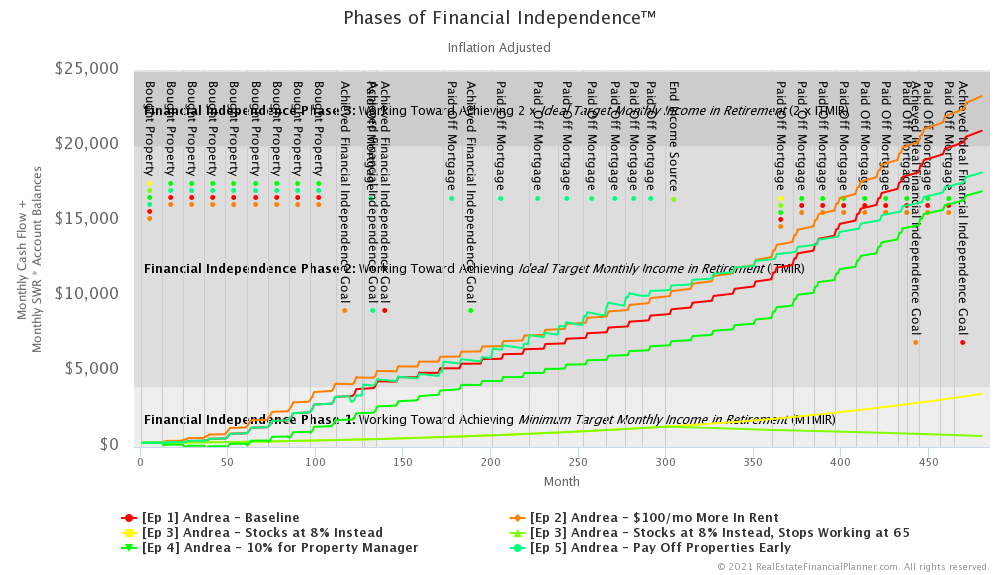

Ep 5: Andrea Pays Off Properties Early with Cash Flow

Pro Tip: Listen to the podcast below and while you’re listening follow along with the charts below. Then, when you’re done, copy the Scenario to your own Real Estate Financial Planner™ account to change any of the assumptions. In Episode 5, Andrea asks herself a common question: should I pay off my properties early with extra cash flow? Plus these related questions: Will paying off properties early lead to achieving financial independence earlier? Will it increase or decrease my net worth? Will that increase or decrease my risk? Will it give me a higher or lower standard of living in … Read more