Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1167

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1171

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1172

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1173

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1174

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1175

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1176

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1177

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1178

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1179

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1180

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1181

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1204

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1208

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1209

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1210

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1211

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1212

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1213

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1214

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1215

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1216

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1217

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1218

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1167

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1171

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1172

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1173

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1174

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1175

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1176

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1177

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1178

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1179

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1180

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1181

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1204

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1208

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1209

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1210

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1211

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1212

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1213

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1214

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1215

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1216

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1217

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1218

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1167

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1171

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1172

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1173

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1174

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1175

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1176

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1177

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1178

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1179

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1180

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1181

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1204

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1208

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1209

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1210

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1211

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1212

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1213

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1214

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1215

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1216

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1217

Warning: A non-numeric value encountered in /home/realestatefinanc/public_html/wp-content/plugins/refp/Functions_CalculateFromPropertyData.php on line 1218

Welcome to the Ultimate Guide to Cap Rate for Real Estate Investors (also known as “capitalization rate”). In this guide, we will start by discussing what the basic definition of cap rate is and then move on to much more advanced and nuanced topics related to cap rates.

Cap rate is defined as the Net Operating Income (often abbreviated as NOI) divided by the Purchase Price. In The World’s Greatest Real Estate Deal Analysis Spreadsheet™ cap rate is calculated for you.

What’s a Good Cap Rate for Real Estate Investors?

Cap rates vary by real estate market. That makes it difficult to give you a specific number that is a good cap rate for every real estate market and every real estate investor.

For example, in some analysis we completed on 300 real estate investor markets, we discovered that cap rate varied widely for each market and also property to property.

And, you know this, you can find an amazing deal with a great cap rate and you can find lots of deals with less than amazing cap rates.

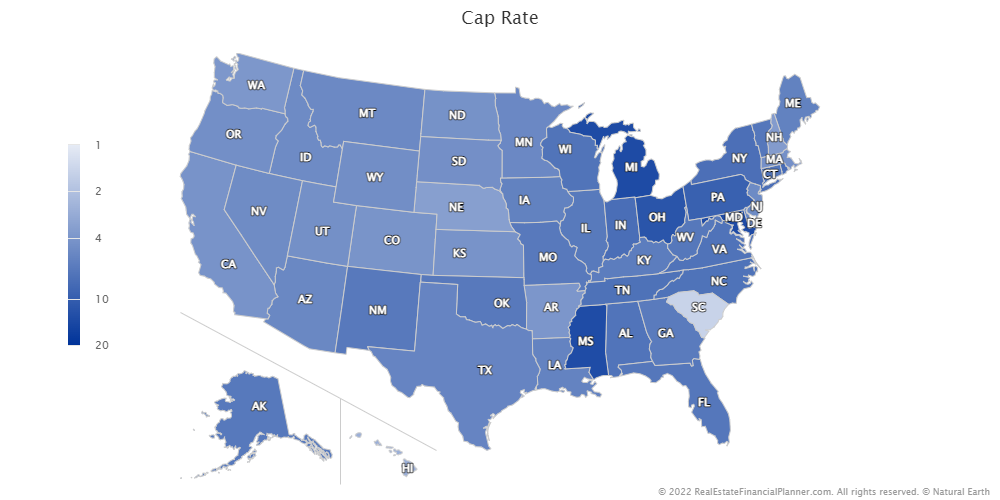

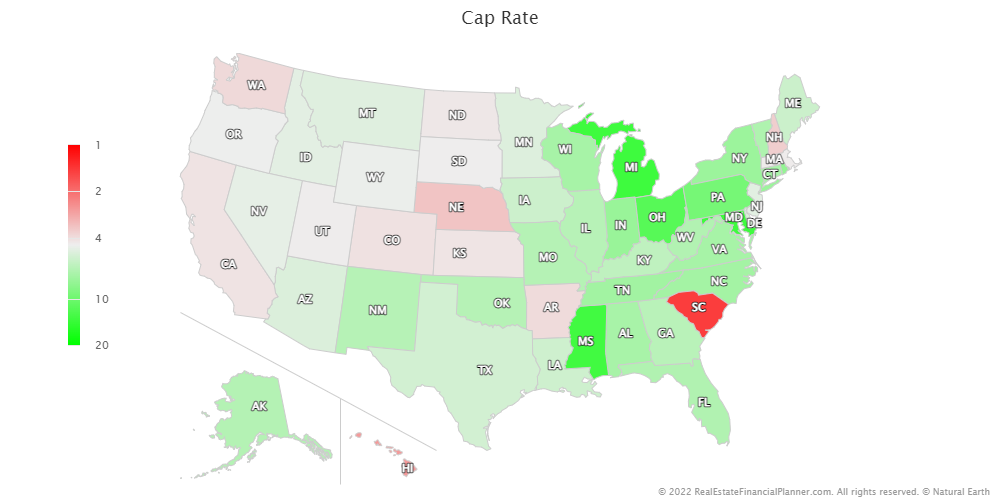

However, if you’re wondering what a typical cap rate might be in various states of the US, check out the map we created above based on our analysis of 300 cities with the highest populations.

