The Ultimate Guide to Owner Financing

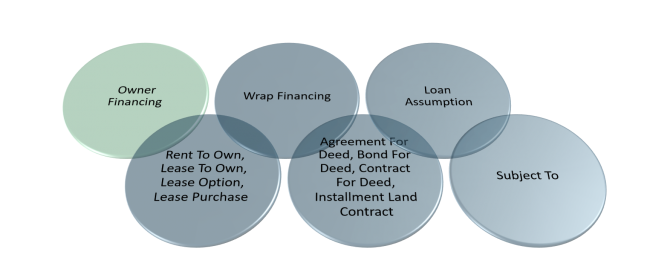

If you’re looking to learn more about owner financing then you’ve found The Ultimate Guide to Owner Financing where you will learn about creative financing strategies with an emphasis on getting the seller of the property (the owner) to act like the bank and allow you to make payments to them to finance your purchase. Owner financing is just one type of Creative Financing. Class Recording:Owner Financing On July 20, 2016 I taught a special real estate investing seminar on how to use owner financing which you can watch below. Owner Financing: What is it? Seller acts like the bank … Read more