Bookkeeping Spreadsheet Download

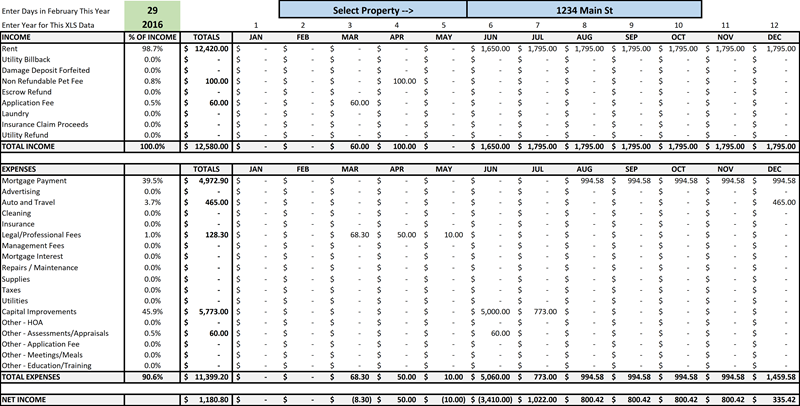

In May, 2020 Brian made some small tweaks to the spreadsheet. This is the most recent version of the bookkeeping and accounting spreadsheet:

Download Bookkeeping Spreadsheet

Essential Bookkeeping and Accounting for Real Estate Investors

As a real estate investor with rental properties, managing your finances effectively is crucial to maximizing your investments and ensuring long-term success. Here’s a comprehensive guide on bookkeeping and accounting essentials tailored for you.

Understanding the Basics

Bookkeeping and accounting are the backbone of any successful real estate investment strategy. While bookkeeping involves recording daily financial transactions, accounting is the process of summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.

Why Bookkeeping Matters

- Financial Analysis and Planning: Accurate bookkeeping helps you analyze your property’s financial health, enabling strategic planning and budgeting.

- Tax Preparation: Organized records streamline the tax preparation process, ensuring you claim all entitled deductions and credits.

- Legal Compliance: Maintaining proper books helps you comply with laws and regulations, reducing the risk of fines or legal issues.

Setting Up Your Bookkeeping System

Setting up an effective bookkeeping system is the first step toward financial management efficiency. You can opt for manual tracking, software solutions like QuickBooks, or professional bookkeeping services. The key is to choose a system that fits your portfolio size and complexity.

Key Bookkeeping Practices for Real Estate Investors

- Separate Personal and Business Finances: Always keep your personal and investment finances separate to simplify tracking and reporting.

- Regularly Update Records: Update your books regularly to avoid backlogs and ensure accuracy. Monthly reconciliations are recommended.

- Track All Income and Expenses: Record every transaction, no matter how small, including rental income, maintenance costs, and capital improvements.

Understanding and Managing Expenses

Effective expense management is critical. Categorize expenses as either operational (ongoing property management, repairs, utilities) or capital (improvements increasing property value). This distinction is important for both tax purposes and financial analysis.

Depreciation: A Key Concept in Real Estate Accounting

Depreciation is an accounting method that allocates the cost of tangible assets over its useful life. For real estate investors, understanding how to calculate and deduct depreciation on your properties can significantly impact your taxable income and cash flow.

Preparing for Taxes

Proper bookkeeping simplifies tax preparation. Familiarize yourself with relevant real estate tax laws and potential deductions such as mortgage interest, property taxes, and depreciation. Consider working with a tax professional who specializes in real estate to maximize your benefits.

Conclusion

Effective bookkeeping and accounting are indispensable for real estate investors. They not only ensure compliance and optimize tax benefits but also provide insights into your property’s financial performance, guiding your investment decisions. Invest time in setting up a robust system or consider hiring a professional to manage it for you. Your future self will thank you for the clarity and control you gain over your real estate investments.