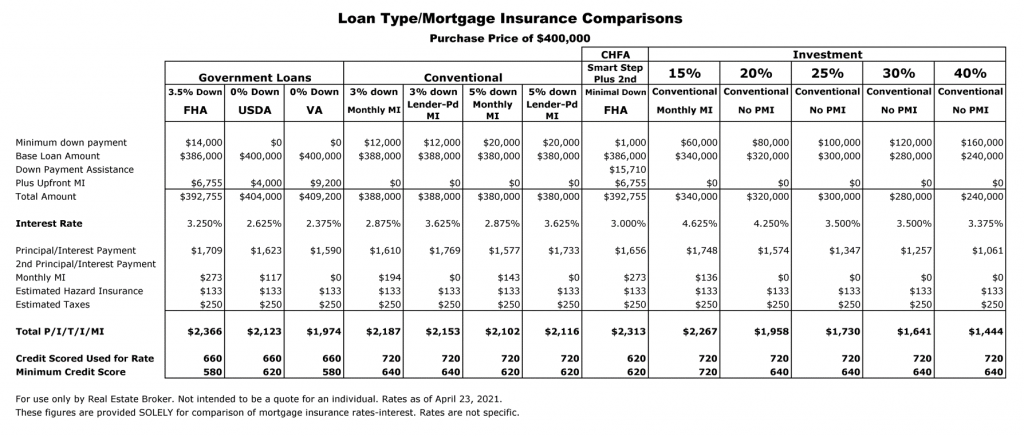

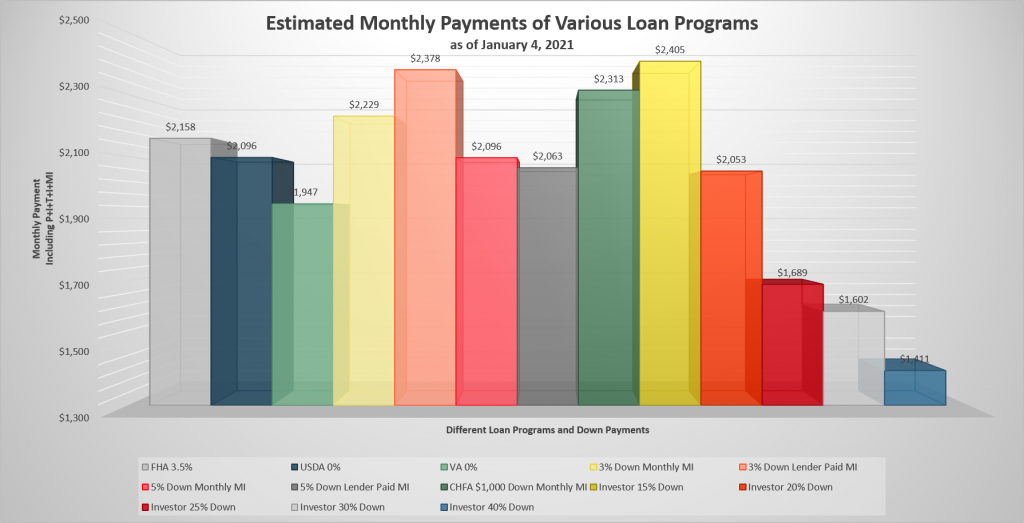

To get a good understanding of the different loan programs, consider checking out the Real Estate Investor Loan Comparison Deep Dive for a great comparison using the chart below.

In that class I show how payments can vary depending on how much you put down AND the interest rate AND the private mortgage insurance of the different loan programs plus a lot more.

We have a large number of classes on financing but your lender is typically the person that helps learn about which financing options are available to you.

Receive Property Lists

After the meeting, I’ll need to go back and set up our Multiple Listing Service to send you the types of properties that you’re looking for.

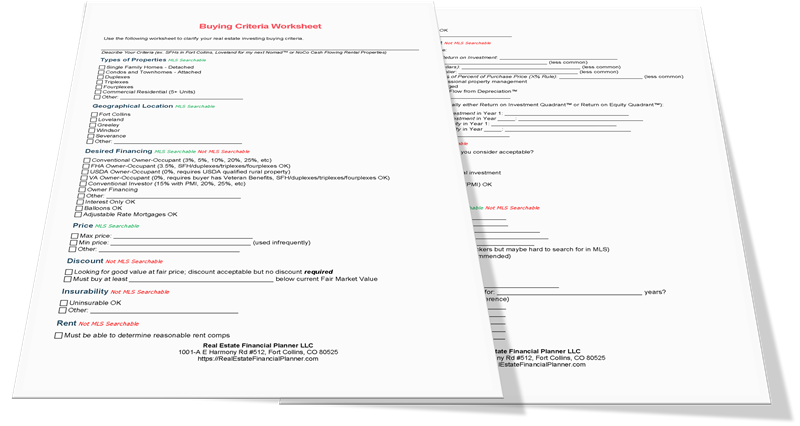

That means you’ll need to know what types of properties you’re looking for. Of course, you can change this as you get feedback from the market and see what’s available based on your criteria.

