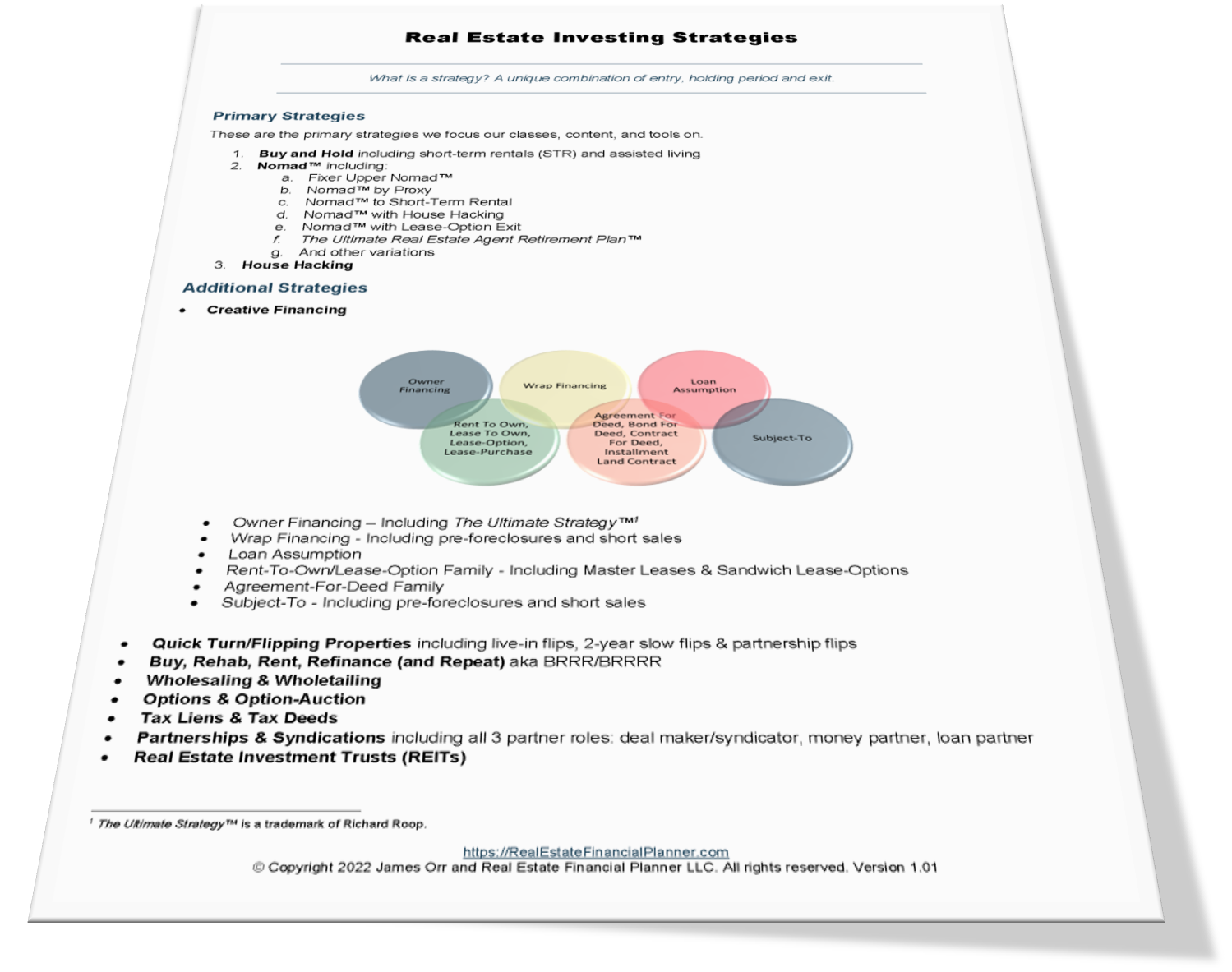

The Ultimate Guide to Creative Financing and Real Estate Entrepreneurship

Welcome to the thrilling world of real estate entrepreneurship, where creativity not only applies to finding and flipping properties but also to the innovative financing methods that can make or break your deals. Whether you’re a seasoned investor or a budding entrepreneur, understanding the spectrum of creative financing options is crucial. Let’s dive into some of the most powerful tools in your arsenal for building a successful real estate portfolio. 1. Owner Financing Owner financing emerges as a beacon of hope for those who may not qualify for traditional bank loans. This method involves the property seller acting as the … Read more