Are you interested in maximizing your real estate investment returns? Look no further than Deal Alchemy™. This powerful tool enables investors to manipulate and transform their deals to optimize returns by moving them between different quadrants, such as trading appreciation for cash flow or increasing tax benefits. In this blog post, we’ll explore the concept of Deal Alchemy™in detail and provide examples of how investors can use it to their advantage. We’ll also discuss the potential risks and benefits of applying this strategy and provide tips on how to analyze a deal effectively. So, sit back, grab a notebook, and let’s dive into the magical world of Deal Alchemy™.

Deal Alchemy™ Defined

We’re taking returns and via a seemingly magical process of transformation, creation or combination… converting them to other returns.

So… Deal Alchemy™ is a process of transforming and manipulating where the returns are coming from in a real estate investment.

Move Returns Between Return Quadrants

The returns in real estate can be divided into four quadrants: appreciation, cash flow, debt paydown, and tax benefits (Cash Flow from Depreciation™). Some investors also consider the return from reserves as a fifth quadrant.

In traditional real estate investing, cash flow is often the main focus of returns. However, through Deal Alchemy™, investors can move returns from one quadrant to another. For example, with a lease-option, investors can trade appreciation for improved cash flow and an option fee upfront. This means that the investor is giving up some appreciation for the benefit of better cash flow, while also getting money upfront in the form of the option fee.

It is important to note that moving returns is not always a one-to-one change. For example, giving up $10,000 in appreciation does not guarantee $10,000 in improved cash flow. The returns in each quadrant are interconnected, and changing one may impact the others. Nonetheless, through Deal Alchemy™, investors have the ability to modify where the returns are coming from and the types of returns they are getting on a property.

In future classes on Deal Alchemy™, we will cover additional methods for moving returns between quadrants. By utilizing these techniques, investors can transform and manipulate real estate deals to maximize their returns and create seemingly magical outcomes.

Oversimplified Lease-Option Example

In an oversimplified example of a lease-option deal, the investor gives a tenant-buyer the option to buy a property for a fixed price, with limited or lower appreciation rates. In exchange, the investor gets improved cash flow, moving the return from the “Appreciation Quadrant” to the “Cash Flow Quadrant.” The investor may also collect an option fee and increase cash flow by a certain amount per month. This type of deal alchemy allows investors to manipulate the returns they are getting from an investment property.

It is important to note that while this type of deal may result in improved cash flow, it may also result in reduced overall return on investment. However, the upfront option fee and improved cash flow may be worth it for some investors. Additionally, there is a risk that the tenant-buyer may not end up buying the property, resulting in additional profit for the investor.