We teach an entire workshop on how to come up with written buying criteria. In that workshop, you’ll fill out a worksheet that will define exactly the types of properties you’re looking for, what you can search for in the MLS and what you’ll need to manually sort.

We have a number of classes on finding properties if you’re interested in learning more about that part of the process.

Analyze Deal

After the meeting and you start receiving properties from the MLS in your email, you’ll need to start analyzing deals to determine which meet your criteria and which you should pass on.

You’ll likely be using The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to do this analysis.

You’ll probably want to review our deal analysis classes to learn more, but at a minimum you’ll want to learn about:

- The Ultimate Guide to Rent Comps

- The Ultimate Guide to CapEx on Rental Property

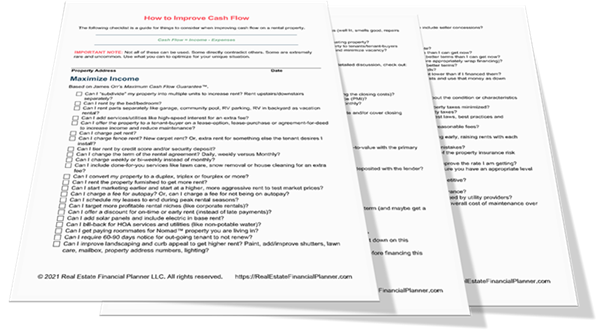

- How to Improve Cash Flow Workshop

- Everything You Learned About Deal Analysis is Wrong – ROIQ+R™

- 8 Money Saving, Risk Reducing Real Estate Investor Insurance Tips

- Return Quadrants™

- Deal Alchemy™

There is a lot to know about analyzing deals, but the bare minimum basics of deal analysis are:

- Research Numbers You Don’t Know

- Look up taxes or ask your real estate agent

- Determine rent comps or ask your property manager

- Use a recent similar insurance quote or ask your insurance agent

- Use a recent mortgage interest rate quote or ask your lender what rates would be for you if you locked today

- Analyze using The World’s Greatest Real Estate Deal Analysis Spreadsheet™

- Determine if it meets your written investment objectives/criteria and makes positive progress toward your goals

- Do you want this property in your portfolio for your desired holding period?

- Will it be easy to rent and manage?

- Determine if you want to make an offer on the property and take action if you do

- Don’t move in slow-motion—especially in a seller’s market or on a desirable property

Write Offer

The last thing we typically discuss at the first meeting is what I’ll need when you do finally find a property you’re interested in making an offer on. Some of these things will need to be done in advance of going out and looking at properties so you’re ready if we find one you like.

It might also help to review 10 Tips to Get Offers Accepted in Hot Markets if you’re in a hot market so you better understand what it takes to get offers accepted in competitive, seller’s markets.

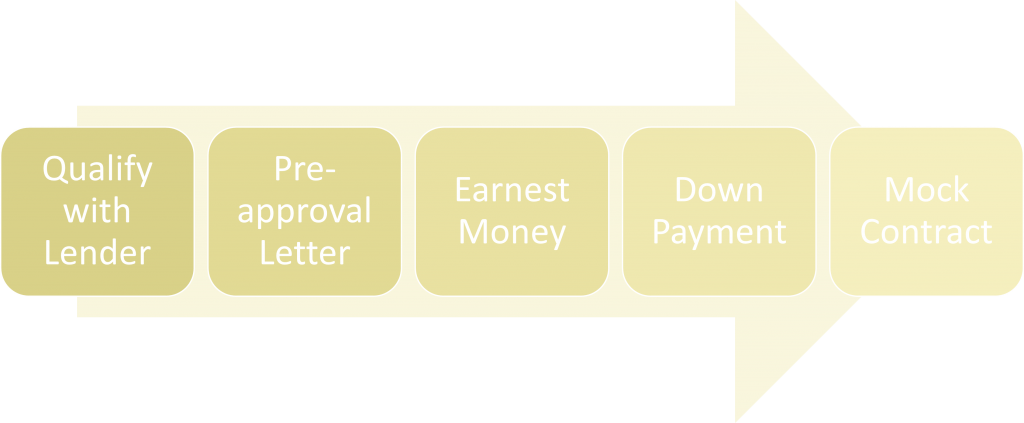

Pre-Showings

After the first meeting with your real estate agent, you’ll have some homework to do before we can go out and look at properties.