You can see they range from about 2 to about 14 with lots of variation and each individual property you might consider buying in your market might be better or worse than what is common in your market.

In fact, I’d argue it probably should be better than what is common unless you’re deal selection criteria has significant additional factors.

Unless You’re Buying a Property For Cash…

Cap rate is really the Cash on Cash Return on Investment if and only if you’re buying the property for cash.

This is good if you want to compare two properties… ignoring financing… to see which would have better cash flow.

If you’re planning to purchase a property with financing, you might want to put more weight into the Cash on Cash Return on Investment calculation which takes into account the financing that you can get as well.

Since cap rate completely ignores the financing you can get on a property. Sometimes, you may come across a property that has a higher cap rate, but one where you can’t get good/reasonable/acceptable financing on it. In those cases, you may choose to buy a property with a lower overall cap rate, but one where you can get great financing on.

By being able to get great financing on it, it may end up being a better cash flowing property. Of course, if you were buying it for cash, the cash flow would have been better on the property with the higher cap rate.

Another consideration to this conversation about properties with great cap rates but with limited financing options is that it may impact your buyer pool when you finally decide to sell. If your buyer can’t get good financing, you might be limiting yourself to cash buyers that buy based on cap rate. And, not every real estate investor focuses on cap rate. Some prefer Cash on Cash Return on Investment to include the financing you can get as a decision-making factor and others look more holistically at the entire Return Quadrant™.

Cap Rate and Return Quadrants™

Speaking of Return Quadrants™… cap rate is the Cash Flow part of the Return Quadrant™ but only when you’re buying the property all cash.

It is just one of four primary returns you get when you buy income property. To focus on that one quadrant, the Cash Flow quadrant exclusively will often have you acting sub-optimally in your real estate investing decisions.

Cap Rate Typically Uses Current Property Value

You might see the cap rate formula written as Net Operating Income divided by Purchase Price, but should you still be using the Purchase Price when calculating cap rate after you’ve purchased the property?

The answer: no.

Typically, people use the current value of the property to calculate cap rate and not your original Purchase Price.

So, typically in markets where you’ve bought the property and prices have increases faster than your rents your cap rate will drop. That’s because you’re getting similar rent on a more expensive property.

In markets where rents are rising faster than property values, you will see cap rates rise as well.

Based on what I just explained about cap rates are impacted by changing market conditions, you can see that cap rates do change over time in real estate markets. So, the cap rate you can get today may not be the same as you can get in your market in the future. It may be better or worse depending on how your real estate market performs with the factors that go into calculating it (lead primarily by price and rents but expenses also come into play… often to a slightly lesser degree).

Valuing Properties Using Cap Rate

Some real estate investors have a feel for what cap rates should be for specific types of multi-family, apartments, or commercial properties and will use this information to determine what the value of the property should be based on how much income it is producing.

For example, we know that the formula for cap rate is:

But, what if you know the cap rate that other similar apartment complexes are selling for, but you’re not sure what your apartment complex is worth.

You know the Net Operating Income on the property because you know all your income and expenses.

You could re-arrange the formula and solve for Purchase Price instead:

So, if we take the Net Operating Income and divide by the cap rate that other, similar apartments have been selling for recently, we can get a rough idea of what the value or Purchase Price that this apartment is likely to sell for.

The thinking is: if investors are willing to accept a certain income-based return on their money (the cap rate) for other apartments, they may be interested in getting the same return to buy my apartment.

A key to this is making sure you’re using a cap rate for very similar properties to yours. You can compare a really nice “A Class” apartment to your in-need-of-repairs “C Class” apartment and use the same cap rate.

How To Calculate Cap Rate

Calculating Cap Rate is easy. Follow these simple steps using an example property.

Cap Rate

| Annual Net Operating Income | $16,791 | |||

| ÷ | Purchase Price | ÷ | $261,142 | |

| Cap Rate | = | 6.43% |

Let's walk through calculating Cap Rate for  Typical 25% Down Payment Gainesville, Florida Rental Property.