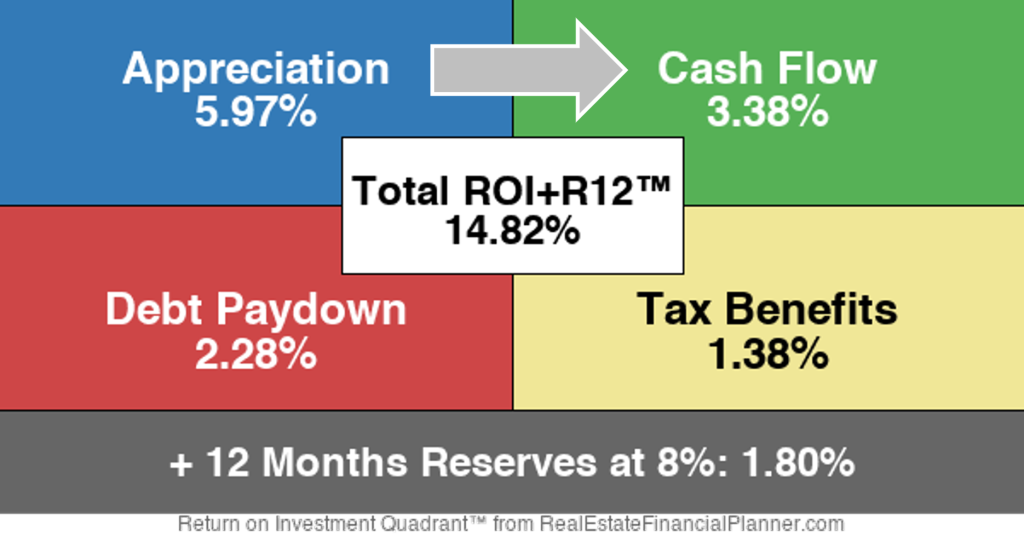

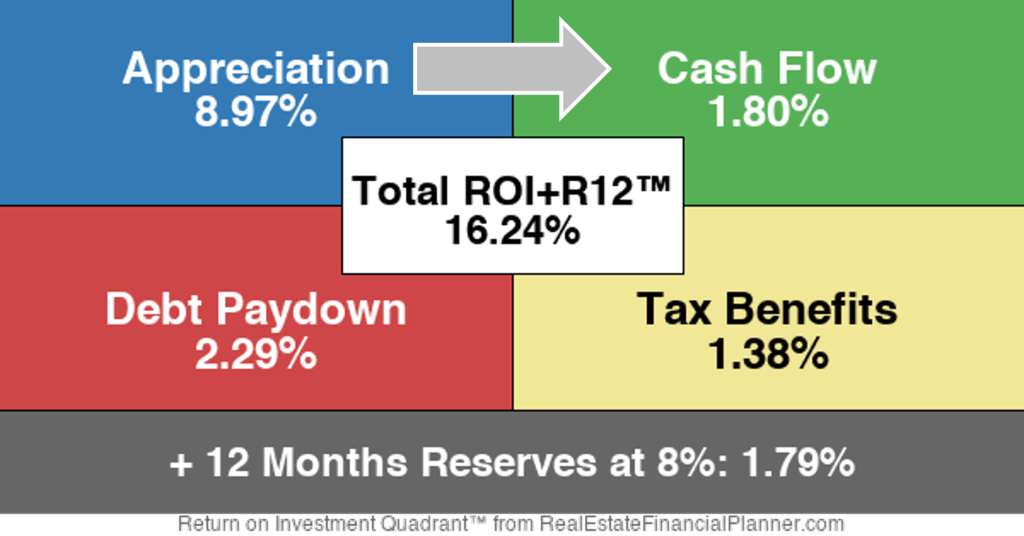

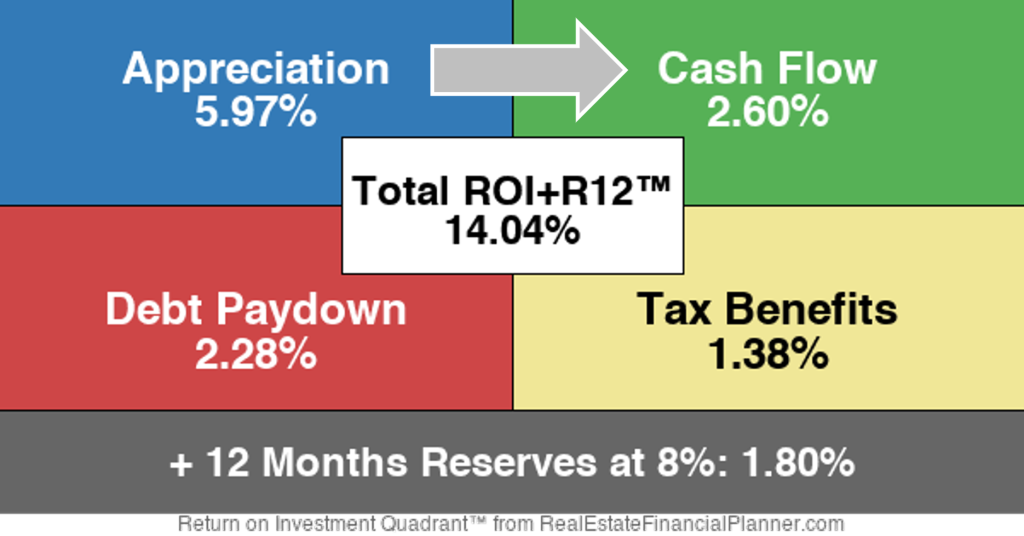

If we look at the return on investment, we can see how those numbers change when we apply Deal Alchemy™ with a lease-option.