Namely, you’ll need to:

- Qualify with Lender – Select a lender and submit everything to get qualified with them. If you’re paying cash, you can skip this and the next step.

- Pre-Approval Letter – Get a pre-approval letter from the lender after you’ve submitted them everything.

- Earnest Money – Understand what Earnest Money is and make sure you have it ready to make an offer.

- Down Payment – Know how much your down payment will be and make sure you have it ready for closing.

- Mock Contract – Go over a mock contract as if you were making an offer so you understand the process and what is in it. This also gives you time to have your questions answered by your other advisors (most frequently your attorney and CPA).

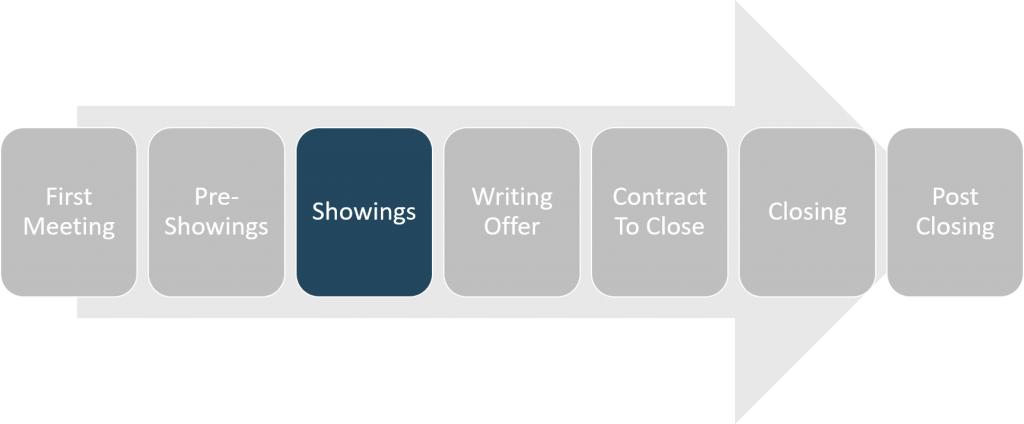

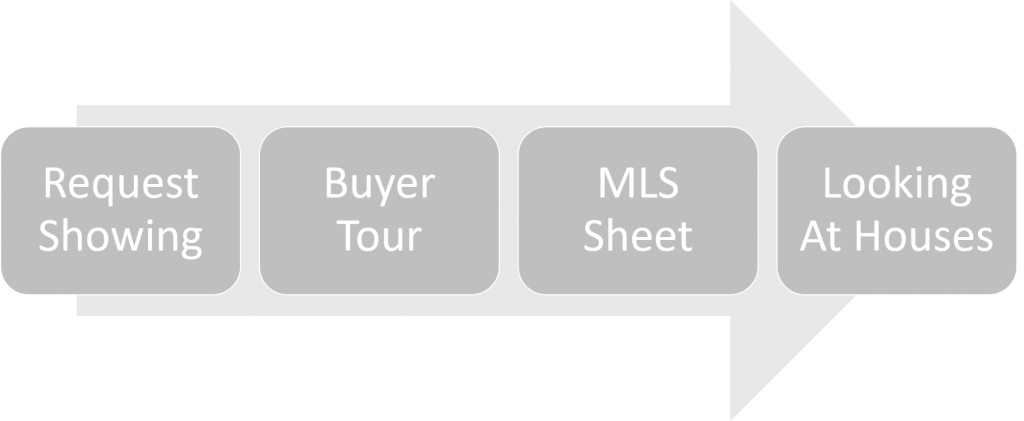

Showings

After you’ve completed your homework, you’re ready to look at properties.

Analyze deals that are sent to you via email. When you find or more that look interesting reach out to your real estate agent to schedule a showing.

Each real estate agent will have their own system for scheduling showing. Here are the steps for mine:

Here are some tips for showings:

- Use “Tenant Eyes” when looking at properties

- Similar to “Buyers Eyes” when listing properties for sale

- Is this a plus for a tenant?

- Will it attract a large pool of good quality, long-term tenants?

- Will it fetch better than average rents?

- Will this limit my tenant pool?

- Will it require maintenance, updates, repairs or CapEx in the near future?

- And, not just the property, but the location/neighborhood too.

- If you’re considering the property, make notes about what needs improving, repairs

- Write it down: the more properties you see the harder it is to remember what needed what

- Be professional – don’t open medicine cabinets, drawers, sit on furniture, bring your small kids or your pets, touch personal property.