Typical 25% Down Payment Gainesville, Florida Rental Property.

Ultimately, we will need Net Operating Income and Purchase Price.

Purchase Price is easy since it is a primary input that does not require any real calculation.

So, let's focus on How to Calculate Net Operating Income.

To calculate Net Operating Income (often abbreviated NOI), we need to know the Gross Operating Income for the property and the Operating Expenses.

We'll start with the Gross Operating Income.

Gross Operating Income is really just the total Gross Potential Income for the property minus the vacancy allowance for the property.

That means we'll need to start with calculating Gross Potential Income based on all the income sources for the property: rent and anything else you might be getting income from on the property.

Annual Gross Potential Income

| Annual Rent | $27,720 | |||

| + | Annual Other Income | + | $0 | |

| Annual Gross Potential Income | = | $27,720 |

Gross Potential Income is how much total income the property could possibly produce from all sources.

For  Typical 25% Down Payment Gainesville, Florida Rental Property we take the total amount of rent they could collect and any additional income they might also get from the property.

Typical 25% Down Payment Gainesville, Florida Rental Property we take the total amount of rent they could collect and any additional income they might also get from the property.

The rent for  Typical 25% Down Payment Gainesville, Florida Rental Property is estimated to be $2,310 per month or $27,720 per year. We'll use the annual amount of $27,720 for our calculation and we will, for now, ignore vacancies... we'll deal with vacancy when calculating Gross Operating Income.

Typical 25% Down Payment Gainesville, Florida Rental Property is estimated to be $2,310 per month or $27,720 per year. We'll use the annual amount of $27,720 for our calculation and we will, for now, ignore vacancies... we'll deal with vacancy when calculating Gross Operating Income.

We're estimating $0 in other income from the property.

Some common examples of other income might be: profits from on-site laundry (especially in multi-family), pet rent, renting out extra spaces on the property (like an extra garage or storage unit) or things like that.

That means that  Typical 25% Down Payment Gainesville, Florida Rental Property has a Gross Potential Income of $27,720 per year.

Typical 25% Down Payment Gainesville, Florida Rental Property has a Gross Potential Income of $27,720 per year.

But that does not consider the impact of vacancy. To do that, we'll look at Gross Operating Income next.

Annual Gross Operating Income

| Annual Gross Potential Income | $27,720 | |||

| - | Annual Vacancy Dollar | - | $832 | |

| Annual Gross Operating Income | = | $26,888 |

Gross Operating Income unlike Gross Potential Income does take into account the impact of vacancy on the property.

For  Typical 25% Down Payment Gainesville, Florida Rental Property, we're estimating that the property is vacant 3% of the time. That means that we're not seeing $831.60 of the $27,720 that we thought we might get from the property.

Typical 25% Down Payment Gainesville, Florida Rental Property, we're estimating that the property is vacant 3% of the time. That means that we're not seeing $831.60 of the $27,720 that we thought we might get from the property.

Annual Gross Operating Income

| Annual Gross Potential Income | $27,720 | |||

| - | Annual Vacancy Dollar | - | $832 | |

| Annual Gross Operating Income | = | $26,888 |

But, what about all the other expenses? Well, those are called Operating Expenses.

Annual Operating Expenses

| Annual Property Taxes | $0 | |||

| Annual Property Insurance | $4,007 | |||

| Annual Homeowner's Association Fees | $0 | |||

| Annual Landlord-Paid Utilities | $0 | |||

| Annual Other Expenses 1 | $0 | |||

| Annual Other Expenses 2 | $0 | |||

| Annual Property Maintenance | $2,689 | |||

| Annual Property Management | $0 | |||

| Annual Operating Expenses | = | $10,097 |

Operating Expenses are all the expenses of operating the property except vacancy and financing of the property.

For  Typical 25% Down Payment Gainesville, Florida Rental Property we used the following:

Typical 25% Down Payment Gainesville, Florida Rental Property we used the following:

- Property Taxes - These are the property taxes paid for the property. For

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated they are $0 per year.

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated they are $0 per year. - Property Insurance - This is the insurance policy to cover the property from perils like fires and liability from injuries on the property. Your specific policy will define what hazards you're covered for. This policy typically does not cover the personal property of tenants; they should get their own renter's insurance policy to cover that. For

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of this insurance policy to be $4,007.22 per year.