Overall, this oversimplified example of a lease-option deal demonstrates how investors can change where the returns are coming from in an investment property by emphasizing cash flow and trading appreciation for other benefits.

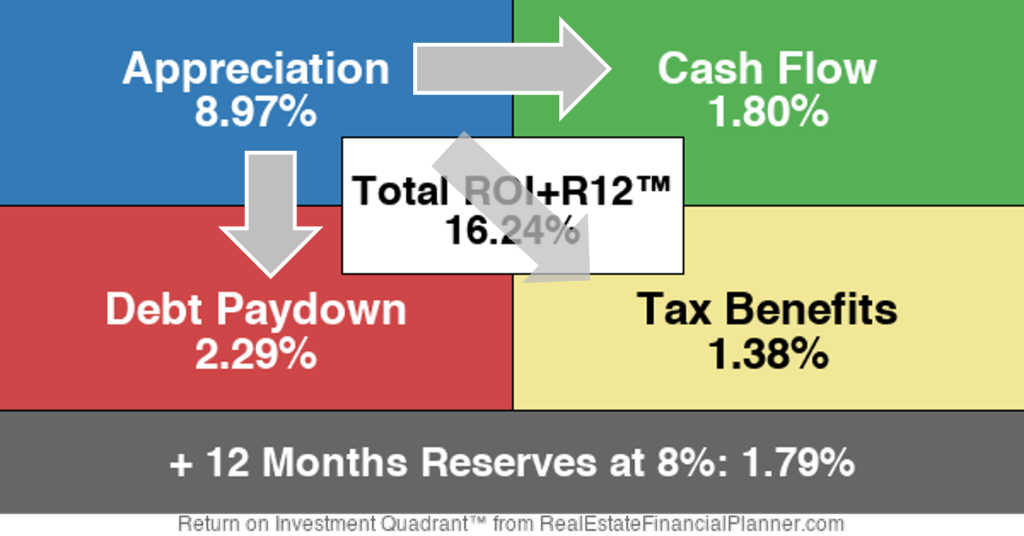

Apply $10K Option Fee as Rebate to Down Payment

Remember in this example, the investor is collecting a $10K option fee.

How do you apply that option fee? Does it count as cash flow? In the first year? Over the entire period that the option is active? Or, do you consider it a rebate on the down payment you had to put up to purchase the property?