We cover this in our classes on looking at properties.

Income and Expenses

Be sure to discuss the income and expenses for the property with your real estate agent and property manager.

Ask yourself:

- Does this property have any additional sources of income that might make it a better deal?

- Does this property have additional expenses that might make it a worse deal?

Assume You’re Being Recorded

One more tip about showings: you should assume you’re being recorded.

It is inexpensive to have recording devices in properties. And, sometimes Sellers, their Real Estate Agent and/or Tenants will be in the property while you look at it.

Never say anything in a property that you wouldn’t want a Seller to hear.

Don’t tip your hand and express your like or dislike of a property while inside

Discuss this property afterward, outside, away from the property with your agent later.

Writing Offer

Once you’ve looked at the property and you’re interested in moving forward, you and your real estate agent will typically write up the offer to purchase the property.

We cover this in detail in our classes on making offers.

Here are some tips if you need to strengthen your offer:

- Offer more money

- Be willing to make up the difference if property doesn’t appraise

- Waive inspection or limit your ability to object on inspection

- Waive ability to object to financing (and/or cash offer)

- Increase earnest money amount/make it non-refunable

Contract to Close

Once you get an offer accepted, the work really begins. We have entire classes on this process, but here’s the abridged version:

- Title work: review it and ask title and/or attorney questions

- HOA: review it and ask HOA and/or attorney questions

- Seller’s Disclosure: review it and have inspector/contractors look closer at any areas of concern during inspection period

- Loan: complete any remaining steps for approval, review final terms

- Appraisal: review it and ask lender if you have any questions

- Survey: consider getting one and ask attorney if you have concerns

- Due Diligence: complete any additional covered due diligence items in the contract

- Inspection

Inspection

We have entire classes on inspections, but here are some tips on inspections:

- Hire inspector and attend inspection to find out any potential concerns with the property, locations

- Typically inspects all major systems.

- Sometimes a system will be uninspectable (weather, condition, location, etc)

- Usually sends written report within 1 or 2 days after inspection

- Plan for this in your dates/deadlines and scheduling

- Attend inspection, shadow inspector and ask questions

- Call to their attention any areas of concern you see and found on Seller’s Property Disclosure

- General maintenance and objectionable things that are defective are typically not the same

- Discuss having additional paid tests done if appropriate: lead-based paint, mold, termites, asbestos, sewer line/septic system, meth

- Acting in good faith typically means only objecting to significant things that you did NOT see during your showing

- There are times you won’t object to anything

- You can object to anything covered in the Contract to Buy and Sell Real Estate (or the equivalent in your market)

- Seller can agree to address some or all of the items you objected to or do nothing at all

- Complete any additional due diligence covered under inspection provisions

Closing

Closing is the ceremony of signing real estate and financing documents where ownership is transferred from seller to buyer.

We cover this in detail in the closing real estate deals classes.

The short list:

- Make sure your insurance is in place (especially if you’re not getting a loan)

- Transfer utilities – buyer typically owns the day of closing

- Bring to closing:

- Money needed to close (good funds as defined by title company… usually cashier’s check or wire but each title company has their own rules)

- Government issued ID (driver’s license, passport) and one other picture ID

- Seller and their agent may be at closing (can often request separate closings if needed)

- Read and ask questions

- If you plan to read everything or will have questions for your attorney/CPA, ask your agent to request the documents ahead of time

- Remember, your real estate agent cannot give you legal advice

Post-Closing

What happens after closing?

- Title company files the deed which puts on public record the transfer of ownership from seller to buyer

- You get a copy in the mail usually within a few weeks

- Owner’s title insurance policy typically mailed to you in about a month

- If you do not receive it call title company

- File all your closing documents and prepare for tax season

- Change locks and garage door opener codes

- Complete all deferred maintenance discovered during showing and inspection

- Service HVAC system

- Replace detector batteries and any out-dated smoke and CO detectors (typically every 8-10 years)

- Prepare property to move-in or for tenant

- General cleaning and carpet cleaning

- Hire property manager or begin managing the property yourself

- We have a bunch of classes on property management.

I also believe that your relationship with your real estate agent should not end at closing. Here’s what I think a great real estate agent should provide after closing:

- Real Estate Reviews by sitting down and reviewing your real estate holdings regularly

- Referral Directory of dream team members your real estate agent recommends. See my Referral Directory as an example.

- Changes in market conditions that affect your real estate

- Months of Inventory

- Changes in interest rates: refinance, etc

- Rental market changes

- Rental comps

- Leases and related paperwork

- Classes on various real estate topics. See my class list for example.

- Answers to your real estate questions