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of this insurance policy to be $4,007.22 per year. - Homeowner's Association Fees - This is usually the cost for the homeowner's association (HOA) where the property is located. What the HOA coverages varies widely between different HOAs so be sure to check with the HOA to find out what is included for your HOA fee. For

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of the homeowner's association fees to be $0 per year.

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of the homeowner's association fees to be $0 per year. - Landlord-Paid Utilities - With many single family homes... and to a slightly lesser extend... duplexes, triplexes adn fourplexes... the tenants all pay individually metered utilities. However, in some cases... especially for larger multi-family properties... the landlord is responsbile for some shared (or in some cases... all) utilities. This is just for the utilities that the landlord is responsbile for paying. Tenant-paid utilities should not be included here. It is not uncommon to have this be equal to zero especially for smaller properties. For

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of the landlord-paid utilities to be $0 per year.

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of the landlord-paid utilities to be $0 per year. - Other Expenses - Sometimes a property will have an extra expenses associated with it. Some examples might include lawn service, snow removal, common area cleaning, etc. For smaller properties, it is not uncommon to have these extra expenses be equal to zero. For

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the annual cost of these extra expenses to be:

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the annual cost of these extra expenses to be: - Other Expenses 1: $0

- Other Expenses 2: $0

- Maintenance - With many properties... especially residential properties... the landlord will be responsible for maintaining the properties and should set aside money to pay for on-going maintenance. For

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of maintenance, on average, to be $2,688.84 per year.

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of maintenance, on average, to be $2,688.84 per year. - There is some debate over whether you should include some or all of the Capital Expenses in the Operating Expenses or if they should be capital improvements to the property and not including in Operating Expenses. You can choose to include them by increasing the maintenance percentage or choose to include them elsewhere by excluding them from Maintenance.

- Property Management - With most properties, there will be an expense to managing the properties either in the form a professional property management fee or the... much lower hard costs... of managing the property yourself. For

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of property management to be 0% of the rent or $0 per year.

Typical 25% Down Payment Gainesville, Florida Rental Property, we've estimated the cost of property management to be 0% of the rent or $0 per year.

If we add up all of these expenses for  Typical 25% Down Payment Gainesville, Florida Rental Property, we're estimating the Annual Operating Expenses to be $10,097.44.

Typical 25% Down Payment Gainesville, Florida Rental Property, we're estimating the Annual Operating Expenses to be $10,097.44.

Annual Operating Expenses

| Annual Property Taxes | $0 | |||

| Annual Property Insurance | $4,007 | |||

| Annual Homeowner's Association Fees | $0 | |||

| Annual Landlord-Paid Utilities | $0 | |||

| Annual Other Expenses 1 | $0 | |||

| Annual Other Expenses 2 | $0 | |||

| Annual Property Maintenance | $2,689 | |||

| Annual Property Management | $0 | |||

| Annual Operating Expenses | = | $10,097 |

Now that we know the Gross Potential Income and the Operating Expenses for the property, we can calculate the Net Operating Income.

Annual Net Operating Income

| Annual Gross Operating Income | $26,888 | |||

| - | Annual Operating Expenses | - | $10,097 | |

| Annual Net Operating Income | = | $16,791 |

Net Operating Income is how much money you're making from the property after vacancy and all the Operating Expenses except for the financing expenses on the property (like the mortgage payment and, if applicable, private mortgage insurance).

For  Typical 25% Down Payment Gainesville, Florida Rental Property we would use the Gross Operating Income of $26,888.40 per year and subtract out all the Operating Expenses of $10,097.44 for the year.

Typical 25% Down Payment Gainesville, Florida Rental Property we would use the Gross Operating Income of $26,888.40 per year and subtract out all the Operating Expenses of $10,097.44 for the year.

That would result in a Net Operating Income of $16,790.96 per year or $1,399.25 per month.

Annual Net Operating Income

| Annual Gross Operating Income | $26,888 | |||

| - | Annual Operating Expenses | - | $10,097 | |

| Annual Net Operating Income | = | $16,791 |

And, finally, with a Net Operating Income of $16,790.96 per year and a Purchase Price of $261,142, we can calculate the Cap Rate.

Cap Rate

| Annual Net Operating Income | $16,791 | |||

| ÷ | Purchase Price | ÷ | $261,142 | |

| Cap Rate | = | 6.43% |

That means that  Typical 25% Down Payment Gainesville, Florida Rental Property has a Cap Rate of 6.43%.

Typical 25% Down Payment Gainesville, Florida Rental Property has a Cap Rate of 6.43%.