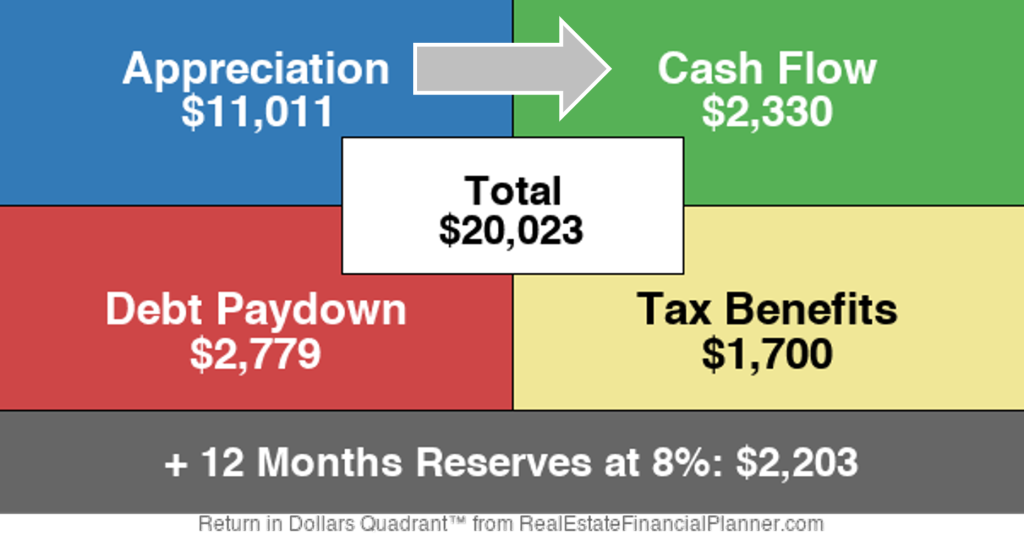

This is the traditional rental before we apply Deal Alchemy™ with a lease-option.

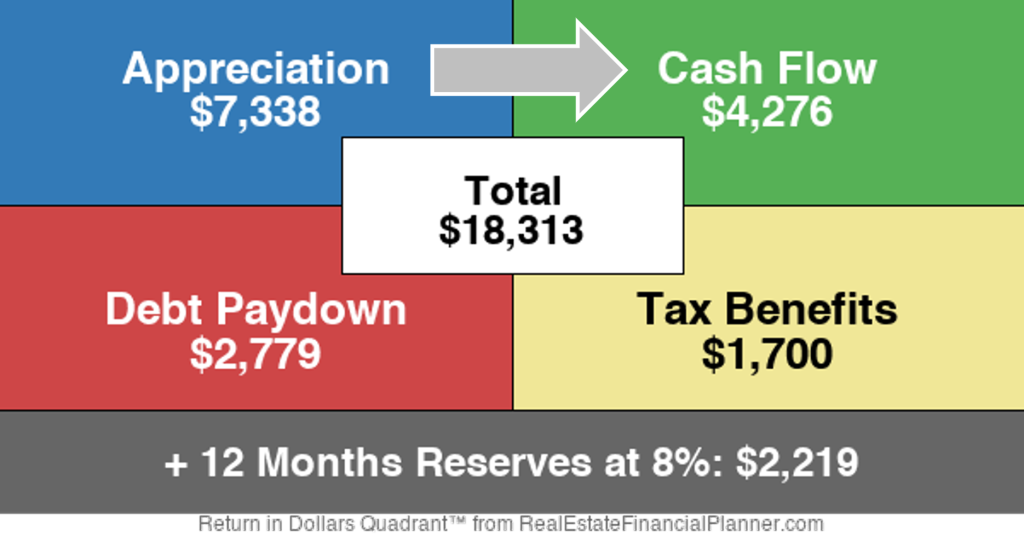

And, here’s what it looks like after we apply Deal Alchemy™ with a lease-option.

