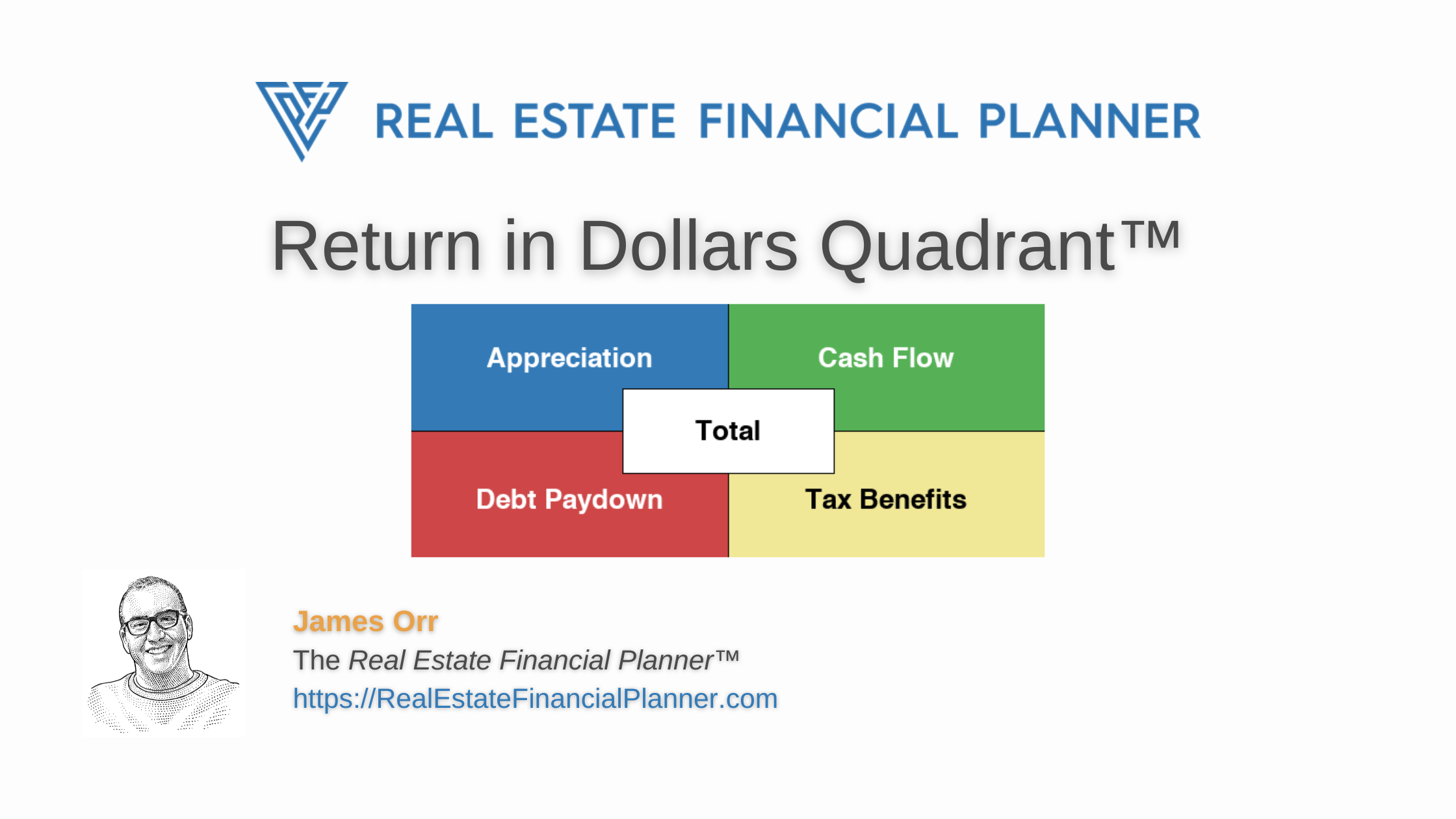

To calculate the Retun in Dollars Quadrant™ for  Typical 25% Down Payment Gainesville, Florida Rental Property, we must calculate Appreciation, Cash Flow, Debt Paydown and Cash Flow from Depreciation™ independently and then add them up to get a total.

Typical 25% Down Payment Gainesville, Florida Rental Property, we must calculate Appreciation, Cash Flow, Debt Paydown and Cash Flow from Depreciation™ independently and then add them up to get a total.

Appreciation

Let's start first with calculating Appreciation which consists of organic appreciation and forced appreciation.

| Organic Appreciation | $7,834 | |||

| + | Forced Appreciation | + | $0 | |

| Total Appreciation | = | $7,834 |

Now that we know what the appreciation is in the next year, we can display it as part of the Return in Dollars Quadrant™.

Cash Flow

Next, let's calculate Cash Flow.

| Annual Net Operating Income | $16,791 | |||

| - | Annual Mortgage Payments | - | $15,244 | |

| - | Annual PMI Payments | - | $0 | |

| Annual Cash Flow | = | $1,547 |

Now that we know what the cash flow is for the year, we can display it as part of the Return in Dollars Quadrant™ along with appreciation.

Debt Paydown

The top half of the quadrant are the returns that are more speculative in nature and that largely depend on the market to perform to get those returns. Let's now move to the bottom half of the Return Quadrant™ and let's start with calculating Debt Paydown.

| Monthly Mortgage Payment | $1,270.32 | |||

| - | Monthly Interest Paid | - | $1,101.69 | |

| Monthly Principal Paid | = | $168.63 | ||

| × | 12 Months | × | 12 | |

| Annual Debt Paydown | = | $2,024 |

Now that we know what the estimated debt paydown is for the year, we can display that as well in the Return in Dollars Quadrant™ along with cash flow and appreciation.

Cash Flow from Depreciation™

To finish out the Return in Dollars Quadrant™ we need to calculating Cash Flow from Depreciation™.

| Gross Depreciation | $8,072 | |||

| × | Tax Rate | × | 15% | |

| Cash Flow from Depreciation™ | = | $1,211 |

Armed with Cash Flow from Depreciation™ and the other 3 returns in dollars, we can complete the Return in Dollars Quadrant™.

Retun in Dollars Quadrant™

| Appreciation | $7,834 | |||

| + | Cash Flow | + | $1,547 | |

| + | Debt Paydown | + | $2,024 | |

| + | Cash Flow from Depreciation™ | + | $1,211 | |

| Total Return in Dollars | = | $12,616 |