$200/Month Additional Rent

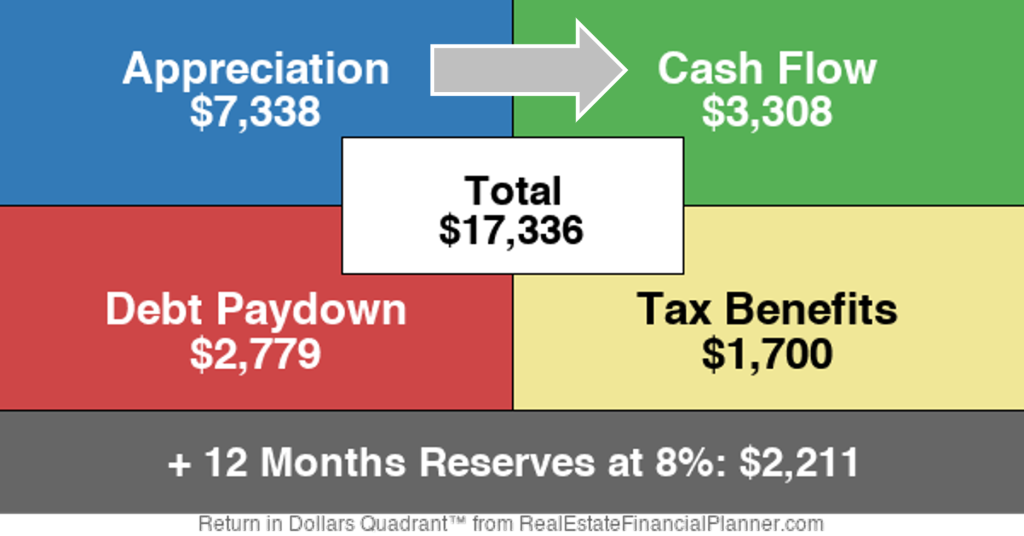

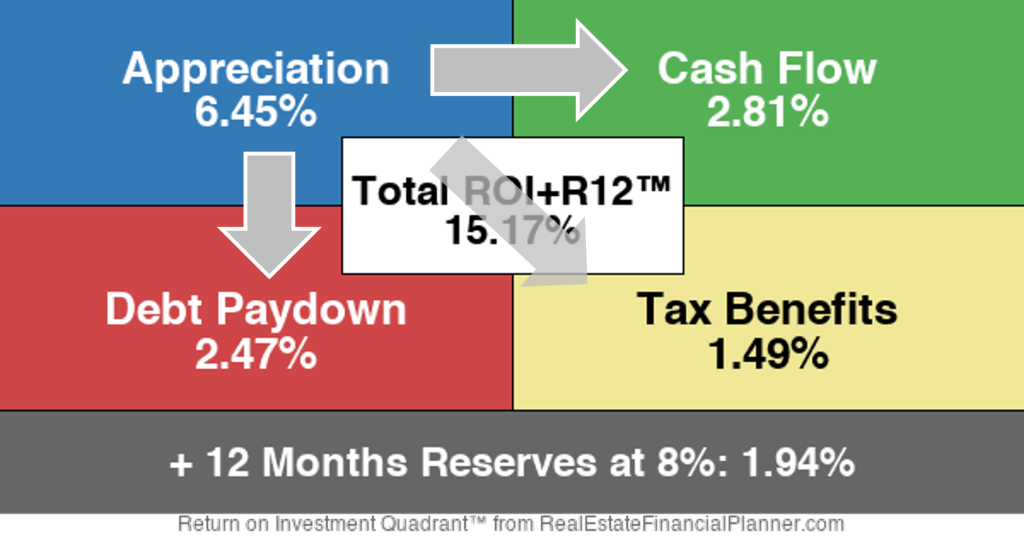

Previously we assumed you were able to get just $100 per month in additional rent when offering the property on a lease-option. What if you could get $200 per month?

And how does that impact the return on investment?

Conclusion

Deal Alchemy™ is a powerful tool for real estate investors that enables them to manipulate and transform deals to maximize their returns. The process involves moving returns from one quadrant to another, such as trading appreciation for cash flow, increasing tax benefits, or using debt paydown to generate additional returns.

One common example of Deal Alchemy™ is using a lease option, which allows investors to trade appreciation for upfront option fees and improved cash flow. By giving a tenant-buyer the option to buy a property for a fixed price, with limited or lower appreciation rates, investors can move the return from the “Appreciation Quadrant” to the “Cash Flow Quadrant.” This type of deal alchemy allows investors to manipulate the returns they are getting from an investment property.

However, moving returns is not always a one-to-one change, and changing one quadrant may impact the others. Therefore, it is essential to consider all aspects of a deal and analyze the potential risks and benefits of applying Deal Alchemy™.

Through Deal Alchemy™, real estate investors can transform and combine returns to create more profitable deals. By utilizing various methods to change where the returns are coming from and where they’re going to, investors can improve their overall return on investment and create seemingly magical outcomes.

In conclusion, Deal Alchemy™ is a powerful tool that enables real estate investors to manipulate and transform deals to maximize their returns. By utilizing various methods to change where the returns are coming from and where they’re going to, investors can improve their overall return on investment and create seemingly magical outcomes. However, it is important to analyze the potential risks and benefits of applying Deal Alchemy™ and consider all aspects of a deal before making any decisions.